California Option For the Sale and Purchase of Real Estate - Commercial Lot or Land

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Commercial Lot Or Land?

Are you now in a circumstance where you need documents for potential business or particular activities regularly.

There are numerous legal document templates accessible online, but finding ones you can rely on is not easy.

US Legal Forms provides thousands of template forms, including the California Option For the Sale and Purchase of Real Estate - Commercial Lot or Land, designed to satisfy federal and state regulations.

When you locate the correct document, click Buy now.

Choose the pricing plan you want, fill in the required information to create your account, and pay for your order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the California Option For the Sale and Purchase of Real Estate - Commercial Lot or Land template.

- If you don't have an account and want to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

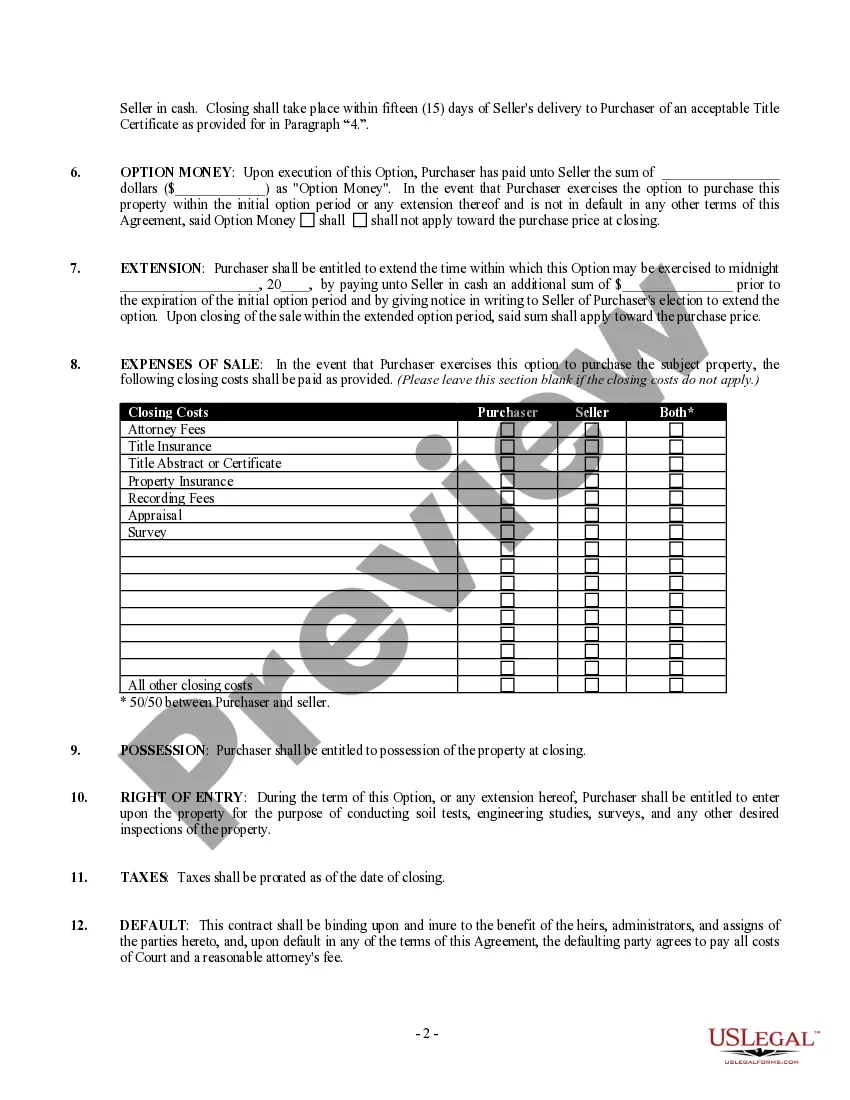

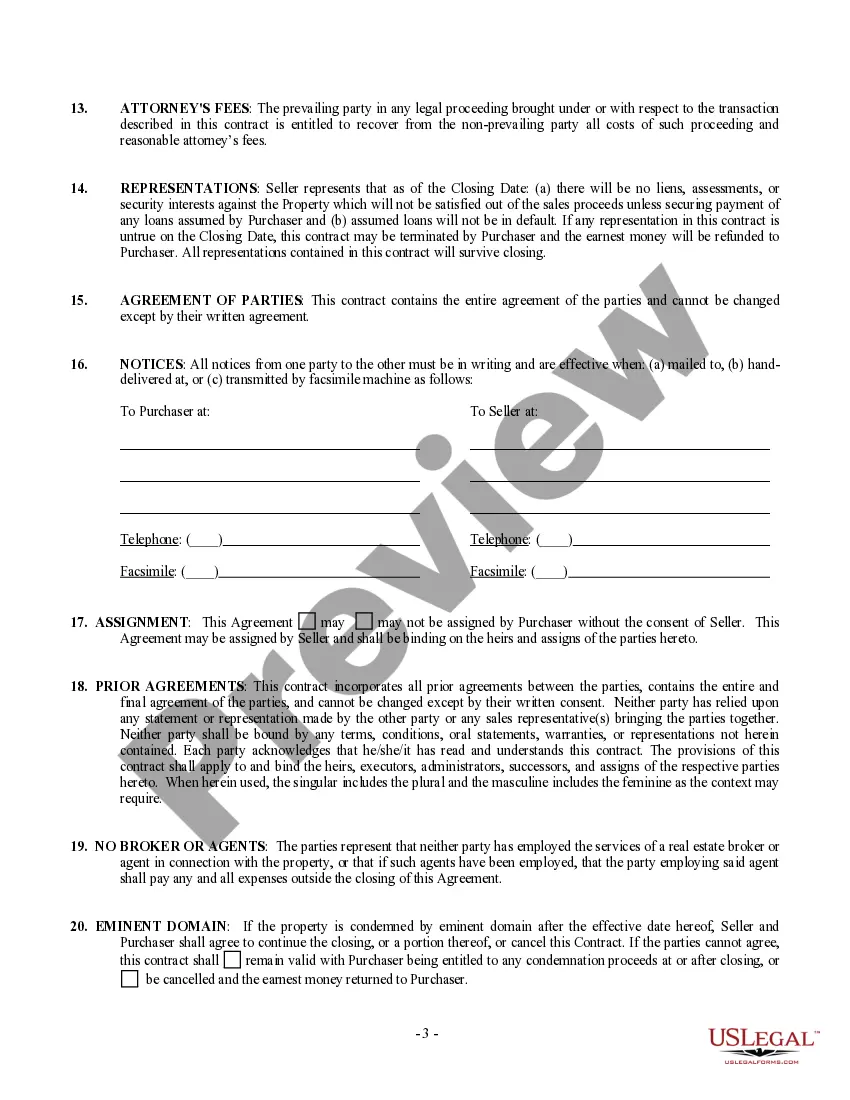

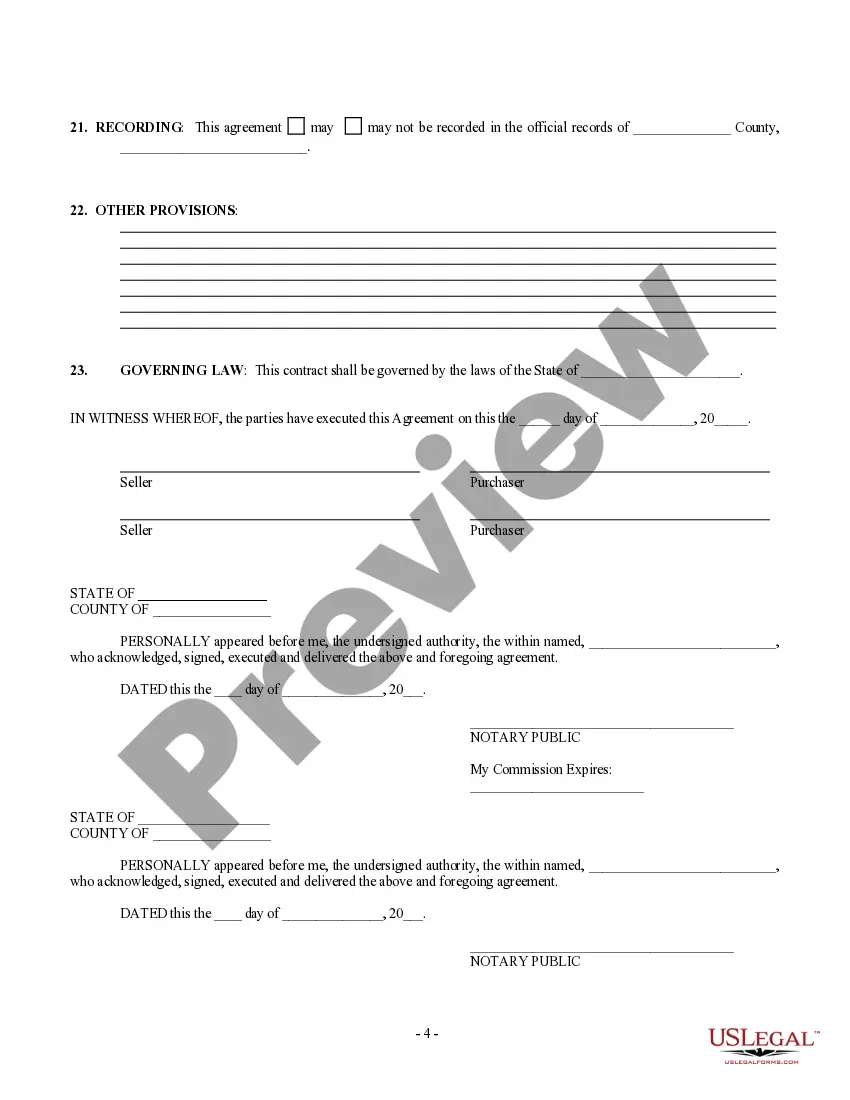

- Use the Review button to examine the form.

- Check the details to confirm you have selected the right document.

- If the document isn’t what you’re looking for, utilize the Search field to find the form that suits your needs and specifications.

Form popularity

FAQ

First, take the property's net annual rental income and divide it by your estimate of the building value, based on sales of similar ones in the local area. This will give you your 'capitalisation rate' or the rate of return. Then, take your net operating income and divide it by that figure.

What value is most commonly used for commercial property? The income approach is the most frequently used method for valuing commercial real estate, as it can be used for any property that produces consistent, predictable income.

A California land contract records the terms of the sale of undeveloped or vacant property. A buyer can purchase either commercial or residential land from a seller by drafting a land contract with all the appropriate information, such as the land's legal description as well as the agreed-upon purchase price.

Legality of contracts for deed. Recorded in the public record, contracts for deed are legally enforceable. Many sellers prefer to keep the contract details between themselves and buyers private. Benefits for buyer and seller.

Commercial real estate investments are largely valued based upon the amount of income that they bring in to the owner. So, investors are essentially purchasing the stability of the cash flow of the asset. A cap rate is the anticipated cash on cash return if the asset was purchased in all cash.

This is the simplest and most intuitive approach in determining the value of a commercial property. It is simply the cost of the land plus the cost of the building's construction. This is basically the same as of determining the value of a residential property.

Sellers and buyers can include a variety of requirements in a California land purchase agreement: Purchase price and payment terms. Interest rates. Fees based on taxes and insurance.

To calculate the land value as a percentage of the total value of the property (land + improvements, such as a house), you would have: $75,000 (the value of the land) / $250,000 (the value of the land and improvements). = 0.30 (the value of the land compared to the overall property expressed in decimal form).