Alabama Collateral Assignment of Lease

Description

How to fill out Collateral Assignment Of Lease?

Finding the right legitimate papers design can be a battle. Obviously, there are plenty of templates available on the Internet, but how will you get the legitimate develop you need? Make use of the US Legal Forms site. The services offers a huge number of templates, like the Alabama Collateral Assignment of Lease, which can be used for business and personal needs. All of the kinds are checked out by pros and fulfill state and federal needs.

When you are presently listed, log in to your bank account and then click the Obtain key to have the Alabama Collateral Assignment of Lease. Use your bank account to appear through the legitimate kinds you possess purchased in the past. Go to the My Forms tab of your respective bank account and obtain an additional backup of your papers you need.

When you are a new user of US Legal Forms, listed below are straightforward guidelines for you to follow:

- Very first, be sure you have selected the correct develop to your metropolis/area. It is possible to look over the form utilizing the Preview key and read the form explanation to make certain this is the right one for you.

- In the event the develop will not fulfill your needs, take advantage of the Seach discipline to find the appropriate develop.

- Once you are certain the form is acceptable, select the Acquire now key to have the develop.

- Opt for the prices plan you desire and enter in the essential details. Make your bank account and pay for the transaction with your PayPal bank account or Visa or Mastercard.

- Select the submit formatting and obtain the legitimate papers design to your gadget.

- Total, change and produce and indicator the acquired Alabama Collateral Assignment of Lease.

US Legal Forms may be the largest collection of legitimate kinds where you can find different papers templates. Make use of the service to obtain expertly-made paperwork that follow state needs.

Form popularity

FAQ

Sample 1Sample 2. Lease Collateral means all security deposits, letters of credit, advance payments and any other property provided by the Lessees of the Engines as security for the payment and performance of the obligations of such Lessees under the Leases of the Engines. Sample 1Sample 2.

Key Purposes of a Collateral Assignment Collateral assignment concerns allocating a property's ownership privileges, or a specific interest, to a lender as loan collateral. The lender retains a security interest in the asset until the borrower entirely settles the loan.

The assignment of leases and rents, also known as the assignment of leases rents and profits, is a legal document that gives a mortgage lender right to any future profits that may come from leases and rents when a property owner defaults on their loan.

When making a request for consent to assign a lease, the Tenant should include all relevant information about the proposed assignee, to enable the Landlord to make a decision. Relevant information is likely to include company details, audited accounts and references.

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. If you pass away before the loan is repaid, the lender can collect the outstanding loan balance from the death benefit of your life insurance policy.

With an absolute assignment, the entire ownership of the policy would be transferred to the assignee, or the lender. Then, the lender would be entitled to the full death benefit. With a collateral assignment, the lender is only entitled to the balance of the outstanding loan.

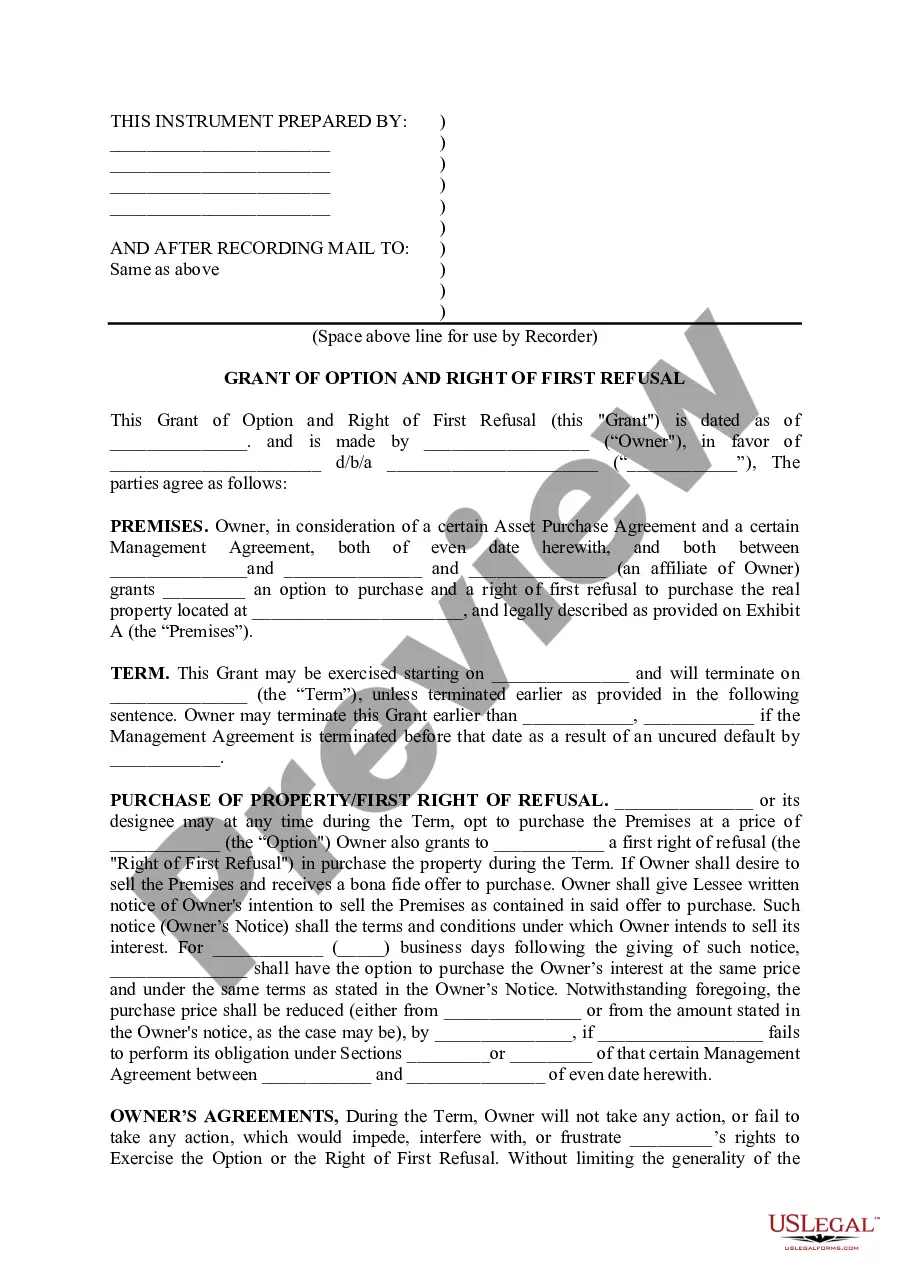

A collateral assignment of lease is a legal contract that transfers the rights to rental payments from the asset's owner to a lender to secure funding. In this contract, the lease's rentals are like a loan from the funder to the lessor and the lease acts as security.