Alabama Termination of Trust by Trustee

Description

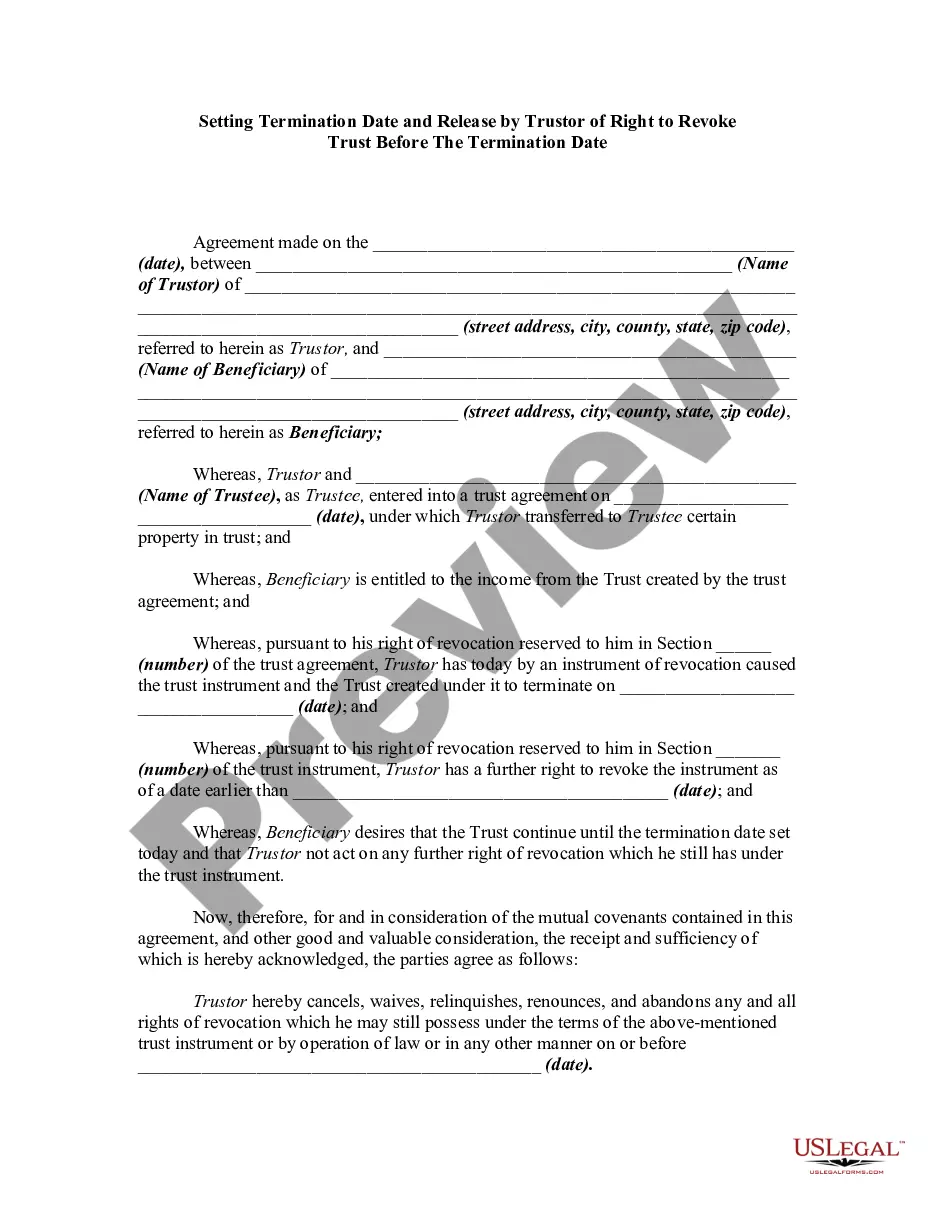

How to fill out Termination Of Trust By Trustee?

You might invest hours on the internet trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are vetted by professionals.

It is easy to obtain or create the Alabama Termination of Trust by Trustee through our service.

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Alabama Termination of Trust by Trustee.

- Every legal document template you buy is yours indefinitely.

- To retrieve another copy of any purchased document, go to the My documents section and click the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct document template for your state/city of preference.

- Review the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

If you discover that your deceased loved one was the victim of strong coercion or acting under duress at the time he or she made the trust, then you may be able to petition an Alabama court to revoke the trust, allowing assets to pass to heirs through the state's default rules.

The property is held by the trust for the beneficiaries (people who will receive it). Anyone, including the trustee, can be a beneficiary.

A trust can be contested, but only on certain grounds and by persons who have a financial stake in the outcome of the contest.

A trust can also be terminated if it involves illegal conduct or if it cannot operate properly as a trust due to its small size. Additionally, beneficiaries can only terminate a trust if they are all in agreement. Unless specified in the trust, trustees are never allowed to terminate a trust.

Further, a trust will be considered as terminated when all the assets have been distributed except for a reasonable amount which is set aside in good faith for the payment of unascertained or contingent liabilities and expenses (not including a claim by a beneficiary in the capacity of beneficiary).

Key Takeaways. Revocable trusts, as their name implies, can be altered or completely revoked at any time by their grantorthe person who established them. The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud. The trust maker was not mentally competent when they created or modified the trust.

On the termination of the trust the trustees are under a duty to distribute the trust assets to the right beneficiaries. Failure to distribute to the correct beneficiary can subject the trustees to liability for breach of trust. See Practice Note: Termination of trustsbeneficiaries.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

Generally, a will contest can be filed at any time prior to admission of a will to probate. If the decedent's will has already been admitted to probate, the statute of limitations on contesting a will is generally 120 days from the date of admission.