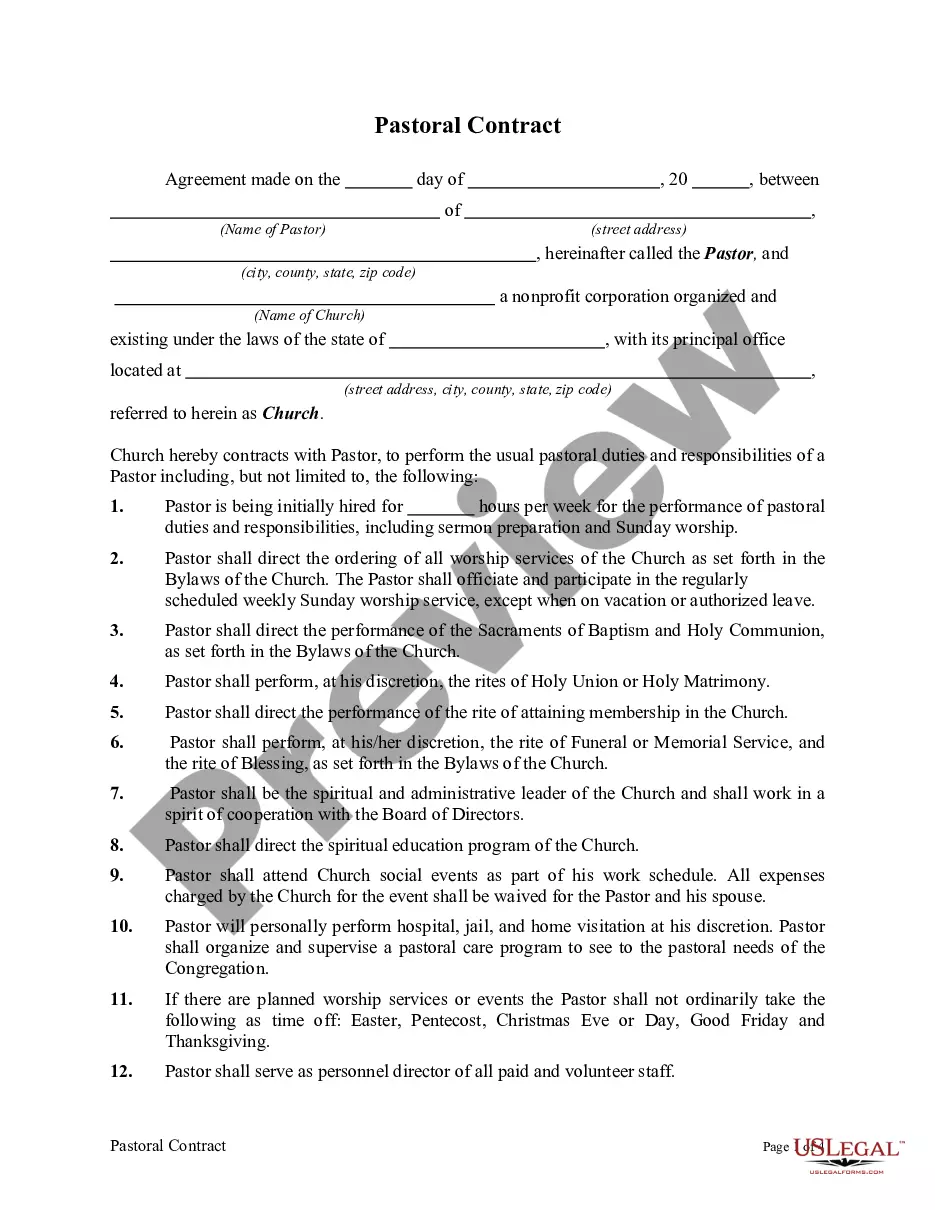

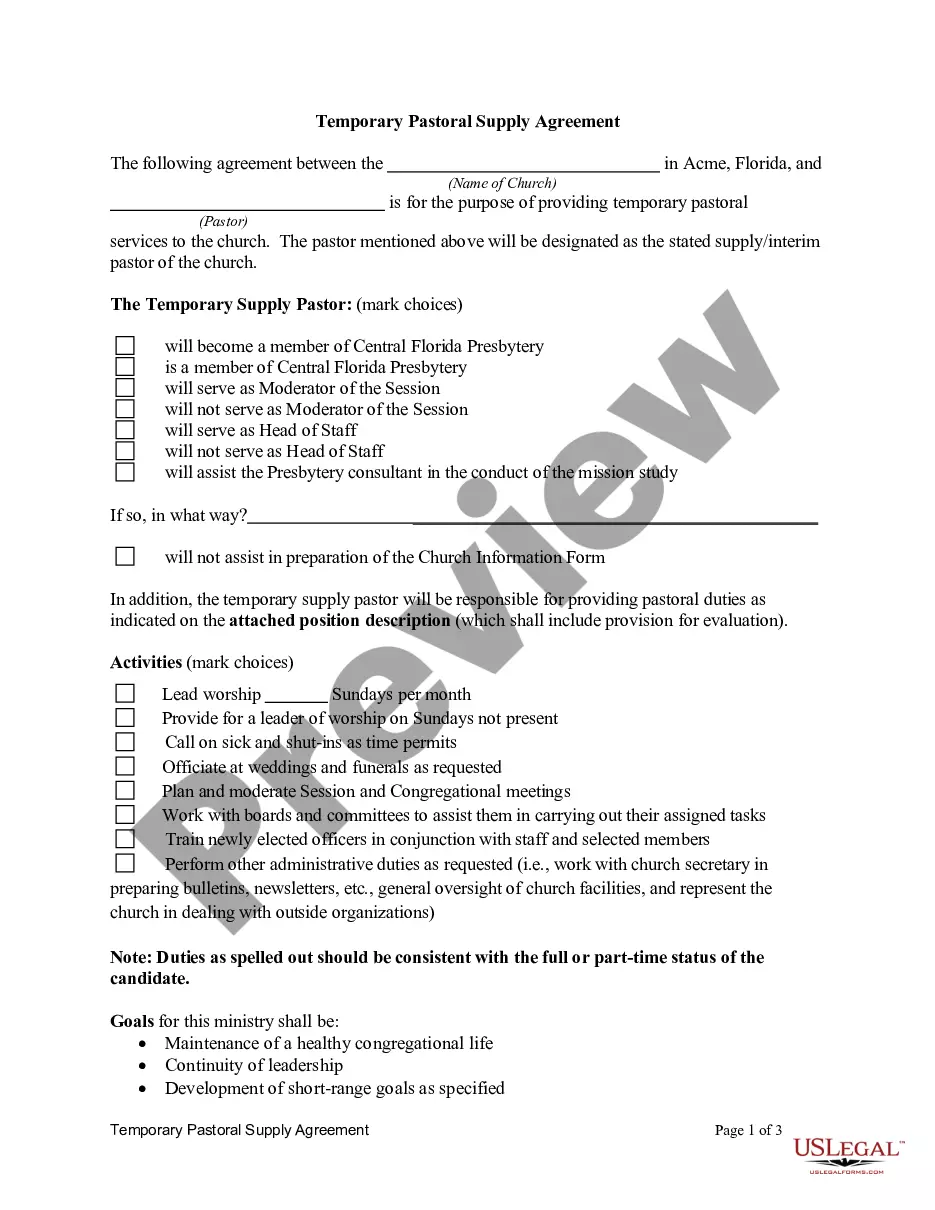

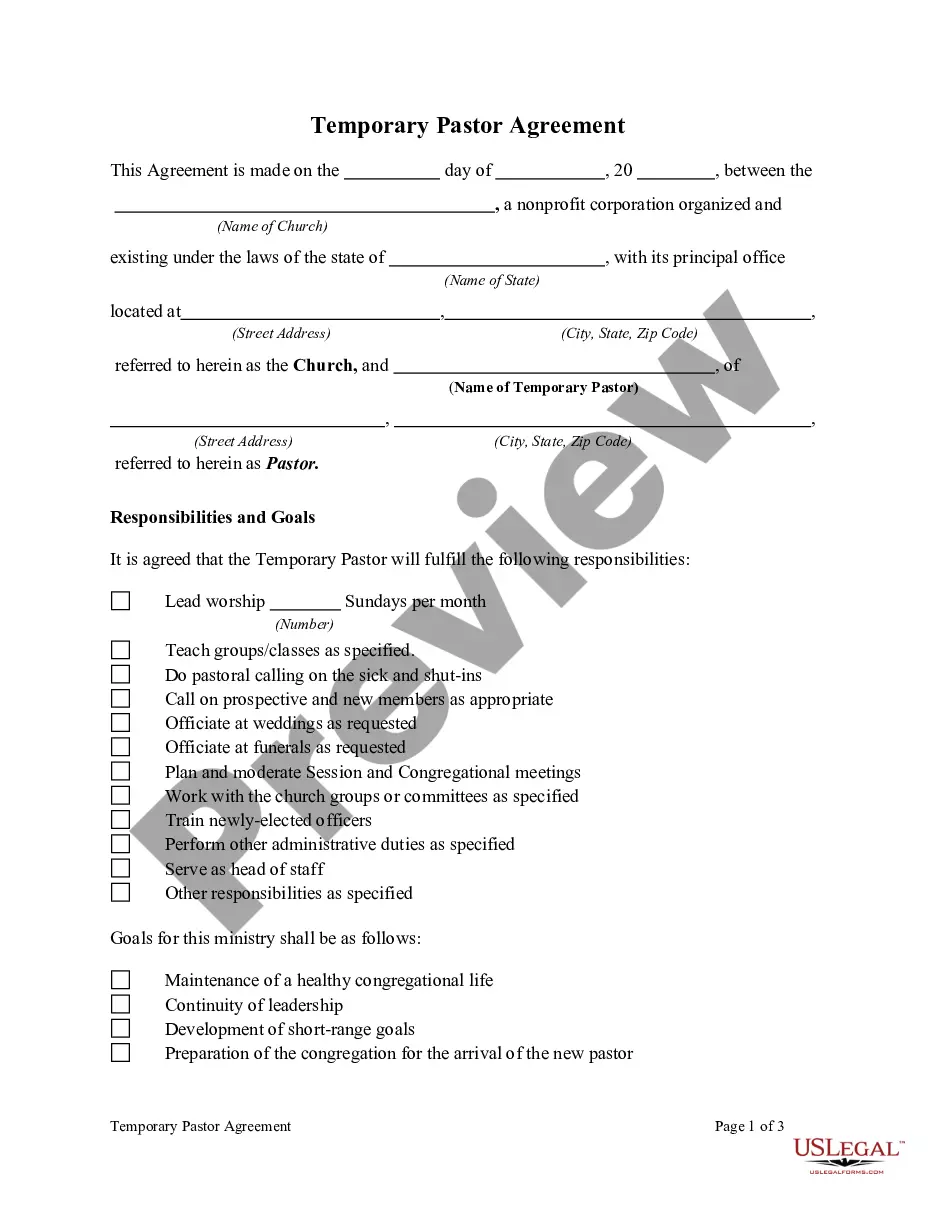

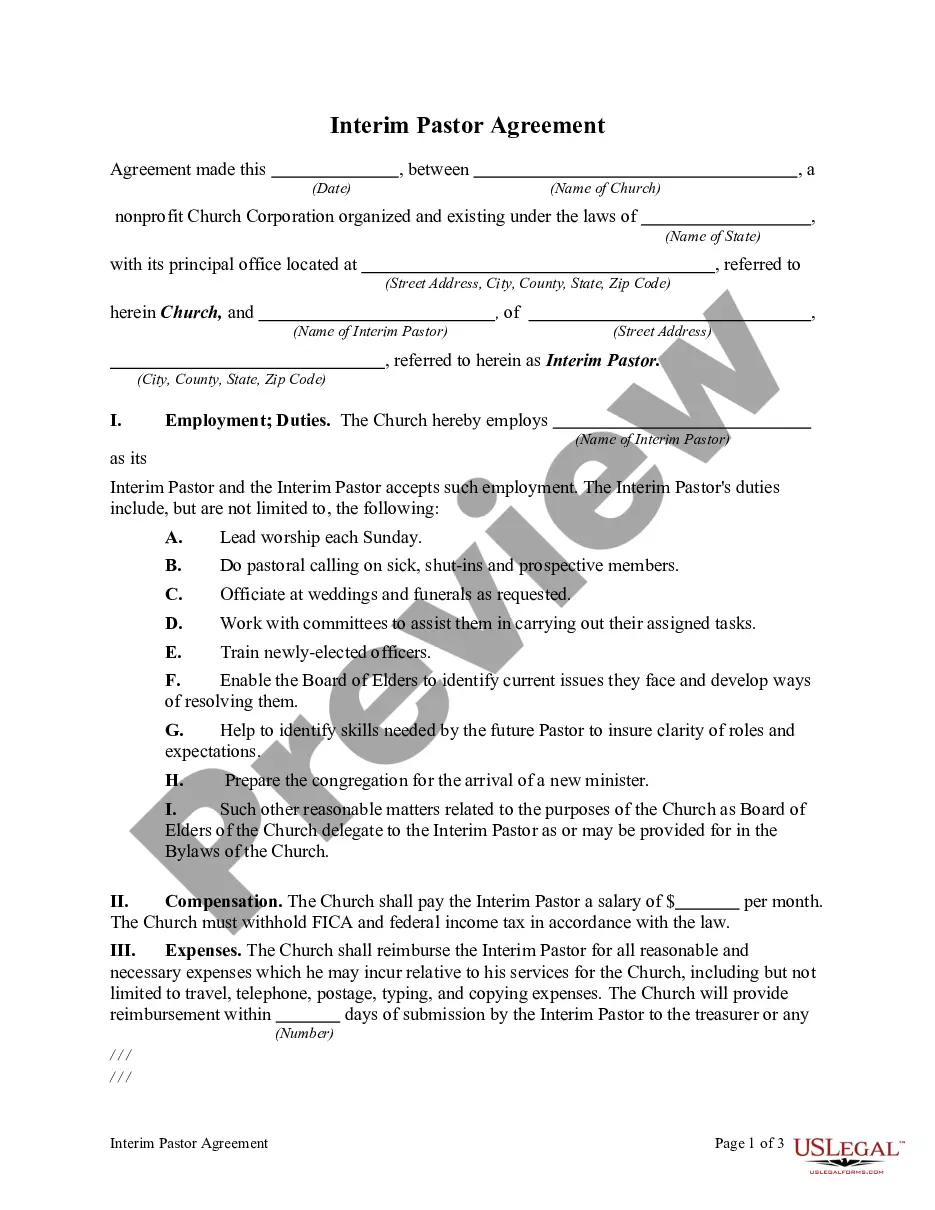

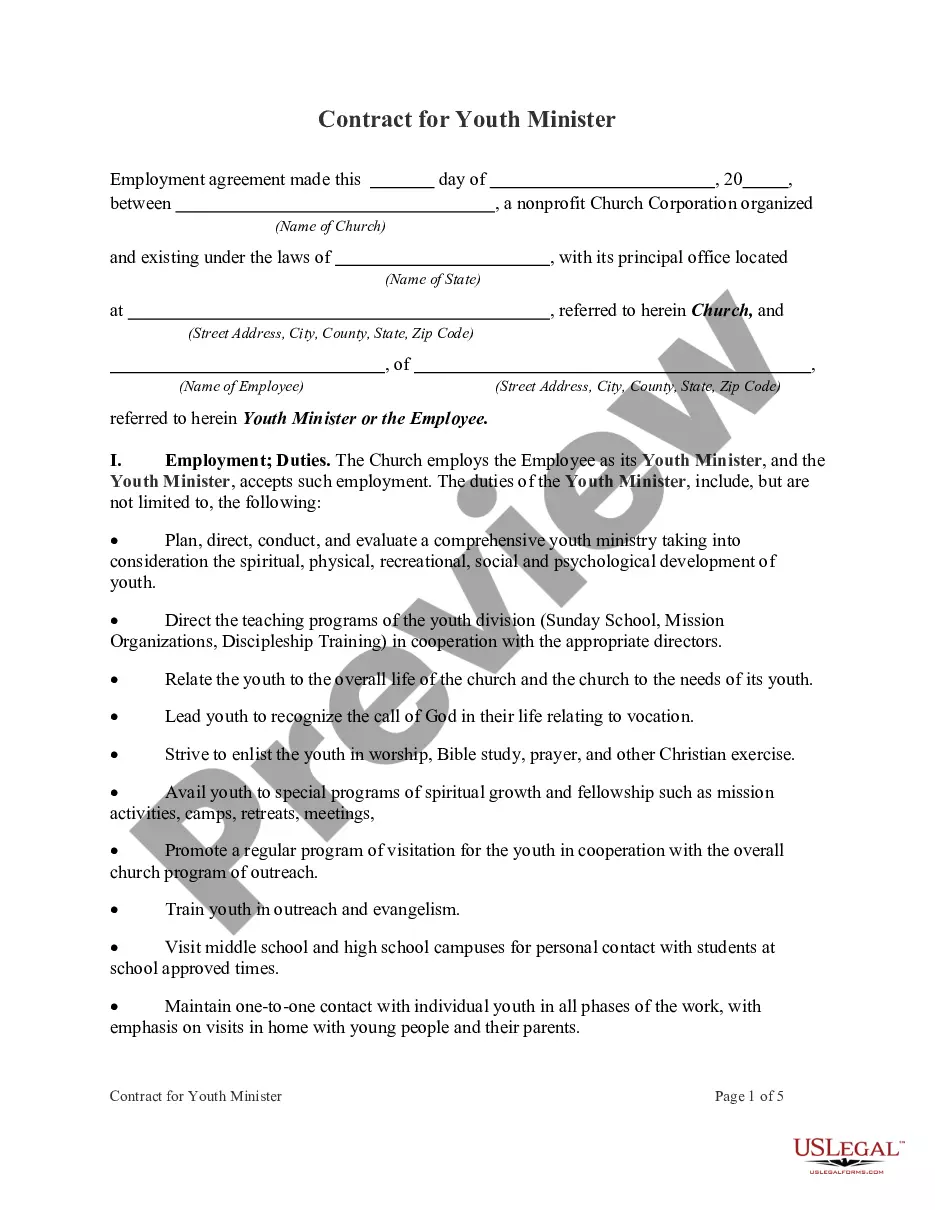

This is a contract between a pastor and a church which is a non-profit corporation. A non-profit corporation is a group organized for purposes other than generating profit and in which no part of the organization's income is distributed to its members, directors, or officers. Non-profit entities are organized under state law. For non-profit corporations, many states have adopted the Revised Model Non-Profit Corporation Act (1986). For federal tax purposes, an organization is exempt from taxation if it is organized and operated exclusively for religious, charitable, scientific, public safety, literary, educational, prevention of cruelty to children or animals, and/or to develop national or international sports.

Alabama Pastoral Contract

Description

Form popularity

FAQ

For many churches the pastor's employment agreement creates significant financial and legal obligations. Given their importance, such contracts should be negotiated with the help of an attorney who is retained to protect the interests of the church as an institution.

The first tax-free giving method is the annual gift tax exclusion. In 2021, the exclusion limit is $15,000 per recipient, and it rises to $16,000 in 2022. You can give up to $15,000 worth of money and property to any individual during the year without any estate or gift tax consequences.

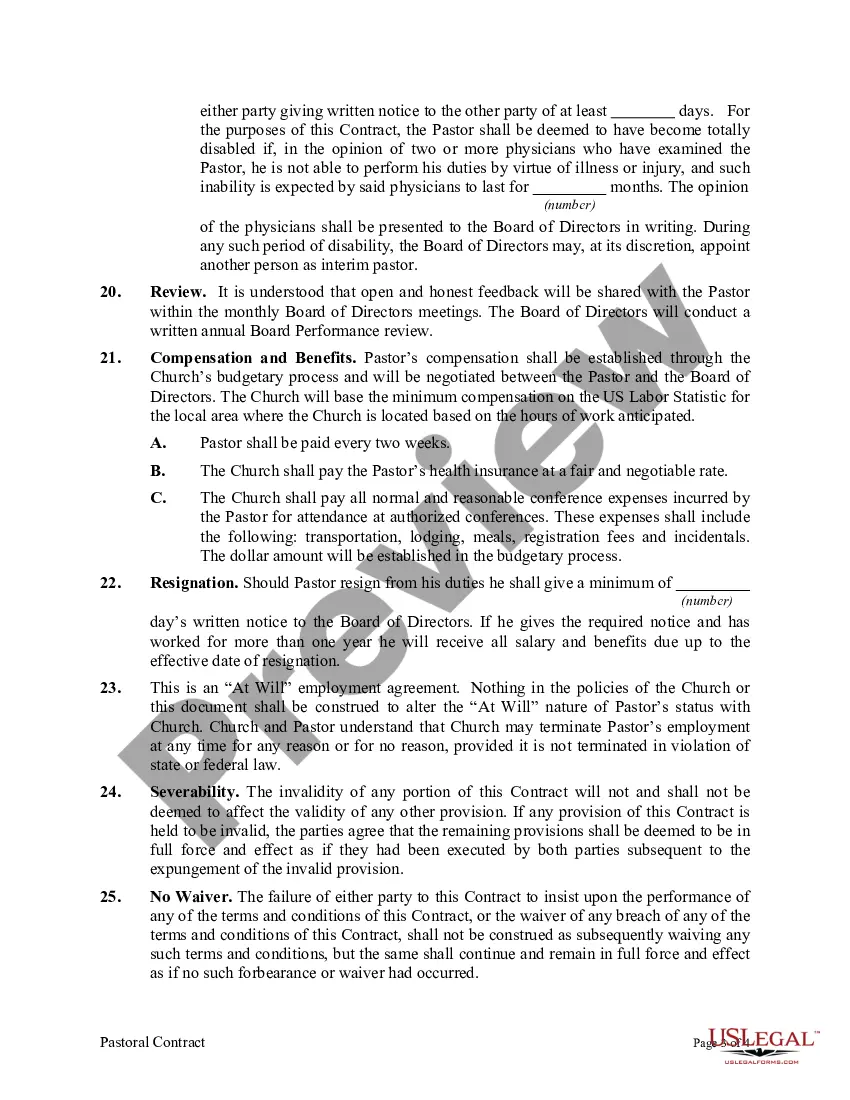

Regardless of whether you're a minister performing ministerial services as an employee or a self-employed person, all of your earnings, including wages, offerings, and fees you receive for performing marriages, baptisms, funerals, etc., are subject to income tax.

Clergy W-2 FormMinisters working for a church or church agency should receive a Form W-2 by January 31. Ministers who report their federal income taxes as self-employed on Form 1099, may face a significant risk of additional taxes and penalties, if they are audited and reclassified as employees by the IRS.

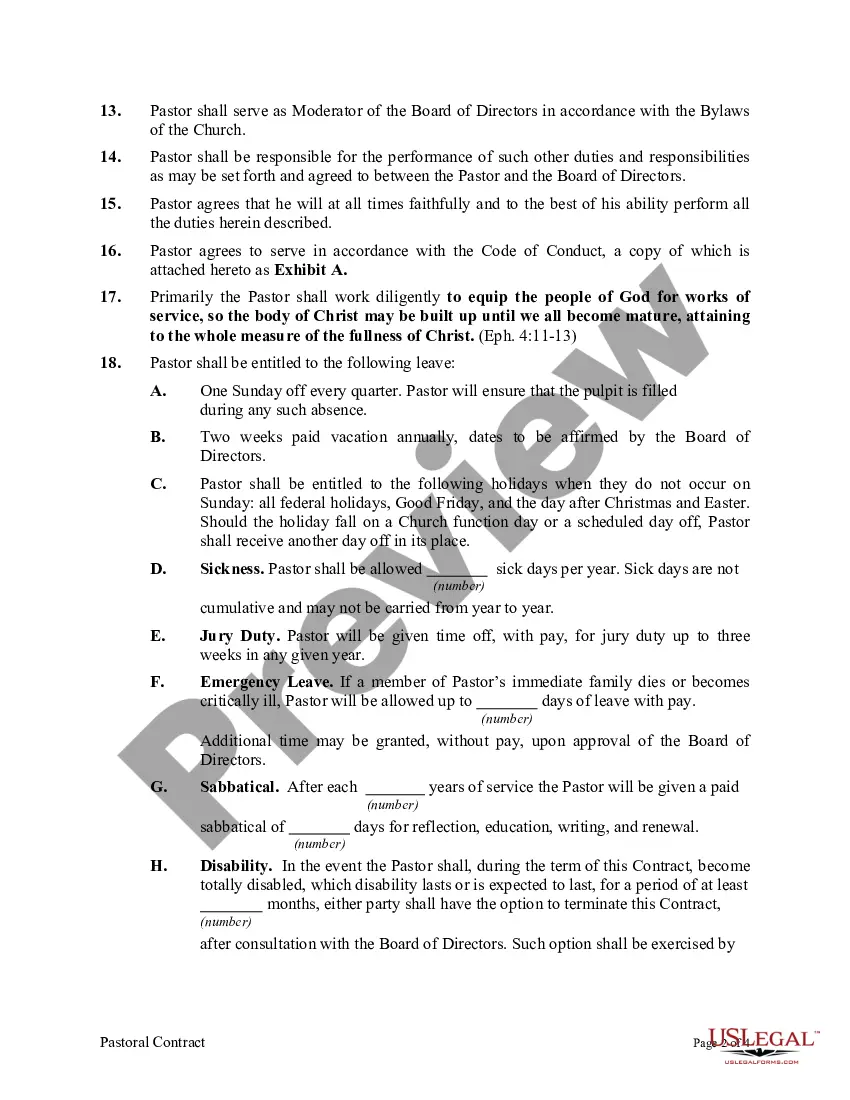

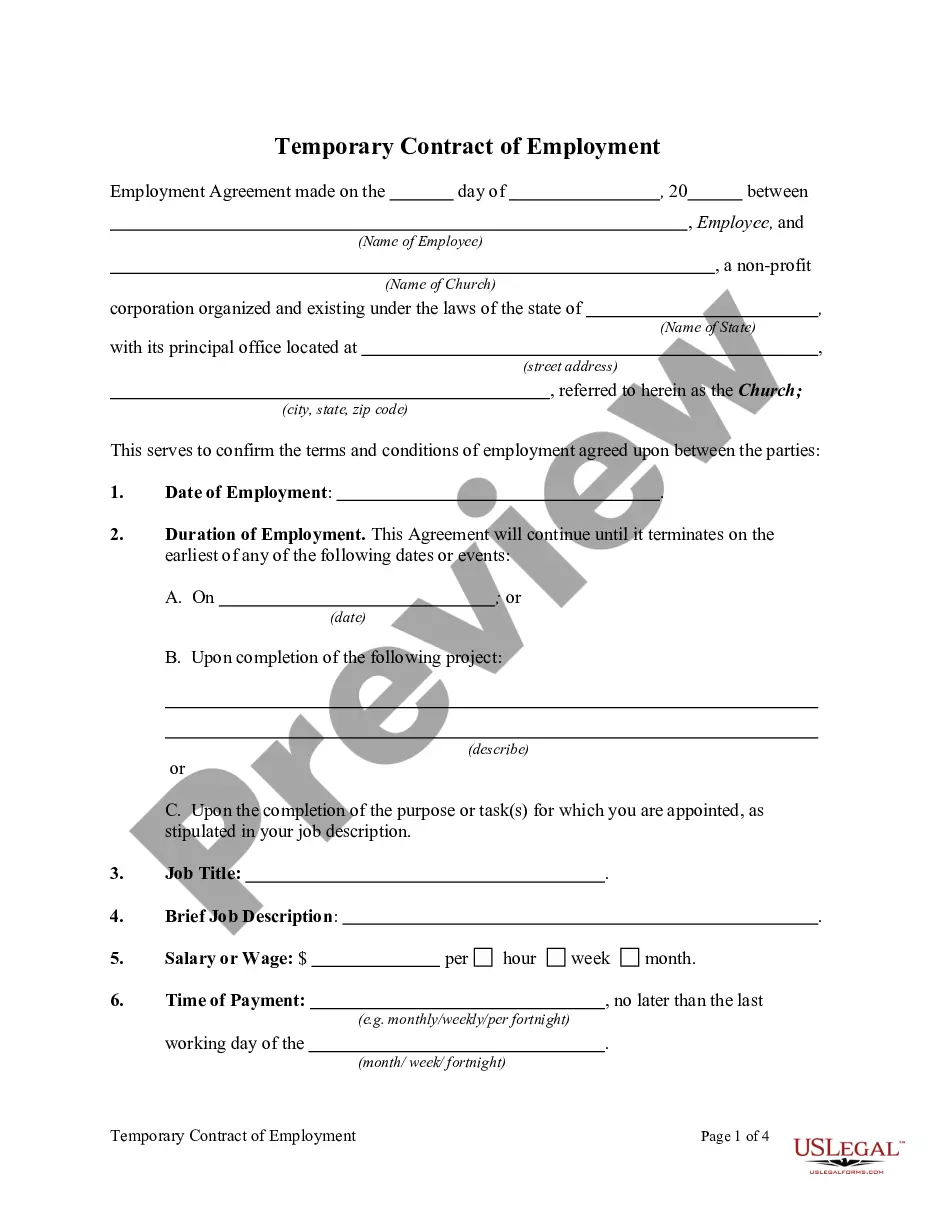

1 To determine usual requirements. Review contracts for other pastors in your denomination to determine usual requirements.2 Specify basic employment elements : start date.3 Delineate the church-specific goals and responsibilities.4 Identify additional items.5 Review the contract.

Churches should be aware of a recent Tax Court ruling on voluntary donations to ministers. In Felton v. Commissioner, TC Memo 2018-168, the Tax Court ruled that voluntary donations made to a minister in special contribution envelopes were taxable income, not nontaxable gifts.

It is not safe to assume that occasional gifts to pastors or other church employees are tax-free. Depending on the process used to collect and distribute the funds, these gifts may need to be reported to the Internal Revenue Service (IRS) as a part of the recipient's taxable income.

Nope! Cash gifts aren't considered taxable income for the recipient. That's rightmoney given to you as a gift doesn't count as income on your taxes.

It is not safe to assume that occasional gifts to pastors or other church employees are tax-free. Depending on the process used to collect and distribute the funds, these gifts may need to be reported to the Internal Revenue Service (IRS) as a part of the recipient's taxable income.