A Cash Farm Lease for Purpose of Producing Crops, Livestock, and Livestock Products, According to Land Use and Cropping Plan is an agreement between a landowner and a tenant farmer. The tenant farmer is responsible for the management and production of crops, livestock, and livestock products on the landowner's property. The cash farm lease sets out the terms and conditions for the use of the land, including the tenant farmer's obligations regarding land use and crop production. The lease also outlines the tenant farmer's rights, such as the right to use the land, the right to harvest and market the crops, and the right to receive lease payments. Types of Cash Farm Lease for Purpose of Producing Crops, Livestock, and Livestock Products, According to Land Use and Cropping Plan include: -Grazing Lease: This lease allows for the tenant farmer to graze the landowner's property with livestock. —Crop Lease: This lease allows the tenant farmer to plant, cultivate, and harvest crops on the landowner's property. —Livestock Lease: This lease allows the tenant farmer to manage livestock on the landowner's property. —Mixed Use Lease: This lease allows the tenant farmer to use the land for a combination of purposes, such as grazing livestock and planting and harvesting crops. —Sharecropping Lease: This lease allows the tenant farmer to share the costs and profits of crop production with the landowner. —Conservation Lease: This lease allows the tenant farmer to use the land for conservation purposes, such as reforestation or wildlife habitat restoration.

Cash Farm Lease for Purpose of Producing Crops, Livestock, and Livestock Products, According to Land Use and Cropping Plan

Description

How to fill out Cash Farm Lease For Purpose Of Producing Crops, Livestock, And Livestock Products, According To Land Use And Cropping Plan?

How much time and resources do you normally spend on drafting official paperwork? There’s a better opportunity to get such forms than hiring legal specialists or spending hours browsing the web for a proper blank. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, such as the Cash Farm Lease for Purpose of Producing Crops, Livestock, and Livestock Products, According to Land Use and Cropping Plan.

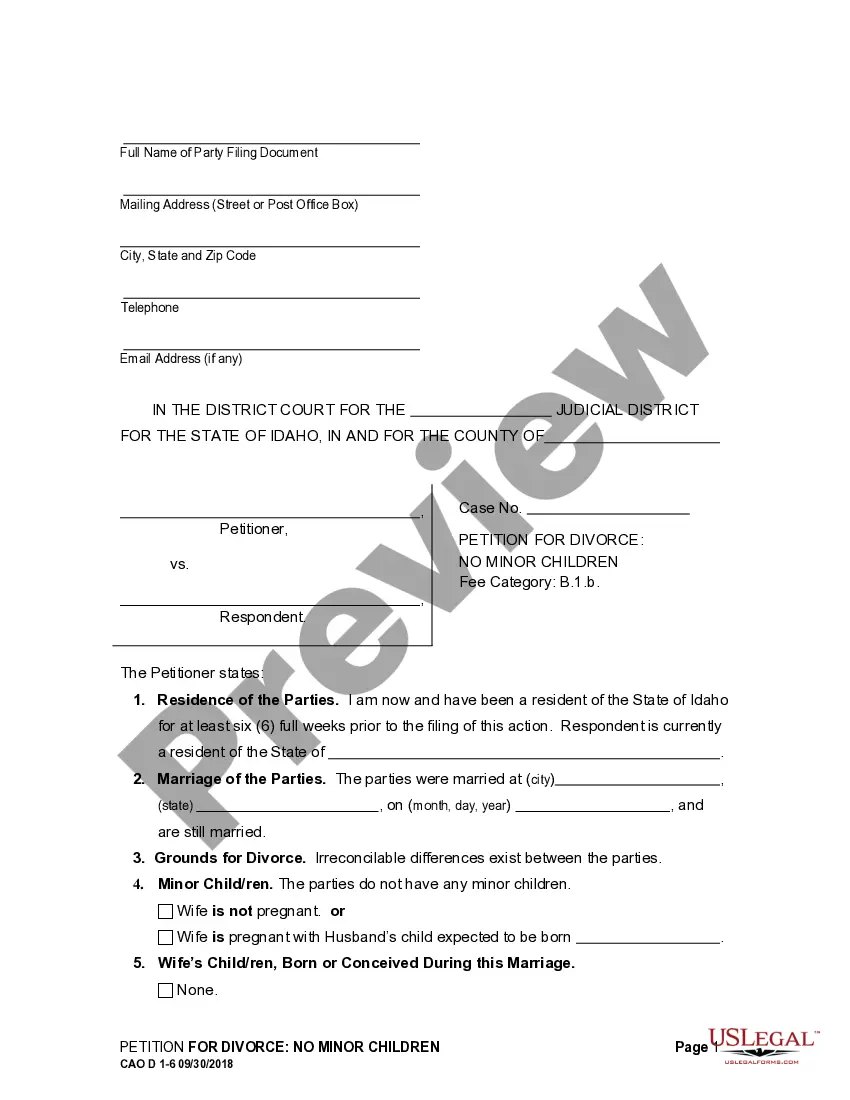

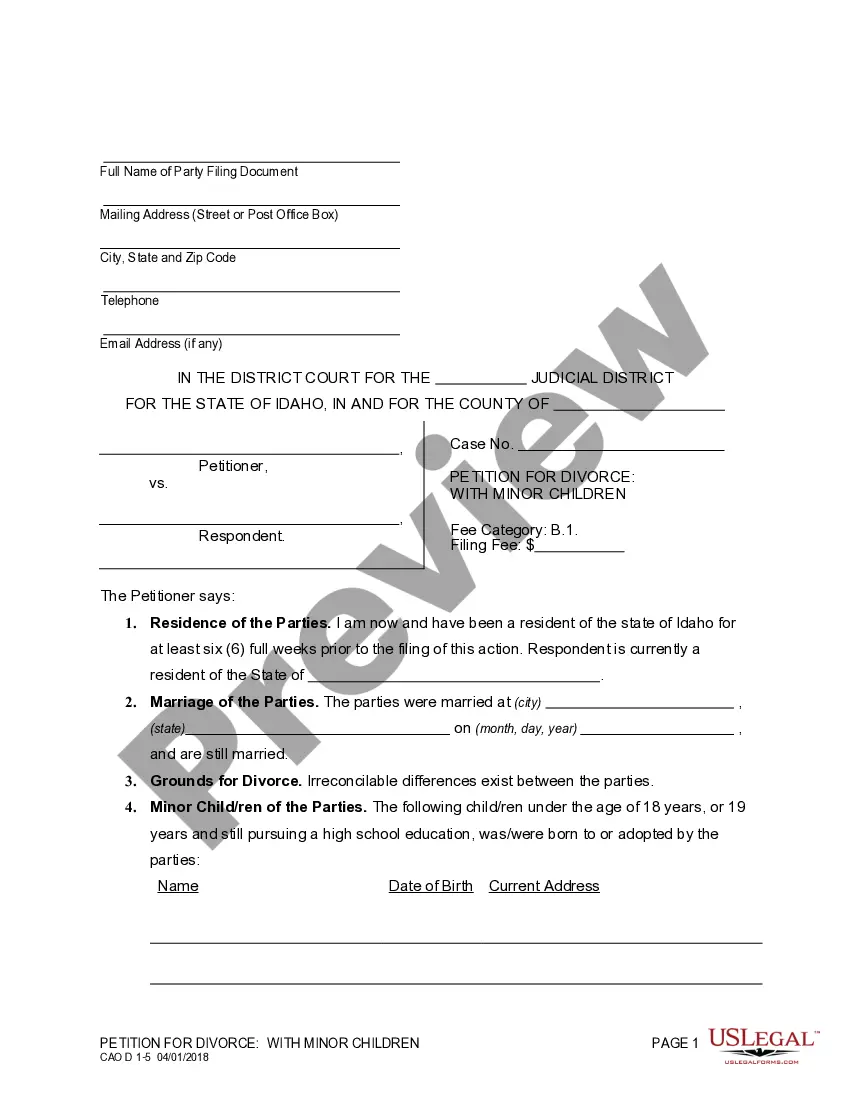

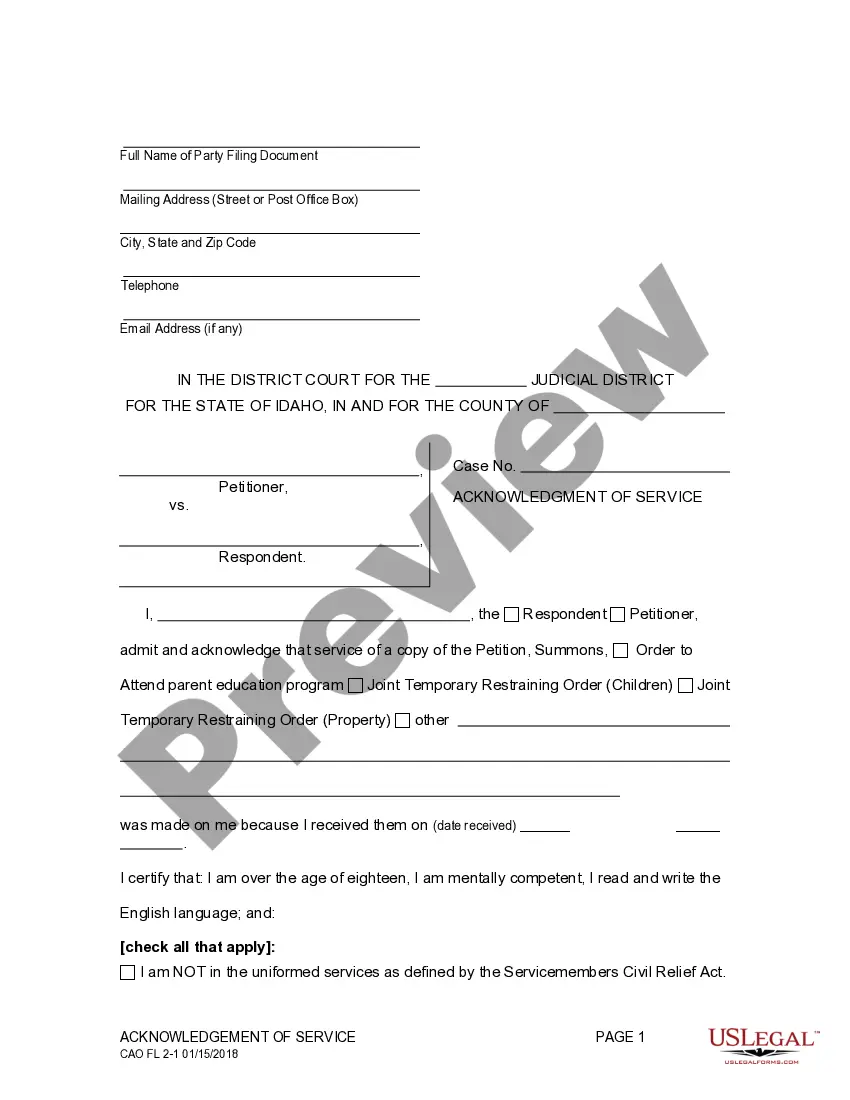

To obtain and prepare a suitable Cash Farm Lease for Purpose of Producing Crops, Livestock, and Livestock Products, According to Land Use and Cropping Plan blank, follow these simple steps:

- Examine the form content to ensure it meets your state laws. To do so, read the form description or utilize the Preview option.

- In case your legal template doesn’t meet your needs, find a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Cash Farm Lease for Purpose of Producing Crops, Livestock, and Livestock Products, According to Land Use and Cropping Plan. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Cash Farm Lease for Purpose of Producing Crops, Livestock, and Livestock Products, According to Land Use and Cropping Plan on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us now!

Form popularity

FAQ

Sharecropping is a legal arrangement with regard to agricultural land in which a landowner allows a tenant to use the land in return for a share of the crops produced on that land.

Tenant farming is a system of agriculture whereby farmers cultivate crops or raise livestock on rented lands. It was one of two agricultural systems that emerged in the South following the American Civil War (1861?1865); the other system was sharecropping.

Advantages of Leasing Location. In certain markets, more properties are available to lease than to purchase, so leasing provides businesses with more options.Flexibility.Availability of cash.Source of financing.Stability of costs.Tax Benefits.Focus.Cost.

In addition to offering diversification and sustainability benefits, owning agricultural land also provides investors with a tangible asset. ing to the American Farm Bureau Federation, the average value of farmland in 2020 was estimated at $3,160 per acre ? an increase of 4% since 2019.

The traditional share arrangement for a grain crop like corn or wheat is one-third to the landowner and two-thirds to the tenant. Usually, the expenses paid, and crop received, are equal to the share ? i.e. the landowner would pay one-third of the expenses and receive one-third of the crop.

Pros and Cons of a Land Lease Steady source of income. Long-term tenant without losing ownership of the land. Not responsible for improvements to the land. Landlord may be entitled get property back with amendments after lease period is over.

Pros: Renting is much cheaper than purchasing land. That frees you up to buy equipment, livestock or crop inputs or even expand your production. Farmland leases typically are either cash rent, flex rent or crop share.

Lowers upfront costs, compared to buying equipment outright. Reduces the chance that your company gets stuck with obsolete equipment, if your contract specifies upgrades. Transfers the cost of equipment maintenance to the leasing company, again ing to the terms of your contract.