Alabama Sample Letter for Revised Promissory Note

Description

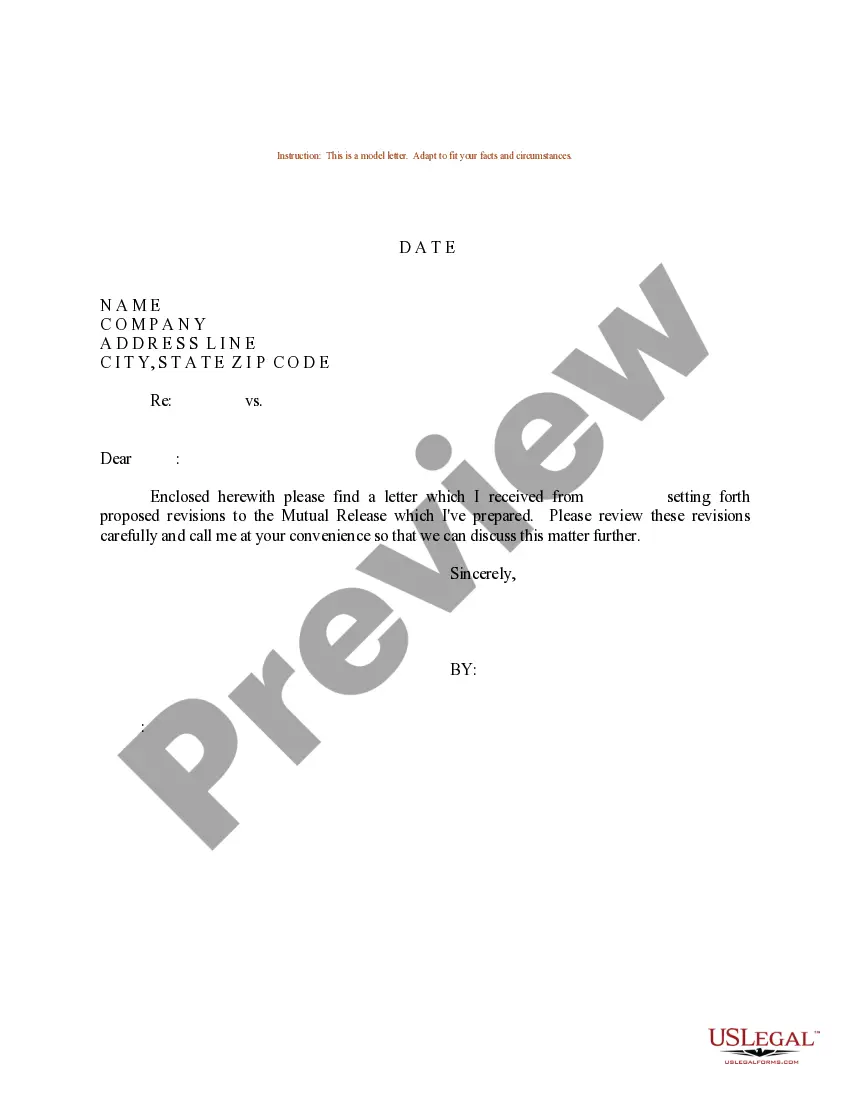

How to fill out Sample Letter For Revised Promissory Note?

You can spend numerous hours online trying to locate the legal document template that matches the state and federal requirements you need.

US Legal Forms offers a vast number of legal templates that are reviewed by experts.

You can easily download or print the Alabama Sample Letter for Revised Promissory Note from their services.

If available, utilize the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Alabama Sample Letter for Revised Promissory Note.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of the acquired form, navigate to the My documents section and click the relevant button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your preferred state/city.

- Review the document details to confirm you have chosen the appropriate form.

Form popularity

FAQ

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

An amended promissory note is a legal document that changes the terms of the original promissory note. These amendments should be made with consent from the lender and, once in place, will be considered binding by all parties involved. Canceling a promissory note is a completely different process from amending it.

Promissory notes are often renewed and extended without the express written consent of, or even notice to, the guarantors of the note.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

An amended and restated promissory note is a legally binding addition to a promissory note that notes any significant changes and replaces the original agreement. Amended and restated promissory notes are seen as the most recent and up-to-date versions of the promise to pay between a borrower and a lender.

Refinancing a hard money note is exactly like refinancing a bank mortgage. Find the refinancing lender and loan, go through a qualifications process, have the property appraised, and give contact information for the original note holder to your new lender so it can make arrangements to pay off the privately held note.

If there is a breach of the terms of a promissory note by the maker, the bearer can seek to enforce the note by filing a claim in Court.

How to Modify a Promissory NoteIdentify the terms of the note that are creating difficulty in repayment.Communicate your need to modify the terms of the note to the note holder.Have the holder of the note draft modifications to the original note.Sign and notarize the modified promissory note.