Alabama Sample Letter for New Business with Credit Application

Description

How to fill out Sample Letter For New Business With Credit Application?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides an assortment of legal form templates that you can download or print.

By using the site, you can access thousands of forms for both business and personal use, organized by categories, states, or keywords. You can quickly obtain the latest versions of forms such as the Alabama Sample Letter for New Business with Credit Application.

If you already have a monthly subscription, Log In and download the Alabama Sample Letter for New Business with Credit Application from the US Legal Forms library. The Download button will be visible on each form you view. You have access to all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the downloaded Alabama Sample Letter for New Business with Credit Application. Each template you add to your account has no expiration date, meaning it is yours permanently. So, if you wish to download or print another copy, just visit the My documents section and click on the form you need. Access the Alabama Sample Letter for New Business with Credit Application using US Legal Forms, arguably the most extensive library of legal document templates. Utilize numerous professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are some basic steps to help you get started.

- Ensure you have selected the correct form for your region/area.

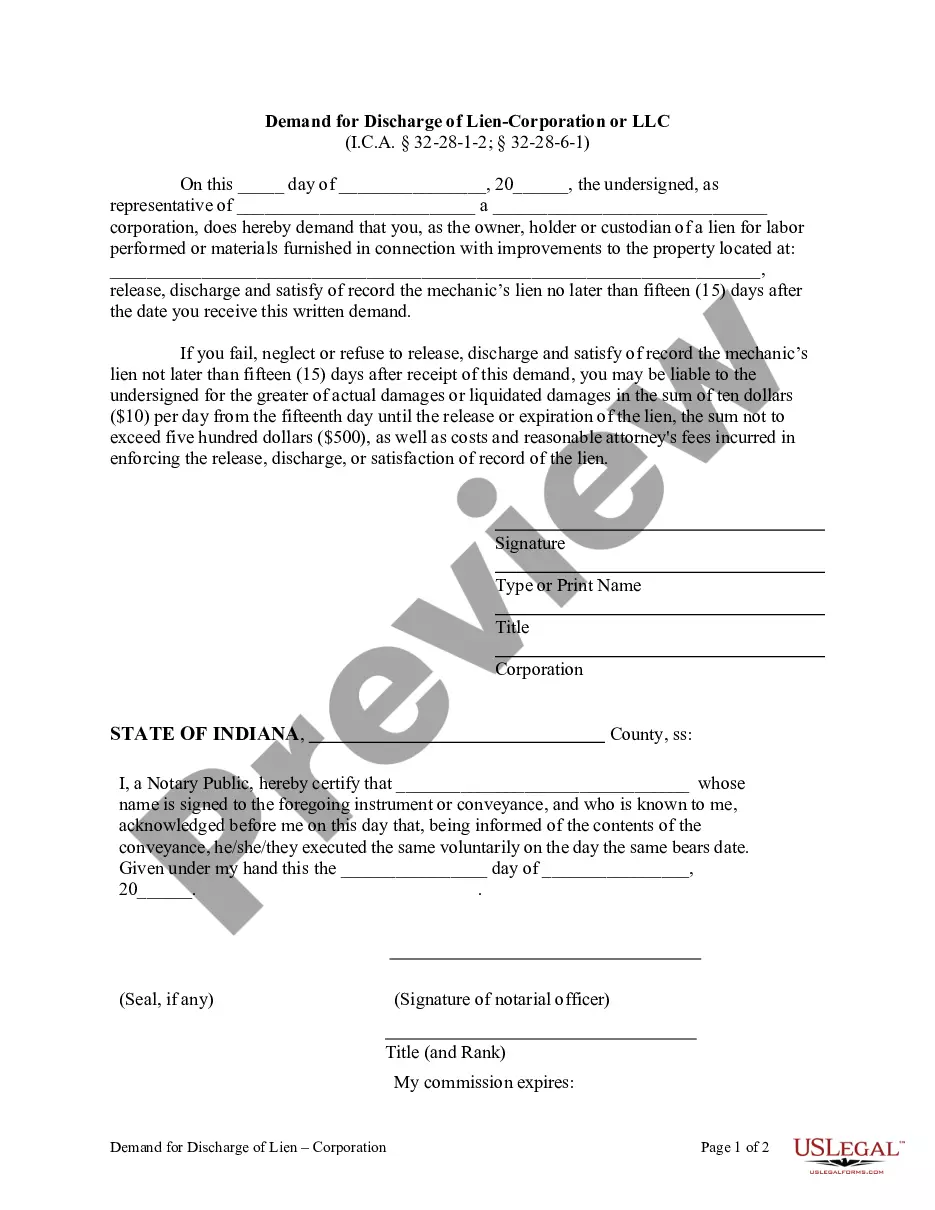

- Click the Review button to evaluate the form's content.

- Read the form description to confirm that you have chosen the appropriate form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your details to set up an account.

Form popularity

FAQ

A letter of credit is a financial document where a bank guarantees payment to a seller on behalf of a buyer, provided that certain conditions are met. It helps businesses in managing risks related to transactions, especially when dealing with new partners. Utilizing an Alabama Sample Letter for New Business with Credit Application can assist you in drafting your request efficiently and accurately, helping you establish trust with potential creditors.

A business credit application form is a standardized document that collects pertinent information about a business seeking credit. This form typically includes details such as business structure, ownership, and financial status. Leveraging an Alabama Sample Letter for New Business with Credit Application can help you complete this form efficiently, making a strong impression on potential creditors.

A letter of credit for a new business serves as a guarantee of payment to a vendor or supplier, ensuring that you meet your financial obligations. This financial instrument can boost your credibility when establishing new business relationships. By using an Alabama Sample Letter for New Business with Credit Application, you can communicate your intent clearly, securing better credit terms.

An application for credit is a process where a business formally requests financial assistance, usually for purchasing goods or services. This application assesses creditworthiness to determine the terms of credit to be extended. An Alabama Sample Letter for New Business with Credit Application can guide you through this process and help convey your business's credibility.

A credit application for a business is a formal request for credit, helping you obtain financing for various business activities. It typically includes information about your business operations, ownership, and financials. Utilizing an Alabama Sample Letter for New Business with Credit Application can clarify your credit request while enhancing your professional image.

A credit application for a vendor is a form that you complete to request credit terms for purchasing goods or services. This application typically requires information about your business, including financial details and credit history. Using an Alabama Sample Letter for New Business with Credit Application can simplify this process and ensure you provide all necessary information.

Crediting a vendor means that you acknowledge the terms and conditions provided by the vendor for extending credit. This often involves assessing your creditworthiness as a new business. In the context of an Alabama Sample Letter for New Business with Credit Application, this process helps you establish a good relationship and build trust with your vendors.

A credit application from a vendor is a request made by a business to obtain goods or services on credit terms. This application allows the vendor to evaluate the buyer’s creditworthiness before extending credit. Proper completion and submission can lead to favorable credit terms. To streamline this process, consider using an Alabama Sample Letter for New Business with Credit Application, which aids in presenting your business reliably.

A business credit application is a specific form that a business fills out to request credit from a lender or vendor. This application typically includes details such as the business’s financial statements, ownership information, and credit history. Approaching this application with thorough documentation increases chances of approval. You can leverage an Alabama Sample Letter for New Business with Credit Application to ensure your application reflects your business’s credibility.

A credit application is a formal request made by a business to obtain credit from a lender or supplier. This document provides crucial information about the business, such as its financial health and credit history. Completing a credit application accurately is essential for getting approved for credit. To support your application, an Alabama Sample Letter for New Business with Credit Application can provide a professional touch that enhances your presentation.