Alabama Loan Agreement between Stockholder and Corporation

Description

How to fill out Loan Agreement Between Stockholder And Corporation?

Are you currently in a role where you need documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust can be challenging.

US Legal Forms offers a large selection of template forms, such as the Alabama Loan Agreement between Stockholder and Corporation, that are designed to meet state and federal requirements.

Once you find the right form, click on Buy now.

Select the payment plan you want, fill in the required details to set up your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you will be able to download the Alabama Loan Agreement between Stockholder and Corporation template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

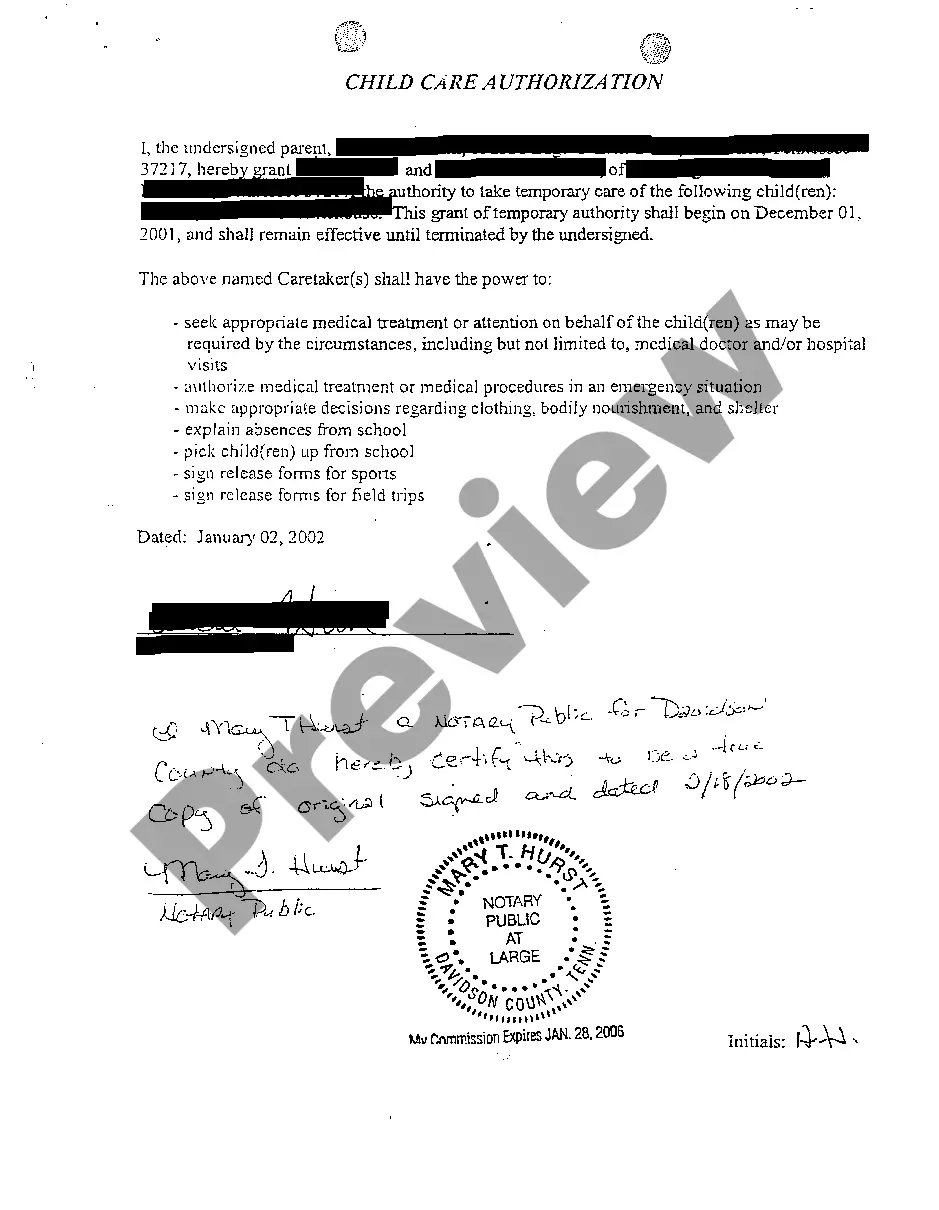

- Use the Preview button to review the form.

- Read the description to confirm that you have chosen the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that fits your requirements.

Form popularity

FAQ

A loan to a shareholder must be returned to the corporation by the end of the next fiscal year to ensure that the amount will not be taxed. For the loan not to be considered income, according to the CRA, interest must be charged by the corporation at a prescribed rate to any shareholder loan amount.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

The shareholder must recognize compensation or dividend income but has interest expense, which may be deductible depending on how the borrowed funds are used. (For example, if used for personal purposes (other than a residential mortgage), the interest would be nondeductible personal interest.)

Lending corporate cash to shareholders can be an effective way to give the shareholders use of the funds without the double-tax consequences of dividends. However, an advance or loan to a shareholder must be a bona fide loan to avoid a constructive dividend.

Usually, an IOU and a promissory note form are only signed by the borrower, although they may be signed by both parties. A loan agreement is a single document that contains all of the terms of the loan, and is signed by both parties.

Because of the low dividend tax rates, a corporation can issue dividends to a shareholder that are used to repay a loan due the corporation by the shareholder. This is more advantageous than forgiving the loan, which results in cancellation-of-indebtedness income that is taxable as ordinary income.

A Shareholder Loan Agreement, sometimes called a stockholder loan agreement, is an enforceable agreement between a shareholder and a corporation that details the terms of a loan (like the repayment schedule and interest rates) when a corporation borrows money from or owes money to a shareholder.

How do I create a Shareholder Loan Agreement?Determine how the corporation will make payments.State the term length.Specify the loan amount.Determine the payment details.Provide both parties' information.Address miscellaneous matters.Sign the document.

You have one year from your fiscal year-end date to pay it back. This can be repaid as a direct repayment, salary, or dividend. Be careful doing so since your shareholder loan will be reported to CRA as an asset on your balance sheet at fiscal year-end.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?