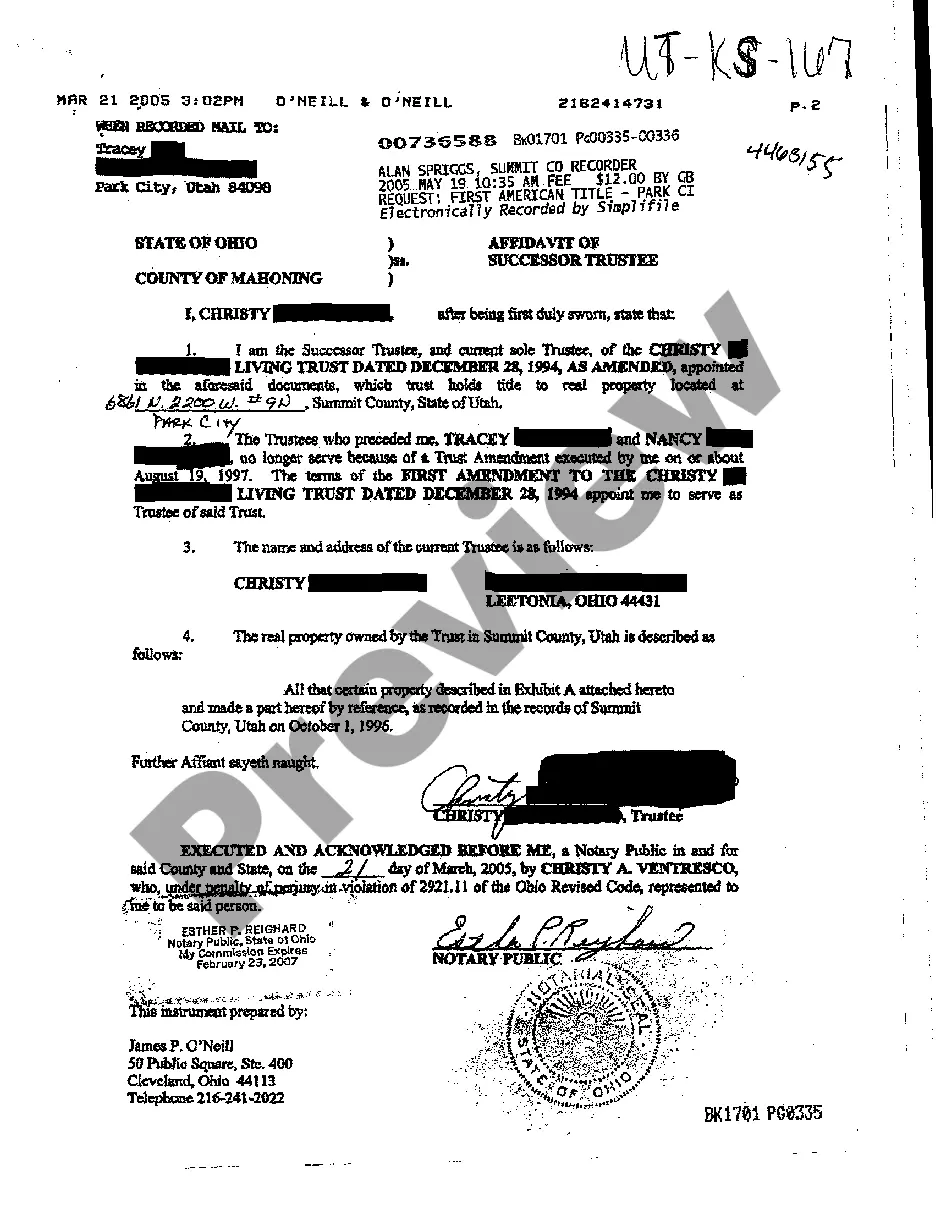

Alabama Right of First Refusal to Purchase Real Estate

Description

How to fill out Right Of First Refusal To Purchase Real Estate?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates available for download or printing.

By using the website, you can access thousands of forms for both business and personal use, organized by categories, states, or keywords. You can find the latest versions of documents such as the Alabama Right of First Refusal to Purchase Real Estate in just moments.

If you already have an account, Log In and retrieve the Alabama Right of First Refusal to Purchase Real Estate from the US Legal Forms collection. The Download button will be visible on each form you review. You can access all previously acquired forms within the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit, complete, print, and sign the downloaded Alabama Right of First Refusal to Purchase Real Estate. Each template you add to your account has no expiration and remains yours indefinitely. Therefore, if you need to download or print another copy, just navigate to the My documents section and click on the form you require.

- Ensure you have selected the appropriate form for your city/state.

- Click the Preview button to review the form's details.

- Check the form information to confirm you have chosen the correct document.

- If the form does not meet your needs, use the Search field at the top of the page to find the document that does.

- Once satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose your pricing plan and provide your details to create an account.

Form popularity

FAQ

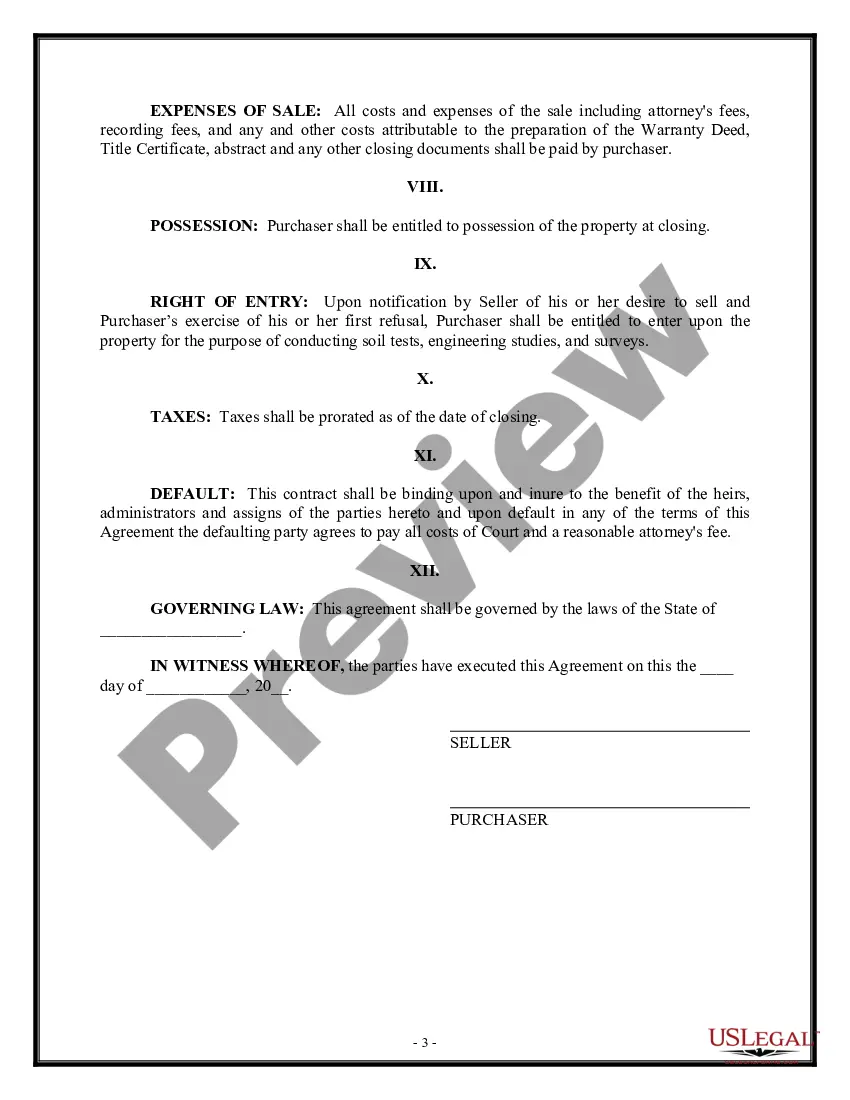

In the Multiple Listing Service (MLS), the right of first refusal in Alabama typically allows tenants or interested parties to be notified of an upcoming sale, enabling them the chance to buy before others. This inclusion can attract buyers who value this option, making a property more appealing on the market. It’s a great strategy to provide an advantage for interested buyers.

To secure the first right of refusal, initiate discussions with the property owner to express your interest in the property. It’s important to negotiate the terms and ensure they are documented properly in a contract. Working with a reputable platform like US Legal Forms can help you navigate this process efficiently. This way, you can ensure that your rights are protected and that the agreement meets all necessary legal standards.

To obtain your first right of refusal in Alabama, you should negotiate it with the property owner and include it in the sale or lease agreement. This process often involves drafting a clear and legally binding document that specifies the terms. Consulting with legal experts, like US Legal Forms, can streamline this process and ensure your rights are fully protected. Make sure both parties clearly understand the conditions to avoid any confusion later.

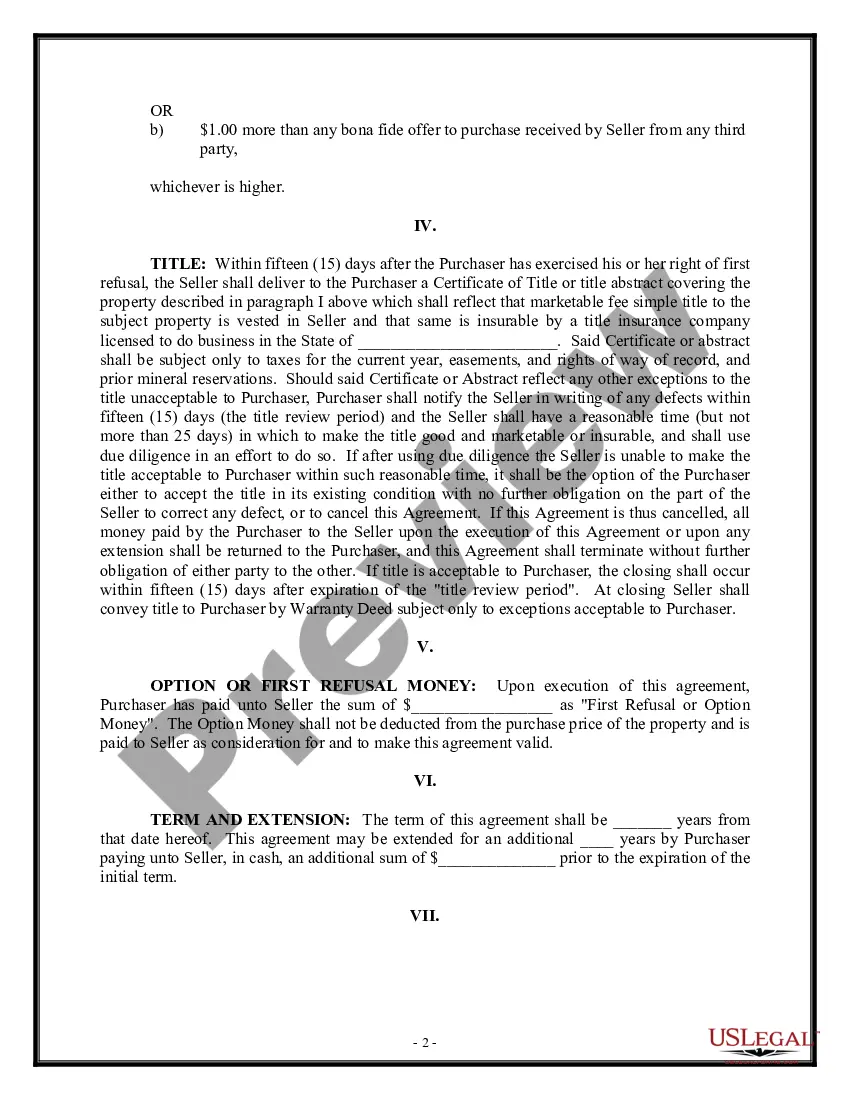

The right of first refusal is usually triggered when a third party offers to buy or lease the property owner's asset. Before the property owner accepts this offer, the property holder (the person with the right of first refusal) must be allowed to buy or lease the asset under the same terms offered by the third party.

The right of first refusal applies to sales as well as rentals. And with any sale or rental, the board has the opportunity to exercise its right of first refusal or to waive that right.

Right of first refusal (ROFR), also known as first right of refusal, is a contractual right to enter into a business transaction with a person or company before anyone else can. If the party with this right declines to enter into a transaction, the obligor is free to entertain other offers.

The right of first refusal granted herein shall terminate (i)with respect to any particular First Refusal Space upon the failure by Tenant to exercise its right of first refusal with respect to the First Refusal Space so offered by Landlord pursuant to the terms of this Section1.

To be enforceable, options and rights of first refusal must usually be in writing, signed, contain an adequate description of the property, and be supported by consideration. They may be included in lease contracts, or they may be drafted as standalone agreements.

Once that is done the ROFR holder has the option of purchasing the property instead or waiving their ROFR and allowing another sale to go through. To get to closing, a title company has to have a signed Waiver of Right of First Refusal document in the file before funding can occur.

Right of first refusal usually has a time limit placed on it, and when the time is up, any potential buyers can make an offer on the property. Quite often, a right of first refusal will last anywhere from 24-72 hours from the time another party presents an acceptable offer.