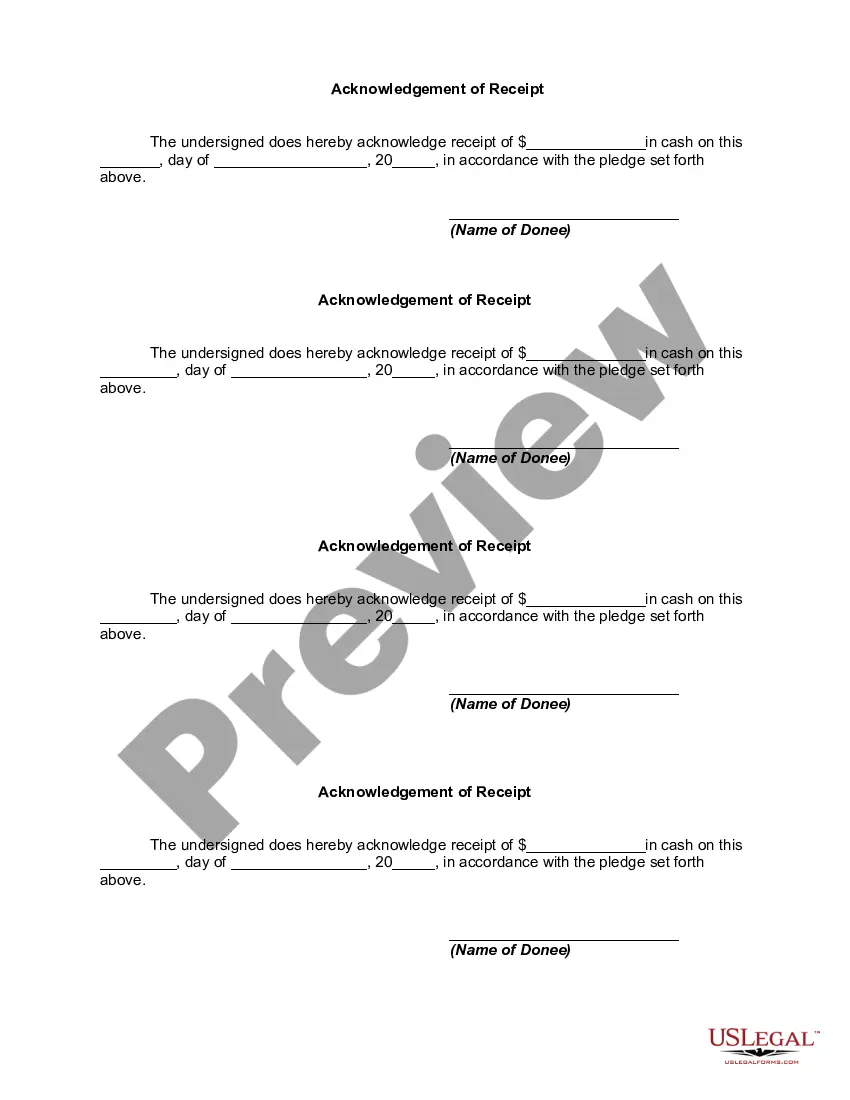

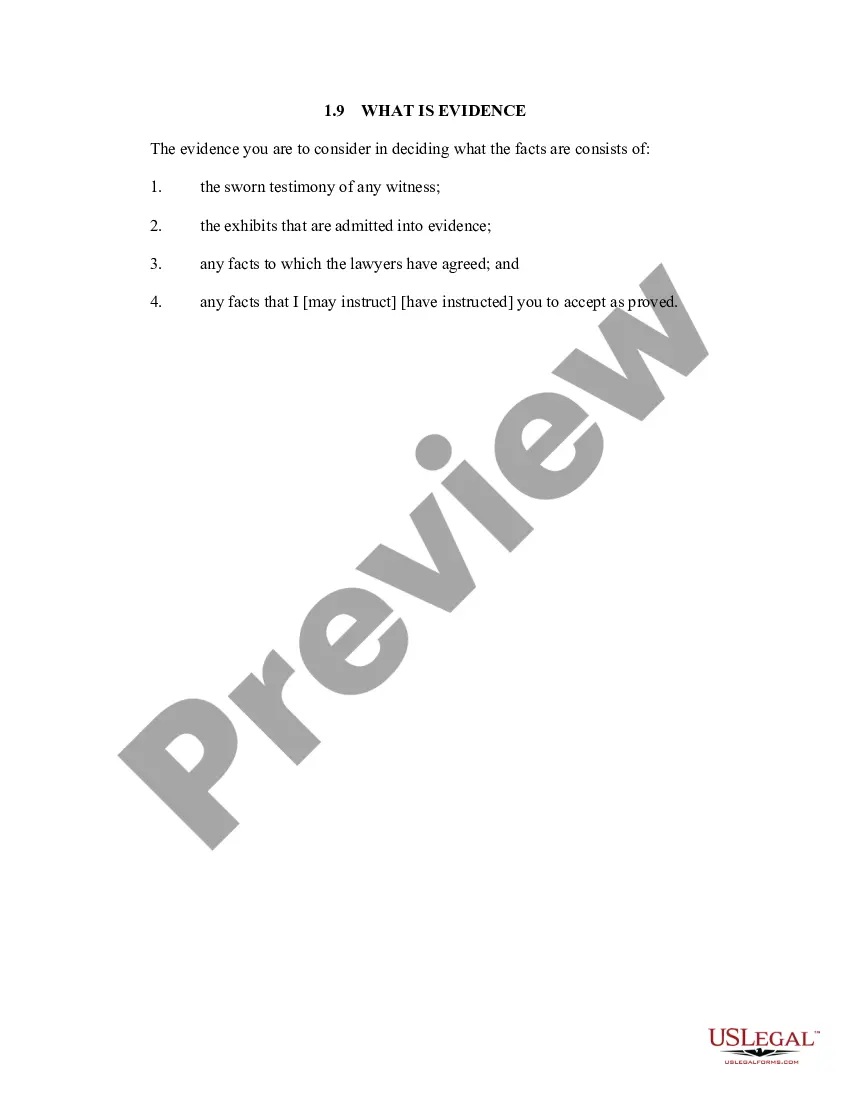

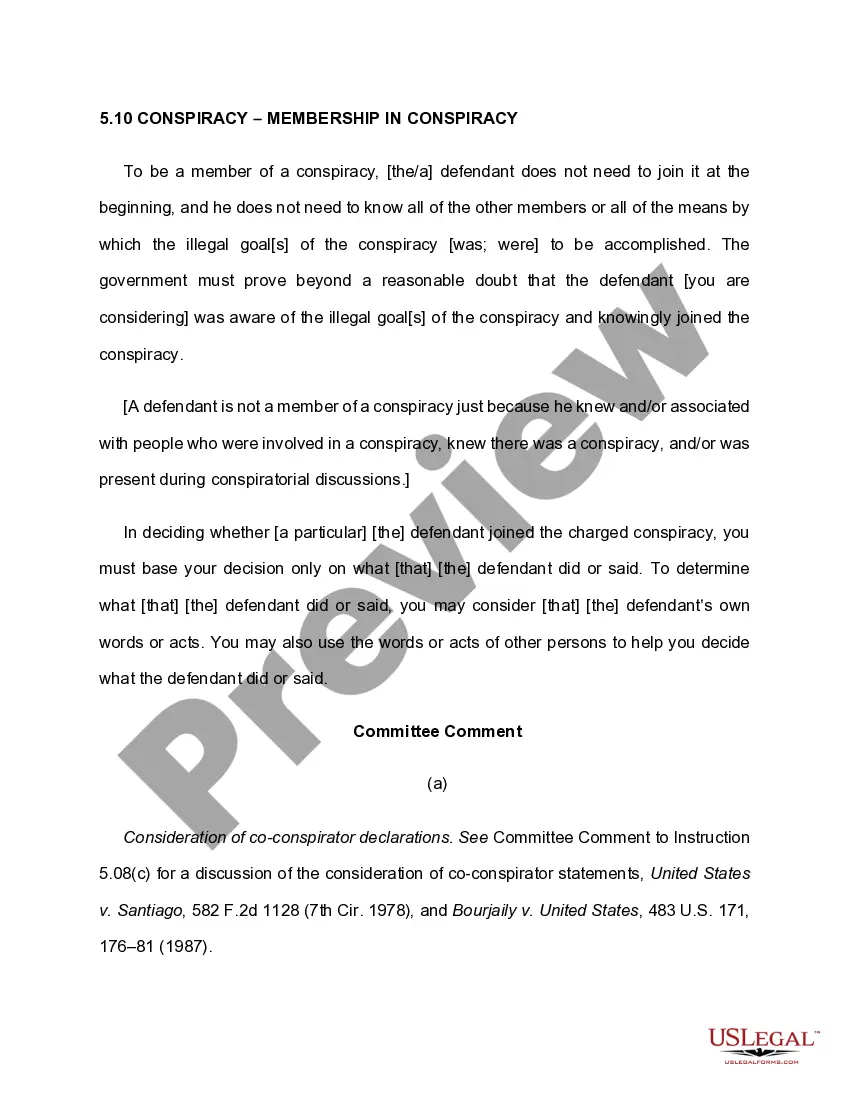

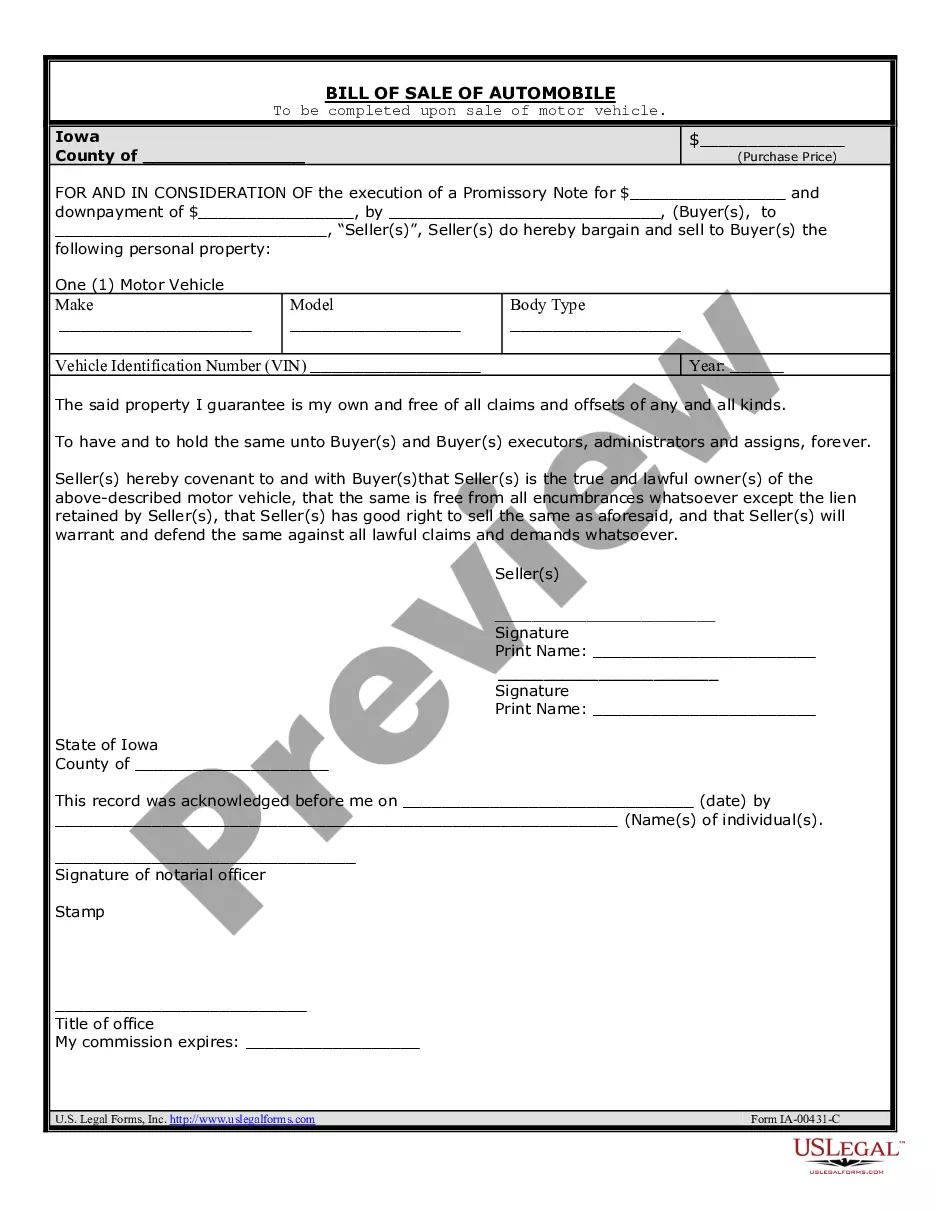

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alabama Declaration of Gift Over Several Year Period

Description

How to fill out Declaration Of Gift Over Several Year Period?

If you wish to finalize, obtain, or produce lawful document templates, utilize US Legal Forms, the finest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to secure the documents you need.

Numerous templates for business and personal purposes are organized by categories and jurisdictions, or keywords. Use US Legal Forms to acquire the Alabama Declaration of Gift Over Several Year Period with just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Alabama Declaration of Gift Over Several Year Period with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- When you are already a US Legal Forms user, Log In to your account and click the Download button to access the Alabama Declaration of Gift Over Several Year Period.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s content. Remember to read the description closely.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative types of the legal form template.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Finalize, modify and print or sign the Alabama Declaration of Gift Over Several Year Period.

Form popularity

FAQ

Gifting more than the annual exclusion amount requires you to file IRS Form 709. This form allows you to track any excess amounts against your lifetime exemption limit. Utilizing the Alabama Declaration of Gift Over Several Year Period can help clarify your gifting strategy and minimize potential tax liabilities.

If you gift someone more than the annual gift tax exclusion amount, you must report the gift on IRS Form 709. The excess amount counts against your lifetime gift exemption, which can affect your estate tax in the future. Being aware of the Alabama Declaration of Gift Over Several Year Period can assist you in planning your gifts strategically and ensuring you avoid unnecessary tax complications.

The IRS may know about your gifts through several sources, including the use of Form 709 for larger gifts or if you exceed the annual exclusion. Financial institutions may also report large transactions that could indicate a gift. To avoid any issues, it is essential to comply with the requirements of the Alabama Declaration of Gift Over Several Year Period and report as necessary.

To document a gift for tax purposes, simply keep records of the gift including the recipient's name, the gift amount, and the date. If the gift exceeds the annual exclusion, you should consider using IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. Proper documentation is essential, especially with the Alabama Declaration of Gift Over Several Year Period, to ensure compliance with tax obligations.

Alabama Code 36-25-7 pertains to ethics laws for public officials and employees, especially regarding gifts. This code prohibits public officials from soliciting gifts valued over a specific amount. Understanding this code is crucial for maintaining compliance when making gifts, especially those indicative of the Alabama Declaration of Gift Over Several Year Period, to avoid conflicts of interest.

Alabama does not levy a state gift tax, but federal gift tax rules do apply. This means that you can give gifts valued under $15,000 (as of the 2021 IRS guidelines) per person without them counting towards your lifetime gift tax exemption. The Alabama Declaration of Gift Over Several Year Period provides guidance on structuring significant gifts while remaining compliant with regulations.

Typically, Alabama allows a certain gift limit for teachers, which often revolves around goodwill and appreciation rather than monetary restrictions. According to current regulations, gifts valued under $25 are acceptable without drawing undue attention or regulations. Following the local law and being aware of the Alabama Declaration of Gift Over Several Year Period can help maintain professionalism in gifting.

In Alabama, gift certificates do have specific expiration policies. Under Alabama law, gift certificates cannot expire within five years from the date of issuance. This ensures that recipients have ample time to use their gift, aligning with the flexibility offered in the Alabama Declaration of Gift Over Several Year Period.

Yes, you can elect to gift split on a late filed return, but this requires the consent of both spouses for the gifts made during that tax year. Make sure to file the late return correctly to reflect the gift-splitting arrangement. This option can be advantageous when dealing with an Alabama Declaration of Gift Over Several Year Period, as it maximizes the gift exclusion.

The statute of limitations for gift tax returns is generally three years from the date you file the return. However, if you omit more than 25% of the gifts, this period may extend to six years. Being aware of the statute is crucial when planning for an Alabama Declaration of Gift Over Several Year Period.