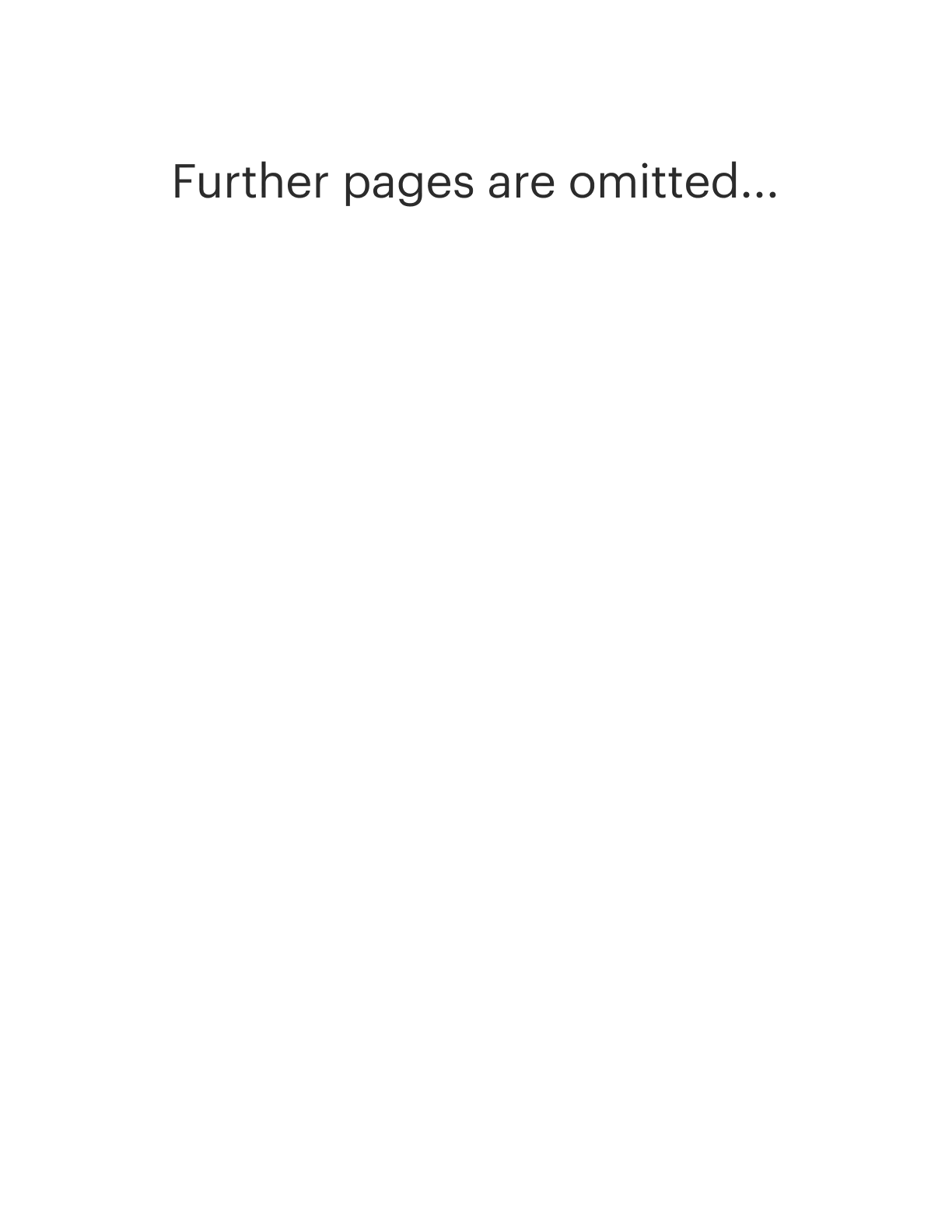

Alabama Irrevocable Letter of Credit

Description

How to fill out Irrevocable Letter Of Credit?

It is possible to commit hrs on the Internet attempting to find the legal document template that meets the federal and state requirements you require. US Legal Forms supplies a large number of legal forms which are examined by specialists. You can easily down load or produce the Alabama Irrevocable Letter of Credit from my service.

If you already have a US Legal Forms bank account, you are able to log in and click on the Download option. After that, you are able to complete, edit, produce, or indicator the Alabama Irrevocable Letter of Credit. Each legal document template you buy is the one you have eternally. To get one more version of the purchased type, proceed to the My Forms tab and click on the related option.

Should you use the US Legal Forms internet site the very first time, follow the basic instructions listed below:

- Very first, make certain you have selected the correct document template to the area/area of your choice. Read the type outline to ensure you have picked out the correct type. If readily available, take advantage of the Preview option to look throughout the document template as well.

- If you would like locate one more variation of your type, take advantage of the Lookup discipline to get the template that meets your requirements and requirements.

- After you have discovered the template you would like, just click Acquire now to proceed.

- Select the pricing plan you would like, key in your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You may use your charge card or PayPal bank account to purchase the legal type.

- Select the structure of your document and down load it in your product.

- Make adjustments in your document if needed. It is possible to complete, edit and indicator and produce Alabama Irrevocable Letter of Credit.

Download and produce a large number of document web templates making use of the US Legal Forms website, that offers the most important collection of legal forms. Use professional and status-distinct web templates to take on your company or individual needs.

Form popularity

FAQ

Irrevocable letters of credit are more common than revocable ones. These stipulate that no amendments or cancellations can occur without the consent of all parties involved. Irrevocable letters of credit can either be confirmed or unconfirmed. Revolving letters of credit are designed for multiple uses.

Banks will usually charge a fee for a letter of credit, which can be a percentage of the total credit that they are backing. The cost of a letter of credit will vary by bank and the size of the letter of credit. For example, the bank may charge 0.75% of the amount that it's guaranteeing.

An irrevocable letter of credit (or ILOC) is a written agreement between a bank and the party to which the letter is issued. Irrevocable letters of credit are used to guarantee a buyer's obligations to a seller.

An irrevocable letter of credit is a financial instrument used in international trade to ensure payment security for sellers and provide assurance to buyers. It is issued by a bank on behalf of the buyer, guaranteeing that the seller will receive payment upon complying with the specified terms and conditions.

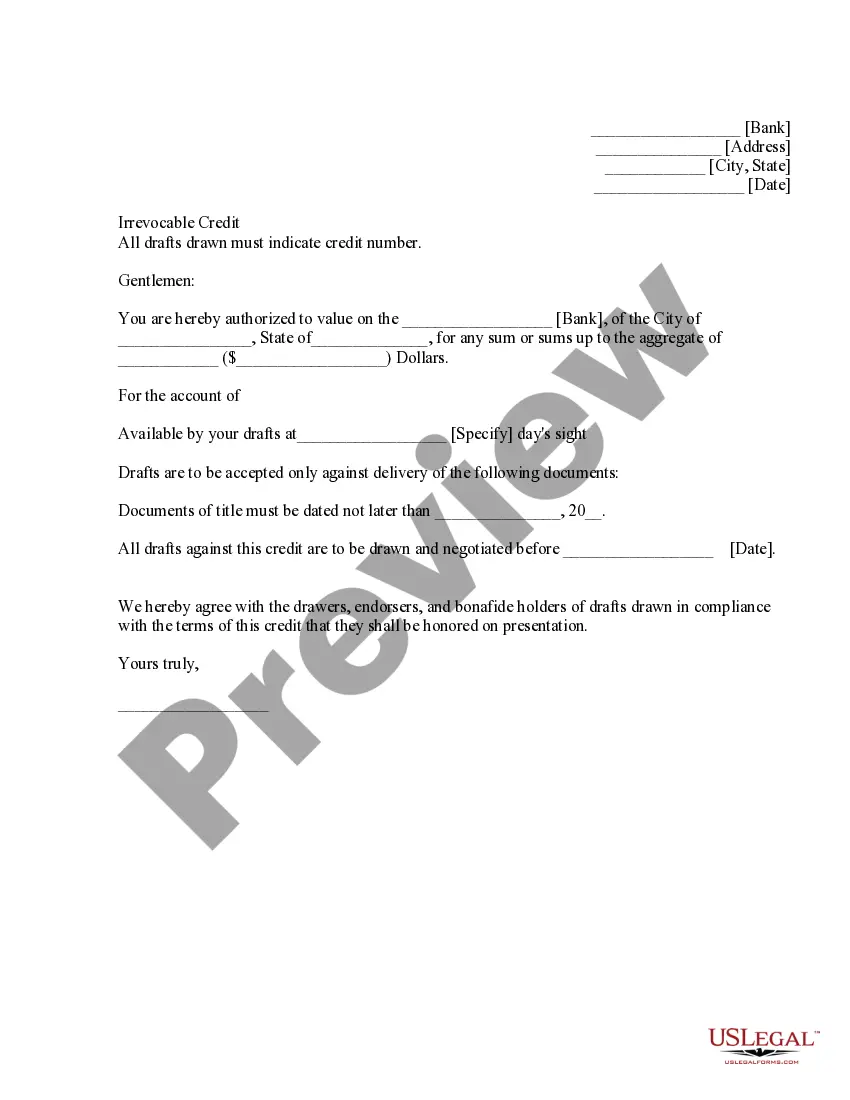

A revocable letter of credit is a financial instrument that can be amended or cancelled by the issuing bank without the approval and consent of the beneficiary or trading parties. This LC does not provide any security and could be terminated at any time, resulting in financial loss for the seller.

An Irrevocable Letter of Credit is one which cannot be cancelled or amended without the consent of all parties concerned. A Revolving Letter of Credit is one where, under terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the credit being needed.

Inland letter of credit is an obligation of the bank that opens the letter of credit (the issuing bank) to pay the agreed amount to the seller on behalf of the buyer, upon receipt of the documents specified in the letter of credit under domestic business transaction.

For example, under a revocable letter of credit, if the seller was unable to ship within the stipulated time period, he could simply amend the shipment date to whenever suits him. That may not suit the buyer, but he would be powerless.