A Legacy is a gift of property or money under the terms of the will of a person who has died. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alabama Assignment of Legacy in Order to Pay Indebtedness

Description

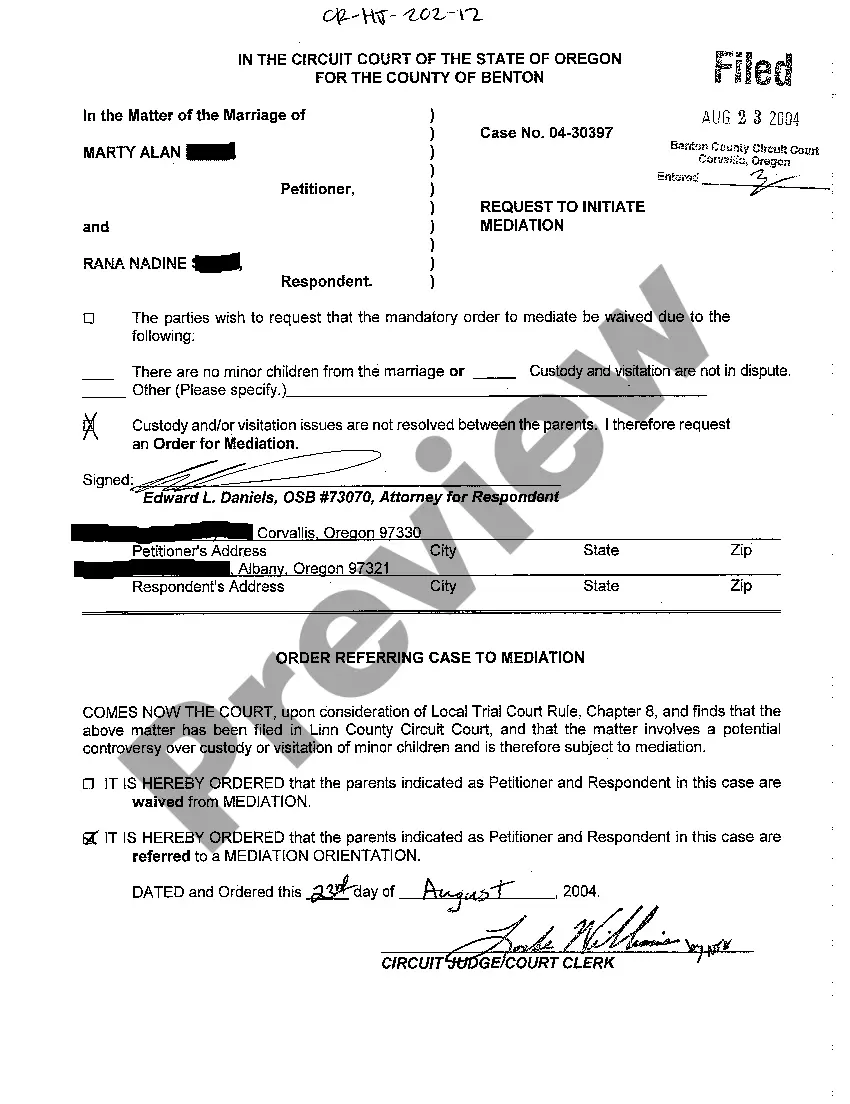

How to fill out Assignment Of Legacy In Order To Pay Indebtedness?

Choosing the best lawful file design could be a have a problem. Needless to say, there are a variety of templates available on the Internet, but how would you get the lawful type you want? Make use of the US Legal Forms internet site. The assistance delivers a large number of templates, for example the Alabama Assignment of Legacy in Order to Pay Indebtedness, that can be used for organization and personal needs. Every one of the types are examined by pros and satisfy federal and state needs.

When you are already listed, log in for your bank account and click the Download switch to have the Alabama Assignment of Legacy in Order to Pay Indebtedness. Use your bank account to check from the lawful types you might have acquired formerly. Go to the My Forms tab of your respective bank account and have yet another duplicate from the file you want.

When you are a brand new end user of US Legal Forms, listed here are simple recommendations that you can stick to:

- Very first, make sure you have chosen the correct type to your city/region. You can examine the form using the Review switch and read the form information to ensure it will be the best for you.

- In the event the type will not satisfy your expectations, take advantage of the Seach area to get the proper type.

- When you are sure that the form is suitable, go through the Get now switch to have the type.

- Choose the prices plan you want and enter in the necessary details. Design your bank account and pay money for the transaction making use of your PayPal bank account or Visa or Mastercard.

- Select the document format and download the lawful file design for your device.

- Complete, change and printing and indication the attained Alabama Assignment of Legacy in Order to Pay Indebtedness.

US Legal Forms is the most significant local library of lawful types in which you will find various file templates. Make use of the company to download skillfully-produced files that stick to express needs.

Form popularity

FAQ

AL Specifics. In Alabama, creditors must present any claims within 6 months of the executor's appointment, or 5 months of the date of the first Notice to Creditor publication, whichever is later, and within 30 days of being individually notified of the death by the executor (see AL Code § 43-2-350).

The family allowance is not chargeable against any benefit or share passing to the surviving spouse or children by the will of the decedent unless otherwise provided in the will, by intestate succession, or by way of elective share.

A surviving spouse of a decedent who was domiciled in Alabama is entitled to a homestead allowance of $15,000. Pursuant to Ala. Code. Sec.

Any person who wilfully refuses or fails to deliver a will after being ordered by the court in a proceeding brought for the purpose of compelling delivery is subject to the penalty for contempt of court.

Code of Alabama §§43-8-110 to 113 If there is no surviving spouse, each child/dependent of the decedent is entitled to the $15,000.00 allowance divided by the number of surviving children/dependents. The bill also raised the personal property exemption under §43-8-111 from $3,500.00 to $7,500.00.

Notice to surviving spouse and next of kin - Generally. Whenever an application is made to prove a will in this state, at least 10 days' notice must be given to the surviving spouse and next of kin, or either of them, residing and being within the state, before such application is heard.

Chapter 2 - Administration of Estates. Chapter 6 - Escheats. Chapter 7 - Uniform Simultaneous Death Act.

(a) Whenever an employee of another shall die intestate and there shall be due him or her any sum as wages or salary the debtor may discharge himself or herself from liability therefor by paying such amount to the surviving spouse of the deceased employee or, if there is no surviving spouse to the person having the ...