Indemnification is the act of making another "whole" by paying any loss another might suffer. This usually arises from a clause in a contract where a party agrees to pay for any monetary damages which arise or have arisen.

Alabama Indemnification of Purchaser of Personal Property from Estate

Description

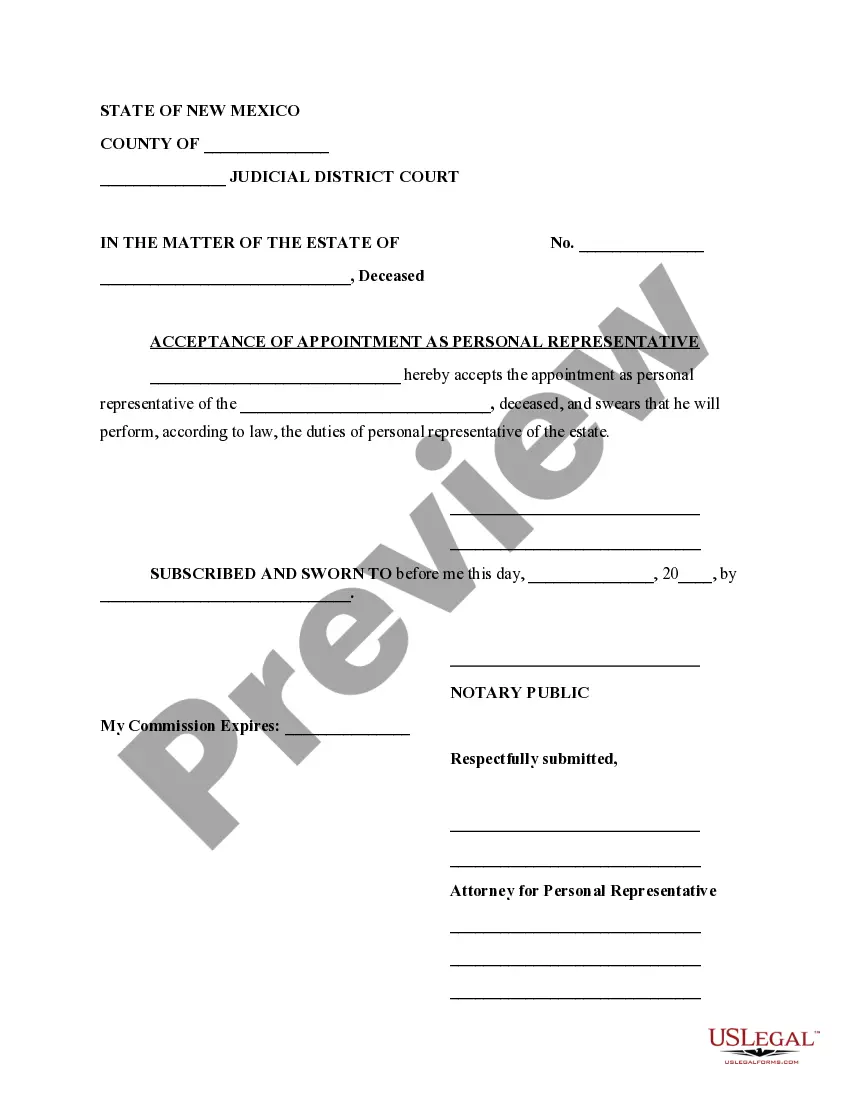

How to fill out Indemnification Of Purchaser Of Personal Property From Estate?

If you need to fill out, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Use the site's straightforward and user-friendly search feature to find the documents you need.

A wide range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the template, use the Search box at the top of the screen to find alternative versions in the legal form format.

Step 4. Once you locate the form you need, click on the Get now button. Select the subscription plan you want and enter your details to create an account.

- Employ US Legal Forms to obtain the Alabama Indemnification of Purchaser of Personal Property from Estate in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Alabama Indemnification of Purchaser of Personal Property from Estate.

- You can also access forms you have previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure that you have chosen the form for your specific city/state.

- Step 2. Utilize the Preview feature to review the form's contents. Don't forget to go through the details.

Form popularity

FAQ

The wording of an indemnity clause should be precise, stating the indemnifying party's commitment to compensate for all losses or damages. For Alabama indemnification of purchaser of personal property from estate, the clause may read, 'The Indemnitor shall indemnify and hold the Indemnitee harmless for any claims arising from the transaction.' Well-drafted language fosters clarity and reduces the risk of conflict.

Writing an indemnification clause involves outlining the scope of protection, specifying any exceptions, and identifying the parties involved. In the context of Alabama indemnification of purchaser of personal property from estate, clarity and completeness are crucial to avoid future disputes. Consider consulting legal resources or platforms like USLegalForms to ensure accuracy and compliance.

An example of a standard indemnity clause might state, 'The indemnifying party agrees to indemnify and hold harmless the purchaser from any claims related to the personal property acquired.' In the realm of Alabama indemnification of purchaser of personal property from estate, this wording encapsulates the essential protections needed. Clear examples help parties understand their rights and responsibilities.

Standard indemnity wording typically includes clauses that outline the obligations of the indemnifying party to compensate for any losses incurred. In the context of Alabama indemnification of purchaser of personal property from estate, it ensures that all potential claims are addressed. Clarity in the language helps prevent misunderstandings and fosters trust between the parties.

Filling out a letter of indemnity form involves providing specific details about both parties involved, the property in question, and any relevant agreements made. Be sure to clearly state the purpose of the indemnity to avoid ambiguity. For an efficient solution, you can use the USLegalForms platform, which offers templates and guidance tailored to Alabama indemnification of purchaser of personal property from estate.

An indemnification clause in a real estate contract provides protection to one party against potential losses or damages that could arise from the contract's execution. In the context of Alabama Indemnification of Purchaser of Personal Property from Estate, this clause ensures that buyers are financially secured from claims related to the property after the sale. Including a well-defined indemnification clause can minimize risks and clarify responsibilities for all parties involved. If you seek assistance in drafting or understanding these clauses, consider visiting US Legal Forms for comprehensive solutions.

In Alabama, the indemnification law protects purchasers of personal property from estates by ensuring they are compensated for any potential losses arising from claims against that property. This law helps to clarify responsibilities and liabilities for both buyers and sellers in a transaction. Understanding the Alabama Indemnification of Purchaser of Personal Property from Estate can be crucial for those involved in estate sales, as it safeguards their interests. For more detailed information and resources, US Legal Forms offers templates and guidance tailored to your needs.

Creditors in Alabama typically have six months to file claims against an estate after the personal representative has been appointed. This timeframe gives creditors an opportunity to collect what is owed before assets are distributed. For buyers in such transactions, knowing the implications of the Alabama Indemnification of Purchaser of Personal Property from Estate can offer peace of mind. You may also find it beneficial to explore services from USLegalForms that can clarify these legal processes.

In Alabama, debt collection can occur for up to the same five years after a person’s death as allowed for creditors to pursue an estate. This ensures that creditors have sufficient time to identify and collect debts owed by the deceased. For individuals concerned about liabilities related to purchasing personal property, understanding the Alabama Indemnification of Purchaser of Personal Property from Estate is essential to mitigate risks. Consider consulting resources from USLegalForms for expert guidance.

To file a claim against an estate in Alabama, you need to submit your claim in writing to the estate's personal representative or executor. Depending on the circumstances, your claim must be filed within the statutory period, which is often a short timeframe. Utilizing the Alabama Indemnification of Purchaser of Personal Property from Estate can help safeguard your interests as you navigate this process. Legal assistance from platforms like USLegalForms can simplify filing and ensure your rights are protected.