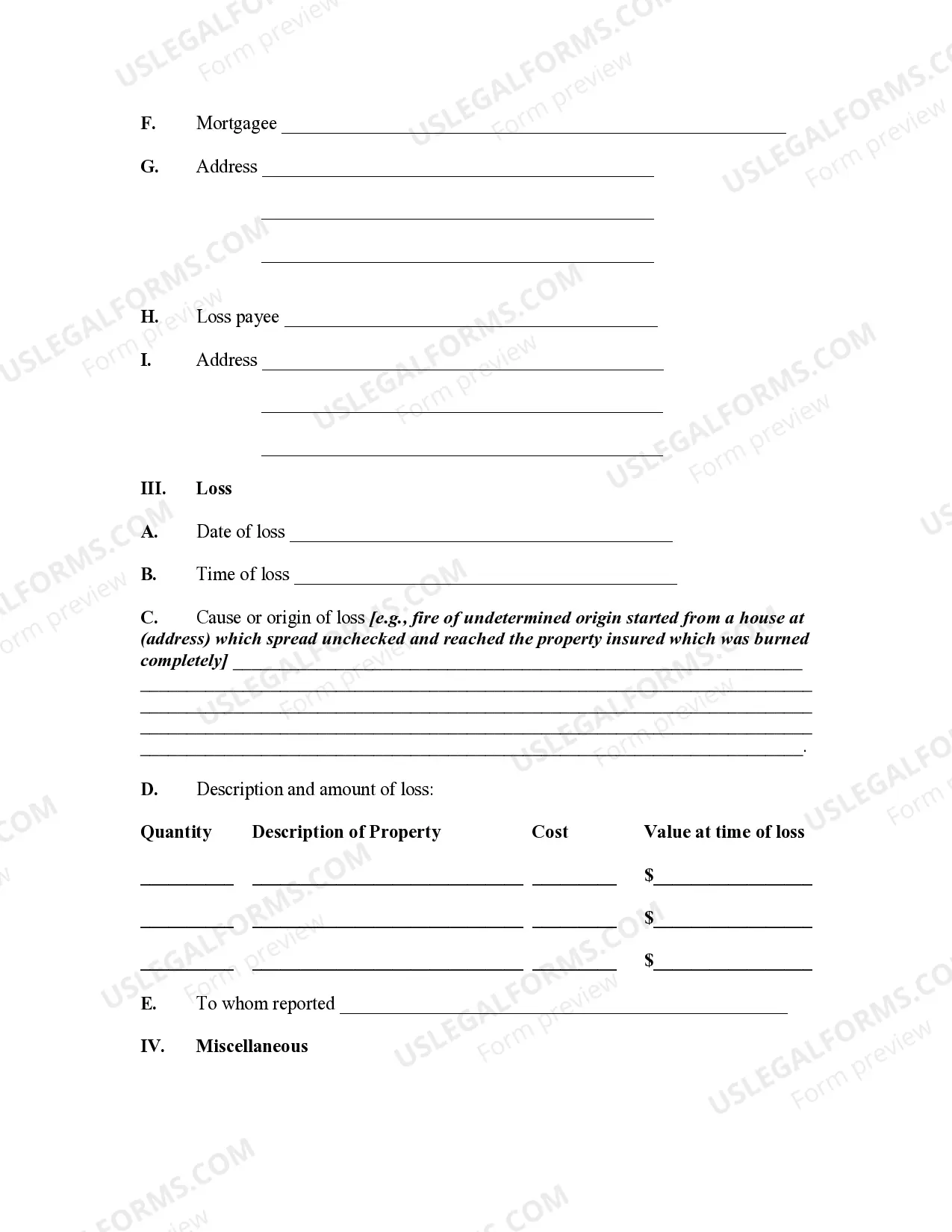

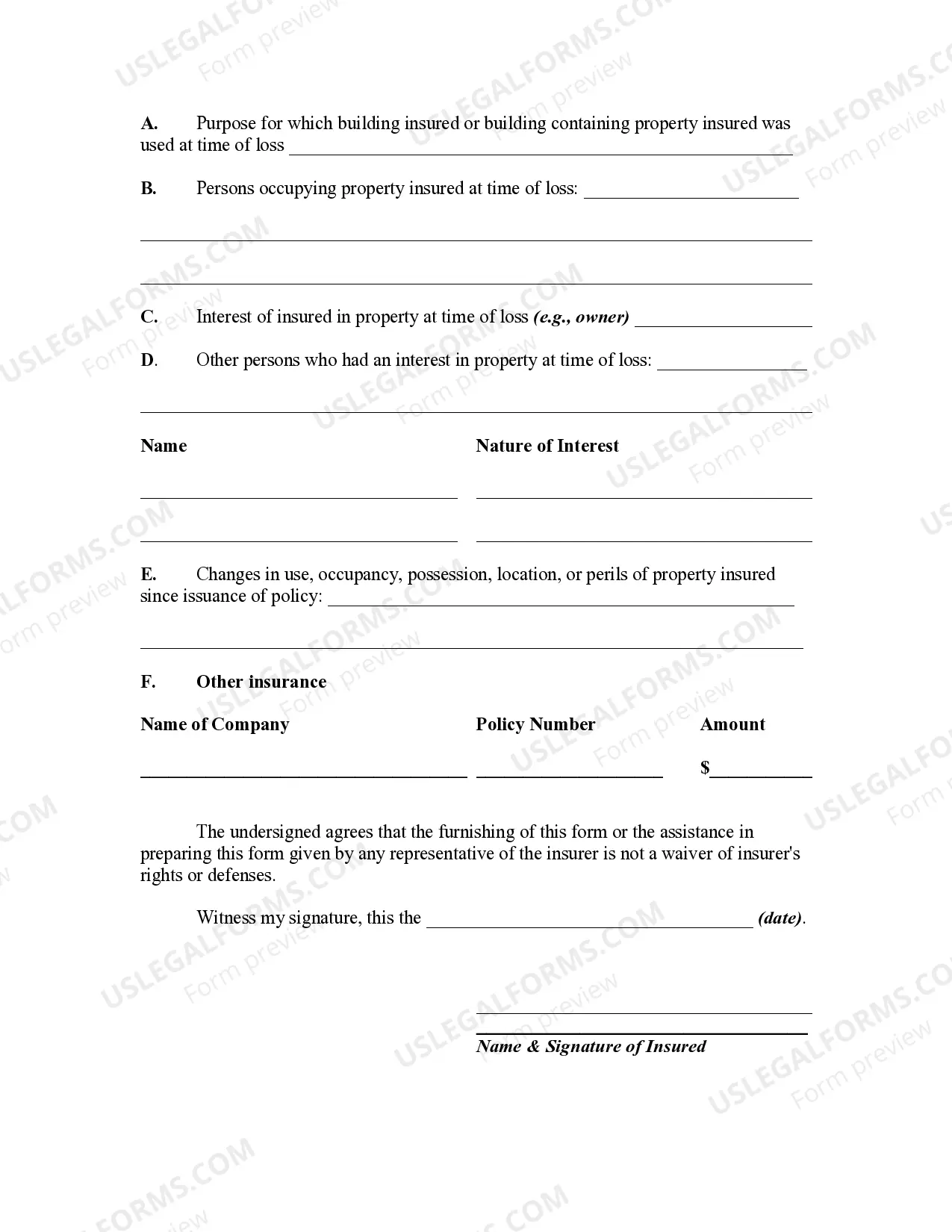

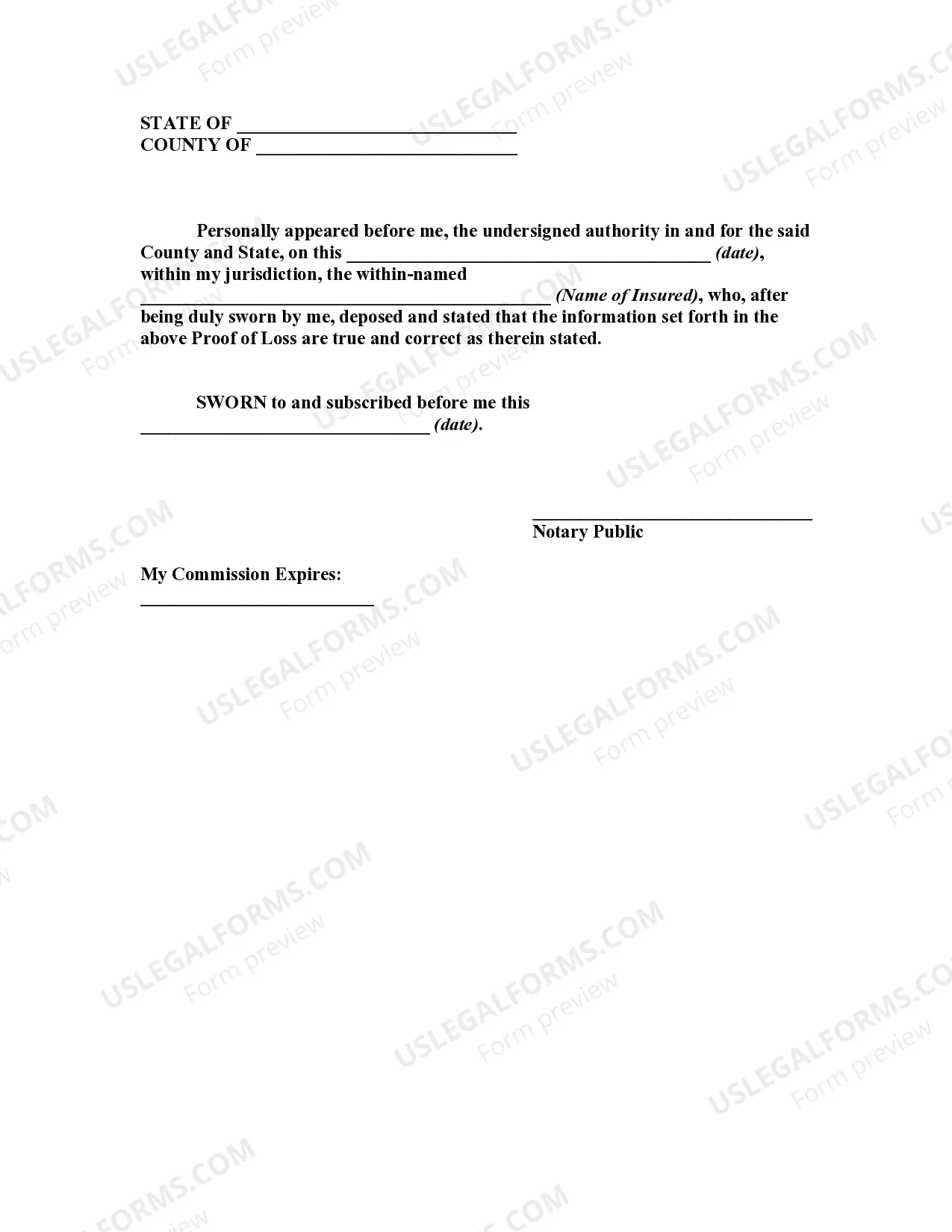

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

Alabama Proof of Loss for Fire Insurance Claim

Description

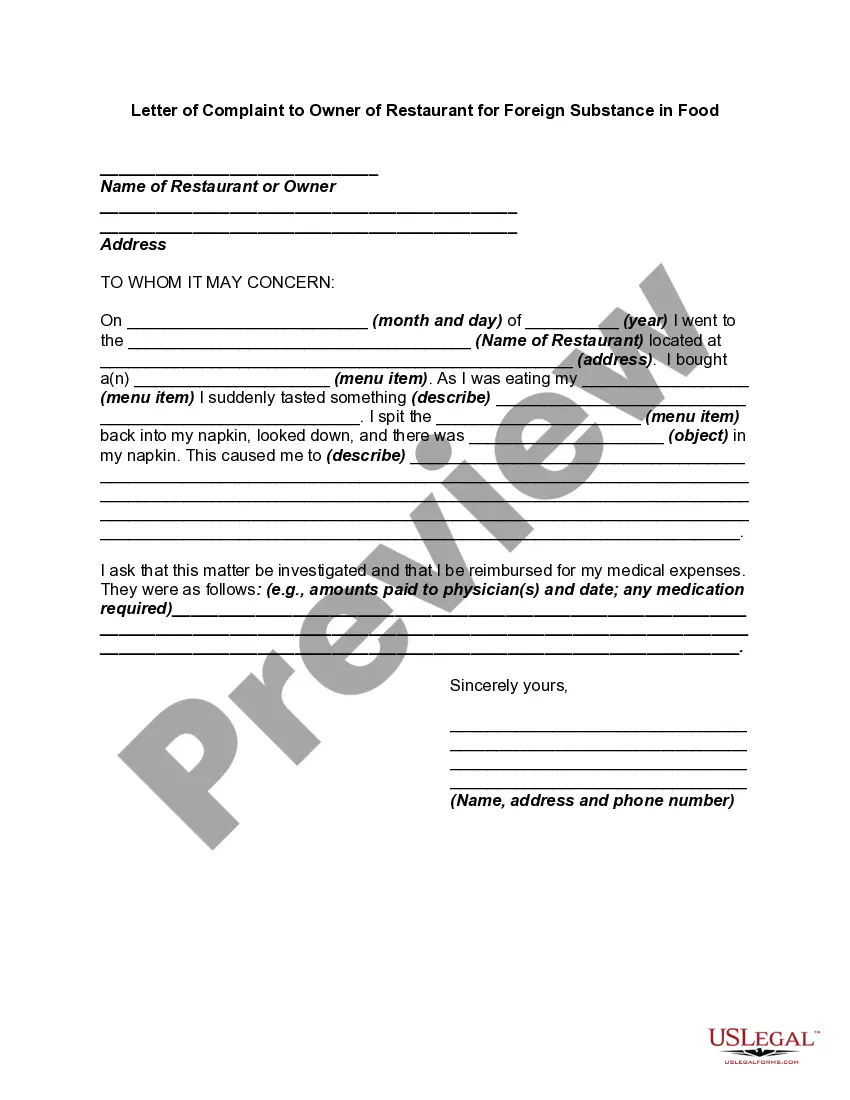

How to fill out Proof Of Loss For Fire Insurance Claim?

If you wish to full, down load, or produce legal record layouts, use US Legal Forms, the greatest variety of legal types, which can be found on-line. Take advantage of the site`s simple and easy convenient look for to find the files you will need. Different layouts for enterprise and specific reasons are categorized by categories and states, or keywords and phrases. Use US Legal Forms to find the Alabama Proof of Loss for Fire Insurance Claim with a handful of clicks.

Should you be previously a US Legal Forms consumer, log in to the bank account and click the Down load key to obtain the Alabama Proof of Loss for Fire Insurance Claim. You may also gain access to types you earlier saved within the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape to the proper city/land.

- Step 2. Make use of the Review choice to look through the form`s information. Never neglect to learn the outline.

- Step 3. Should you be not satisfied with the kind, utilize the Lookup industry towards the top of the display to get other models of the legal kind format.

- Step 4. Once you have identified the shape you will need, go through the Acquire now key. Pick the prices strategy you favor and add your credentials to register for the bank account.

- Step 5. Process the purchase. You should use your Мisa or Ьastercard or PayPal bank account to complete the purchase.

- Step 6. Pick the structure of the legal kind and down load it on the product.

- Step 7. Total, revise and produce or indicator the Alabama Proof of Loss for Fire Insurance Claim.

Each legal record format you buy is yours permanently. You may have acces to every kind you saved in your acccount. Select the My Forms segment and choose a kind to produce or down load once again.

Remain competitive and down load, and produce the Alabama Proof of Loss for Fire Insurance Claim with US Legal Forms. There are millions of professional and condition-distinct types you can utilize to your enterprise or specific requires.

Form popularity

FAQ

Actual loss refers to the loss that has been incurred by the insured during the occurrence of fire. Insured value refers to the value for which the insurer purchased the fire insurance. The actual value of property refers to the total value of the property at the time or day of fire incidents.

A causes of loss form is used to establish and define the particular types of perils covered in an insured's commercial property policy.

Satisfactory proof of loss, as required for an insured to obtain penalties from an insurer, is that which is sufficient to fully apprise the insurer of the claim and extent of the damage. Louisiana Bag Co., 2008-0453, p. 16, 999 So.

In an insurance claims environment, it is up to the policyholder to present and prove their loss to the insurance company ? this form and its supporting documents enables the insured to do just that.

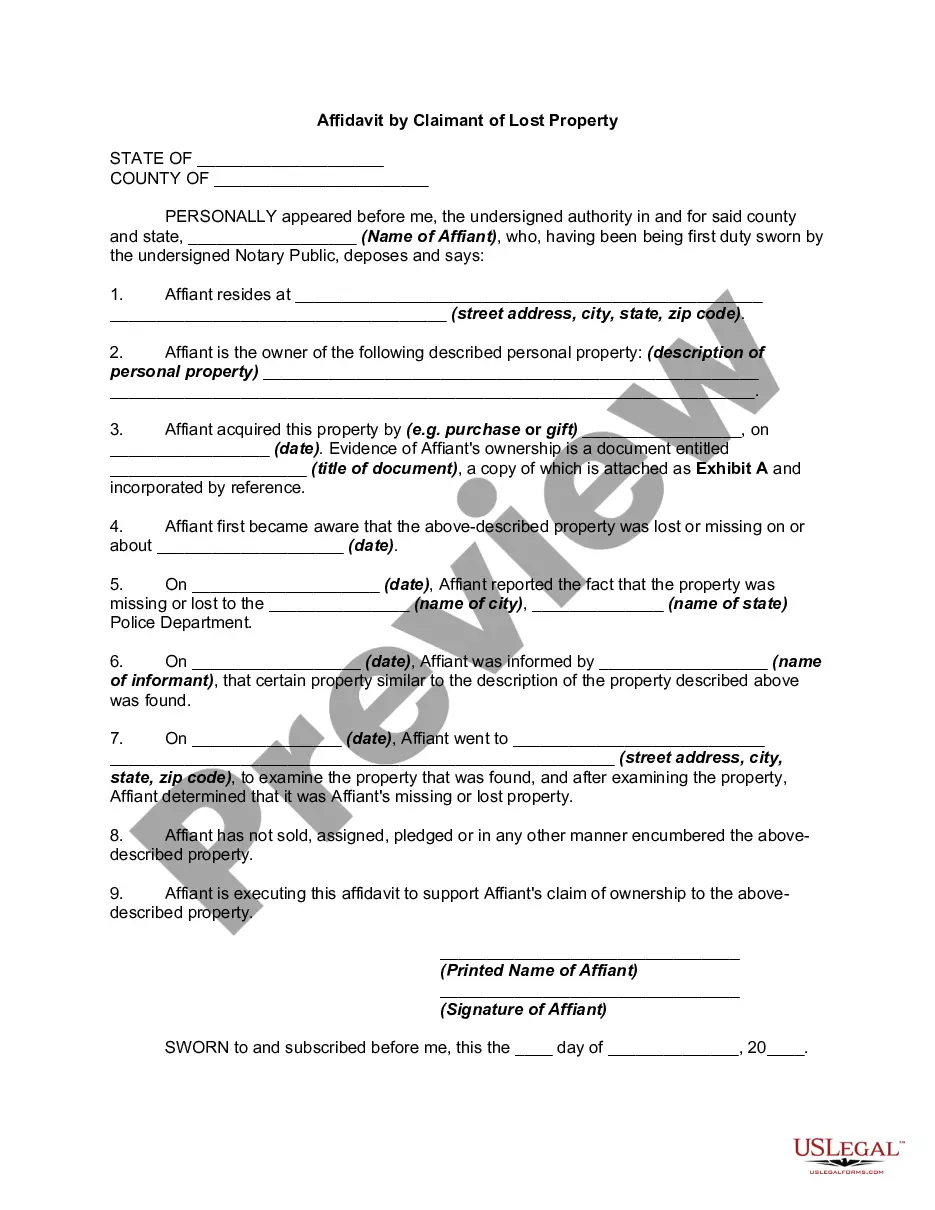

Proof of loss is a legal document that explains what's been damaged or stolen and how much money you're claiming. Your insurer may have you fill one out, depending on the loss. Homeowners, condo and renters insurance can typically help cover personal property.

If you can show some other evidence like photos or a bank statement of the purchase, your insurance company may accept your claim. Keep in mind that companies vary on what kinds of proof they'll accept.

It is important to submit your Proof of Loss statement form as soon as possible but no later than any date that is specified inside your insurance coverage policy. Often, this is a maximum of 60 days after the incident that caused the insurance claim in the first place.

In most cases, the Proof of Loss must include the following: Amount of loss that the policyholder is claiming. Documentation that supports the amount of claimed loss. Date that the loss occurred.