Alabama Receipt for Payment of Loss for Subrogation

Description

How to fill out Receipt For Payment Of Loss For Subrogation?

If you wish to total, down load, or print legitimate document themes, use US Legal Forms, the most important collection of legitimate types, that can be found on the Internet. Make use of the site`s basic and convenient lookup to discover the files you will need. A variety of themes for business and person uses are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to discover the Alabama Receipt for Payment of Loss for Subrogation with a few mouse clicks.

In case you are presently a US Legal Forms client, log in in your profile and click the Down load option to obtain the Alabama Receipt for Payment of Loss for Subrogation. You may also accessibility types you in the past acquired from the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow the instructions below:

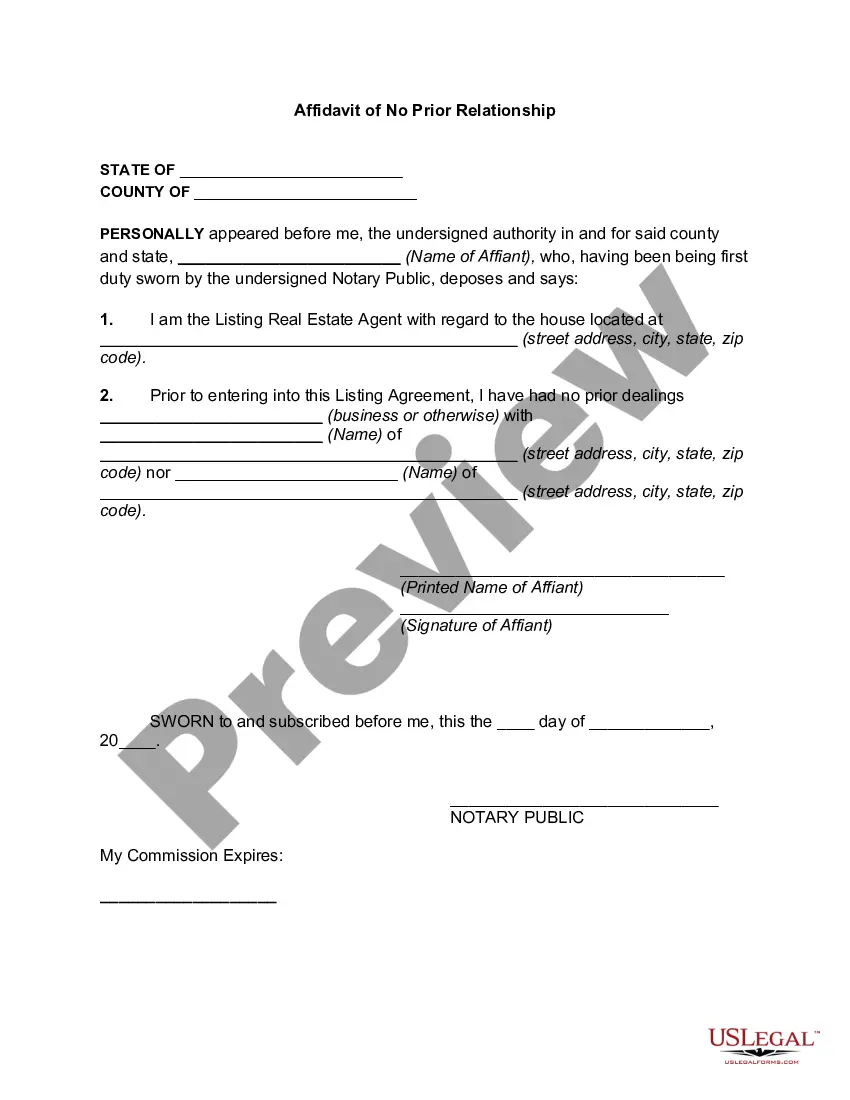

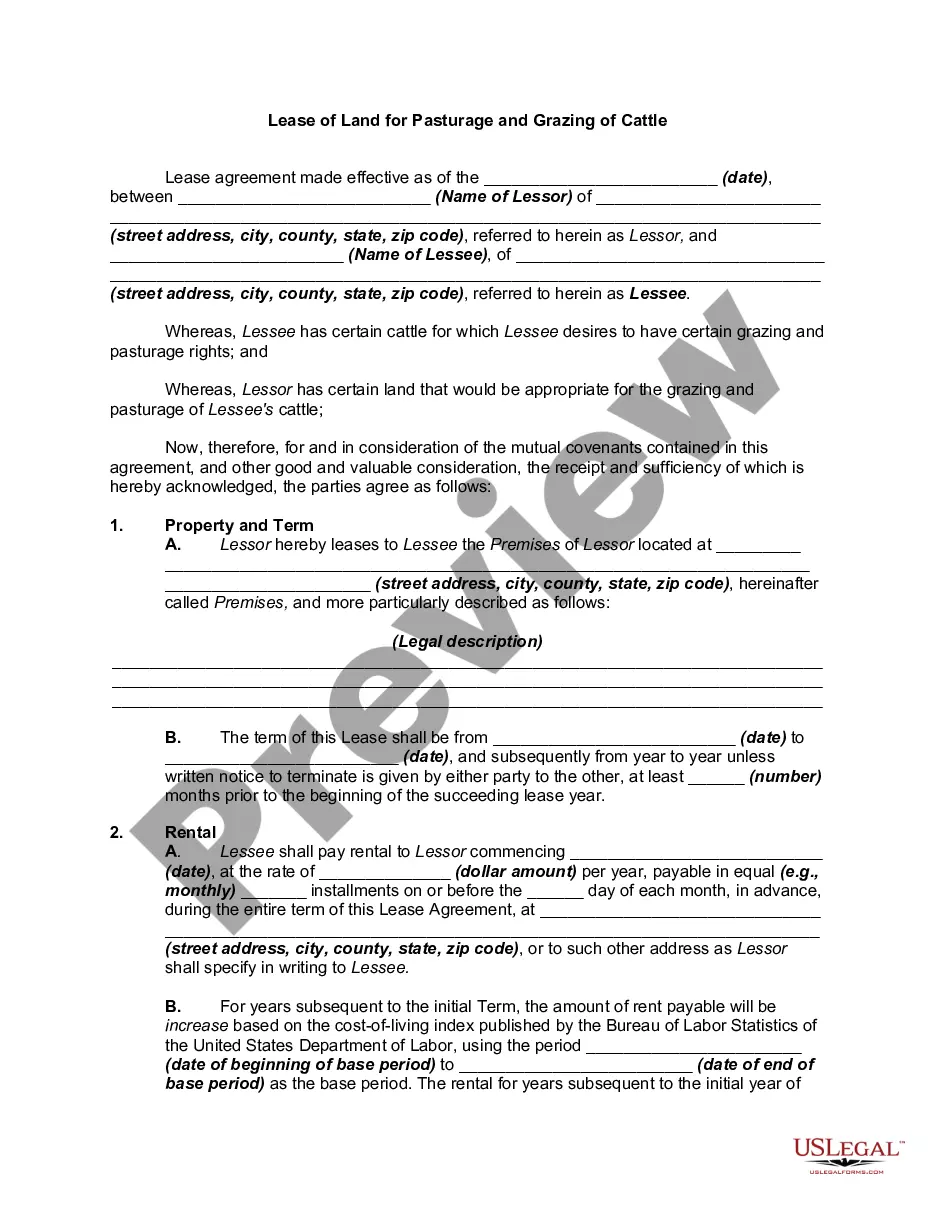

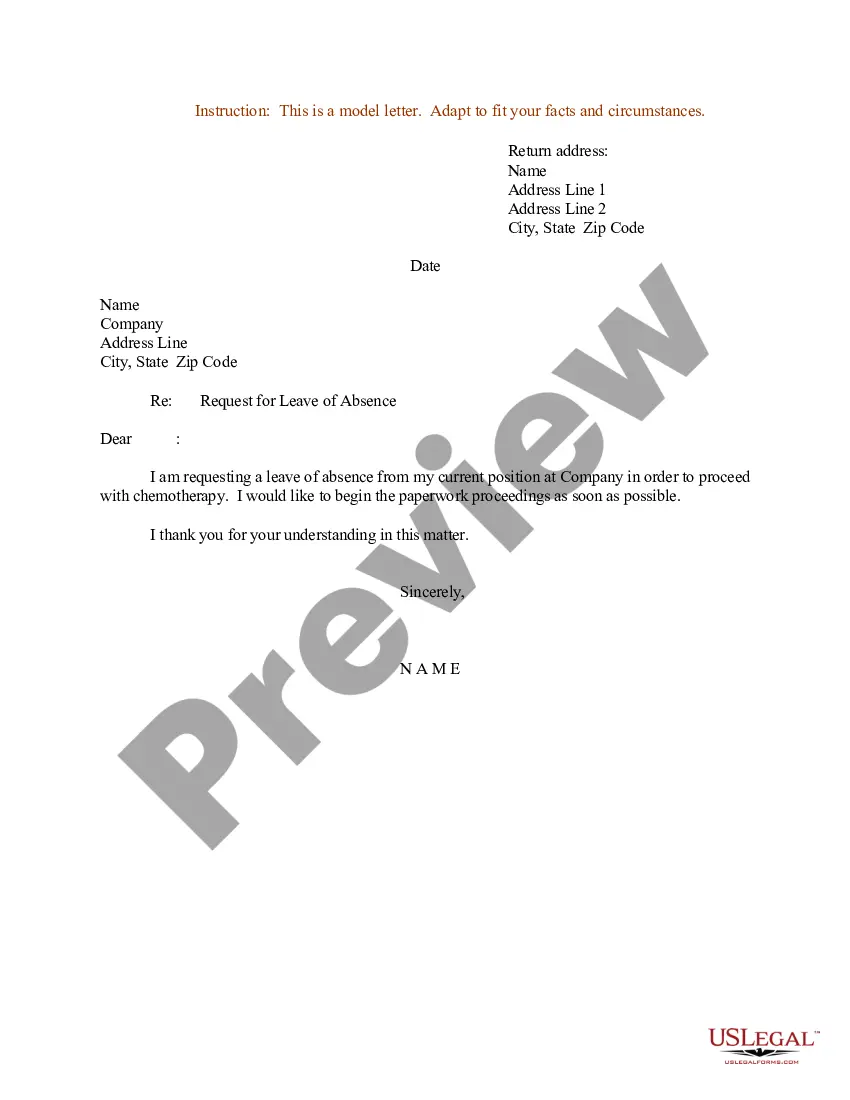

- Step 1. Be sure you have chosen the form for your correct area/country.

- Step 2. Make use of the Preview choice to examine the form`s content material. Never forget to read through the explanation.

- Step 3. In case you are not satisfied together with the develop, take advantage of the Look for discipline near the top of the screen to locate other versions of your legitimate develop web template.

- Step 4. Upon having located the form you will need, go through the Purchase now option. Pick the costs prepare you prefer and include your qualifications to sign up to have an profile.

- Step 5. Method the deal. You can utilize your Мisa or Ьastercard or PayPal profile to complete the deal.

- Step 6. Choose the file format of your legitimate develop and down load it on your own product.

- Step 7. Comprehensive, change and print or indicator the Alabama Receipt for Payment of Loss for Subrogation.

Each and every legitimate document web template you get is the one you have eternally. You possess acces to each develop you acquired in your acccount. Go through the My Forms segment and choose a develop to print or down load again.

Remain competitive and down load, and print the Alabama Receipt for Payment of Loss for Subrogation with US Legal Forms. There are millions of specialist and state-certain types you may use to your business or person needs.

Form popularity

FAQ

At the minimum, your subrogation file should contain all elements corresponding to liability determination and proof of damages. Being able to prove who is at fault is essential. You'll want to include documentation and any information you've gathered, such as witness statements or police reports.

An insurance claim is a formal request filed by a policyholder seeking compensation for a covered loss. There are several different types of insurance claims ? the type of claim that you need to file depends on the policies that you have and what they cover.

Subrogation forces the person who caused the incident to cover the damages rather than the injured party. Subrogation also ensures that the injured party cannot claim recovery benefits twice: once from the insurance company and a second by suing the wrongdoer in court.

Indemnity is a type of insurance compensation paid for damage or loss. When the term is used in the legal sense, it also may refer to an exemption from liability for damage. Indemnity is a contractual agreement between two parties in which one party agrees to pay for potential losses or damage caused by another party.

Subrogation, in the legal context, refers to when one party takes on the legal rights of another, especially substituting one creditor for another. Subrogation can also occur when one party takes over another's right to sue.

Subrogation allows your insurer to recoup costs (medical payments, repairs, etc.), including your deductible, from the at-fault driver's insurance company, if the accident wasn't your fault. A successful subrogation means a refund for you and your insurer.

Subrogation has been described as: the right of an insurance company to recover money from the person that caused the accident for the damages it paid to you as the insured party. the insurance company's right to be put in the position of you to pursue recovery from the person responsible for the accident.

The insured's loss results in the insurer's obligation to pay the proceeds of the insurance policy. An insurance policy is the insurance contract that describes the conditions and circumstances under which the insurer will indemnify the insured or other named beneficiaries.