A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders

Description

How to fill out Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

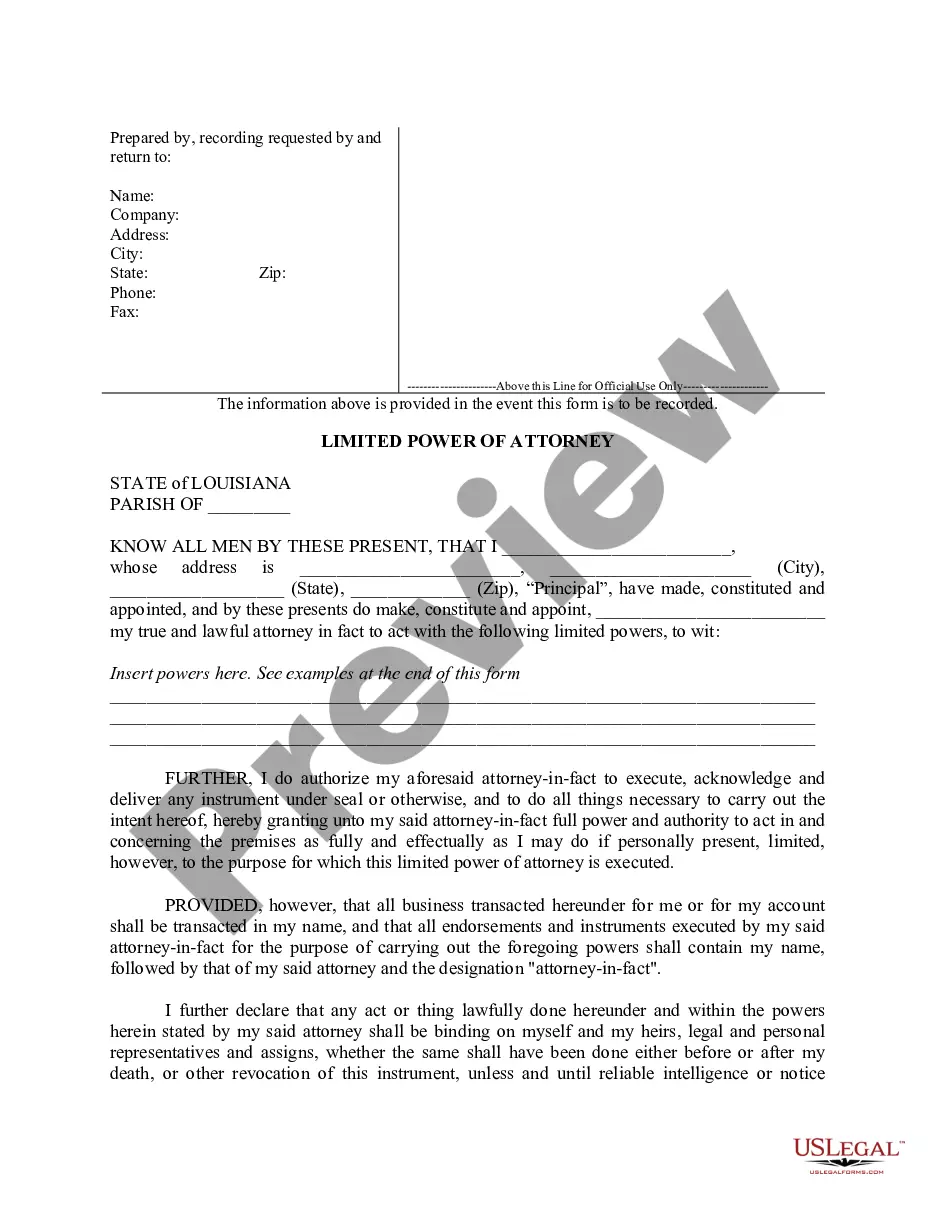

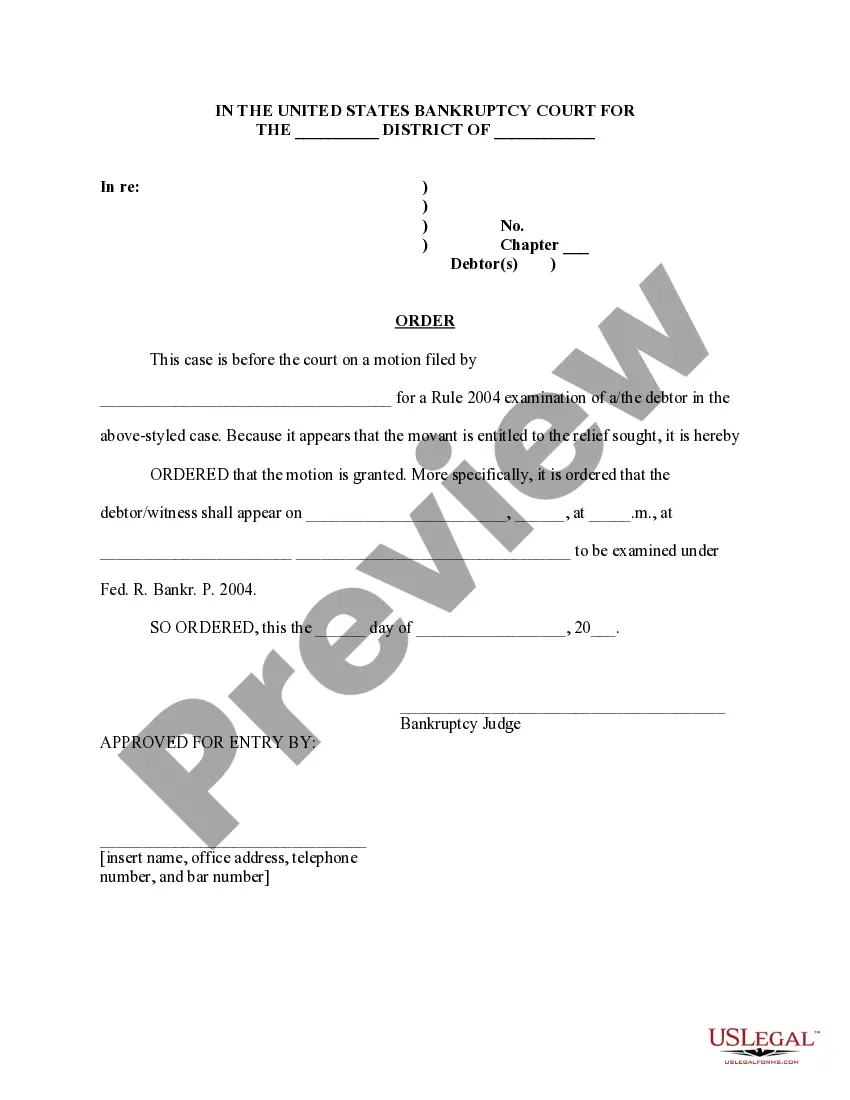

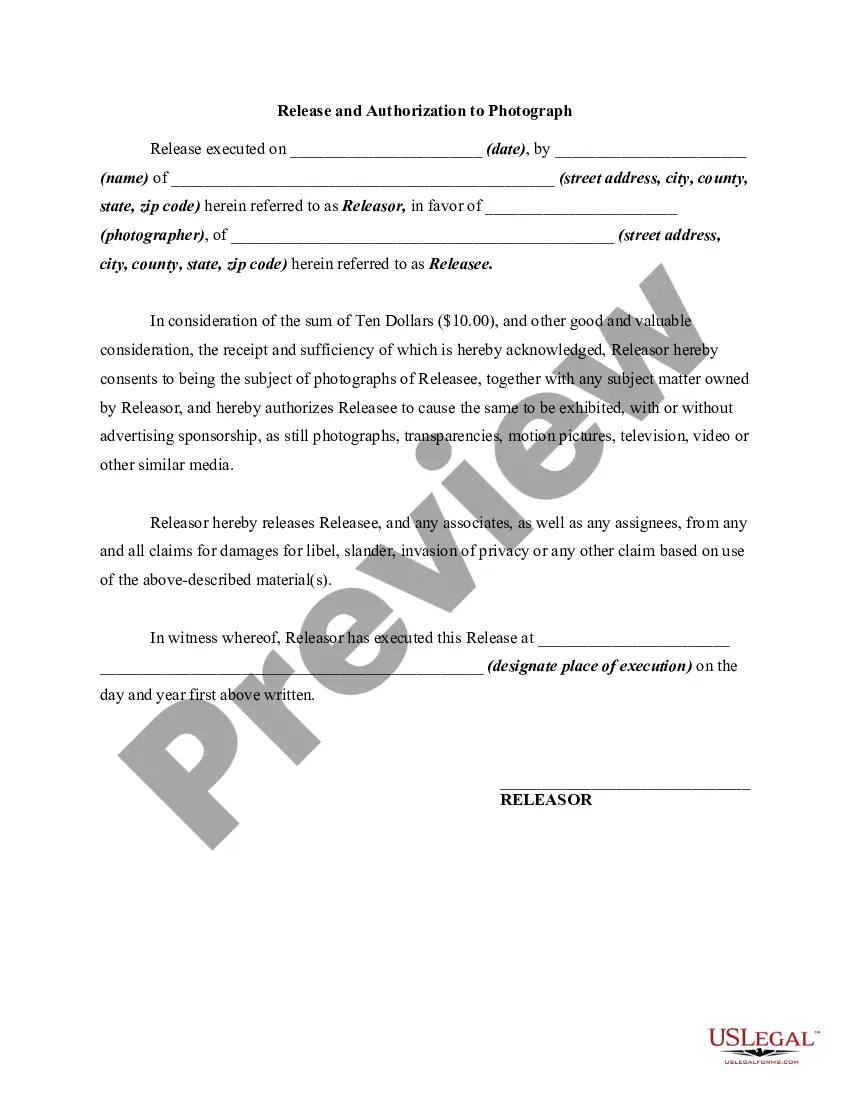

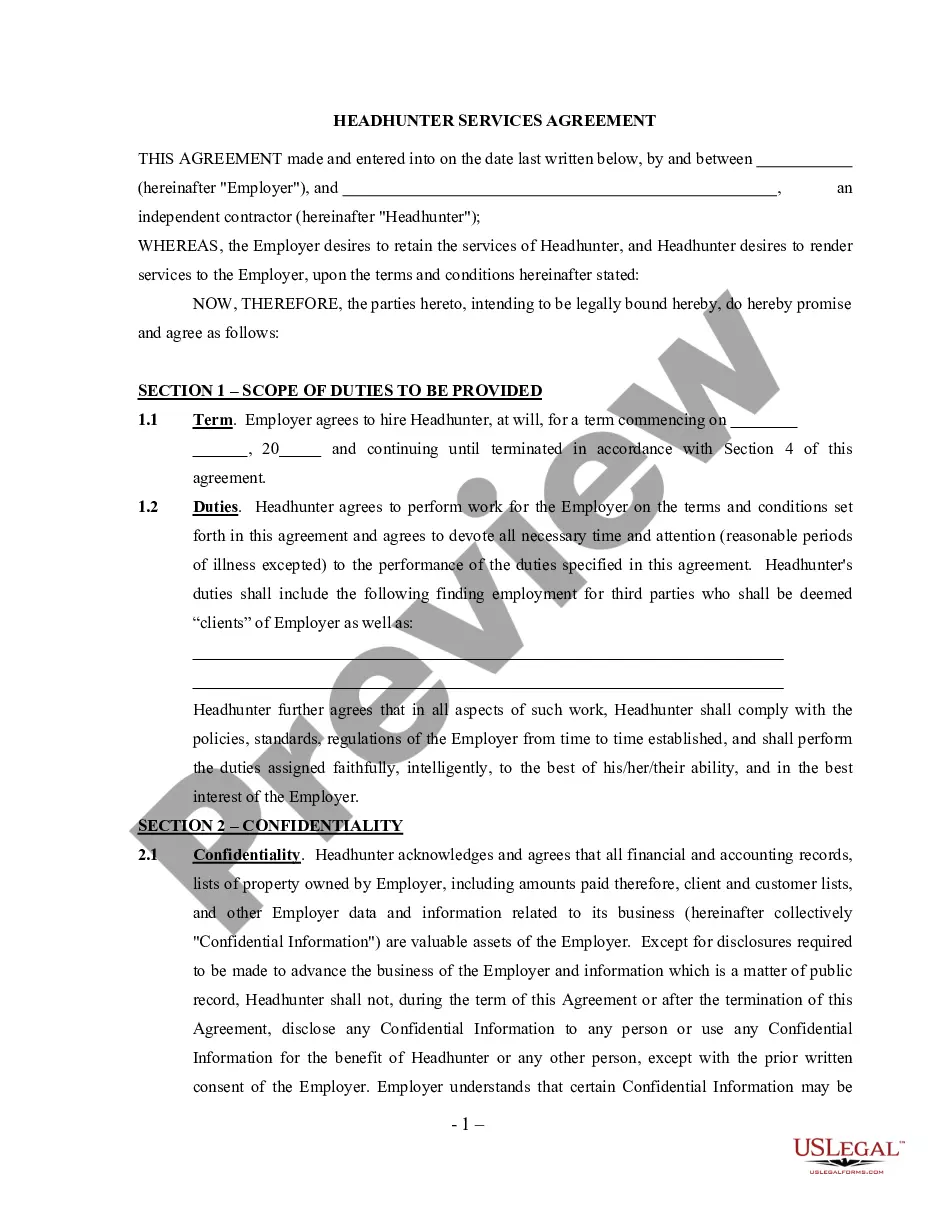

Locating the appropriate authorized document template can pose challenges. Of course, there are numerous templates available online, but how do you find the specific legal form you need? Utilize the US Legal Forms website. This service offers thousands of templates, such as the Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders, which can be utilized for business and personal purposes. All templates are reviewed by professionals and comply with federal and state regulations.

If you are already registered, sign in to your account and click the Download button to retrieve the Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders. Use your account to search through the legal forms you have purchased previously. Navigate to the My documents section of your account to obtain another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your jurisdiction/state. You can review the form using the Preview button and read the form description to confirm it is the right one for you. If the form does not satisfy your requirements, use the Search field to locate the appropriate form.

US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Take advantage of the service to download professionally crafted documents that adhere to state requirements.

- Once you are confident that the form is suitable, click the Get now button to acquire the form.

- Select the pricing plan you desire and enter the necessary information.

- Create your account and complete your purchase using your PayPal account or credit card.

- Choose the file format and download the authorized document template to your device.

- Fill out, modify, print, and sign the obtained Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

Form popularity

FAQ

A guarantor agreement is a legal contract whereby one party agrees to assume liability for another's financial obligations. This agreement typically outlines the terms and conditions surrounding the guarantee, including the specifics of the debts being guaranteed. In cases involving Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders, having a clear and comprehensive guarantor agreement can protect all parties involved. Utilizing tools from UsLegalForms can simplify the process of creating an effective guarantor agreement, ensuring clarity and legal compliance.

A guarantee of collection is an assurance that the guarantor will help collect a debt if the primary borrower defaults, but does not take on full responsibility for payment. Conversely, a guaranty of payment ensures that the guarantor is directly liable for making payment if the borrower fails to do so. In the context of Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders, understanding these terms is vital for correctly navigating financial agreements and ensuring all parties fulfill their obligations.

A subsidiary guarantee of parent debt occurs when a subsidiary company agrees to be responsible for the debts incurred by its parent company. This legally binding agreement helps to enhance the parent company's creditworthiness. By establishing an Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders, both parties can ensure a stronger financial position. Using this type of guarantee can often increase credibility with lenders and investors.

The due date for filing the Alabama business privilege tax typically falls on April 15 each year. If you have not yet completed the form, make sure to mark this date on your calendar to avoid penalties. Utilizing insights from the Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders can assist you in meeting these deadlines confidently.

The CPT Alabama form is used for reporting the Alabama business privilege tax, a requirement for most business entities in the state. By filling out this form, you declare your business's financial activity, which may affect your overall tax obligations. Understanding the Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders can help clarify your responsibilities related to this form.

Filing business privilege taxes late in Alabama can result in a penalty, which may include a percentage of the unpaid tax amount and additional interest accruing over time. To avoid late penalties, maintaining compliance with filing deadlines is crucial. Leveraging the Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders can enhance fiscal strategies for timely tax management.

If you fail to file the business privilege tax in Alabama, the state imposes various penalties, which can significantly increase your tax liability. The Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders reinforces your business's legitimacy and financial responsibility, potentially minimizing penalties through proper planning.

All businesses operating in Alabama are required to file the Alabama business privilege tax (PPT) if they meet specific gross receipts thresholds. This includes corporations, limited liability companies, and partnerships. Your understanding of the Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders can help you navigate these filing obligations more effectively.

Yes, you can request an extension for filing your Alabama business privilege tax return. However, this extension only applies to the time allowed for filing, not for paying any owed taxes. Utilizing strategies like the Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders can strengthen your financial reliability during these pressures.

In Alabama, there are penalties for filing taxes late, which can include both a monetary fine and interest on the unpaid tax amount. The Alabama Continuing Guaranty of Business Indebtedness By Corporate Stockholders may serve to protect your business from excessive penalties by ensuring that financial obligations are met. It's important to file your taxes on time to avoid compounding costs.