Alabama Corporate Guaranty - General

Description

How to fill out Corporate Guaranty - General?

Locating the correct legal document template can be a challenge.

Clearly, there are numerous designs available online, but how can you secure the legal form you seek.

Utilize the US Legal Forms website. The service offers a multitude of templates, including the Alabama Corporate Guaranty - General, that you can utilize for commercial and personal needs.

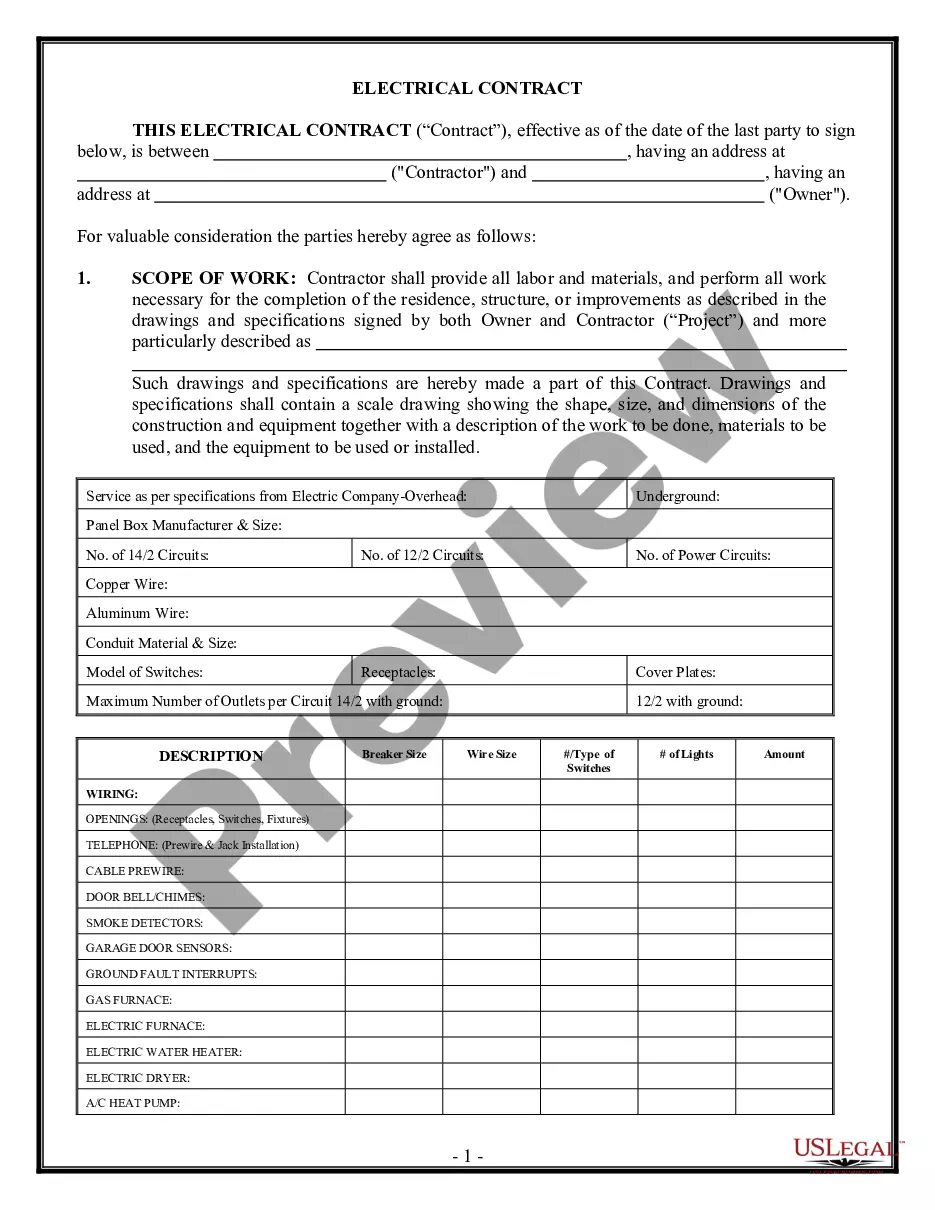

You can preview the form using the Preview option and read the form details to confirm it is suitable for your requirements.

- All of the forms are reviewed by experts and comply with state and federal standards.

- If you are already registered, Log In to your account and click the Download button to retrieve the Alabama Corporate Guaranty - General.

- Use your account to review the legal forms you have acquired previously.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your locality/region.

Form popularity

FAQ

When writing a personal guarantee, start with a clear statement identifying the parties involved and the obligations guaranteed. Specify any limits on the guarantee and include your signature for validation. It is important to draft this correctly, especially in the context of an Alabama Corporate Guaranty - General, to ensure legal enforceability.

To fill out a personal guarantee, you should include your personal information, business details, and specify the amount or limits of the guarantee. Be sure to clarify your role and the obligations you are assuming. Proper completion is crucial to ensuring an effective Alabama Corporate Guaranty - General that protects all parties involved.

A guaranty arrangement is a legal contract where one party agrees to cover the obligations of another party in the event of default. This arrangement often serves as a necessary security measure in various business transactions. For those working within Alabama Corporate Guaranty - General frameworks, it's vital to clearly outline responsibilities and expectations in the agreement.

In Alabama, the bid limit for general contractors depends on whether the license is categorized as a General or Specialty contractor. Generally, licensed contractors can bid up to certain amounts, which are periodically updated by the Board for Contractors. Understanding this limit is crucial for any contractor looking to execute projects under the Alabama Corporate Guaranty - General.

Filling out a letter of guarantee requires you to include essential details about your business, the parties involved, and the financial obligations being guaranteed. Start by clearly stating your intent to provide a guarantee and specify the amount you are guaranteeing. This is particularly important in the context of an Alabama Corporate Guaranty - General, as clear terms can prevent misunderstandings.

A personal guarantee usually requires your signature, a clear description of the obligation, and sometimes, additional supporting information, like personal financial statements. The document must clearly state your intent to guarantee the debt or obligation. By utilizing the Alabama Corporate Guaranty - General as a guideline, you can ensure you meet all necessary requirements.

To make a personal guarantee, you should clearly outline the terms in a written document, specifying the obligations and the parties involved. Both parties must understand and agree to the terms to ensure the guarantee is enforceable. Using an Alabama Corporate Guaranty - General template can streamline this process and bolster your agreement’s validity.

Yes, signing a personal guarantee can put your personal assets at risk, including your home, if the business defaults. If a lender enforces the agreement, they may pursue assets used as collateral. To protect yourself, consider consulting with a legal expert about the implications of an Alabama Corporate Guaranty - General.

Incorporating in Alabama involves choosing your business structure, selecting a unique name, and filing the necessary paperwork with the state. You will also need to obtain a business license and an Employer Identification Number (EIN). Using resources like US Legal Forms can simplify this process, especially with their Alabama Corporate Guaranty - General documentation.

Yes, personal guarantees can hold up in court if they meet certain legal standards. Courts generally uphold these agreements unless there are serious issues, like lack of clear intention or coercion. When you use an Alabama Corporate Guaranty - General, you establish a clear commitment which strengthens your position in legal settings.