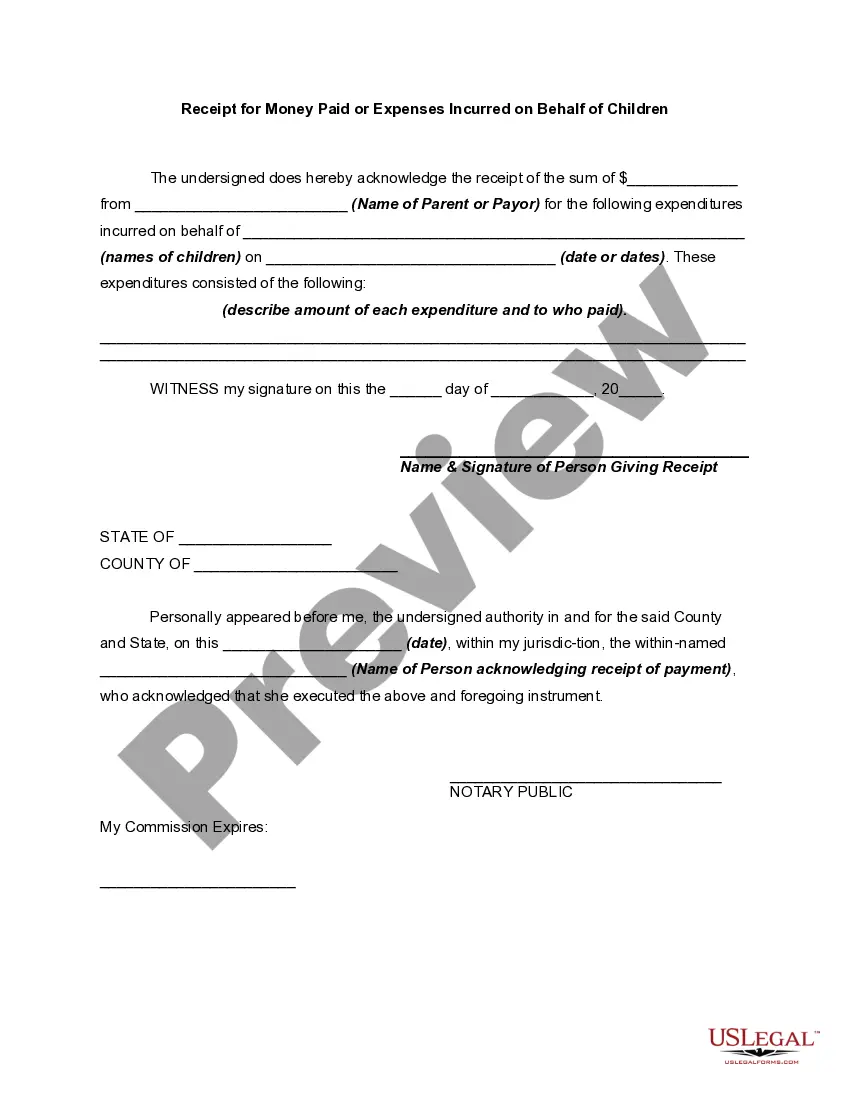

Alabama Receipt for Money Paid on Behalf of Another Person

Description

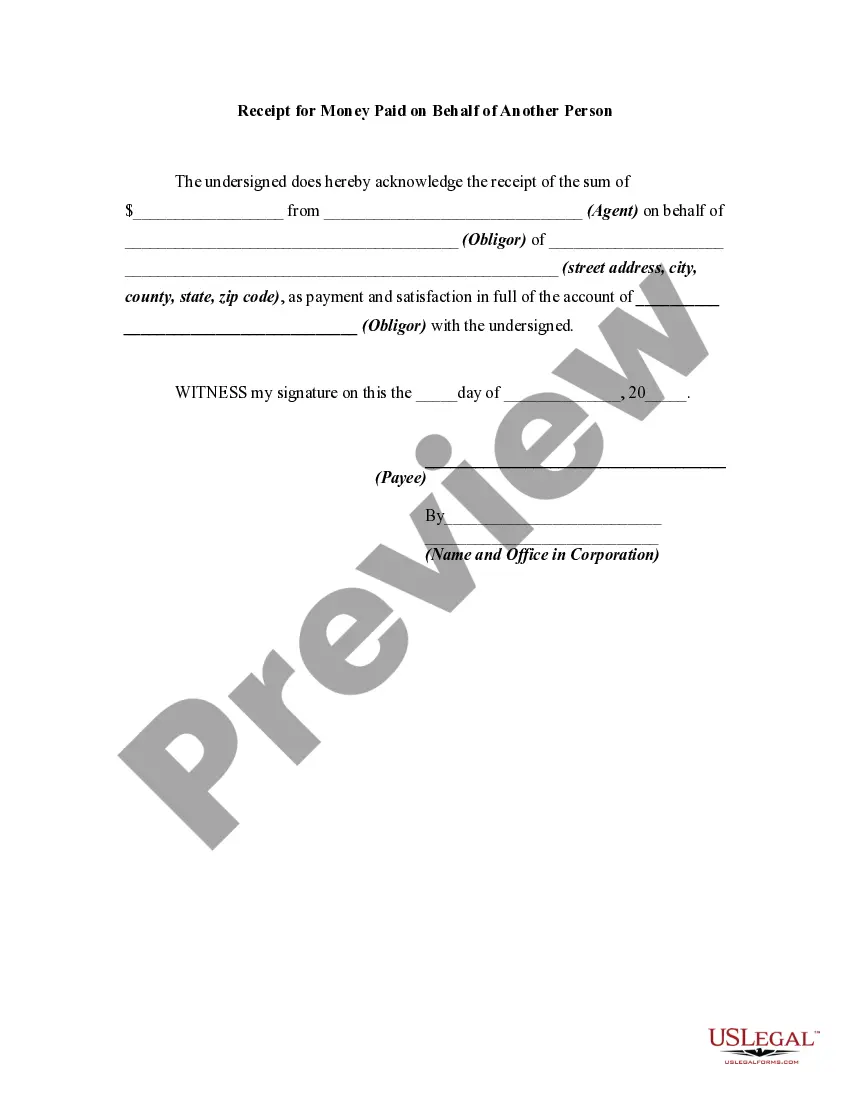

How to fill out Receipt For Money Paid On Behalf Of Another Person?

Are you in the situation where you require documents for both business or personal activities almost every workday.

There are numerous legal document templates accessible online, but finding ones you can rely on is not simple.

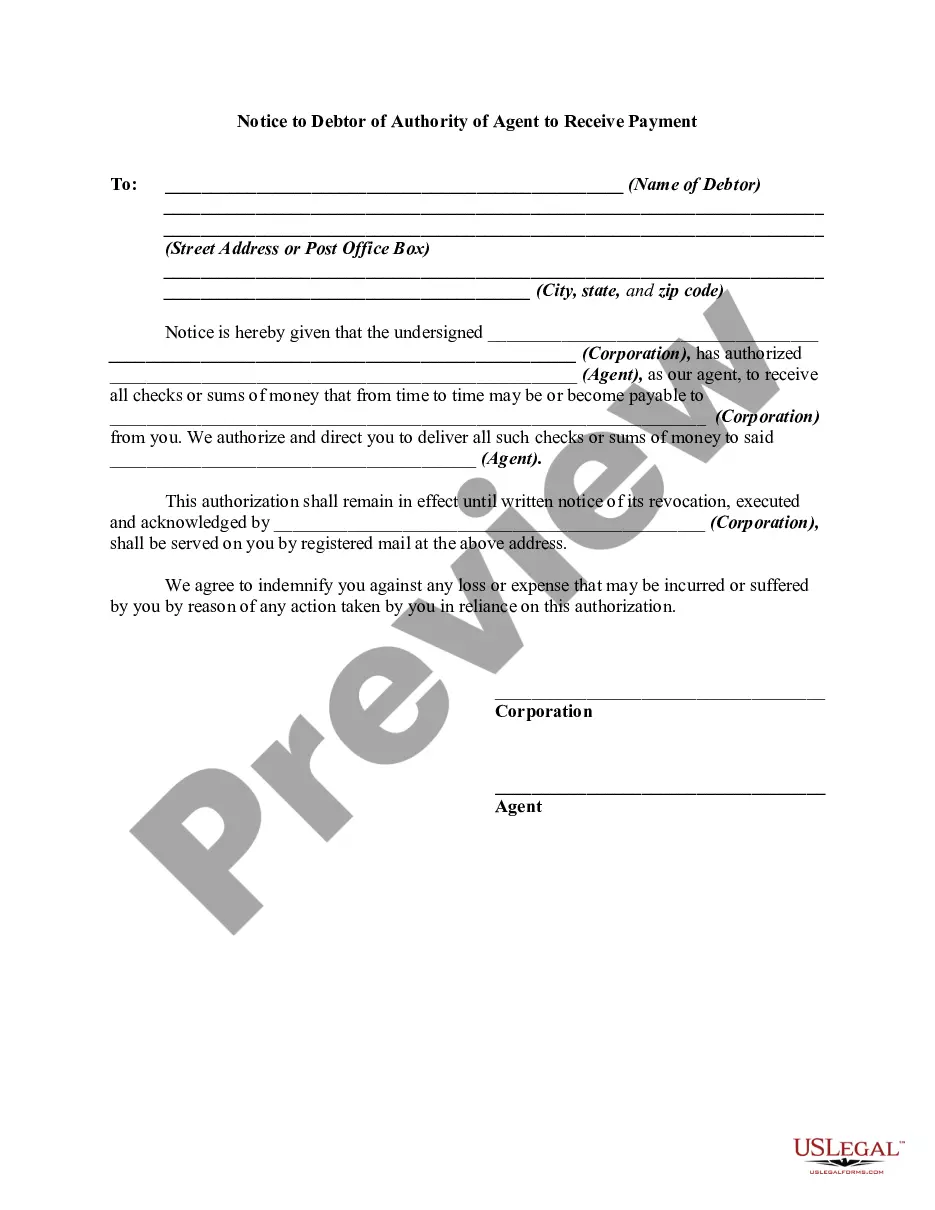

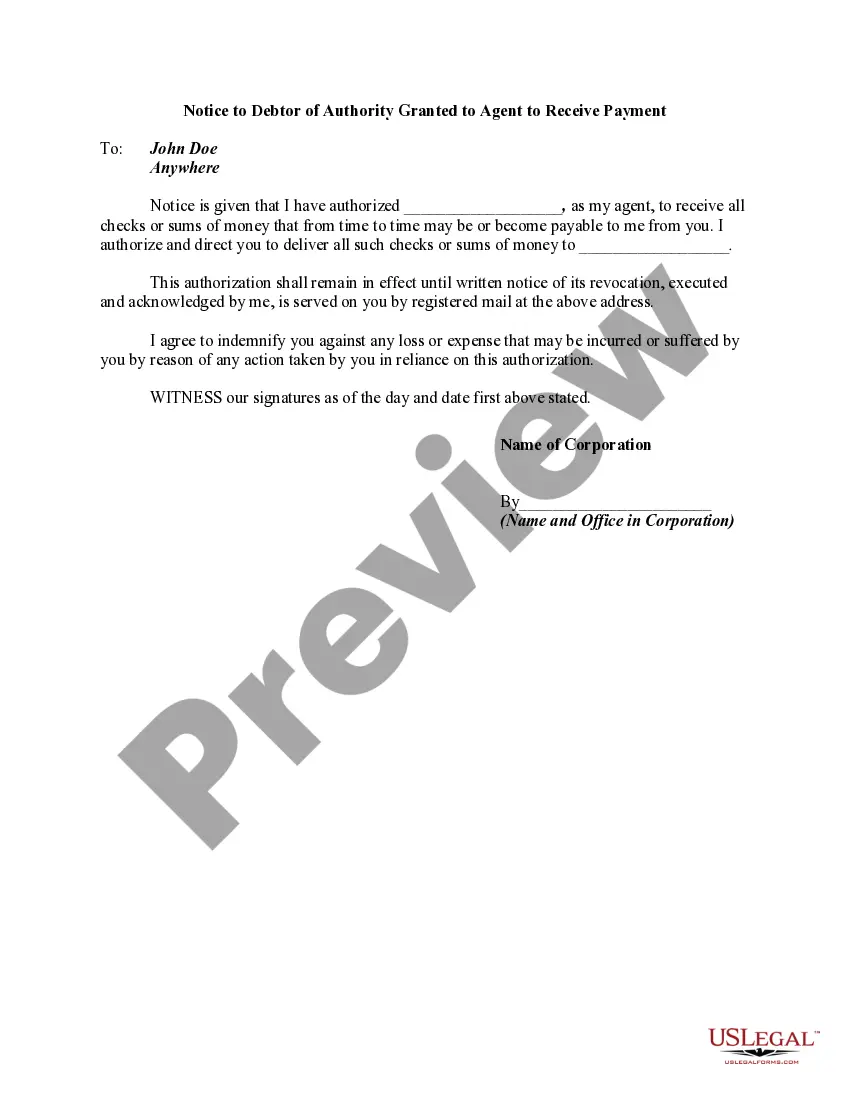

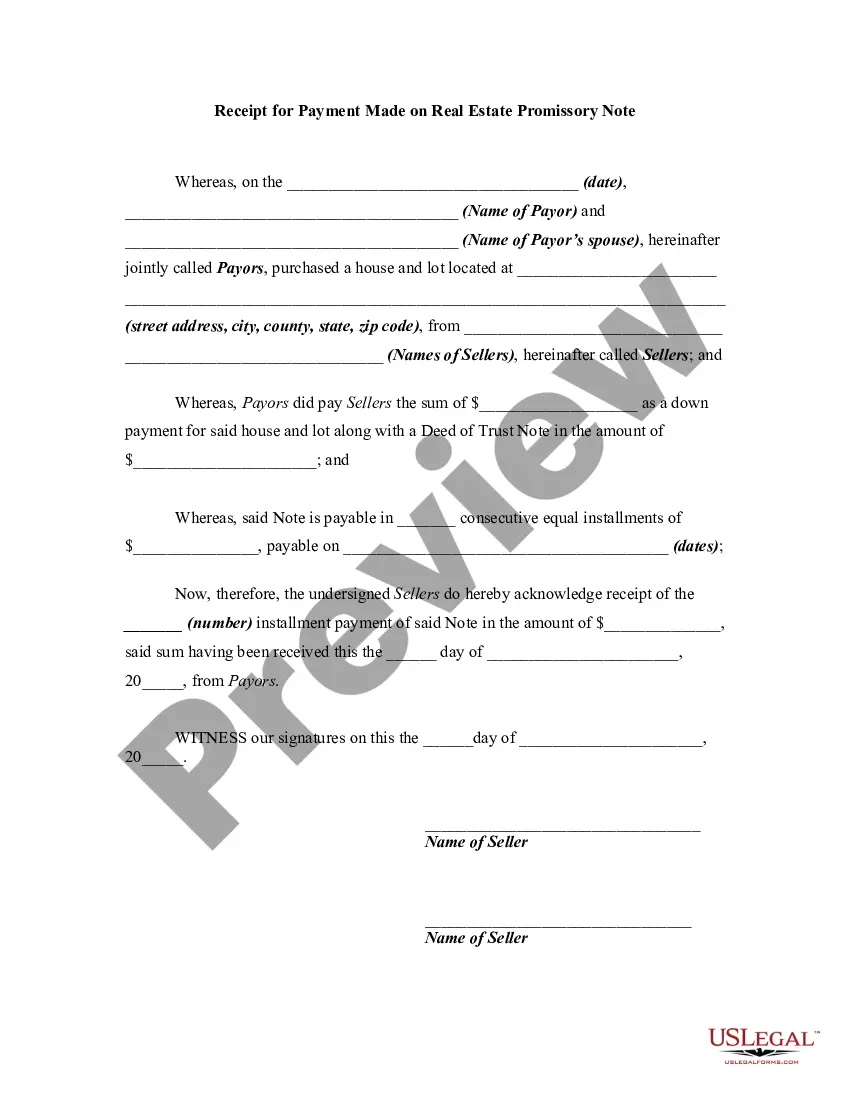

US Legal Forms offers thousands of template forms, including the Alabama Receipt for Money Paid on Behalf of Another Person, designed to fulfill state and federal requirements.

When you find the correct form, click Get now.

Choose the payment plan you prefer, fill in the necessary information to create your account, and settle your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Alabama Receipt for Money Paid on Behalf of Another Person template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your specific city/state.

- Click the Review button to check the form.

- Examine the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your requirements and needs.

Form popularity

FAQ

Some customers are exempt from paying sales tax under Alabama law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

The Alabama Form 20S is due by the 15th day of the 3rd month after the end of the tax year. Returns or payments bearing a U.S. Postal Service cancellation no later than midnight of the due date will be considered timely filed. Mail returns with payments to: Alabama Department of Revenue. Pass Through Entity.

Forms 1099 reflecting Alabama income tax withheld along with Forms W2 must be submitted with the Form A3 Annual Reconciliation on or before January 31 of the following year.

PAID PREPARER INFORMATION.Anyone who is paid to prepare the Alabama Form 20S for an Alabama S corporation must sign and provide the information re- quired in the Paid Preparer's Use Only section of the Form 20S.

(a) Section 40-14A-22, Code of Alabama, 1975, levies the annual Alabama business privilege tax on every corporation, limited liability entity, and disregarded entity doing business in Alabama, or organized, incorporated, qualified or registered under the laws of Alabama.

Alabama use tax overview Two types of use tax exist, sellers use tax and consumers use tax. Sellers use tax is a transaction tax. It is determined by applying the use tax rate (equal to the sales tax rate) to the purchase price of qualifying goods and services.

If you would like to apply for a Sales Tax Exempt Certificate, you can find the form on Alabama Department of Revenue website. If you are granted sales tax exempt status, please read the instructions for use included with the approval letter. Sales Tax Exempt status must be renewed every year.

Where a customer is a tax-exempt entity, such as a non-profit, government agency, school or religious group, the entity can buy certain goods and services sales tax-free, provided it presents a copy of its tax-exempt certificate at the time of sale.

How to Collect Sales Tax in Alabama. Alabama is a destination-based sales tax state. This means that if you are based in Alabama and sell to a buyer in Alabama you should always collect sales tax at the rate of that buyer's ship to location. The state sales tax rate in Alabama is 4%.

Under the new law, a partnership, or other entity classified as a Subchapter K entity, is required to file a composite return and make composite payments on behalf of its nonresident owners or members if there are one or more nonresident owners or members at anytime during the taxable year.