Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer

Description

How to fill out Affidavit By A Corporate Officer For The Benefit Of A Corporation In His Or Her Capacity As An Officer?

Are you presently in a situation where you require documents for both business or personal reasons almost all the time.

There are numerous legal document templates available online, but locating reliable ones is not straightforward.

US Legal Forms offers thousands of document templates, such as the Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer, which are crafted to comply with state and federal regulations.

Once you find the correct document, click Get now.

Select the pricing plan you prefer, enter the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Subsequently, you can download the Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the appropriate city/region.

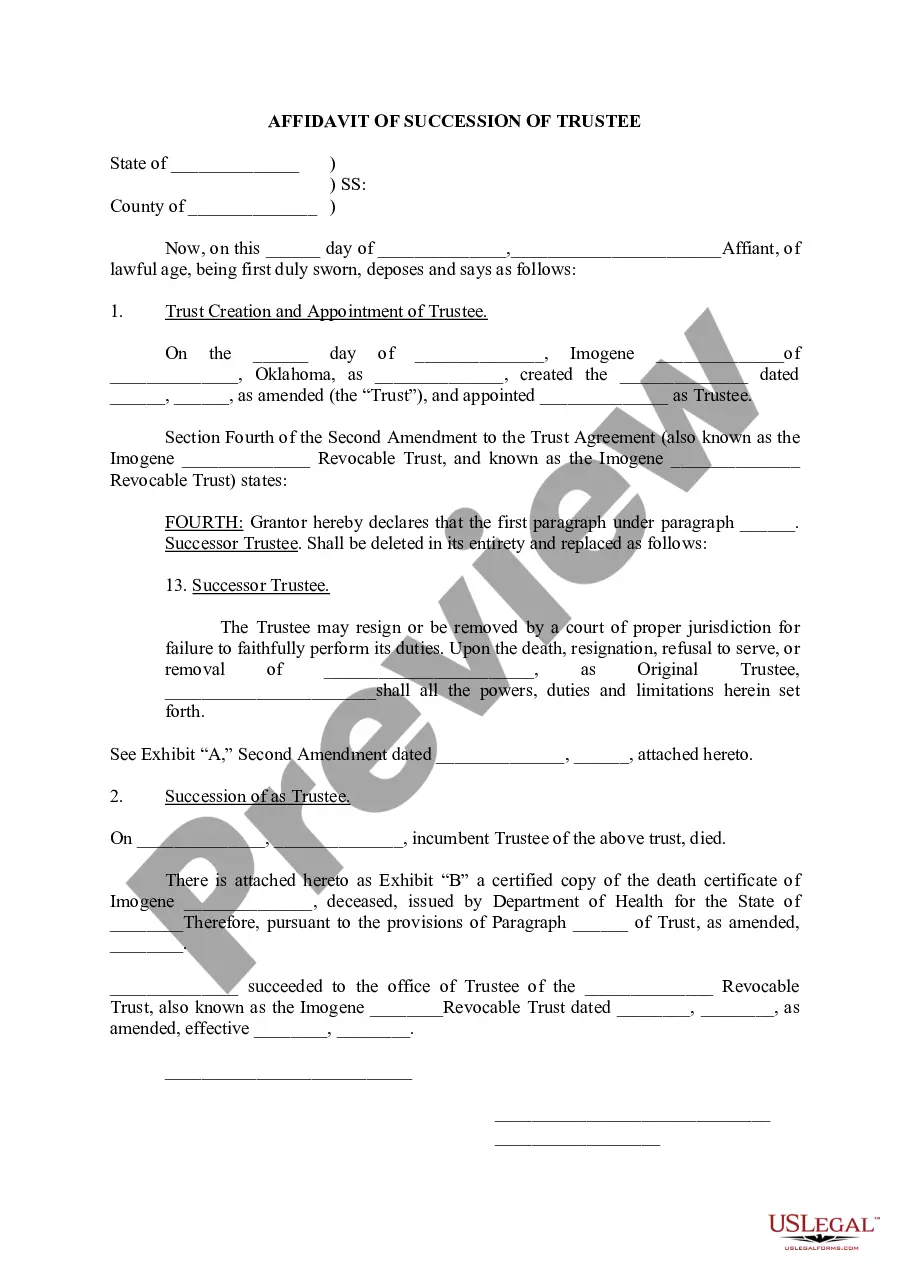

- Use the Preview button to review the document.

- Check the description to confirm you have selected the correct form.

- If the document is not what you are looking for, use the Search field to find the document that meets your needs.

Form popularity

FAQ

Yes, Alabama's Property Privilege Tax (PPT) can be filed electronically by eligible businesses. This digital option simplifies the submission process and enhances accuracy by minimizing human error. For corporate officers involved in the filing process, it's wise to aggregate all necessary documents, including the Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer, to ensure everything aligns seamlessly.

Yes, Alabama offers an extension for filing the Business Privilege Tax return, allowing corporations extra time to prepare their submissions. Typically, businesses can request a 6-month extension, which provides relief during busy financial reporting periods. Incorporating this knowledge into your Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer can help address any filing delays respectfully.

The Alabama Business Privilege Tax is based on the corporation's gross receipts, with a minimum tax of $100 for corporations and up to $15,000 for those with substantial revenues. Understanding this tax structure is crucial for corporate officers, allowing them to budget appropriately. Consequently, including this information in your Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer can reflect transparency in financial matters.

The Alabama Property Privilege Tax (PPT) must be filed by any business entity that owns or operates property in Alabama. This requirement typically includes corporations, partnerships, and sole proprietorships, among others. Corporate officers should ensure compliance when preparing the Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer, thereby safeguarding the corporation against potential penalties.

Certain forms, such as those related to some special tax situations or specific deductions, may not qualify for electronic filing. It's essential to consult the Alabama Department of Revenue's guidelines for a comprehensive list of forms that can be e-filed. Remember, your Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer may still need to be submitted through traditional means if electronic options are unavailable.

Yes, you can electronically file an Alabama tax return, including corporate returns and business privilege tax filings. This method is convenient and helps in reducing the potential for errors. For corporate officers preparing documents such as the Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer, electronic filing is an excellent option to consider.

Several Alabama tax forms can be filed electronically, making the process more streamlined for corporate officers. Primarily, the Alabama corporate income tax return and the Business Privilege Tax forms can be submitted electronically. Utilizing electronic filing not only saves time but also ensures that your Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer is processed efficiently.

In Alabama, all corporations engaging in business activities within the state must file an Alabama Business Privilege Tax (BPT) return. This includes for-profit and non-profit entities, as well as foreign entities operating in Alabama. By understanding these requirements, corporate officers are encouraged to prepare an Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer to ensure all aspects of compliance are met.

While a corporation can technically exist without bylaws, it is highly inadvisable. Bylaws provide structure and guidance for decision-making and operations. Therefore, having clear bylaws is essential, and in some cases, an Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer may be required to reinforce compliance and legitimacy.

Yes, Alabama requires Limited Liability Companies (LLCs) to file an annual report. This report helps maintain good standing in the eyes of the state. Additionally, having well-drafted corporate bylaws can assist in ensuring compliance, particularly in the context of creating an Alabama Affidavit by a Corporate Officer for the Benefit of a Corporation in His or Her Capacity as an Officer.