Alabama Donation or Gift to Charity of Personal Property

Description

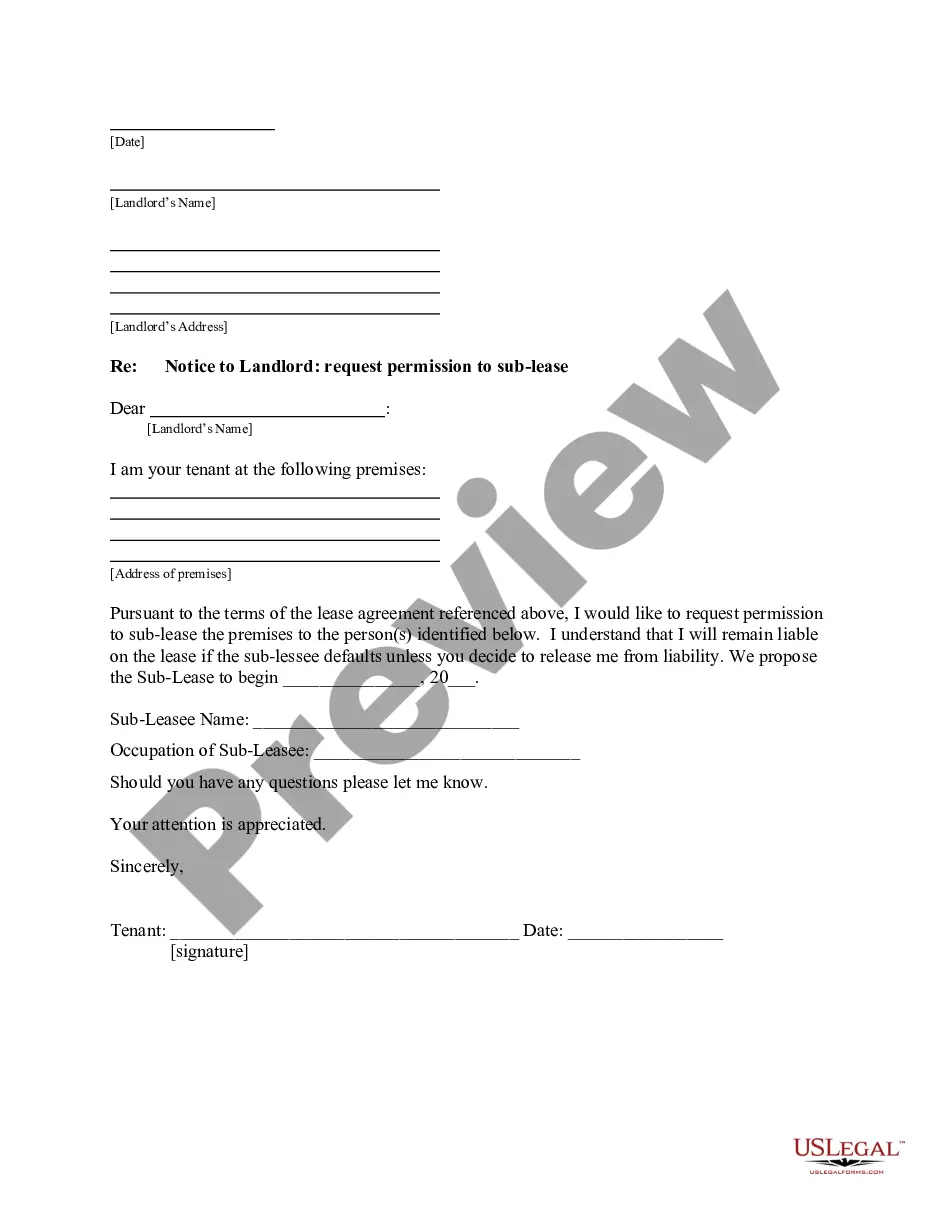

How to fill out Donation Or Gift To Charity Of Personal Property?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print. By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of documents like the Alabama Donation or Gift to Charity of Personal Property in moments.

If you already have a membership, Log In to download the Alabama Donation or Gift to Charity of Personal Property from the US Legal Forms collection. The Download button will appear on every document you view. You have access to all previously downloaded forms in the My documents tab of your account.

To use US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct document for your state/region. Click the Review button to look over the document's content. Check the document summary to ensure you have selected the right one.

Access the Alabama Donation or Gift to Charity of Personal Property with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If the document doesn't meet your requirements, use the Search field at the top of the screen to locate one that does.

- When you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose the pricing plan you prefer and provide your details to sign up for the account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the document to your device.

- Make edits. Fill out, modify, and print and sign the downloaded Alabama Donation or Gift to Charity of Personal Property.

- Every template you upload to your account has no expiration date and is yours forever. So, if you wish to download or print another copy, just go to the My documents section and click on the document you need.

Form popularity

FAQ

An act of donation for property specifically pertains to the process of giving tangible personal assets to a charity. This can include items like furniture, vehicles, or artwork, and is classified under the Alabama Donation or Gift to Charity of Personal Property. By executing this act, you help charitable organizations while possibly receiving tax benefits. Utilize resources like US Legal Forms to ensure your donation is properly documented and compliant with legal standards.

An act of donation refers to the voluntary transfer of property or assets to a charity without receiving anything in return. In the context of an Alabama Donation or Gift to Charity of Personal Property, this act demonstrates generosity and support for causes you care about. It plays a vital role in charitable contributions and community support. Understanding this concept is important as it allows you to engage in philanthropy effectively.

The form for donation of property is essential for facilitating the Alabama Donation or Gift to Charity of Personal Property. This document outlines the details of the donation, including the type of property, its estimated value, and the recipient charity's information. It's important to use the correct form to ensure compliance with legal requirements. You can find suitable forms on platforms like US Legal Forms that cater specifically to donations, making the process smoother.

To deduct charitable donations, including an Alabama Donation or Gift to Charity of Personal Property, you need detailed documentation. This includes receipts from the charity, a record of the items donated, and any relevant appraisals if the value exceeds a certain threshold. Keeping these documents organized is crucial for supporting your claims during tax time. If you need help tracking this information, uslegalforms provides tools designed to help you manage your charitable donations.

Filling out a donation tax receipt for an Alabama Donation or Gift to Charity of Personal Property requires you to include specific details about the donation. This includes the date of the donation, a description of the donated items, and the estimated fair market value of those items. Most importantly, the receipt should be signed by an authorized representative of the charity. For assistance, uslegalforms offers resources that can help simplify this process.

To write off an Alabama Donation or Gift to Charity of Personal Property, you need to gather appropriate documentation, such as receipts or written acknowledgments from the charitable organization. These documents should detail the value of the donated items and confirm that you did not receive anything in return. Additionally, you must ensure that the charity is qualified under IRS rules to make your donation tax-deductible. Using platforms like uslegalforms can help you ensure you’re meeting all the requirements.

To claim an Alabama Donation or Gift to Charity of Personal Property, you typically need to complete IRS Form 1040, Schedule A for itemizing your deductions. This form allows you to list your charitable donations and claim the tax benefits accordingly. Ensure that you have proper records of your donations to support your claims. If you're unsure, consider consulting with a tax professional or using uslegalforms to guide you through the process.

To gift your property to charity, you must first choose a qualified charitable organization and prepare the necessary legal documents, like a deed. This process operates under the concept of Alabama Donation or Gift to Charity of Personal Property. It is advisable to consult legal professionals or platforms like uslegalforms to guide you through completing the documentation correctly. This will help maximize the impact of your charitable gift.

To transfer ownership in Alabama, you need to execute a deed that outlines the intended transfer of property. This process can relate directly to an Alabama Donation or Gift to Charity of Personal Property if the recipient is a charitable organization. Make sure the deed is properly notarized and recorded at the county’s probate court. Seeking help from a legal expert ensures the transfer adheres to all legal requirements.

Gifting property in Alabama starts with drafting a deed that clearly states your intention to transfer ownership. It is essential to follow the legal protocols detailed in Alabama's laws concerning deeds to ensure your Alabama Donation or Gift to Charity of Personal Property is valid. You may want to involve a legal professional to assist with the necessary paperwork and filings. This step will help facilitate a smooth transfer.