Alabama Direct Deposit Form for Stimulus Check

Description

How to fill out Direct Deposit Form For Stimulus Check?

You have the opportunity to dedicate time online searching for the valid document template that meets the state and federal requirements you seek.

US Legal Forms offers a vast array of valid templates that can be examined by professionals.

You can easily acquire or print the Alabama Direct Deposit Form for Stimulus Check from their services.

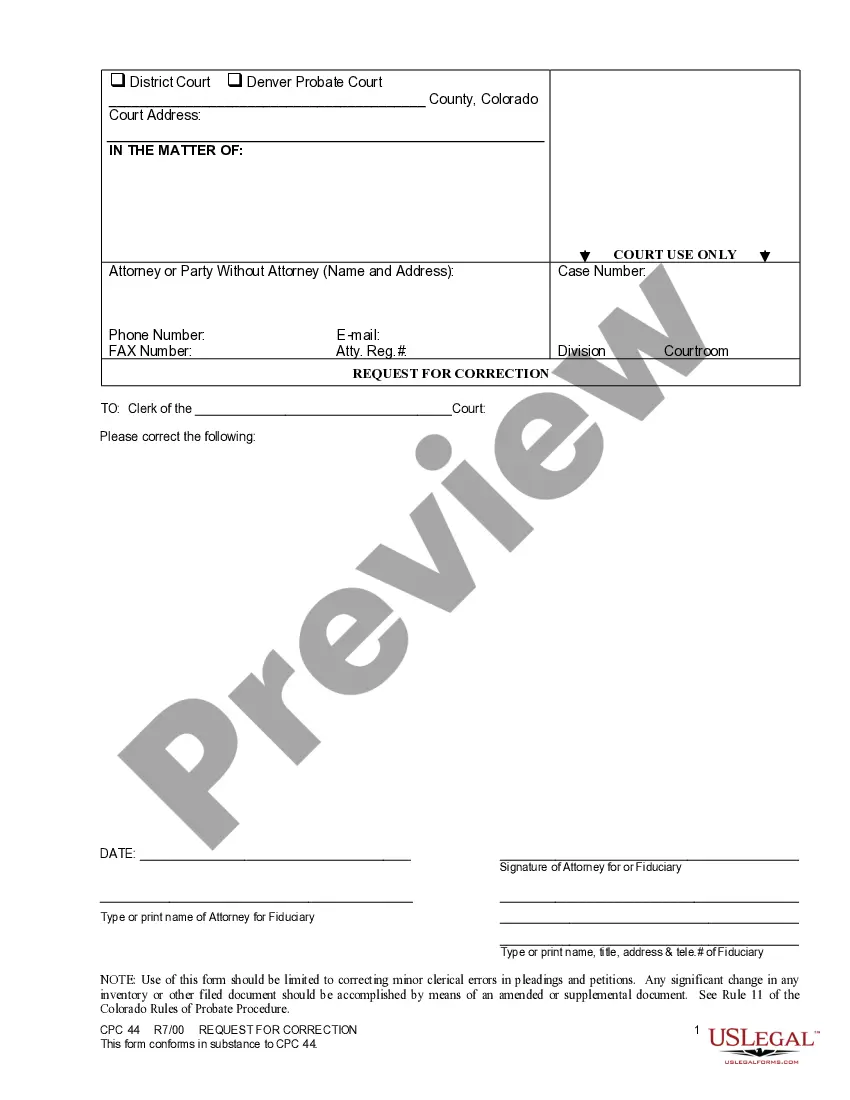

If available, utilize the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can sign in and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Alabama Direct Deposit Form for Stimulus Check.

- Every valid document template you obtain is yours permanently.

- To obtain an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the state/region of your choice.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

Statement from Alabama Department of Revenue: "For the most up-to-date information concerning the status of your current year refund, call 1-855-894-7391 or check our website, then click on Where's My Refund.

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040....If you haven't yet filed your return, or if the IRS rejected your return:Go to the File section of the H&R Block Online product.Choose how you want to file.Choose Direct Deposit.

The tool will get you personalized refund information based on the processing of your tax return. They will provide an actual refund date as soon as the IRS processes your tax return and approves your refund. Most refunds will be issued in less than 21 days.

Once you have signed up for a bank account, you can use it to get your payment faster when you file taxes. Have your new account number and routing number before you start the process. This will allow you to receive your stimulus check as a direct deposit.

In fact the IRS has already announced that there will likely be longer than usual tax refund payment delays due to processing/validation of past year and amended returns, staffing/budget constraints and the ongoing payment and reconciliation of past stimulus payments and tax credits (like the CTC).

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.

At this point, you can enter a routing and account number for your bank account, prepaid debit card or alternative financial product that has a routing and account number associated with it, the IRS said. That is the only time you are able to change your banking information.

It's possible to change or update your direct deposit information with the IRS for your tax refund; it's just a matter of if your return has been completely filed already. If you haven't filed your return, or if the IRS rejected your return, you can contact the IRS directly to update your bank account information.

Tracking the status of a tax refund is easy with the Where's My Refund? tool. It's available anytime on IRS.gov or through the IRS2Go App. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received.

The agency is still trying to catch up on a backlog because of the pandemic. It's taking us longer than normal to process mailed correspondence and more than 21 days to issue refunds for certain mailed and e-filed 2020 tax returns that require review, the agency said.