Alabama Accounts Receivable - Contract to Sale

Description

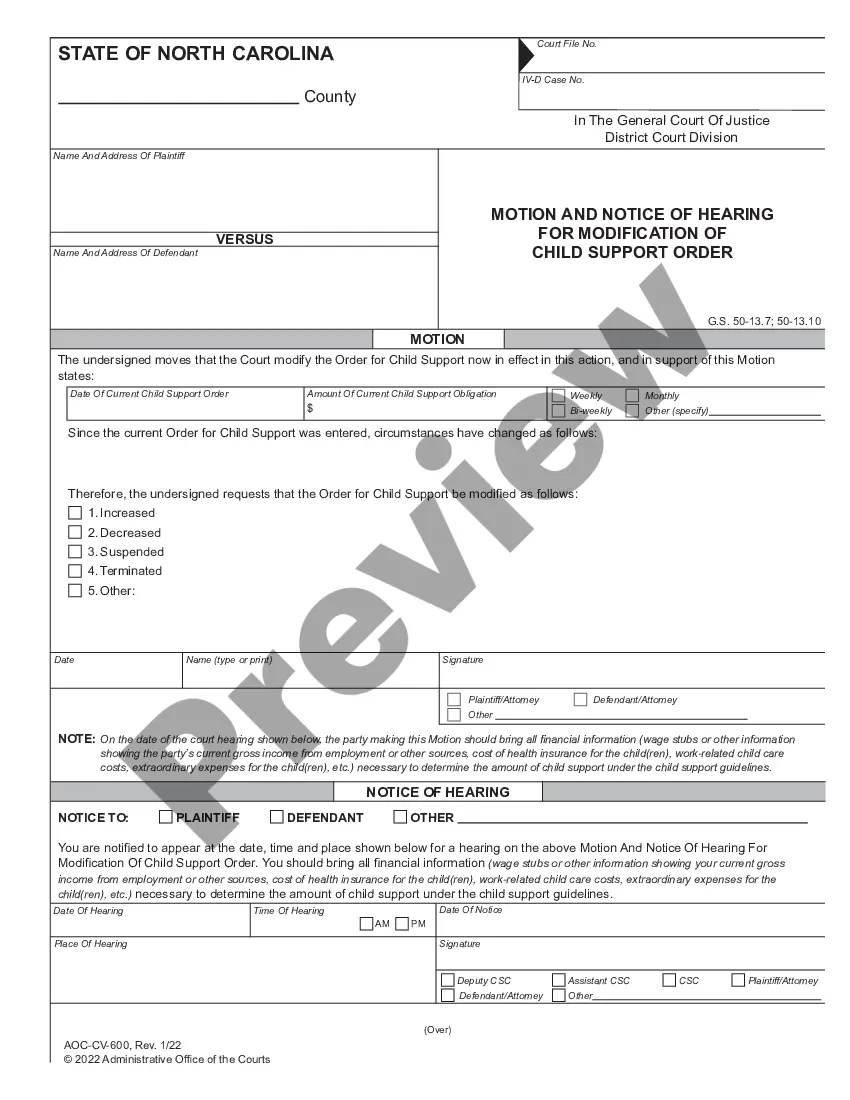

How to fill out Accounts Receivable - Contract To Sale?

If you need to total, acquire, or printing legitimate document templates, use US Legal Forms, the biggest variety of legitimate forms, which can be found on the web. Take advantage of the site`s simple and hassle-free search to discover the files you need. A variety of templates for enterprise and personal reasons are sorted by groups and states, or key phrases. Use US Legal Forms to discover the Alabama Accounts Receivable - Contract to Sale within a number of mouse clicks.

When you are currently a US Legal Forms client, log in to the accounts and then click the Download switch to have the Alabama Accounts Receivable - Contract to Sale. You can even gain access to forms you earlier delivered electronically from the My Forms tab of the accounts.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for your appropriate metropolis/nation.

- Step 2. Utilize the Review option to examine the form`s content material. Never overlook to read through the explanation.

- Step 3. When you are not happy with all the type, use the Research area near the top of the screen to locate other variations in the legitimate type template.

- Step 4. Upon having located the shape you need, select the Get now switch. Pick the pricing strategy you like and include your references to sign up to have an accounts.

- Step 5. Approach the transaction. You may use your bank card or PayPal accounts to accomplish the transaction.

- Step 6. Choose the structure in the legitimate type and acquire it on the product.

- Step 7. Full, modify and printing or signal the Alabama Accounts Receivable - Contract to Sale.

Each and every legitimate document template you acquire is yours forever. You may have acces to every type you delivered electronically inside your acccount. Click the My Forms portion and select a type to printing or acquire once again.

Be competitive and acquire, and printing the Alabama Accounts Receivable - Contract to Sale with US Legal Forms. There are many professional and express-specific forms you can utilize to your enterprise or personal needs.

Form popularity

FAQ

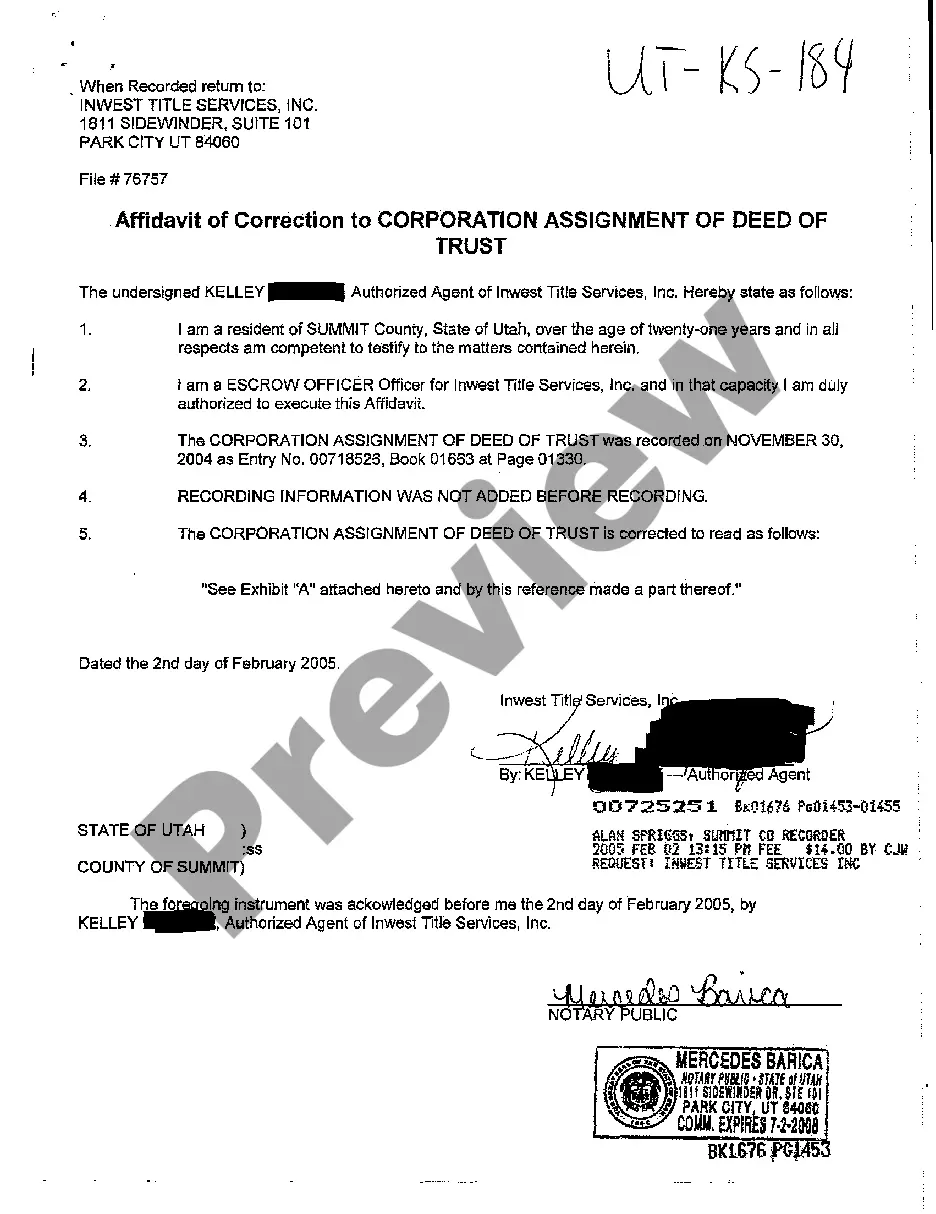

An accounts receivable sales agreement is a legal document that outlines the terms under which a seller transfers their accounts receivable to a buyer. This agreement clarifies the rights and obligations of both parties regarding the outstanding debts. It is crucial for protecting interests and ensuring a clear understanding of the transaction. The Alabama Accounts Receivable - Contract to Sale can serve as a valuable resource in drafting this agreement, providing clarity and legal protection.

Filling out a sales contract requires clear and concise information about the parties involved, the terms of sale, and any relevant conditions. Start by including the names and addresses of both the buyer and seller, followed by a detailed description of the goods or services being sold. Be sure to incorporate payment terms and any contingencies. Using the Alabama Accounts Receivable - Contract to Sale template from uslegalforms can streamline this process and ensure you cover all necessary details.

The contract must be in writing, contain the full names of the buyer(s) and seller(s), identify the property address or legal description, identify the sales price, and include signatures by the parties.

A receivable purchase agreement is a contract between a seller and a financial institution that allows the seller to sell unpaid invoices from buyers to the financial institution. This means that the seller can enable cash flow until payment is received from the buyer.

Did it make you wonder why a company would sell its receivables to another company? The answer is quite simple, to quickly and easily increase their working capital. The process is called factoring or accounts receivable financing and is an excellent alternative to traditional bank financing.

If you want to make regular payments, choose accounts receivable financing. If you want the amount you owe to be deducted from what the business owes you, and to get paid the remainder, less a fee when customers pay, then invoice factoring is the way to do that.

Receivables purchase agreements (RPAs) are financing arrangements that can unlock the value of a company's accounts receivable. Here's how they work: A "Seller" will sell its goods to a customer (1). The customer becomes an "Account Debtor" since it owes the Seller a Debt for those goods (2).

A receivable purchase agreement is a contract between a seller and a financial institution that allows the seller to sell unpaid invoices from buyers to the financial institution. This means that the seller can enable cash flow until payment is received from the buyer.