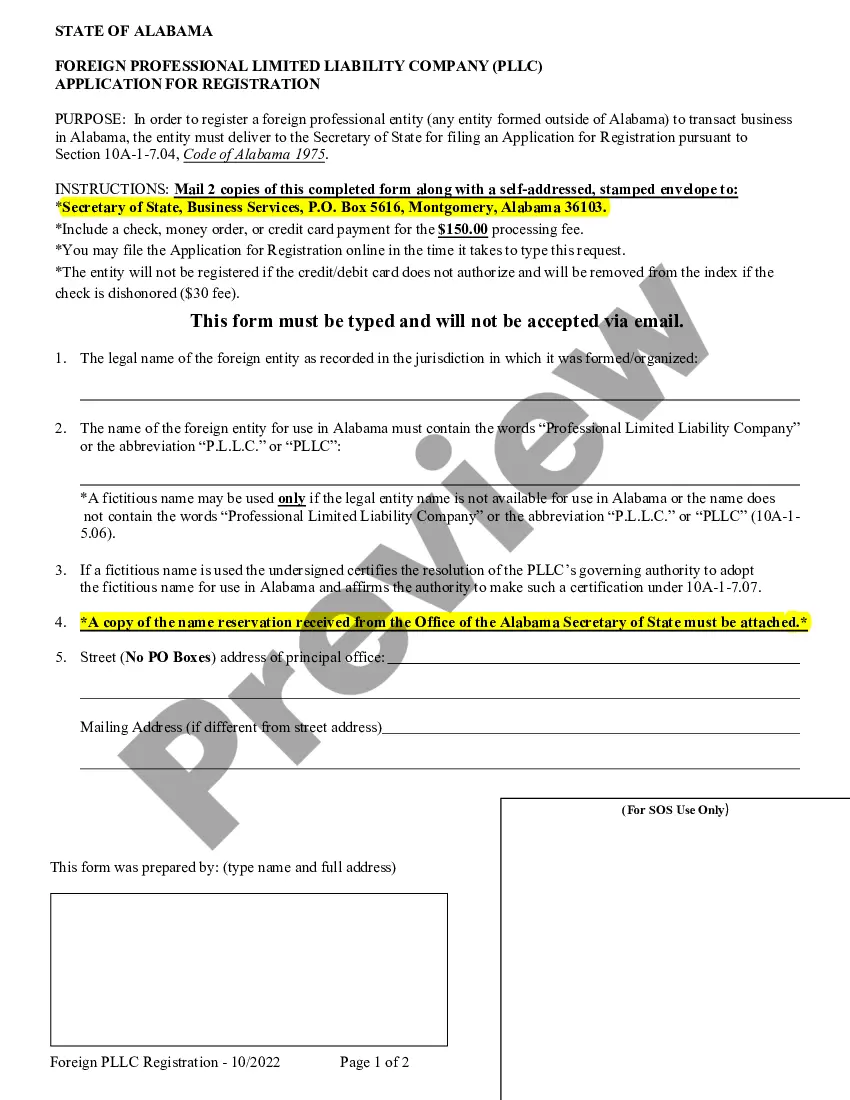

The Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit is a document created by the Secretary of State of Alabama that allows for the registration of a professional corporation from another state to do business in Alabama. The application is available in two different versions depending on whether the corporation is for-profit or non-profit. The types of Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit are: 1. Profit Corporation Application for Registration — This application is necessary for corporations that are for-profit and must be filled out by all officers of the corporation. It includes information such as the corporation’s name, purpose, address, officers, and other details. 2. Non-Profit Corporation Application for Registration — This application is necessary for corporations that are non-profit and must be filled out by all officers of the corporation. It includes information such as the corporation’s name, purpose, address, officers, and other details. Both applications must be filed with the Secretary of State and a filing fee must be paid. Once the application is approved, the corporation will be registered to do business in Alabama.

Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Foreign Professional Corporation Application For Registration Profit Or Non-Profit?

Crafting official documents can be quite stressful without accessible fillable templates. With the US Legal Forms online library of formal documents, you can trust the forms you acquire, as they all adhere to federal and state regulations and have been validated by our experts.

Obtaining your Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit from our collection is as straightforward as ABC. Previously registered users with a valid subscription only need to Log In and click the Download button after locating the right template. Later, if necessary, users can access the same form from the My documents section of their account. However, even if you are a newcomer to our service, signing up for a valid subscription will only take a few moments. Here’s a brief guide for you.

Haven’t you utilized US Legal Forms yet? Subscribe to our service now to obtain any official document swiftly and effortlessly whenever you need to, and keep your paperwork organized!

- Document compliance assessment. You should meticulously examine the content of the form you desire and ensure it meets your requirements and complies with your state regulations. Reviewing your document and going through its general overview will assist you in that.

- Alternative search (optional). If there are any discrepancies, explore the library using the Search tab at the top of the page until you find an appropriate template, and click Buy Now when you locate the one you need.

- Account creation and form acquisition. Register for an account with US Legal Forms. After verifying your account, Log In and select your desired subscription plan. Complete payment to continue (PayPal and credit card options are accepted).

- Template download and subsequent use. Select the file format for your Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit and click Download to save it on your device. Print it to complete your documents manually or utilize a multi-featured online editor to prepare an electronic version more swiftly and efficiently.

Form popularity

FAQ

Obtaining a certificate of authority in Alabama requires a careful approach. Begin by submitting the Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit with all the necessary information about your corporation. It’s vital to include evidence of your good standing in your home state, along with any required fees. Using platforms like uslegalforms can simplify this process, guiding you through the necessary documentation and ensuring compliance with Alabama's regulations.

To secure a certificate of Authority in Alabama, you must first complete the Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit. This process typically involves providing relevant documentation, such as your corporation's formation documents and a designated registered agent in Alabama. Once you submit the application along with any applicable fees, the state will review your submission and issue the certificate if everything is in order, allowing you to operate legally in Alabama.

A certificate of Authority allows a foreign professional corporation to legally conduct business in Alabama. This document signifies that your corporation has fulfilled all the necessary requirements to operate under Alabama law. For those submitting the Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit, obtaining this certificate is a key step in ensuring compliance. Without it, your corporation cannot expand its operations into Alabama.

No, a certificate of Authority and a certificate of Good Standing are not the same. A certificate of Authority is required for foreign professional corporations to operate in Alabama while the certificate of Good Standing verifies that your company is in compliance with state regulations. To successfully complete your Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit, understanding these differences is crucial. Each document serves a distinct purpose in maintaining your corporation’s legal status.

In Alabama, anyone can form a corporation, provided they comply with state laws. This includes individuals looking to start a business or professionals wanting to create an Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit. It is crucial to ensure that the individuals involved meet the legal requirements. If you're unsure, platforms like uslegalforms can guide you through the formation process.

Setting up an S Corp in Alabama starts with forming a regular corporation through the Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit. After incorporating, you need to file IRS Form 2553 to elect S Corporation status. This structure allows you to enjoy certain tax benefits while still adhering to the necessary Alabama regulations. Consider utilizing uslegalforms for seamless navigation through the paperwork.

Creating a corporation in Alabama involves several key steps. First, decide whether you want to establish a profit or non-profit corporation, as this will influence the Alabama Foreign Professional Corporation Application for Registration. Next, prepare the necessary documents, including bylaws and articles of incorporation, and submit them to the appropriate state departments. Using resources like uslegalforms can help simplify this process and ensure compliance.

To form a corporation in Alabama, you begin by choosing a suitable name for your business. Then, you need to file the Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit with the Secretary of State. This application ensures your corporation meets both state and federal requirements. Additionally, consider using platforms like uslegalforms to streamline the application process.

Yes, a foreign corporation can do business in the US, but it must comply with state-specific regulations. This often involves filing an application like the Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit, depending on the state of operation. Different states have their own requirements, so it is vital for foreign corporations to understand and follow these rules to operate legally. Partnering with platforms like USLegalForms can help navigate this process smoothly.

Code 10A 1 7.04 in Alabama pertains to the regulations governing foreign corporations operating in the state. This section outlines the requirements for the registration and conduct of foreign entities, including submitting the Alabama Foreign Professional Corporation Application for Registration Profit or Non-Profit. Being familiar with this code ensures your corporation adheres to local laws and maintains compliance throughout its operation.