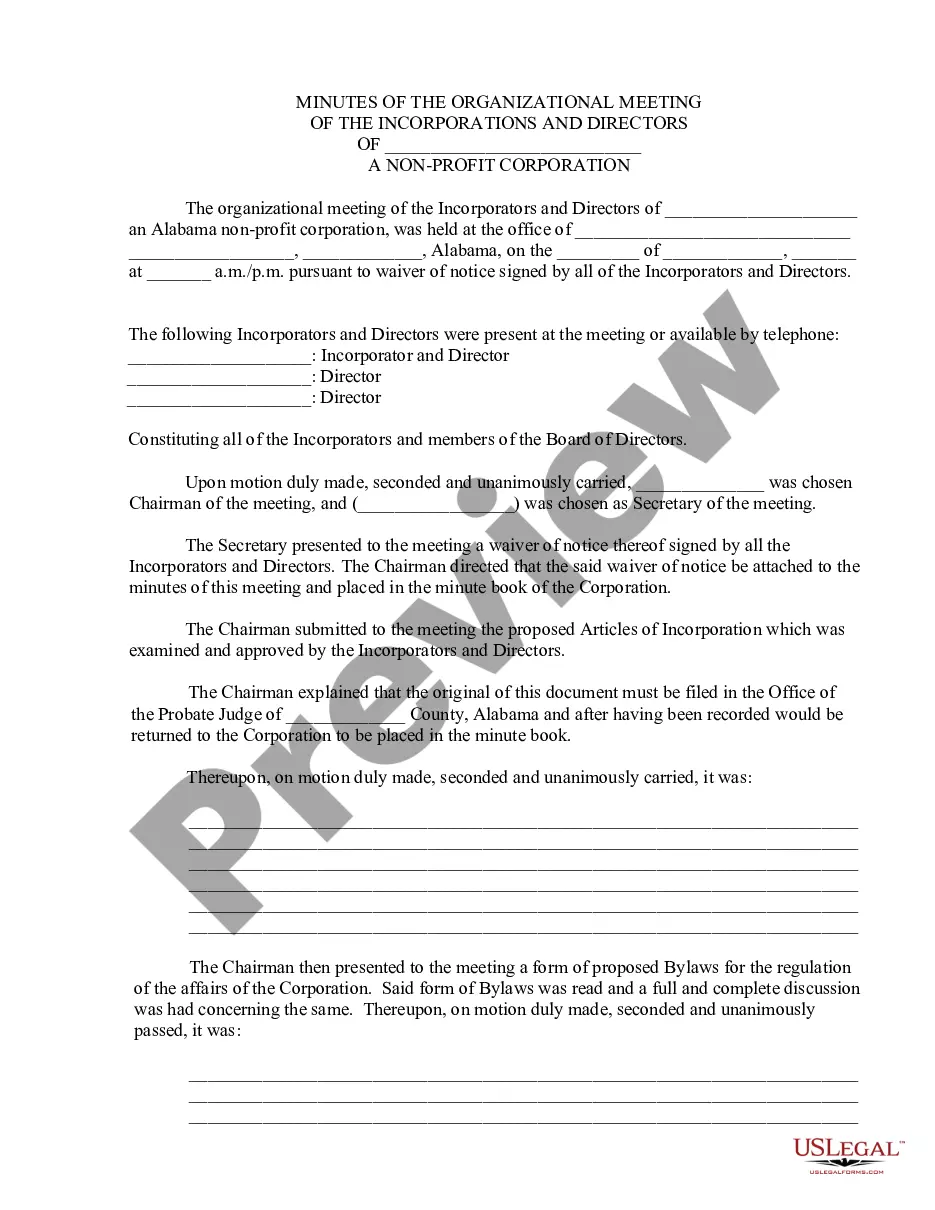

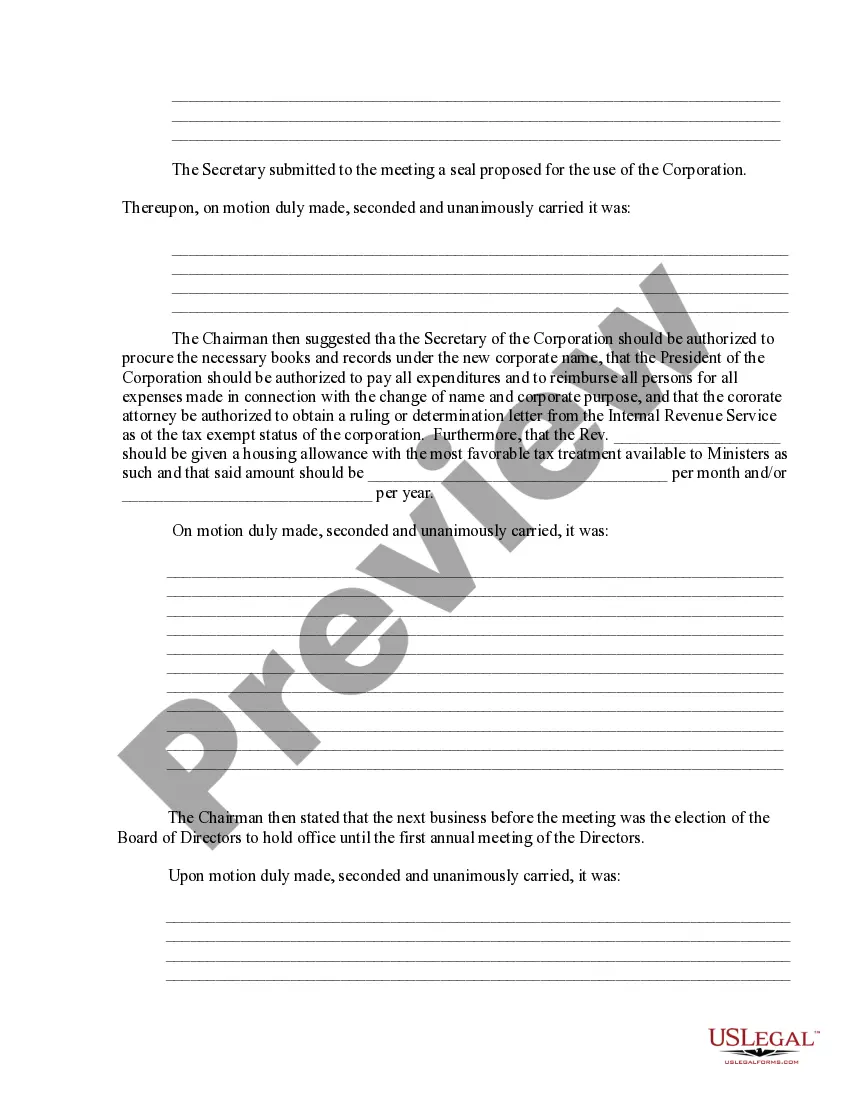

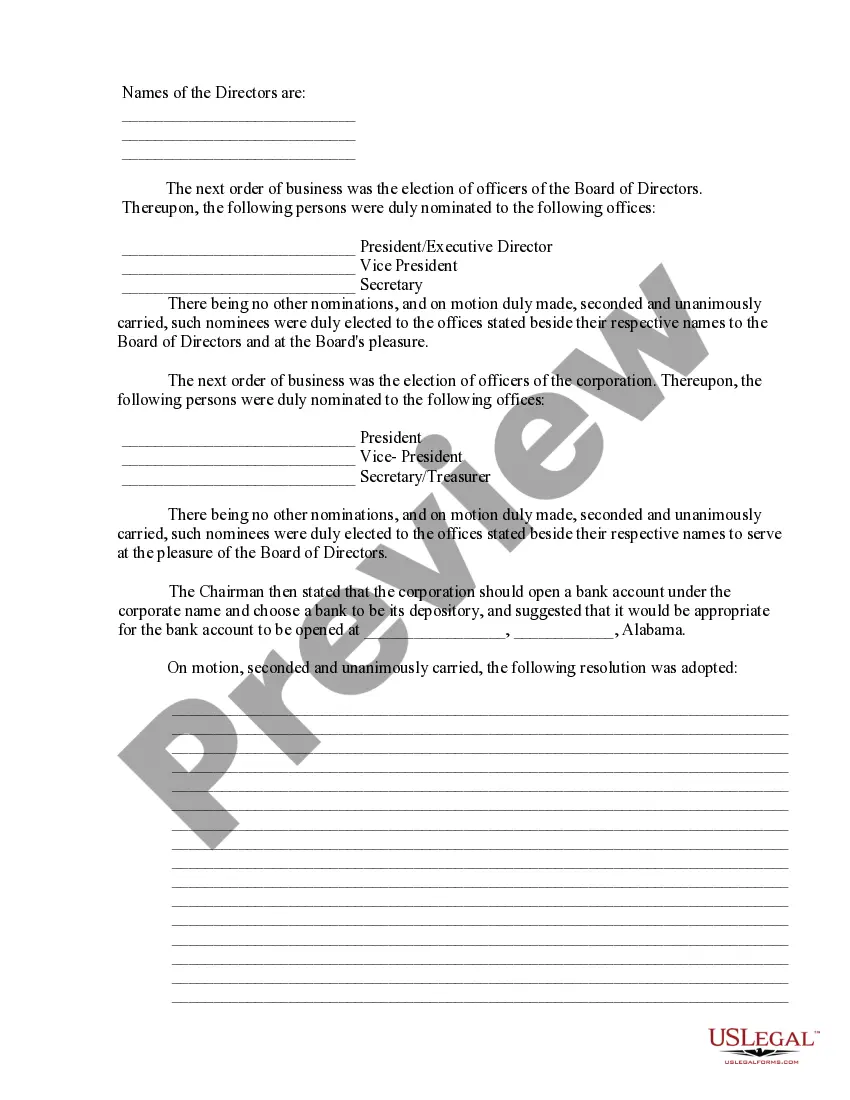

This is a sample of the minutes from the organization meeting of the incorporators and directors of a non-profit corporation. It includes a waiver of notice and by-laws of Non-Profit Corporation.

Alabama Organizational Minutes, Waiver of Notice and Bylaws of Nonprofit Corporation

Description

How to fill out Alabama Organizational Minutes, Waiver Of Notice And Bylaws Of Nonprofit Corporation?

Employing Alabama Organizational Minutes, Waiver of Notice and Bylaws of Nonprofit Corporation templates created by professional lawyers enables you to avert complications during document submission.

Simply obtain the template from our site, complete it, and seek legal advice to validate it.

By doing this, you will conserve significantly more time and effort than if you were to request legal aid for creating a document from the ground up to fulfill your requirements.

Utilize the Preview feature and examine the description (if available) to ascertain if you require this particular sample, and if so, just click Buy Now.

- If you have already acquired a US Legal Forms subscription, just Log In to your account and return to the form webpage.

- Locate the Download button adjacent to the template you are reviewing.

- Upon downloading a document, you will find all of your saved samples in the My documents section.

- If you lack a subscription, there's no need for concern.

- Simply follow the steps below to register for an account online, obtain, and complete your Alabama Organizational Minutes, Waiver of Notice and Bylaws of Nonprofit Corporation template.

- Verify and ensure that you’re acquiring the correct state-specific form.

Form popularity

FAQ

Like the Constitution, your bylaws should deal with only the highest level of governing issues such as: Organizational purpose, board structure, officer position descriptions and responsibilities, terms of board service, officer/board member succession and removal, official meeting requirements, membership provisions,

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

The standard filing fee for Form 1023 will cost you $750, but your fee will be reduced by $400 if you don't expect revenue to exceed $40,000. The financial considerations involved in starting a nonprofit require a lot of legwork and more than a little paperwork, but you will be rewarded with financial security.

Basic Rules for Non-Profit OrganizationsNon-profit entities must keep good records. They must record meetings of minutes and set up a separate bank account. All profits must be used in the organization's work and non-profit organizations are not allowed to distribute profits to members for any reason.

Private benefit. Nonprofits are not allowed to urge their members to support or oppose legislation. Political campaign activity. Unrelated business income. Annual reporting obligation. Operate in accord with stated nonprofit purposes.

First, there is the required IRS Form 1023 User Fee, which is now $600 (as of March, 2018) regardless of your organization's projected future income. This application fee is made online as part of your application to the United States Treasury and submitted as part of your 501c3 application packet.

Section 501(c)(4): civic leagues and social welfare organizations, homeowners associations, and volunteer fire companies. Section 501(c)(5): such as labor unions. Section 501(c)(6): such as chambers of commerce.

That can include private benefit, inurement, lobbying, political campaign activity, excessive unrelated business income, not filing an annual 990 tax information form, and failing to achieve its original purpose.