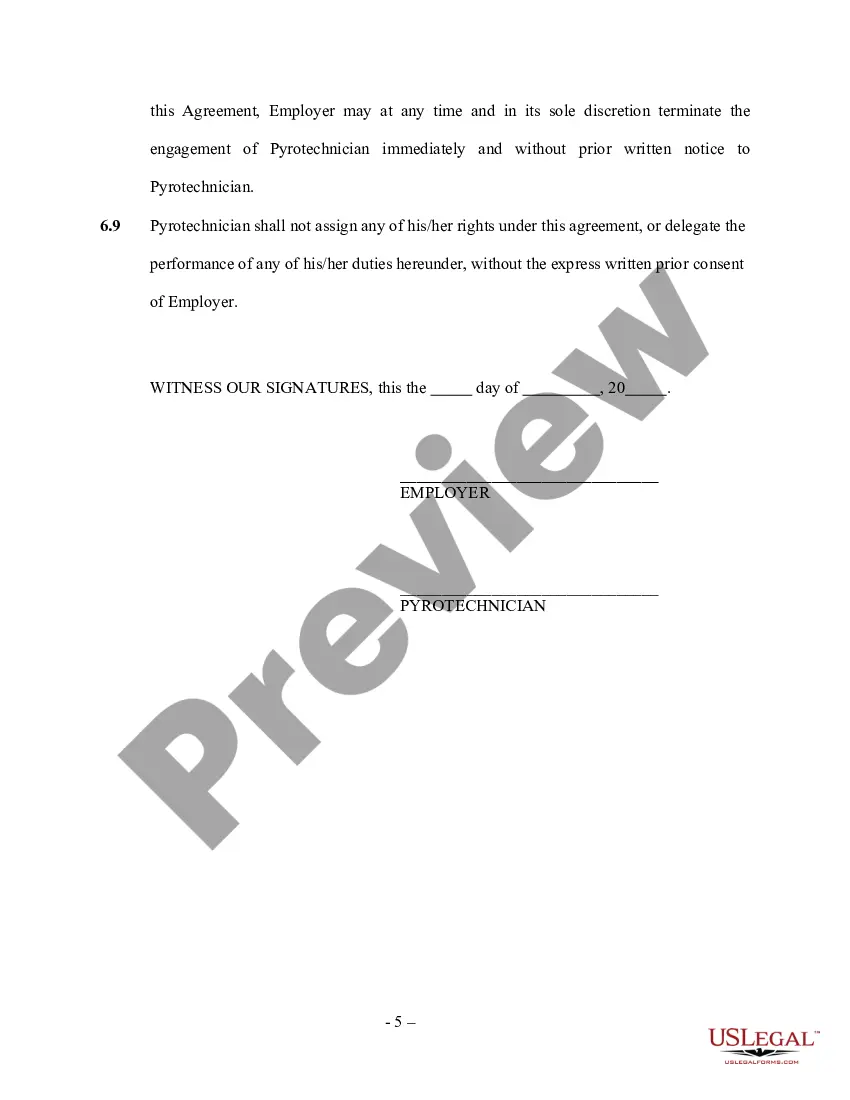

Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract

Description

How to fill out Self-Employed Independent Contractor Pyrotechnician Service Contract?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or print. By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract within moments.

If you have a subscription, Log In and retrieve the Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have selected the appropriate form for your city/county. Click the Preview button to review the form’s content. Examine the form summary to confirm that you have chosen the correct form. If the form doesn’t meet your requirements, utilize the Search field at the top of the screen to find the one that does. When you are satisfied with the document, finalize your decision by clicking the Get now button. Then, select your preferred payment plan and provide your details to register for the account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the document to your device. Make amendments. Fill out, edit, and print and sign the downloaded Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract. Every document you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

US Legal Forms is committed to providing the most comprehensive selection of legal documents tailored to your needs.

Start your experience with US Legal Forms today and simplify your document management.

- Access the Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract using US Legal Forms, the most extensive collection of legal document templates.

- Utilize a vast array of professional and state-specific templates that meet your business or personal requirements and specifications.

- Find various forms organized by categories for easy navigation.

- Download forms with just a few clicks.

- Edit and customize forms to suit your needs.

- Store forms in your account for future use without any expiration.

Form popularity

FAQ

The main difference between an independent contractor and an employee lies in the level of control and flexibility. Independent contractors typically have more control over how they perform their work and often work for multiple clients simultaneously. In contrast, employees usually work under specific guidelines set by their employer, including work hours and duties. Recognizing this distinction is crucial in forming an Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract, as it influences legal responsibilities and taxes.

Independent contractors often need to complete several documents, including an independent contractor agreement and tax forms like the W-9. Depending on the client or project, additional paperwork such as insurance certificates may also be required. Using resources from uslegalforms can simplify the process of drafting an Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract, ensuring you have all necessary documentation ready.

Yes, in many cases, independent contractors in Alaska may need a business license, especially if they operate under a business name or provide certain services. Specific licenses depend on the type of work performed and local regulations. When creating an Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract, it’s crucial to check for these licenses to stay compliant and avoid fines.

Legal requirements for independent contractors vary by state. In Alaska, contractors must comply with local laws, including tax obligations and potential business licenses, depending on their services. Understanding these requirements, especially for an Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract, ensures you operate within the law and protects your business interests.

An independent contractor agreement is a legal document that outlines the terms of a working relationship between a contractor and a client. This agreement specifies services to be provided, payment terms, and deadlines. In the context of an Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract, it ensures both parties understand their roles and responsibilities, which helps prevent misunderstandings.

Statute 23.10.430 in Alaska pertains to the rights and duties of workers and employers in certain industries, including independent contractors. It addresses aspects like wage claims and working conditions, which are crucial for independent contractors, including pyrotechnicians. Understanding this statute can guide you in drafting your Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract effectively. Ensuring compliance with these laws will protect you and provide clarity in your business dealings.

Yes, having a contract as an independent contractor is essential for protecting your interests. An Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract clearly outlines the terms of your work and payment expectations. It serves as a legal agreement between you and your client, ensuring both parties understand their responsibilities. By using a contract, you can help prevent misunderstandings and disputes down the line.

Writing an independent contractor agreement involves outlining the terms of your work arrangement. Begin by defining the scope of work, payment schedule, and deadlines. Additionally, specify any legal terms regarding the relationship and obligations of both parties. To simplify this, consider using a professional template for an Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract to ensure that all critical elements are addressed.

To fill out an independent contractor agreement, start with the date and names of both parties involved. Clearly identify the services the contractor will perform and detail the payment terms. Make sure to include clauses addressing confidentiality and termination to protect your interests. Utilizing a standard template for an Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract can make this task easier and more effective.

To fill out an independent contractor form, start by providing your personal information, including your name and contact details. Next, include specifics about the project, such as the scope of work and compensation details. Ensure you clearly define terms such as deadlines and deliverables. Using a well-structured Alaska Self-Employed Independent Contractor Pyrotechnician Service Contract template can guide you through this process efficiently.