Alaska Audiologist Agreement - Self-Employed Independent Contractor

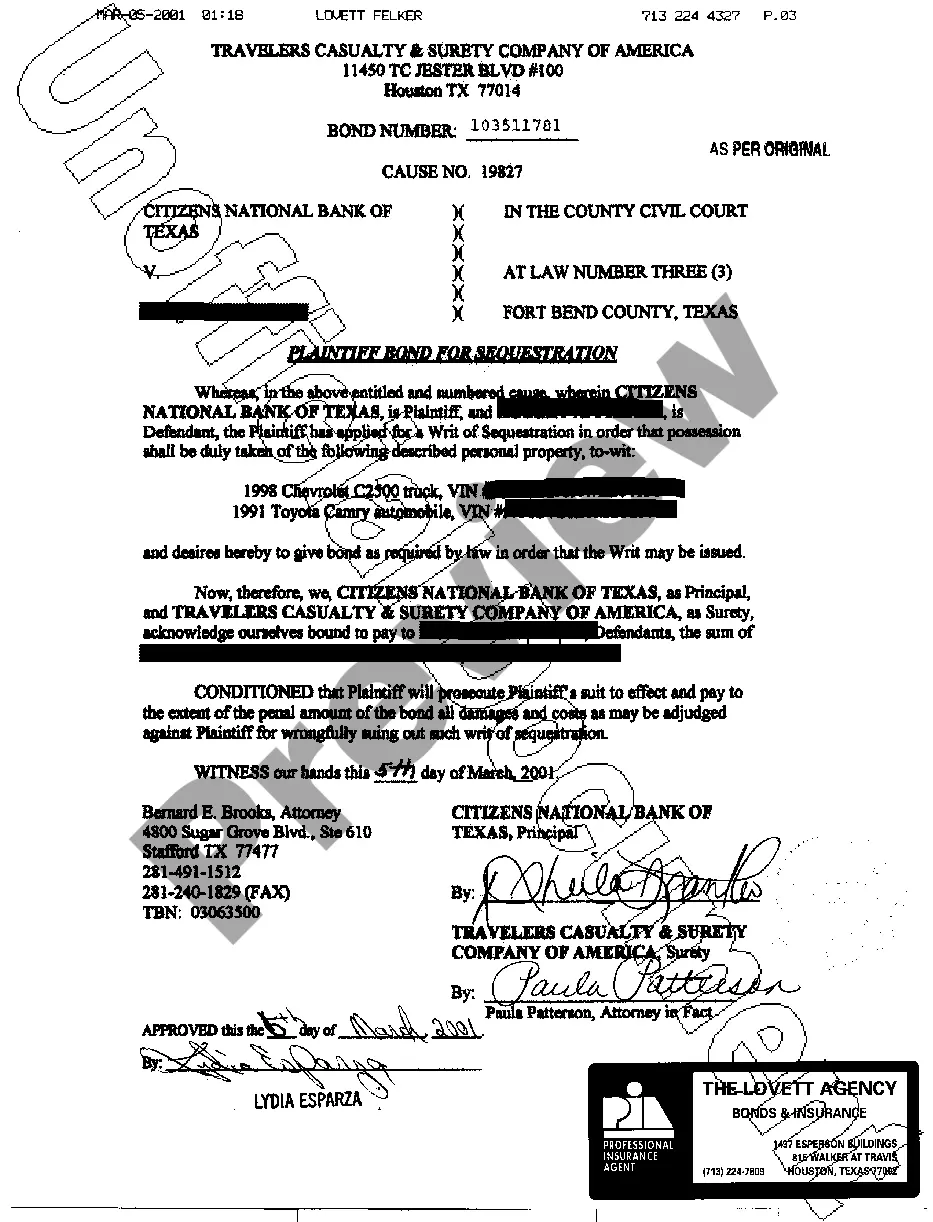

Description

How to fill out Audiologist Agreement - Self-Employed Independent Contractor?

If you need to finalize, obtain, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's straightforward and convenient search feature to locate the documents you require. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to find the Alaska Audiologist Agreement - Self-Employed Independent Contractor in just a few clicks.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Alaska Audiologist Agreement - Self-Employed Independent Contractor.

Every legal document template you acquire is yours permanently. You have access to every form you downloaded in your account. Click the My documents section and choose a form to print or download again. Compete and obtain, and print the Alaska Audiologist Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Alaska Audiologist Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

The process to obtain an Alaska medical license can take several weeks to months, depending on various factors. First, you must complete your education and training, then submit your application to the Alaska Medical Board. After that, the board reviews all documentation and may request further information. By utilizing resources like the Alaska Audiologist Agreement - Self-Employed Independent Contractor, you can ensure that you comply with all necessary legal requirements and streamline your path to licensure.

Filling out an independent contractor form requires you to provide your personal details, the nature of your services, and the agreed-upon compensation. Be clear and concise to ensure all relevant information is included, which helps avoid misunderstandings in the future. Using the Alaska Audiologist Agreement - Self-Employed Independent Contractor, you can find guidance on the necessary components to include for both parties' protection.

Writing an independent contractor agreement involves detailing the terms of the working relationship between you and your client. Start with the basic details such as names and project specifics, then include payment terms, responsibilities, and timelines. You might find the Alaska Audiologist Agreement - Self-Employed Independent Contractor to be a valuable resource, as it provides a comprehensive framework that you can adapt to your needs.

To fill out an independent contractor agreement, begin by entering the names and addresses of both parties involved. Next, outline the scope of work, payment structure, and duration of the agreement. Remember to include clauses about confidentiality and dispute resolution. The Alaska Audiologist Agreement - Self-Employed Independent Contractor offers a straightforward template that simplifies this process.

Independent contractors typically need to fill out several key documents, including a W-9 form for tax purposes, an independent contractor agreement, and possibly a declaration of independent contractor status form. The Alaska Audiologist Agreement - Self-Employed Independent Contractor may also require specific paperwork depending on your practice and the services you provide. It's important to keep organized records to ensure compliance with state and federal regulations.

Filling out a declaration of independent contractor status form involves providing your personal information, business details, and the nature of your work. You'll need to clearly state that you operate as a self-employed independent contractor under the Alaska Audiologist Agreement. Make sure to review your entries for accuracy before submitting the form, as this establishes your legal standing in Alaska.

An independent contractor agreement in Alaska is a legal document that outlines the terms and conditions between a business and a self-employed individual. This agreement specifies rights, responsibilities, payment terms, and project deadlines, ensuring a clear understanding for both parties. The Alaska Audiologist Agreement - Self-Employed Independent Contractor provides essential legal protection, allowing audiologists to work independently while maintaining flexibility in their services.

In Alaska, the distinction between an employee and a contractor primarily revolves around the nature of the work relationship. Employees often work within the confines of company guidelines and receive benefits, while contractors enjoy greater flexibility and independence in their projects. Crafting a solid Alaska Audiologist Agreement - Self-Employed Independent Contractor can help clarify these differences and set expectations for both parties.

The key difference between an independent contractor and an employee in Alaska lies in the level of control and independence. An independent contractor operates more autonomously, chooses their work methods, and is responsible for their taxes. In contrast, employees are typically subject to more oversight and enjoy benefits provided by the employer. Understanding this distinction can be crucial when drafting the Alaska Audiologist Agreement - Self-Employed Independent Contractor.

A basic independent contractor agreement outlines the terms and conditions under which an independent contractor, such as an audiologist, will perform their services. This document should address scope of work, payment terms, confidentiality, and termination conditions. Utilizing the Alaska Audiologist Agreement - Self-Employed Independent Contractor ensures clarity and professionalism in the working relationship.