Alaska Registration Rights Agreement regarding the purchase of convertible subordinated debentures

Description

How to fill out Registration Rights Agreement Regarding The Purchase Of Convertible Subordinated Debentures?

Have you been in the situation in which you require paperwork for either business or person uses nearly every time? There are a variety of lawful papers themes available online, but finding versions you can rely on isn`t straightforward. US Legal Forms gives a huge number of form themes, just like the Alaska Registration Rights Agreement regarding the purchase of convertible subordinated debentures, which can be composed to satisfy state and federal needs.

When you are presently informed about US Legal Forms web site and possess a merchant account, just log in. After that, you can acquire the Alaska Registration Rights Agreement regarding the purchase of convertible subordinated debentures design.

Should you not come with an accounts and wish to begin using US Legal Forms, follow these steps:

- Get the form you will need and ensure it is to the correct metropolis/county.

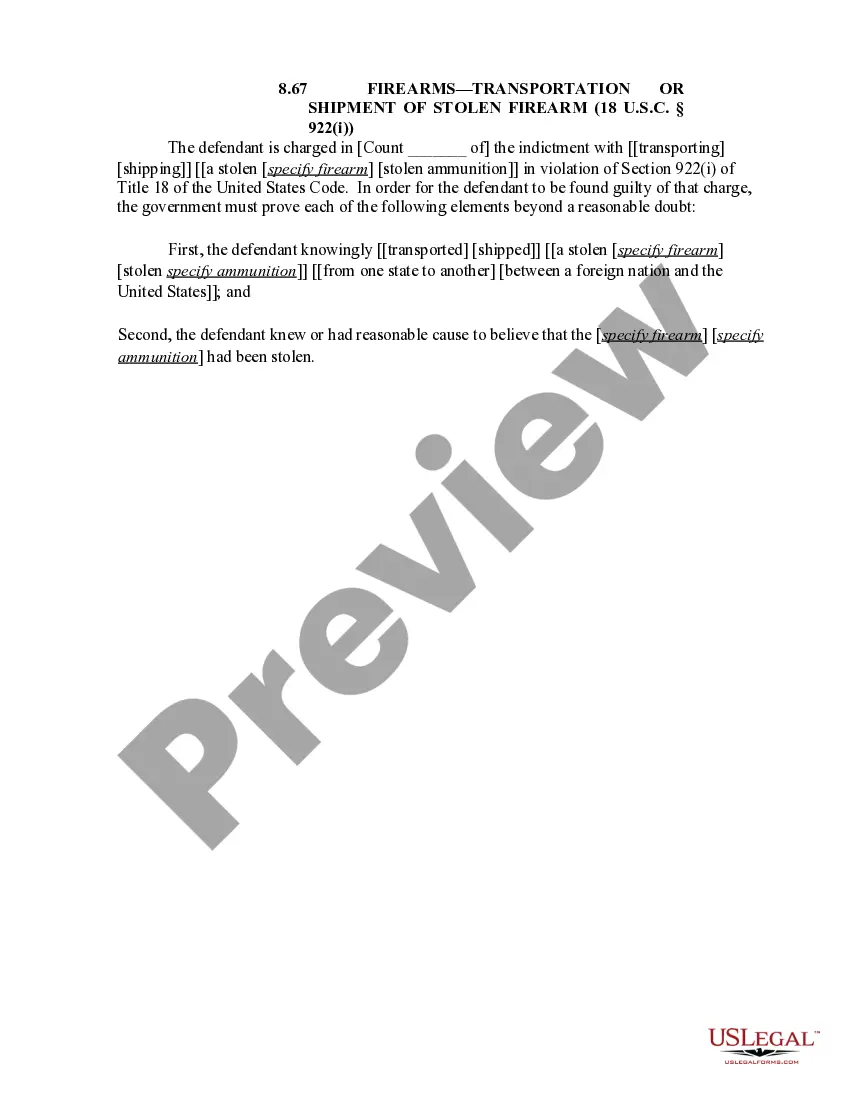

- Use the Review button to examine the shape.

- See the outline to actually have selected the proper form.

- In the event the form isn`t what you are looking for, make use of the Research area to discover the form that suits you and needs.

- If you obtain the correct form, just click Purchase now.

- Pick the prices prepare you desire, fill in the required details to generate your money, and pay for your order utilizing your PayPal or credit card.

- Choose a handy data file file format and acquire your duplicate.

Find each of the papers themes you possess purchased in the My Forms menu. You may get a extra duplicate of Alaska Registration Rights Agreement regarding the purchase of convertible subordinated debentures anytime, if needed. Just go through the required form to acquire or printing the papers design.

Use US Legal Forms, one of the most considerable selection of lawful kinds, to save efforts and steer clear of blunders. The assistance gives professionally created lawful papers themes which you can use for an array of uses. Produce a merchant account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

A convertible debenture is a hybrid financial instrument that has both fixed income and equity characteristics. In its simplest terms, it is a bond that gives the holder the option to convert into an underlying equity instrument at a predetermined price.

Related Content. In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

Demand registration rights, where an investor can force a company to file a registration statement to register the holder's securities so the investor can sell them in the public market without restriction.

?Definition? A registration rights provision in a term sheet allows an investor to require a company to register the investor's shares with the SEC when certain conditions are met, ensuring that the investor has the opportunity to sell their shares in the public market.

What is Optionally Convertible Debentures. Definition: Optionally convertible debentures are debt securities which allow an issuer to raise capital and in return the issuer pays interest to the investor till the maturity.