Alaska Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp.

Description

How to fill out Agreement And Plan Of Merger By NFA Corp. And Casty Acquisition Corp.?

Choosing the best authorized record web template can be a struggle. Of course, there are tons of templates available on the net, but how can you obtain the authorized kind you will need? Utilize the US Legal Forms website. The assistance provides a huge number of templates, for example the Alaska Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp., that can be used for organization and personal requirements. Each of the types are checked out by professionals and satisfy federal and state demands.

In case you are currently signed up, log in for your bank account and then click the Download key to get the Alaska Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp.. Make use of bank account to look through the authorized types you may have purchased earlier. Go to the My Forms tab of your respective bank account and obtain another backup of the record you will need.

In case you are a new consumer of US Legal Forms, listed below are basic recommendations for you to adhere to:

- First, be sure you have selected the appropriate kind for your personal town/region. You can check out the form making use of the Preview key and look at the form information to make sure it is the right one for you.

- In case the kind will not satisfy your expectations, make use of the Seach field to find the correct kind.

- Once you are certain the form is acceptable, click the Get now key to get the kind.

- Opt for the rates plan you want and type in the necessary details. Create your bank account and pay for the order using your PayPal bank account or credit card.

- Choose the file formatting and acquire the authorized record web template for your gadget.

- Total, change and print and indication the acquired Alaska Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp..

US Legal Forms is the biggest collection of authorized types for which you can see numerous record templates. Utilize the service to acquire expertly-manufactured paperwork that adhere to condition demands.

Form popularity

FAQ

The Buyer and the Sellers are referred to collectively herein as the "Parties."

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

A merger typically occurs when one company purchases another company by buying a certain amount of its stock in exchange for its own stock. An acquisition is slightly different and often does not involve a change in management.

Hear this out loud PauseMerger Parties means, individually and collectively, the Company, the Shareholders, Merger Sub and Buyer.

Every M&A transaction involves at least one purchaser, or buyer, the party that will be making the acquisition. This is the person (i.e., individual or company) that signs the purchase agreement, pays the purchase price and which, after closing, directly or indirectly, owns or controls the target company or its assets.

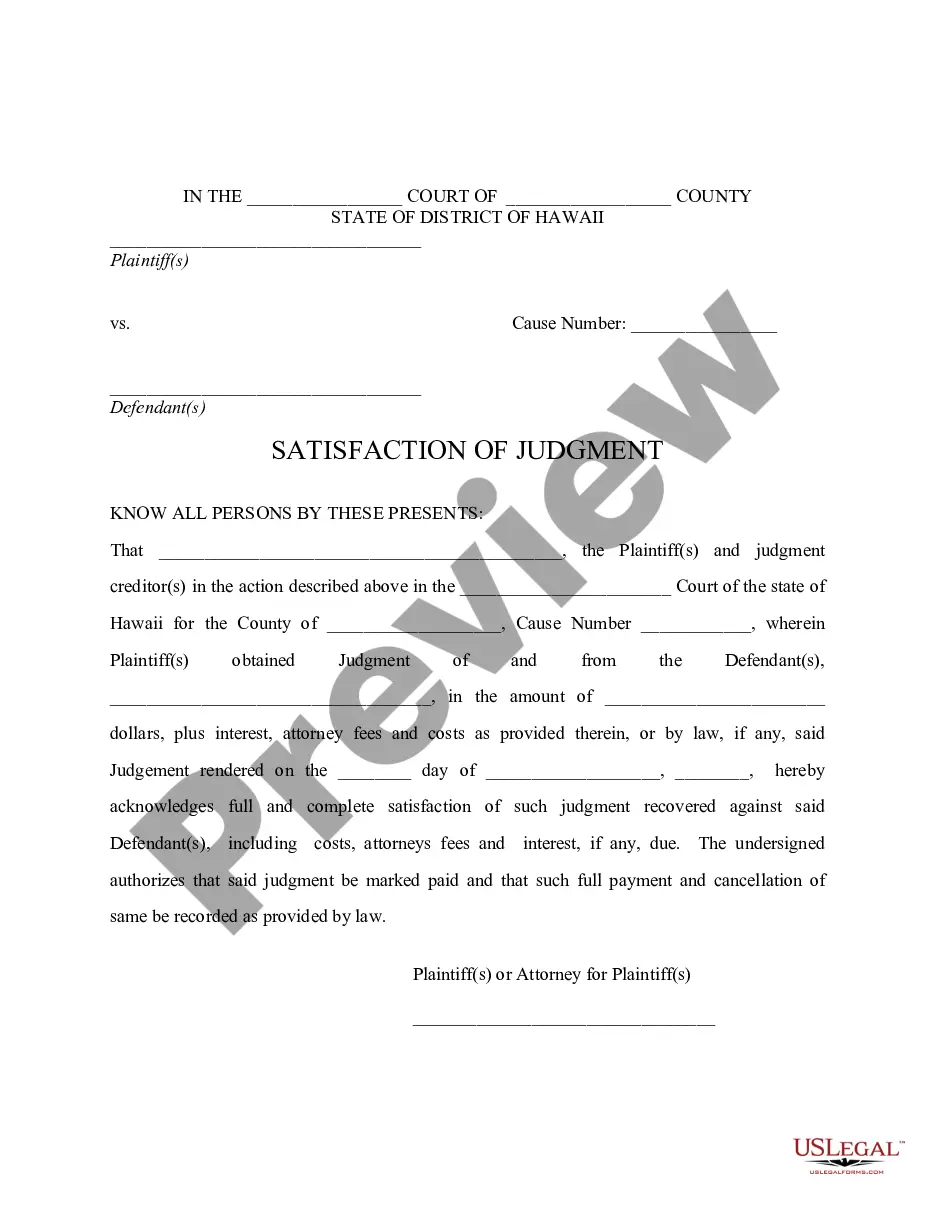

Hear this out loud PauseAn agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).