Oklahoma Bill of Sale and Quitclaim by Surface Owner of All Interest in Equipment Deemed Abandoned on Surface Owner's Lands - Abandonment

Description

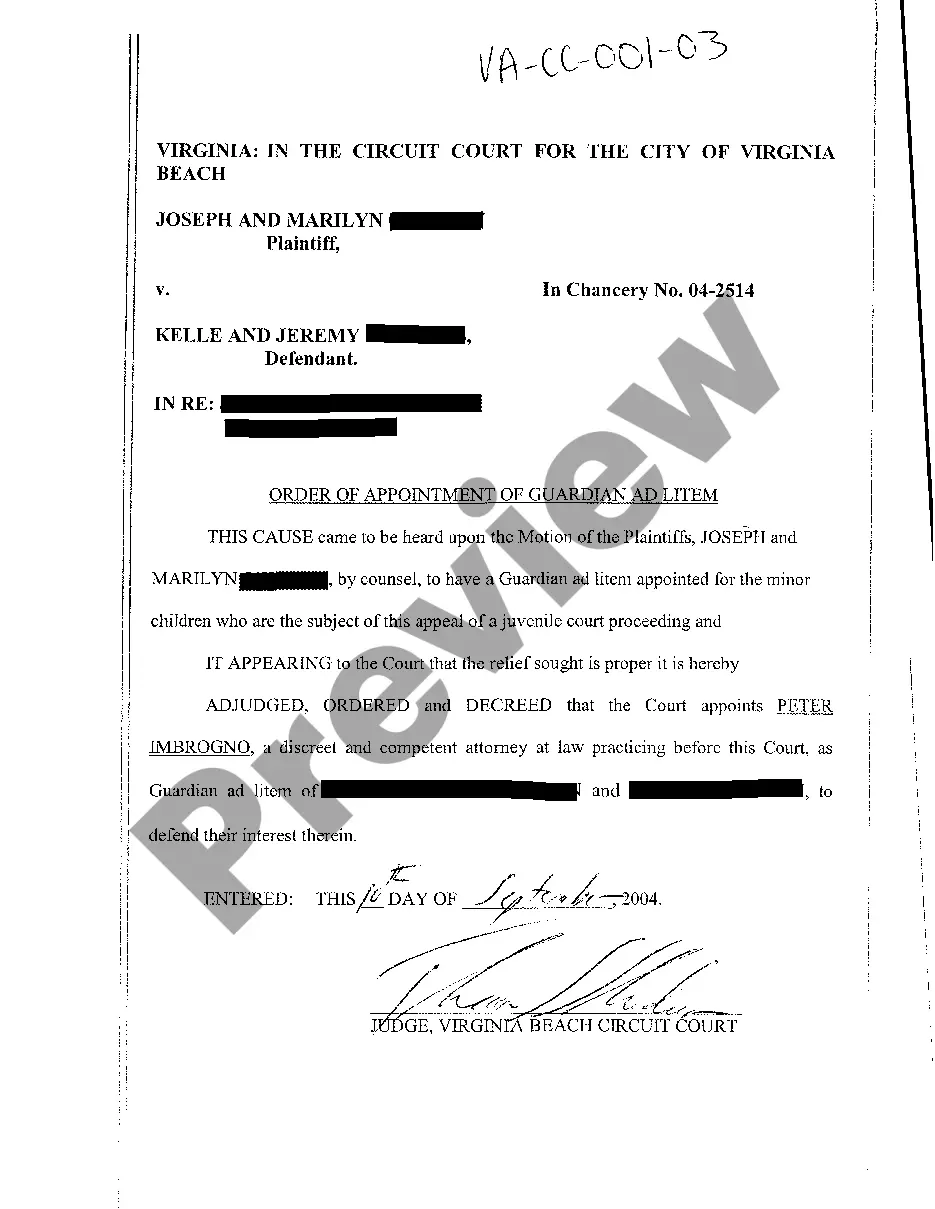

How to fill out Bill Of Sale And Quitclaim By Surface Owner Of All Interest In Equipment Deemed Abandoned On Surface Owner's Lands - Abandonment?

US Legal Forms - among the largest libraries of lawful types in the States - gives a wide range of lawful record templates you can obtain or print out. While using web site, you can get a large number of types for organization and specific uses, categorized by classes, claims, or keywords.You will find the most recent variations of types such as the Oklahoma Bill of Sale and Quitclaim by Surface Owner of All Interest in Equipment Deemed Abandoned on Surface Owner's Lands - Abandonment in seconds.

If you currently have a registration, log in and obtain Oklahoma Bill of Sale and Quitclaim by Surface Owner of All Interest in Equipment Deemed Abandoned on Surface Owner's Lands - Abandonment in the US Legal Forms local library. The Down load button will show up on each and every kind you view. You get access to all in the past downloaded types in the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, allow me to share simple instructions to help you started:

- Ensure you have selected the best kind for your personal metropolis/county. Click the Review button to check the form`s content. Look at the kind description to actually have chosen the correct kind.

- When the kind does not match your requirements, utilize the Research area near the top of the monitor to obtain the the one that does.

- Should you be satisfied with the shape, affirm your option by visiting the Buy now button. Then, choose the costs prepare you prefer and supply your accreditations to register for an accounts.

- Method the transaction. Use your credit card or PayPal accounts to accomplish the transaction.

- Pick the structure and obtain the shape on your gadget.

- Make modifications. Load, modify and print out and indicator the downloaded Oklahoma Bill of Sale and Quitclaim by Surface Owner of All Interest in Equipment Deemed Abandoned on Surface Owner's Lands - Abandonment.

Each format you added to your bank account does not have an expiry date and is also your own property permanently. So, if you want to obtain or print out an additional duplicate, just go to the My Forms section and click around the kind you will need.

Obtain access to the Oklahoma Bill of Sale and Quitclaim by Surface Owner of All Interest in Equipment Deemed Abandoned on Surface Owner's Lands - Abandonment with US Legal Forms, probably the most comprehensive local library of lawful record templates. Use a large number of skilled and express-distinct templates that meet up with your organization or specific requires and requirements.

Form popularity

FAQ

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

Are mineral rights considered real property in Oklahoma? The severability and fractionalization of Oklahoma mineral rights create a rich trove of mineral rights opportunities across the state. Since mineral rights are treated as real estate in Oklahoma, these rights are considered real property.

Usually the potential buyer will break down your ownership into net royalty acres which are the net mineral acres you own normalized to a 12.5% royalty. Also understanding the terms of the lease including when the lease expires and if there is an option to extend the lease can affect the value.

Without any royalty income it comes down to what buyers think the future income might be. For non-producing properties, the Mineral Rights Value in Oklahoma could be anywhere from a few hundred dollars per acre to $5,000+/acre. It really depends on which county your property is located in.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

A quitclaim deed to real estate may be substantially the same as a warranty deed, with the word "quitclaim" inserted in connection with the words "do hereby grant, bargain, sell and convey," as follows: "Do hereby quitclaim, grant, bargain, sell and convey," and by omitting the words, "and warrant the title to the same ...

Oklahoma's adverse possession law allows continuous trespassers to gain title to an otherwise abandoned piece of real estate after inhabiting it for a certain period of time.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states.