Alaska Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus

Description

How to fill out Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

If you wish to full, down load, or produce authorized document themes, use US Legal Forms, the largest selection of authorized types, which can be found online. Take advantage of the site`s simple and easy convenient research to obtain the papers you want. Numerous themes for company and individual purposes are categorized by classes and says, or key phrases. Use US Legal Forms to obtain the Alaska Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus with a handful of click throughs.

If you are previously a US Legal Forms consumer, log in for your bank account and click the Acquire key to find the Alaska Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus. You may also entry types you in the past saved from the My Forms tab of your bank account.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form for that proper city/region.

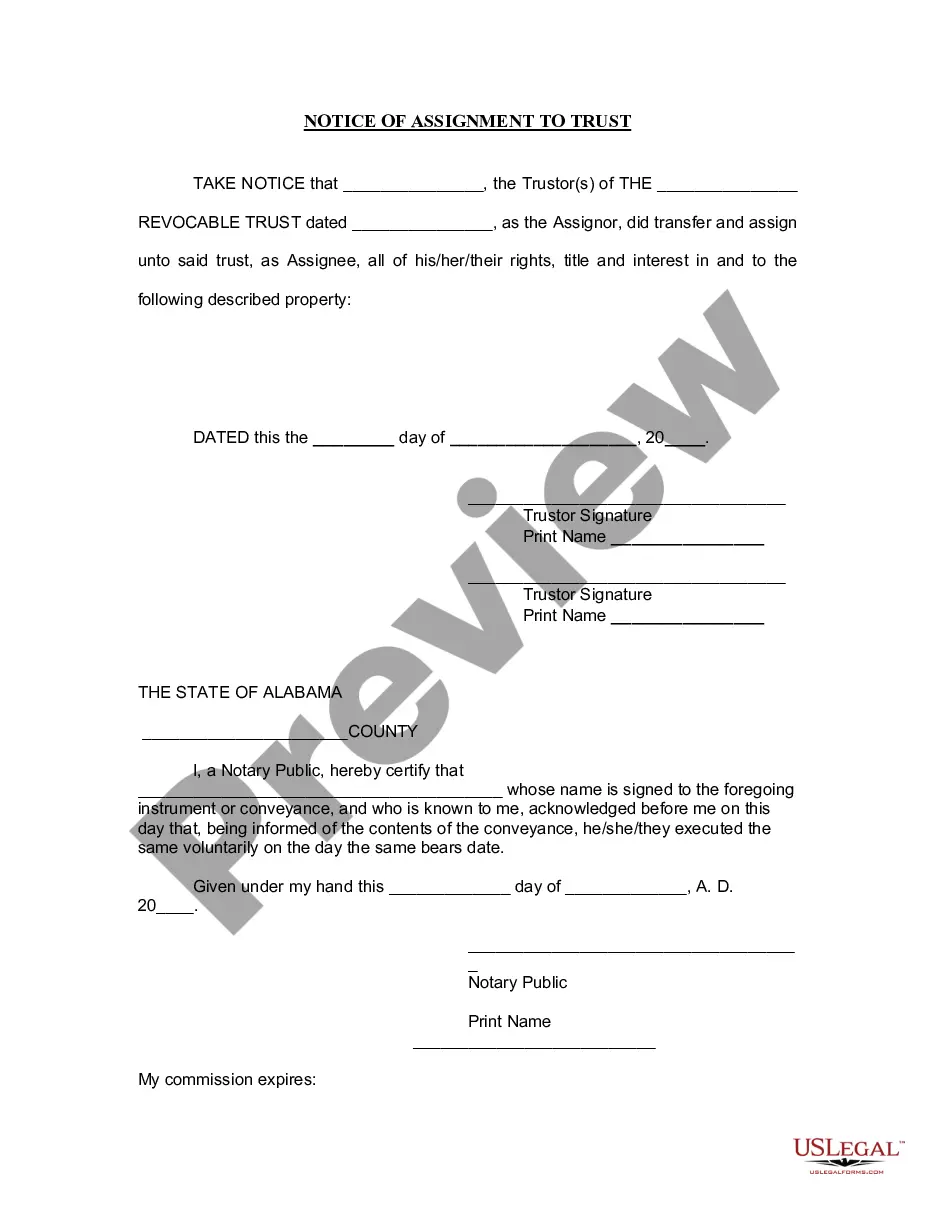

- Step 2. Take advantage of the Review choice to check out the form`s articles. Never forget to learn the explanation.

- Step 3. If you are unsatisfied with the form, make use of the Look for area at the top of the display screen to find other versions from the authorized form design.

- Step 4. When you have located the form you want, go through the Purchase now key. Opt for the rates strategy you favor and include your qualifications to register for the bank account.

- Step 5. Process the financial transaction. You can utilize your bank card or PayPal bank account to complete the financial transaction.

- Step 6. Select the file format from the authorized form and down load it on the system.

- Step 7. Comprehensive, edit and produce or signal the Alaska Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.

Each authorized document design you purchase is your own eternally. You possess acces to each form you saved with your acccount. Click on the My Forms segment and choose a form to produce or down load again.

Remain competitive and down load, and produce the Alaska Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus with US Legal Forms. There are many expert and express-certain types you can use for the company or individual needs.

Form popularity

FAQ

Basic Requirements Petition for Amendment/Conversion of license. Authenticated copy of the Board Resolution approving the amendments/conversion. Monitoring/Clearance from appropriate Department of the Commission* Endorsement/Clearance from appropriate government agencies.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

Hear this out loud PauseTo amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

Basic Requirements Petition for Amendment/Conversion of license. Authenticated copy of the Board Resolution approving the amendments/conversion. Monitoring/Clearance from appropriate Department of the Commission* Endorsement/Clearance from appropriate government agencies.

To start a corporation in Alaska, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the State of Alaska Corporations Section. You can file the document online or by mail. The Articles of Incorporation cost $250 to file.