Alaska Stock Option and Stock Award Plan of American Stores Company

Description

How to fill out Stock Option And Stock Award Plan Of American Stores Company?

If you have to comprehensive, obtain, or printing lawful file templates, use US Legal Forms, the biggest collection of lawful varieties, that can be found on the web. Use the site`s easy and convenient look for to discover the files you will need. Various templates for business and individual reasons are sorted by classes and suggests, or search phrases. Use US Legal Forms to discover the Alaska Stock Option and Stock Award Plan of American Stores Company in a number of mouse clicks.

When you are already a US Legal Forms buyer, log in for your accounts and click on the Acquire button to obtain the Alaska Stock Option and Stock Award Plan of American Stores Company. Also you can access varieties you previously acquired within the My Forms tab of your accounts.

If you work with US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape to the correct town/nation.

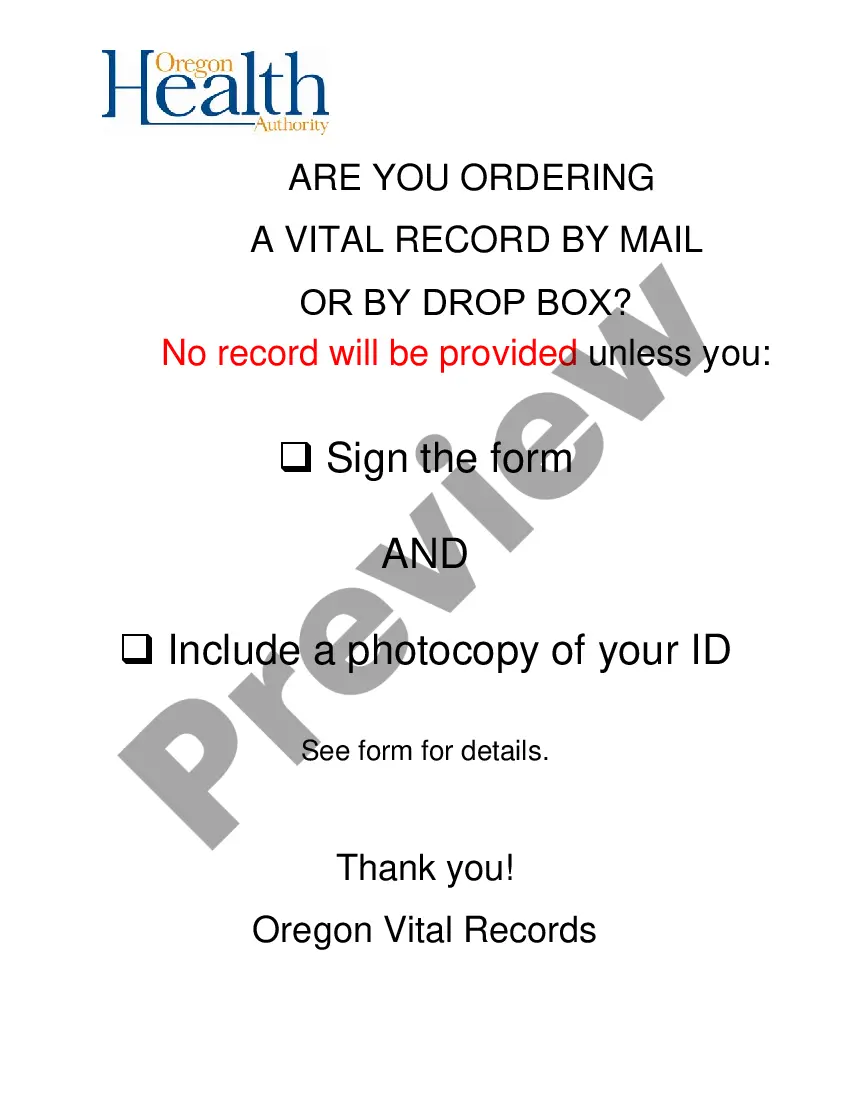

- Step 2. Use the Preview solution to examine the form`s information. Never neglect to learn the information.

- Step 3. When you are not satisfied with all the type, utilize the Research field at the top of the display screen to get other variations from the lawful type format.

- Step 4. After you have located the shape you will need, select the Buy now button. Pick the prices program you choose and include your accreditations to sign up on an accounts.

- Step 5. Procedure the deal. You may use your charge card or PayPal accounts to accomplish the deal.

- Step 6. Pick the formatting from the lawful type and obtain it on your product.

- Step 7. Total, edit and printing or indicator the Alaska Stock Option and Stock Award Plan of American Stores Company.

Each lawful file format you get is yours forever. You may have acces to each type you acquired with your acccount. Click on the My Forms segment and pick a type to printing or obtain once more.

Be competitive and obtain, and printing the Alaska Stock Option and Stock Award Plan of American Stores Company with US Legal Forms. There are millions of skilled and condition-specific varieties you can utilize for your personal business or individual demands.

Form popularity

FAQ

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the shareholders. Companies may also grant stock awards to lower-level employees to incentivize them to take ownership of the company's performance and retain their loyalty.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

Restricted stock awards represent actual ownership of stock and come with conditions on the timing of their sale. An employee benefits from stock options when they buy the stock at the exercise price and then sell it at a higher price.

When you receive an RSU, you don't have any immediate tax liability. You only have to pay taxes when your RSU vests and you receive an actual payout of stock shares. At that point, you have to report income based on the fair market value of the stock.

A restricted stock award is when a company grants someone stock as a form of compensation. The stock awarded has additional conditions on it, including a vesting schedule, so is called restricted stock. Restricted stock awards may also be called simply stock awards or stock grants.