Alaska Joint Trust with Income Payable to Trustors During Joint Lives

Description

How to fill out Joint Trust With Income Payable To Trustors During Joint Lives?

You have the ability to spend time online looking for the legal document format that meets the federal and state requirements you will require.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can conveniently obtain or print the Alaska Joint Trust with Income Payable to Trustors During Joint Lives from the service.

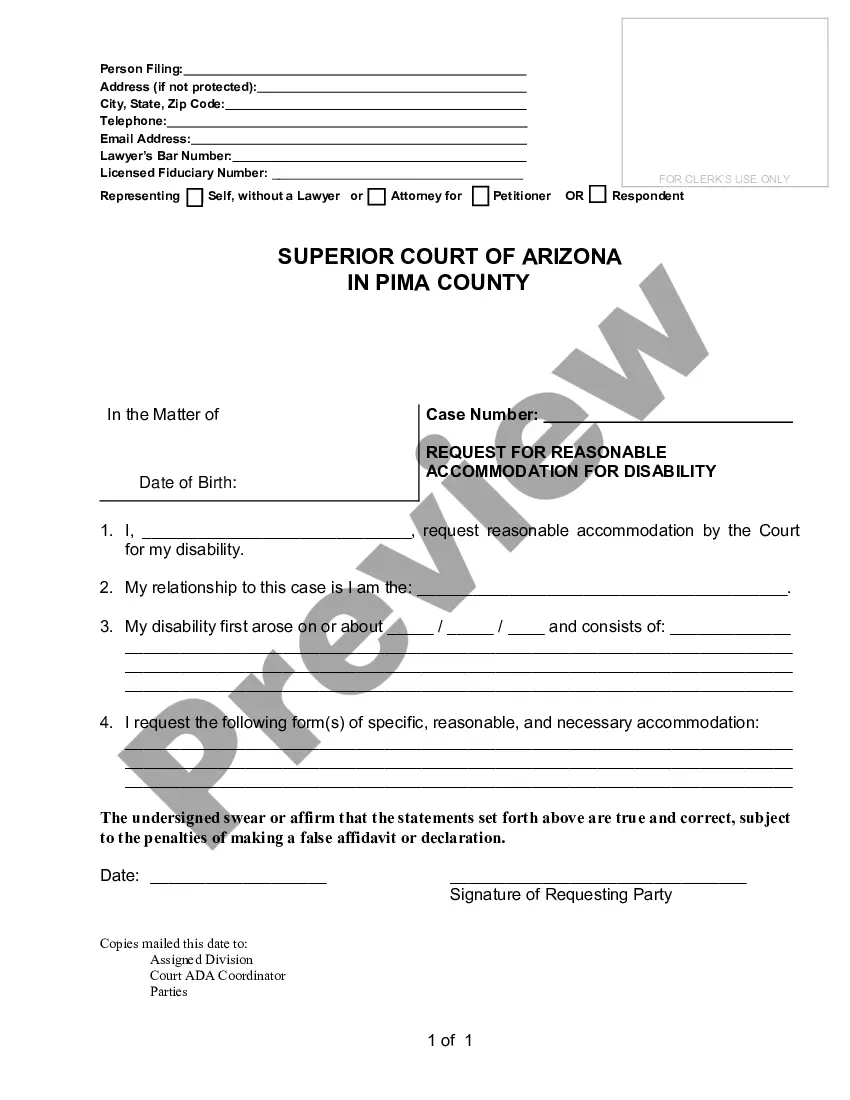

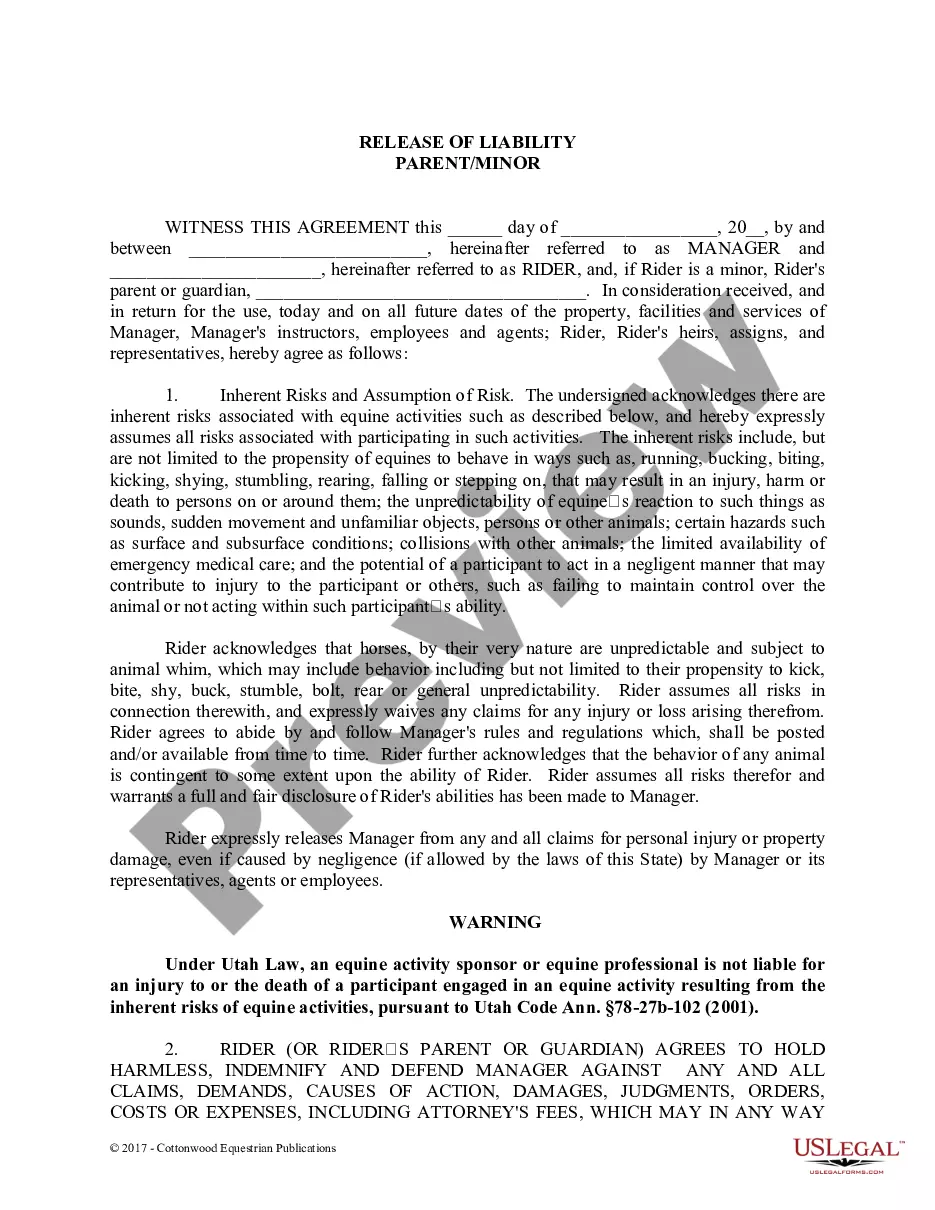

If available, use the Review option to examine the document format as well. If you want to obtain another version of the form, use the Search area to find the format that satisfies your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, edit, print, or sign the Alaska Joint Trust with Income Payable to Trustors During Joint Lives.

- Every legal document template you purchase is yours for a long time.

- To obtain another copy of any purchased form, go to the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure that you have selected the correct document format for your desired area/city.

- Check the form description to confirm you have chosen the correct form.

Form popularity

FAQ

Joint Revocable Trusts can be a solid option when a married couple has a generally simple estate and when total assets (combined) don't meet the estate tax limit threshold, which is $11.58m in 2020. Keep in mind, though, that a Joint Revocable Living Trust, when not set up properly, may result in estate tax issues.

The income from the revocable (living) trust is to be reported on the personal income tax returns of the Trustors (persons who formed the trust). The IRS and California taxing authorities do not recognize a living (revocable) trust as a separate taxpaying entity as long as both Trustors are alive.

If you created a revocable living trust with your spouse, you can change the whole trust or part of the trust following the his or her death. A living trust allows to you make any changes to the terms by creating amendments or by creating a new trust entirely.

Generally, trusts are considered the separate property of the beneficiary spouse and the assets in a trust are not subject to equitable distribution unless they contain marital property.

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.

Typically, when a married couple utilizes a Revocable Living Trust based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

Trusts can be both single and joint. A single living trust involves just one individual, while a joint living trust usually involves a married couple. Joint living trusts are commonly used to transfer assets between spouses upon one spouse's death.