Alaska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

US Legal Forms - one of many biggest libraries of authorized varieties in the States - offers a variety of authorized papers themes you may download or produce. While using website, you may get thousands of varieties for company and personal purposes, categorized by types, suggests, or keywords.You will find the latest variations of varieties just like the Alaska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse in seconds.

If you already possess a subscription, log in and download Alaska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse through the US Legal Forms library. The Down load key will show up on every single kind you look at. You have accessibility to all formerly delivered electronically varieties in the My Forms tab of your account.

If you would like use US Legal Forms initially, allow me to share simple guidelines to obtain started out:

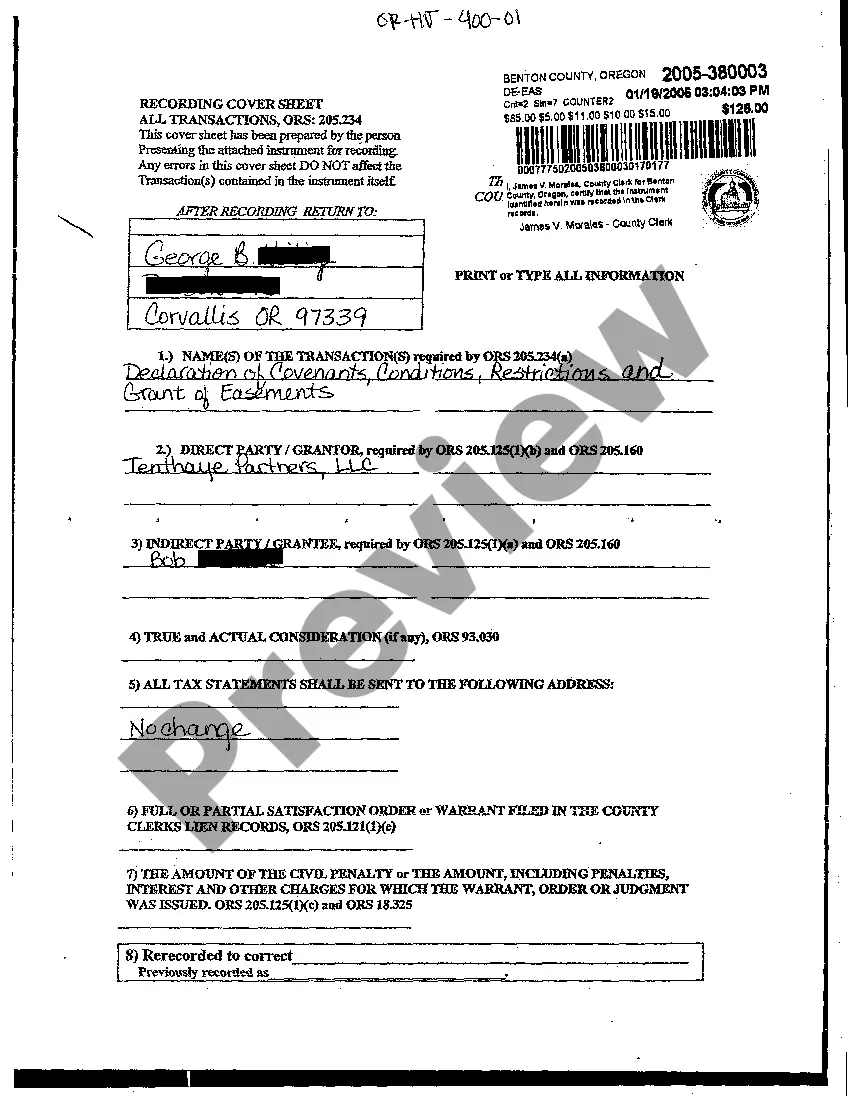

- Ensure you have picked the right kind for the metropolis/county. Click on the Review key to analyze the form`s content material. See the kind outline to actually have selected the right kind.

- In case the kind doesn`t match your specifications, take advantage of the Search field towards the top of the display to discover the the one that does.

- In case you are pleased with the form, validate your decision by clicking on the Get now key. Then, opt for the costs strategy you prefer and give your accreditations to register for an account.

- Procedure the purchase. Make use of your credit card or PayPal account to complete the purchase.

- Find the file format and download the form on the product.

- Make adjustments. Complete, change and produce and sign the delivered electronically Alaska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Every single format you put into your bank account does not have an expiration time which is your own property permanently. So, if you wish to download or produce yet another copy, just go to the My Forms area and click on the kind you will need.

Get access to the Alaska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with US Legal Forms, probably the most considerable library of authorized papers themes. Use thousands of specialist and condition-certain themes that satisfy your business or personal needs and specifications.

Form popularity

FAQ

The fiduciary must be under a duty to distribute the income currently even if, as a matter of practical necessity, the income is not distributed until after the close of the trust's taxable year.

Beneficiaries of a trust typically pay taxes on distributions they receive from the trust's income. However, they are not subject to taxes on distributions from the trust's principal.

The trustee can transfer real estate to the beneficiary by having a new deed written up or selling the property and giving them the money, writing them a check or giving them cash.

EXAMPLE: Creator establishes a lifetime trust for a beneficiary, which then passes assets to such descendants of the beneficiary as he shall appoint in trust. The beneficiary appoints to his child (unborn at creator's death), for life, remainder to the beneficiary's grandchildren.

Discretionary trust distributions are unique because they are the only type of trust distribution in which the trustee has the authority to decide which beneficiaries among a group of predetermined beneficiaries will inherit, how much they will inherit, when they will inherit, and whether they will inherit from the ...

Outright Trust Distributions They consist of the trustee releasing each beneficiary's inheritance without any restrictions. Outright distributions can either be made as a single lump sum, or periodically. Prior to making outright trust distributions, the trustee will need to pay the trust's debts and taxes.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.