Alaska Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Description

How to fill out Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

Have you ever found yourself in a situation where you require documentation for organizational or individual purposes almost all the time.

There are many legal document templates accessible online, but discovering reliable ones is not easy.

US Legal Forms offers thousands of form templates, such as the Alaska Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor, designed to comply with state and federal regulations.

When you find the correct form, click Buy now.

Select the payment plan you prefer, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Alaska Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and confirm it is for the correct city/region.

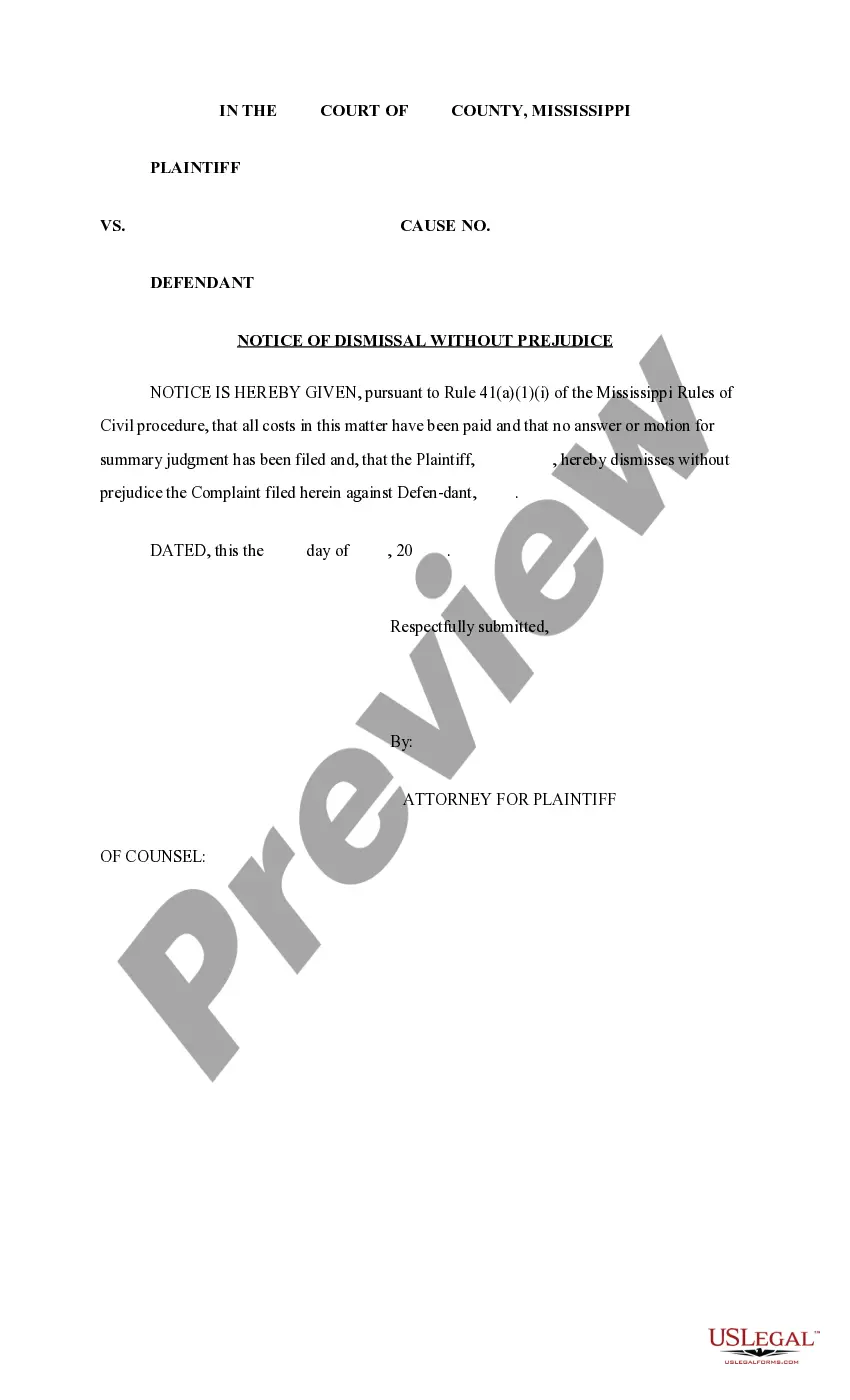

- Utilize the Preview button to examine the form.

- Read the description to ensure you have selected the accurate form.

- If the form does not meet your requirements, use the Search field to locate the form that satisfies your needs.

Form popularity

FAQ

Upon the death of the trustor, the Alaska Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor continues to operate according to its established terms. The trust hardens into a form designed for beneficiaries, ensuring their continued benefit. However, any specific powers granted to the trustor may end. It's beneficial to consult experts on estate planning through uslegalforms to ensure all matters are clarified.

Although one person can be both trustor and trustee, or both trustee and beneficiary, the roles of the trustor, trustee, and beneficiary are distinctly different.

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

An irrevocable trust cannot be modified or terminated without permission of the beneficiary. "Once the grantor transfers the assets into the irrevocable trust, he or she removes all rights of ownership to the trust and assets," Orman explained.

Irrevocable trusts can help you lower your tax liability, protect you from lawsuits and keep beneficiaries from mishandling assets. But you also have to accept the downsides of loss of control and an inflexible structure too.

The only three times you might want to consider creating an irrevocable trust is when you want to (1) minimize estate taxes, (2) become eligible for government programs, or (3) protect your assets from your creditors.

Irrevocable trusts are an important tool in many people's estate plan. They can be used to lock-in your estate tax exemption before it drops, keep appreciation on assets from inflating your taxable estate, protect assets from creditors, and even make you eligible for benefit programs like Medicaid.

While a grantor may technically be allowed to serve as the trustee of an irrevocable trust he creates, this can cause some problems.

With an Irrevocable Trust, once you have transferred the ownership of the house to the trust, it's irrevocable, meaning you are never supposed to be able to take it back. The trust will own that house for the rest of your life.

First, an irrevocable trust involves three individuals: the grantor, a trustee and a beneficiary. The grantor creates the trust and places assets into it. Upon the grantor's death, the trustee is in charge of administering the trust.