Alaska Receipt for Payment of Loss for Subrogation

Description

How to fill out Receipt For Payment Of Loss For Subrogation?

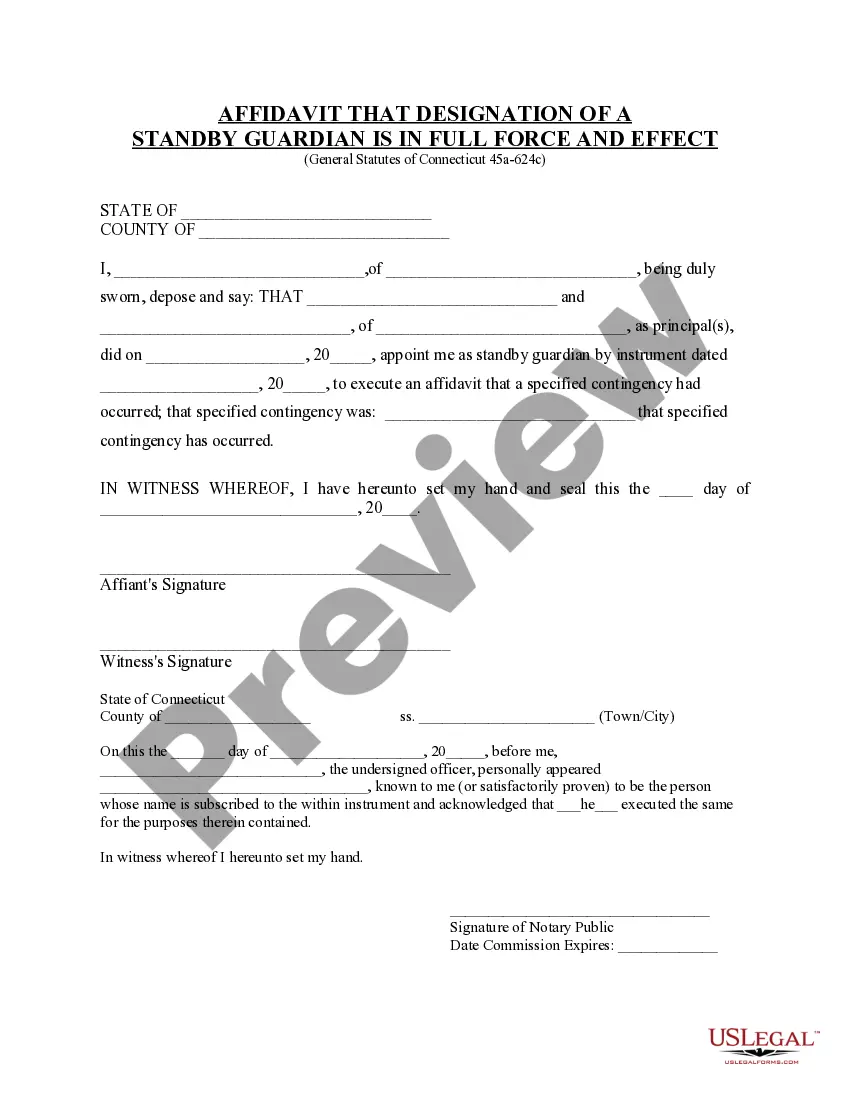

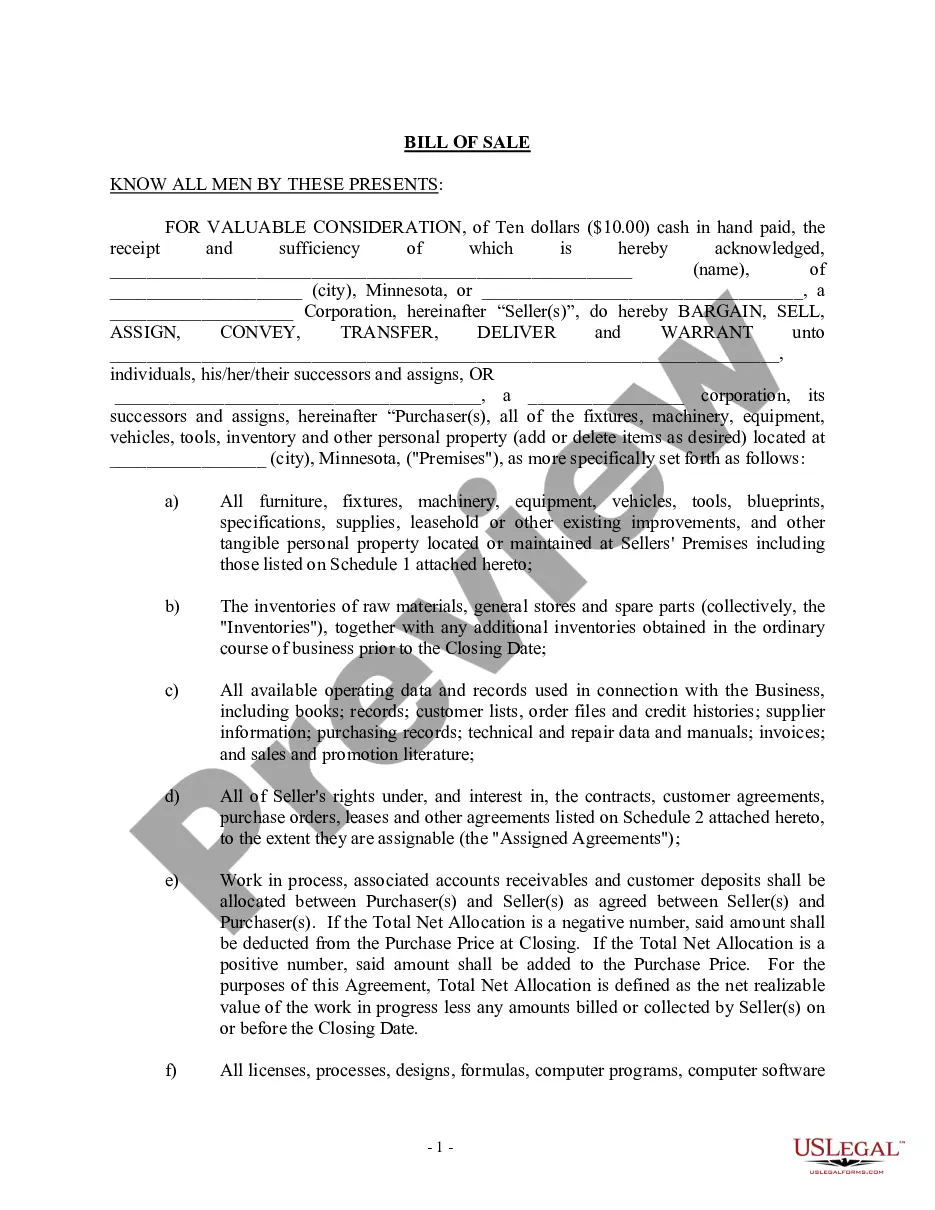

Are you currently within a situation where you need to have files for sometimes enterprise or individual functions just about every day time? There are a lot of legal record web templates available on the net, but finding types you can rely isn`t easy. US Legal Forms gives 1000s of develop web templates, just like the Alaska Receipt for Payment of Loss for Subrogation, which are composed to fulfill federal and state requirements.

If you are previously knowledgeable about US Legal Forms web site and have your account, just log in. Afterward, it is possible to obtain the Alaska Receipt for Payment of Loss for Subrogation format.

Should you not come with an accounts and need to begin to use US Legal Forms, follow these steps:

- Obtain the develop you want and make sure it is for your right town/state.

- Use the Review option to check the shape.

- Look at the information to actually have selected the proper develop.

- If the develop isn`t what you are trying to find, use the Search discipline to find the develop that meets your needs and requirements.

- Once you obtain the right develop, click on Buy now.

- Opt for the rates strategy you need, fill in the desired details to generate your money, and pay for the order with your PayPal or Visa or Mastercard.

- Decide on a handy file format and obtain your duplicate.

Find every one of the record web templates you have purchased in the My Forms food selection. You can obtain a additional duplicate of Alaska Receipt for Payment of Loss for Subrogation whenever, if necessary. Just click on the required develop to obtain or print the record format.

Use US Legal Forms, by far the most comprehensive variety of legal forms, to save time as well as prevent errors. The service gives expertly produced legal record web templates that can be used for a range of functions. Produce your account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

Negotiate the claim. If you and your lawyer are unable to stop the subrogation claim altogether, it is possible to negotiate. Most insurance companies are willing to negotiate because they want to settle claims quickly and get their money.

At the minimum, your subrogation file should contain all elements corresponding to liability determination and proof of damages. Being able to prove who is at fault is essential. You'll want to include documentation and any information you've gathered, such as witness statements or police reports.

And we hereby subrogate to you the rights and remedies that we have in consequence of or arising from loss/damage to our insured goods and we further hereby grant to you all power to take and use all lawful ways and means to demand, recover and to receive the said loss/damage and all and every debt from whom it may ...

What is Subrogation? Subrogation refers to the practice of substituting one party for another in a legal setting. Essentially, subrogation provides a legal right to a third party to collect a debt or damages on behalf of another party.

"Subrogation," or "subro" for short, refers to the right your insurance company holds under your policy ? after they've paid a covered claim ? to request reimbursement from the at-fault party. This reimbursement often comes from the at-fault party's insurance company.

Subrogation has been described as: the right of an insurance company to recover money from the person that caused the accident for the damages it paid to you as the insured party. the insurance company's right to be put in the position of you to pursue recovery from the person responsible for the accident.

"Subrogation," or "subro" for short, refers to the right your insurance company holds under your policy ? after they've paid a covered claim ? to request reimbursement from the at-fault party. This reimbursement often comes from the at-fault party's insurance company.

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.