Alaska Sample Letter for Payroll Dispute

Description

How to fill out Sample Letter For Payroll Dispute?

Choosing the best legitimate file template can be quite a battle. Needless to say, there are tons of templates accessible on the Internet, but how can you obtain the legitimate form you need? Take advantage of the US Legal Forms internet site. The service offers a huge number of templates, including the Alaska Sample Letter for Payroll Dispute, that can be used for enterprise and private requires. Every one of the types are checked by professionals and satisfy federal and state needs.

When you are already registered, log in to your bank account and click the Obtain switch to get the Alaska Sample Letter for Payroll Dispute. Make use of bank account to check throughout the legitimate types you might have bought in the past. Check out the My Forms tab of your own bank account and have one more copy of your file you need.

When you are a whole new customer of US Legal Forms, listed here are basic directions for you to stick to:

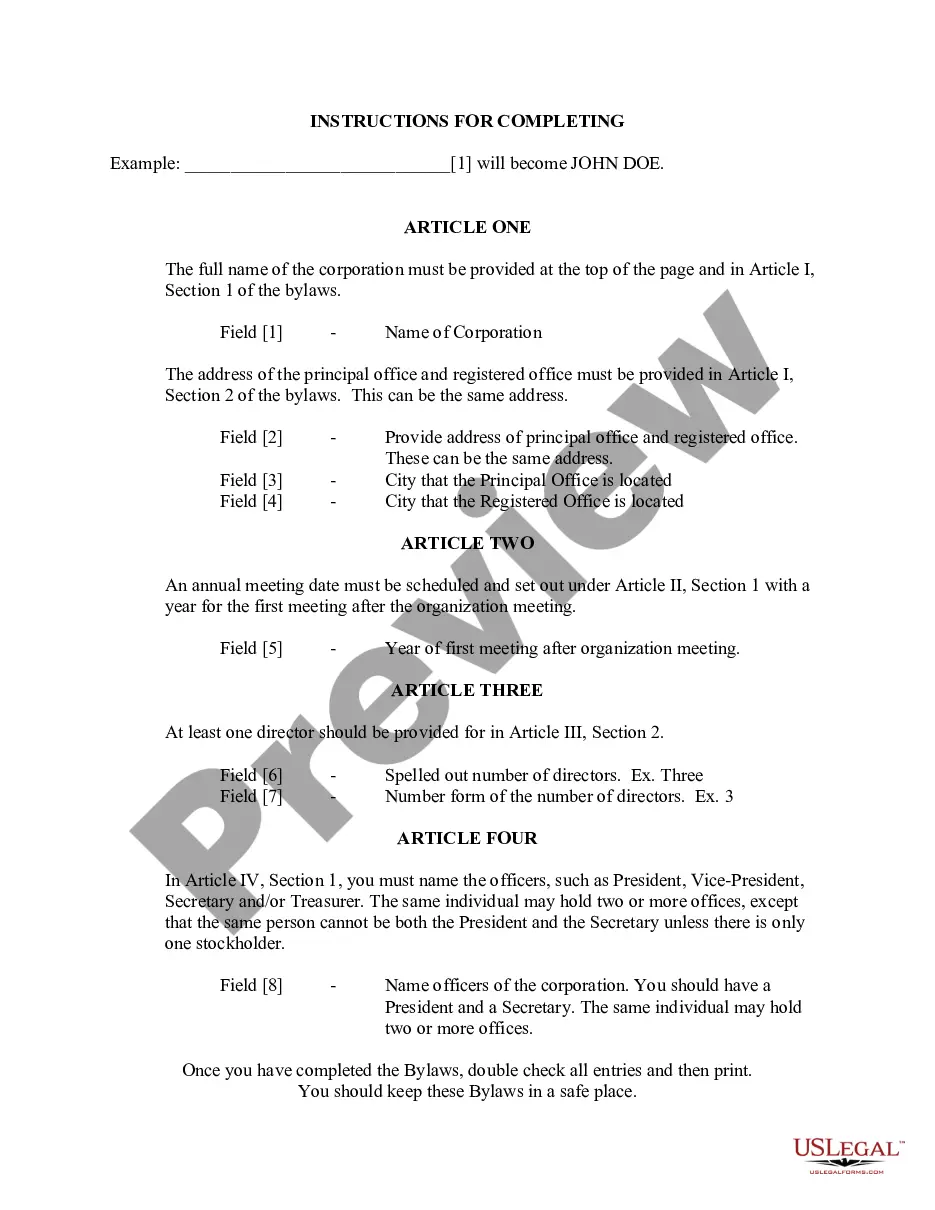

- Initially, ensure you have selected the appropriate form for your city/county. You can examine the form using the Review switch and study the form explanation to ensure this is the best for you.

- If the form fails to satisfy your requirements, utilize the Seach field to discover the proper form.

- When you are certain the form would work, go through the Get now switch to get the form.

- Opt for the pricing prepare you need and enter in the essential info. Build your bank account and buy an order utilizing your PayPal bank account or Visa or Mastercard.

- Pick the document structure and acquire the legitimate file template to your system.

- Comprehensive, revise and print out and indicator the attained Alaska Sample Letter for Payroll Dispute.

US Legal Forms is the largest library of legitimate types that you can see a variety of file templates. Take advantage of the company to acquire professionally-manufactured papers that stick to status needs.

Form popularity

FAQ

Sample wage claim letter (terminated) Dear [employer name]: This is a demand for my final wages. My last day of work was [last day of work]. I have worked and not been paid for [number of hours] hours and I am owed [dollar-amount owed] at this time.

Labor Code Section 224 clearly prohibits any deduction from an employee's wages which is not either authorized by the employee in writing or permitted by law, and any employer who resorts to self-help does so at its own risk as an objective test is applied to determine whether the loss was due to dishonesty, ...

Under California law, an employer can legally deduct from your wages if certain conditions are met. Only under the following circumstances are employers allowed to deduct from your wages: Deductions required by federal or state law including deductions for tax payments, and wage garnishment as ordered by a court.

No. Any deductions other than income taxes and court-ordered payments require your written authorization. If you agreed in writing about the payment amount, that agreement is binding on both you and your employer, ing to the state laws which govern written contracts.

If your employer is withholding your paycheck, you can file a complaint with the Alaska Division of Labor Standards and Safety. The department will then notify your employer about your complaint, and they have 20 days to respond to the complaint or resolve it.

Report it right away to your boss or human resources: Assume it's an honest mistake and ask for an immediate correction. You should get your unpaid wages in your next check, if not sooner. Otherwise, you're lending your boss money at no interest.

If you are at the receiving end of payroll errors, you should inform your employer immediately. Let them know the exact problem you experienced. Provide your proof of payment (paystub) to show evidence of the error. Your HR team should rectify the problem immediately.

Paycheck deductions permitted by law ? and without the expressed consent of the employee ? are limited to taxes, wage garnishments, and meals and lodging. Wage deductions for taxes are more commonly referred to as tax withholdings, and nearly everyone earning a paycheck is subject to them.