Alaska Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legitimate document templates available online, but finding ones you can trust isn't easy.

US Legal Forms provides thousands of template designs, such as the Alaska Reorganization of Partnership by Modification of Partnership Agreement, which are tailored to meet federal and state regulations.

Choose the pricing plan you prefer, fill out the required information to create your account, and pay for the order via PayPal or credit card.

Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Alaska Reorganization of Partnership by Modification of Partnership Agreement at any time if needed. Click the required template to download or print the format. Use US Legal Forms, the largest collection of legal documents, to save time and avoid errors. The service offers professionally created legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Alaska Reorganization of Partnership by Modification of Partnership Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the template you need and ensure it is for your specific city or region.

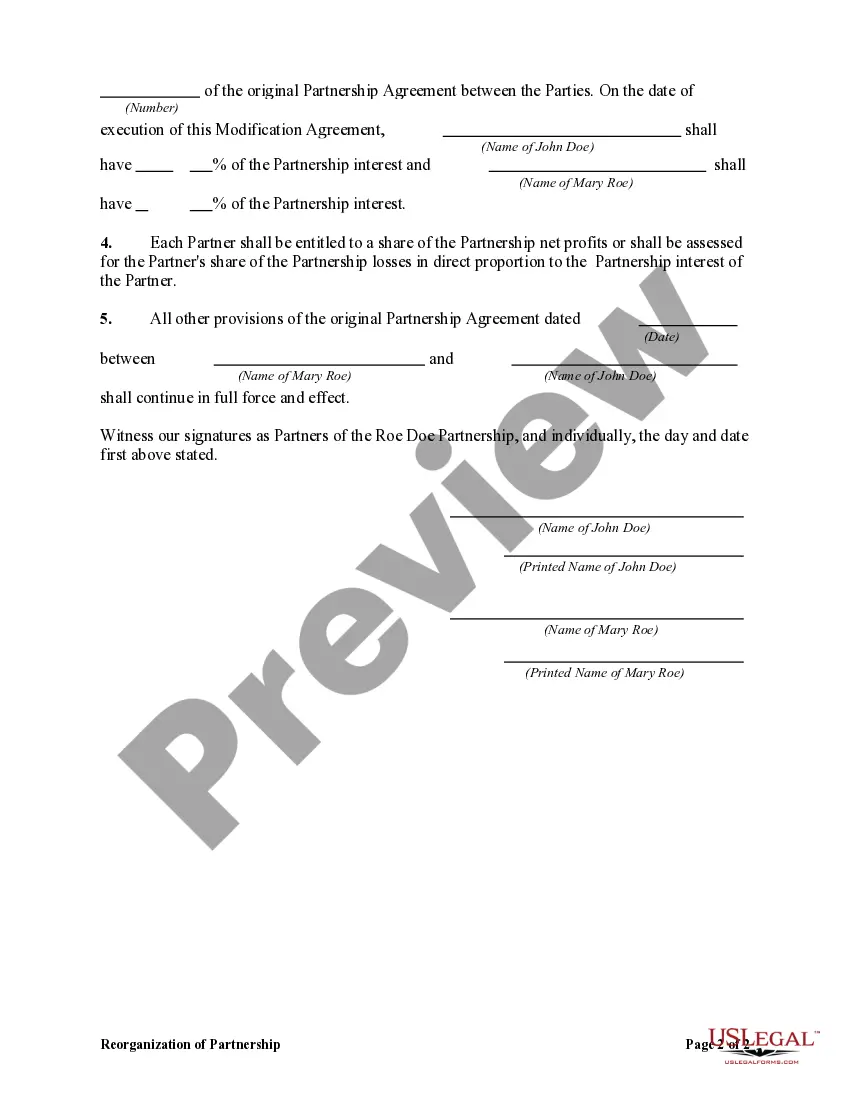

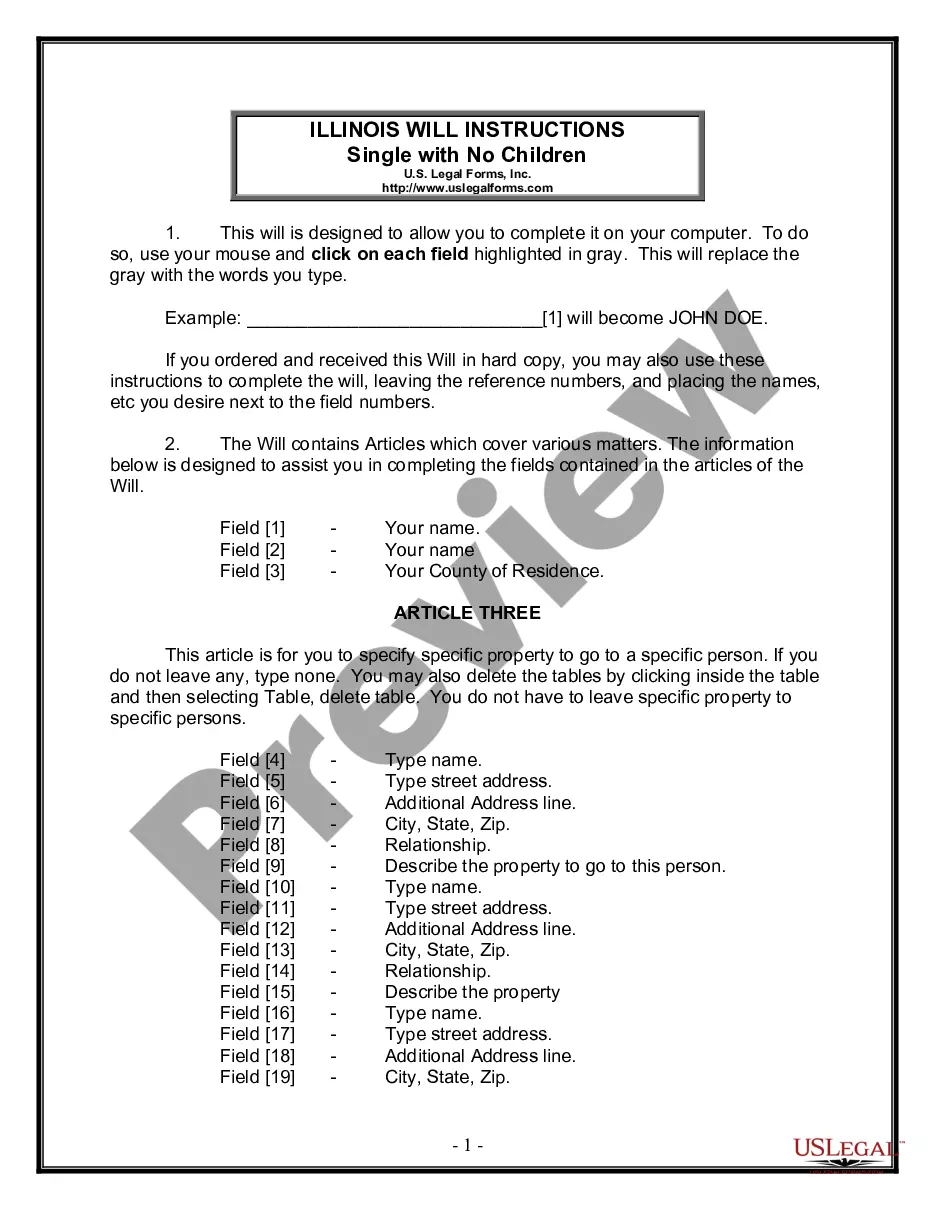

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the correct template.

- If the template isn’t what you are looking for, use the Search box to find the template that suits your needs and specifications.

- Once you find the right template, click Acquire now.

Form popularity

FAQ

A partner's fiduciary duties can be waived or eliminated in the partnership agreement, provided this is clearly articulated within the document. This option is particularly pertinent during an Alaska reorganization of partnership by modification of partnership agreement. Nevertheless, partners should carefully consider the implications of such waivers to maintain trust and operational integrity. UsLegalForms can help you navigate these complexities and ensure your partnership agreement reflects your intentions clearly.

Yes, a partnership agreement can eliminate the duty of loyalty if it explicitly states such provisions. During an Alaska reorganization of partnership by modification of partnership agreement, partners may agree to limit certain duties to allow for greater flexibility in operations. However, it is crucial that these provisions comply with Alaska's partnership laws. For assistance in drafting or modifying your agreement, UsLegalForms offers reliable resources.

To change your registered agent in Alaska, you need to file a form with the Division of Corporations, Business, and Professional Licensing. This change is particularly relevant during an Alaska reorganization of partnership by modification of partnership agreement. You must ensure that you select a registered agent who meets the state's requirements. The UsLegalForms platform can simplify this process by providing the necessary forms and guidance.

In Alaska, fiduciary duties can indeed be waived under certain conditions. When a partnership undergoes reorganization, such as through the modification of a partnership agreement, partners may choose to limit these duties. However, it's essential to ensure that any waivers are clearly stated in the partnership agreement to avoid confusion. For detailed guidance, consider utilizing the UsLegalForms platform to help structure your agreement properly.

Renewing an Alaska business license involves submitting the renewal application and any applicable fees to the appropriate state agency. You should complete this process before your current license expires to avoid any interruptions in your business operations. If your business is undergoing the Alaska Reorganization of Partnership by Modification of Partnership Agreement, make sure to update your license to reflect any new operational changes or ownership shifts.

To change your NAICS code in Alaska, you typically need to update your business registration information with the state. This change may be necessary if your business activities have shifted, reflecting your current operations. When conducting an Alaska Reorganization of Partnership by Modification of Partnership Agreement, be sure to adjust your NAICS code accordingly, as it affects your industry classification and compliance.

Corporations in Alaska must comply with various reporting requirements, including annual reports and financial statements. These documents help maintain transparency and accountability in business operations. If you're undergoing the Alaska Reorganization of Partnership by Modification of Partnership Agreement, ensure that you align your reporting to reflect any changes in partnership structure and responsibilities.

Alaska does impose a corporate income tax on businesses operating within the state. However, the tax rates differ depending on the amount of taxable income. Understanding the corporate tax landscape is crucial, especially if you're looking into the Alaska Reorganization of Partnership by Modification of Partnership Agreement, as it may influence your tax obligations and financial planning.

To set up an S Corp in Alaska, you must first register your corporation with the state and file Form 2553 with the IRS to elect S corporation status. This process allows you to enjoy pass-through taxation benefits, which can be advantageous. If you're also considering the Alaska Reorganization of Partnership by Modification of Partnership Agreement, be aware of how this status could impact your partnership agreements and ownership structure.

The Alaska corporation income tax return form is a document that corporations must file with the state to report their income, deductions, and tax liability. This form is essential for compliance with state tax laws. When considering the Alaska Reorganization of Partnership by Modification of Partnership Agreement, it’s important to understand the tax implications and ensure that all forms are completed accurately to avoid penalties.