Alaska Consultant Agreement with Sharing of Software Revenues

Description

In this agreement, the consultant is not only paid an hourly rate, but is also paid a percentage of the net profits (as defined in the agreement) resulting from the software the consultant develops.

How to fill out Consultant Agreement With Sharing Of Software Revenues?

Are you presently inside a position that requires documents for either business or particular uses almost every day.

There are many legal document templates available on the web, but locating ones you can trust is not easy.

US Legal Forms offers thousands of template forms, such as the Alaska Consultant Agreement with Sharing of Software Revenues, which can be tailored to meet federal and state regulations.

Once you find the suitable form, click on Get now.

Select the pricing plan you wish, provide the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents list. You can obtain another copy of the Alaska Consultant Agreement with Sharing of Software Revenues anytime, if required. Click the desired form to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides professionally designed legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Alaska Consultant Agreement with Sharing of Software Revenues template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct city/region.

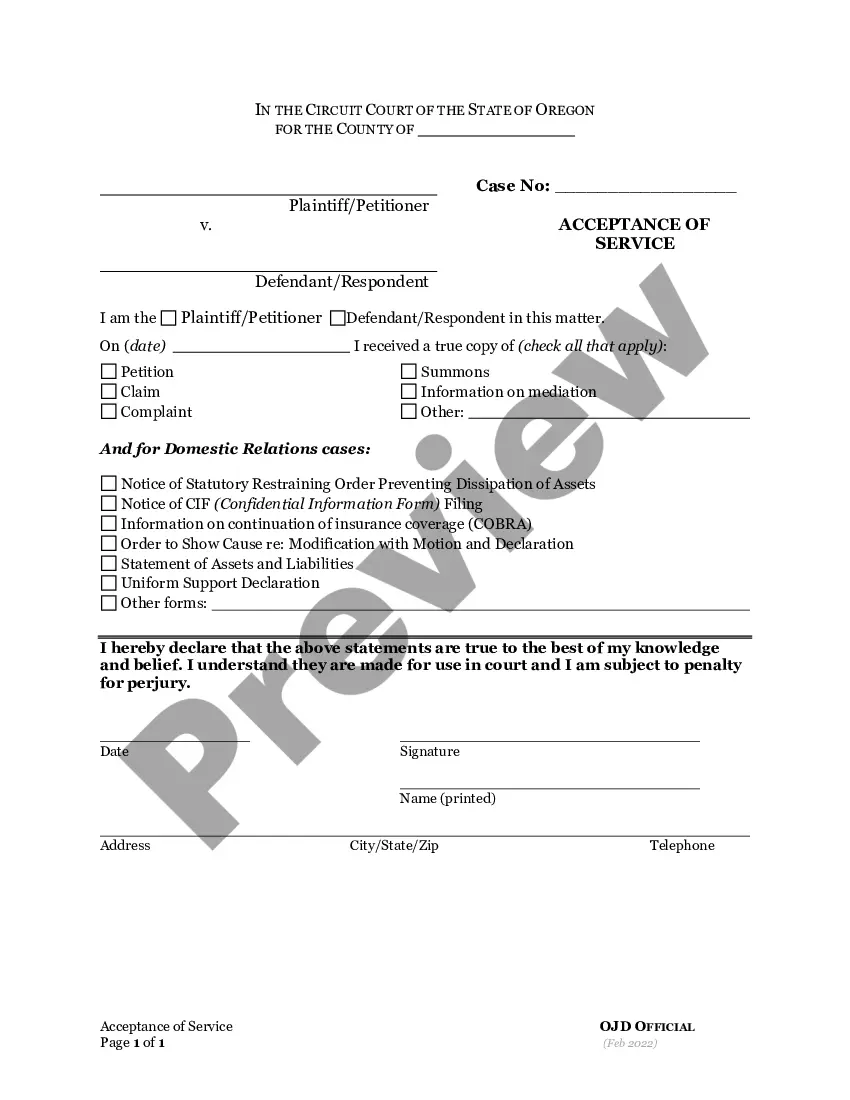

- Utilize the Preview button to examine the form.

- Check the description to ensure you have chosen the right document.

- If the form does not meet your expectation, use the Search field to find the form that suits your needs.

Form popularity

FAQ

A revenue share structure outlines how profits will be distributed between parties based on their agreements. In an Alaska Consultant Agreement with Sharing of Software Revenues, this structure should specify the proportion of revenue each party receives, along with any conditions that may affect these calculations. Such clarity enhances trust between partners and ensures everyone is on the same page.

A typical revenue-sharing percentage often falls between 10% to 50%, depending on the industry and the nature of the partnership. With an Alaska Consultant Agreement with Sharing of Software Revenues, ensure that both parties agree on a fair percentage that reflects the value each brings to the project. Clear documentation protects everyone’s interests and fosters transparency.

Determining revenue-sharing requires evaluating the contributions of each party involved. Consider factors such as investment, resources, and time committed by each consultant and business. An Alaska Consultant Agreement with Sharing of Software Revenues should iterate on these points to arrive at a mutually beneficial revenue-sharing formula.

An example of a revenue-sharing agreement can involve a software consultant who helps a company develop a new application. In this case, the Alaska Consultant Agreement with Sharing of Software Revenues would specify that the consultant receives a percentage of the profits generated from the app. This provides a clear incentive for both parties to work toward increased revenue.

To structure a revenue-sharing agreement, start by defining the scope of the partnership. Identify how revenues will be generated and the specific contributions of each party. An Alaska Consultant Agreement with Sharing of Software Revenues should clearly outline payment terms, timelines, and any conditions for measuring success together.

To structure a profit share agreement, start by defining the profit-sharing model and specifying the calculation method for revenues. It could also be beneficial to use an Alaska Consultant Agreement with Sharing of Software Revenues to outline roles, responsibilities, and expectations clearly. This approach not only helps in maintaining transparency but also fosters a collaborative working environment.

Typical profit-sharing percentages can vary widely depending on the industry and specific arrangements between parties. For an Alaska Consultant Agreement with Sharing of Software Revenues, it is common to see percentages ranging from 10% to 50%, depending on the level of involvement and investment from each consultant. Always review your unique situation to ensure a fair agreement that aligns with everyone's contributions.

A consulting agreement focuses on the services provided by a consultant and the compensation for those services, while a contract can encompass various types of business agreements, including sales and partnerships. In the case of an Alaska Consultant Agreement with Sharing of Software Revenues, it emphasizes the specific terms related to both consulting services and revenue sharing. Understanding this distinction helps you choose the right document for your business needs.

To structure a profit-sharing agreement effectively, first outline the contributions of each party and clearly define the revenue-sharing model. An Alaska Consultant Agreement with Sharing of Software Revenues can specify how profits will be calculated and distributed among the consultants and the software developers. By clarifying roles and expectations, you can minimize misunderstandings and create a solid foundation for a successful partnership.

A consulting agreement is a legally binding document that outlines the terms of engagement between a consultant and a client. It encompasses details such as services provided, payment terms, confidentiality, and project timelines. In the case of an Alaska Consultant Agreement with Sharing of Software Revenues, it also includes specific clauses related to revenue sharing, ensuring clarity and mutual understanding.