Alaska Consulting Agreement - with Former Shareholder

Description

How to fill out Consulting Agreement - With Former Shareholder?

Finding the correct valid document template can be a challenge. Clearly, there are numerous templates accessible online, but how do you locate the appropriate one that you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Alaska Consulting Agreement - with Former Shareholder, which can be used for both business and personal purposes.

All the documents are reviewed by experts and comply with state and federal regulations.

Once you are confident the form is suitable, click on the Acquire now button to obtain the document. Choose the pricing plan you prefer and enter the required information. Create your account and complete your transaction using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the downloaded Alaska Consulting Agreement - with Former Shareholder. US Legal Forms is the largest repository of legal templates where you can find a variety of document formats. Use the service to download professionally crafted documents that adhere to state requirements.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Alaska Consulting Agreement - with Former Shareholder.

- Use your account to browse the legal documents that you have purchased previously.

- Proceed to the My documents tab of your account to access another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

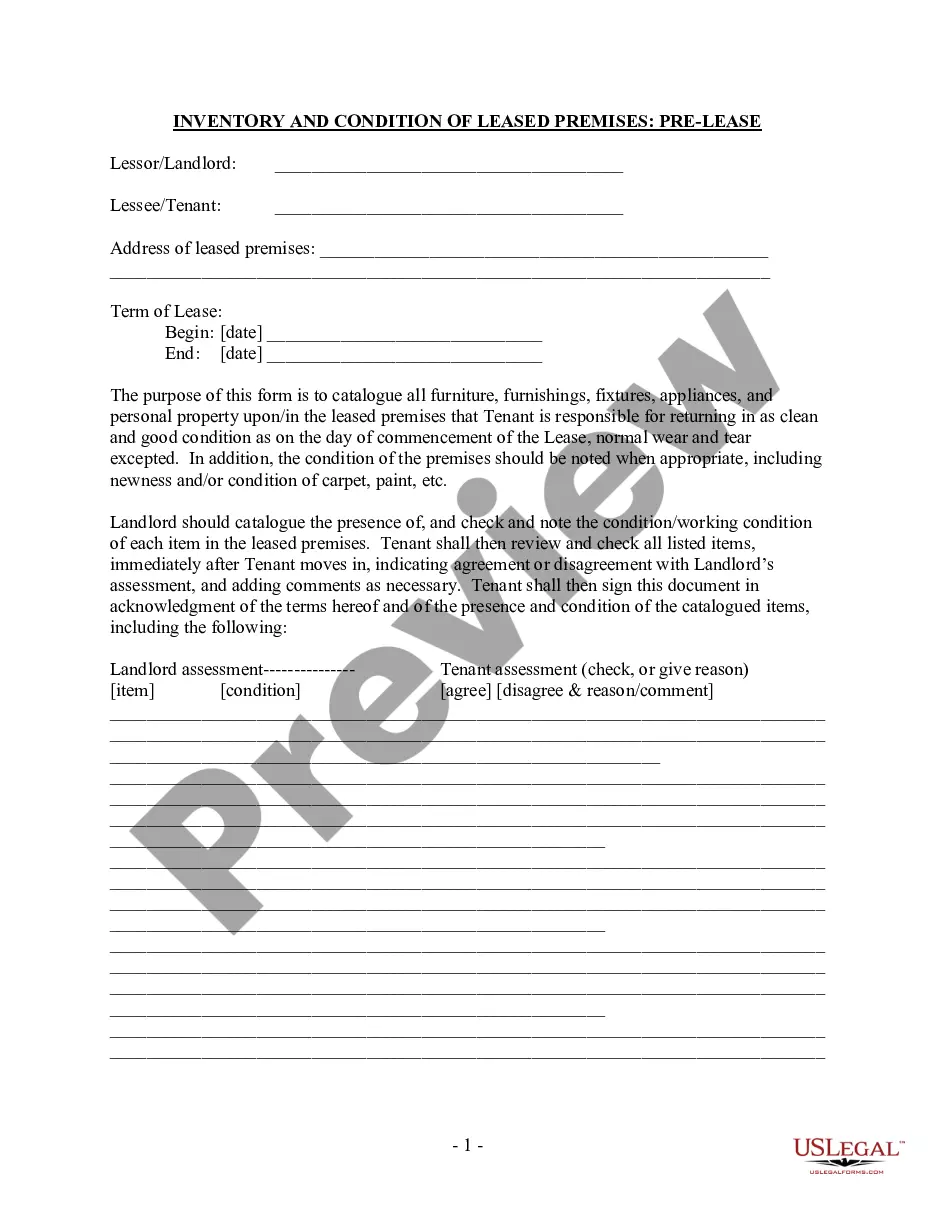

- First, ensure you have selected the correct template for your region/county. You can preview the form using the Preview button and review the form outline to confirm it meets your requirements.

- If the form does not meet your needs, utilize the Search field to find the appropriate template.

Form popularity

FAQ

To register a foreign LLC in Alaska, first apply for a Certificate of Good Standing from your original state. After that, complete the Foreign Registration application and send it to the Alaska Division of Corporations, along with applicable fees. This registration process is key if you're planning an Alaska Consulting Agreement - with Former Shareholder, as it secures your rights to operate legally within the state.

Registering a foreign company in the USA involves choosing a state to register in, then filing necessary documents such as Articles of Incorporation or a Certificate of Authority. Additionally, you may need to appoint a registered agent in that state. This foundational step is significant, especially for agreements like an Alaska Consulting Agreement - with Former Shareholder, as it ensures legal compliance across jurisdictions.

To dissolve a corporation in Alaska, you must file Articles of Dissolution with the Alaska Division of Corporations. Ensure all outstanding debts and obligations are settled before filing. This process is important if you're transitioning to an Alaska Consulting Agreement - with Former Shareholder, as it allows for the proper closure of legal entities and the reallocation of resources.

To register a foreign LLC in Alaska, you must first obtain a Certificate of Good Standing from your home state. Next, submit a Foreign Registration application to the Alaska Department of Commerce, along with the required fees. This process is crucial when creating an Alaska Consulting Agreement - with Former Shareholder, as it establishes your legal standing to operate in the state.

While Alaska does not mandate an operating agreement for LLCs, having one is highly recommended. An operating agreement outlines the management structure and operational procedures, helping prevent disputes among members. It plays a critical role, particularly when forming an Alaska Consulting Agreement - with Former Shareholder, ensuring all parties understand their rights and responsibilities.

In Alaska, an LLC provides limited liability protection while being more flexible in management and taxation. On the other hand, an S Corporation offers similar protection but has specific eligibility requirements and tax benefits, including potential pass-through taxation. Understanding these differences is essential when drafting an Alaska Consulting Agreement - with Former Shareholder, as the structure of your business can impact operations and liability.

Yes, an LLC in Alaska must obtain a business license to operate legally. This applies whether your LLC is newly formed or an existing entity. Obtaining a business license not only legitimizes your services but also helps you avoid fines. To simplify this process, refer to an Alaska Consulting Agreement - with Former Shareholder that can align with your legal obligations.

A consulting agreement after the sale of a business outlines the terms under which the former owner will provide expertise to the new owner. This document ensures that critical knowledge transfers smoothly, fostering business continuity. It typically defines scope, duration, and compensation for the services rendered. If you’re considering this route, exploring an Alaska Consulting Agreement - with Former Shareholder can provide structured support during the transition.

In Alaska, any business that operates or sells goods and services requires a business license. This includes sole proprietors, partnerships, and corporations. Not only does it foster credibility, but it also helps in complying with local regulations. Using an Alaska Consulting Agreement - with Former Shareholder can clarify the expectations and responsibilities involved in your business venture.

To establish an LLC in Alaska, you need to file Articles of Organization with the Division of Corporations. This is typically a straightforward process that also requires a registered agent. Additionally, consider drafting an operating agreement, especially if you are exiting from a previous business relationship. The Alaska Consulting Agreement - with Former Shareholder can help you navigate through the transitional aspects of forming an LLC.