Alaska Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money

Description

How to fill out Escrow Agreement For Sale Of Real Property With Regard To Deposit Of Earnest Money?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal form templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Alaska Escrow Agreement for Sale of Real Property concerning Deposit of Earnest Money within moments.

Review the form overview to ensure you have chosen the right one.

If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you possess a membership, Log In and retrieve the Alaska Escrow Agreement for Sale of Real Property regarding Deposit of Earnest Money from the US Legal Forms repository.

- The Download option will be visible on every form you view.

- You can access all previously saved forms within the My documents section of your account.

- If you want to utilize US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct form for your town/state.

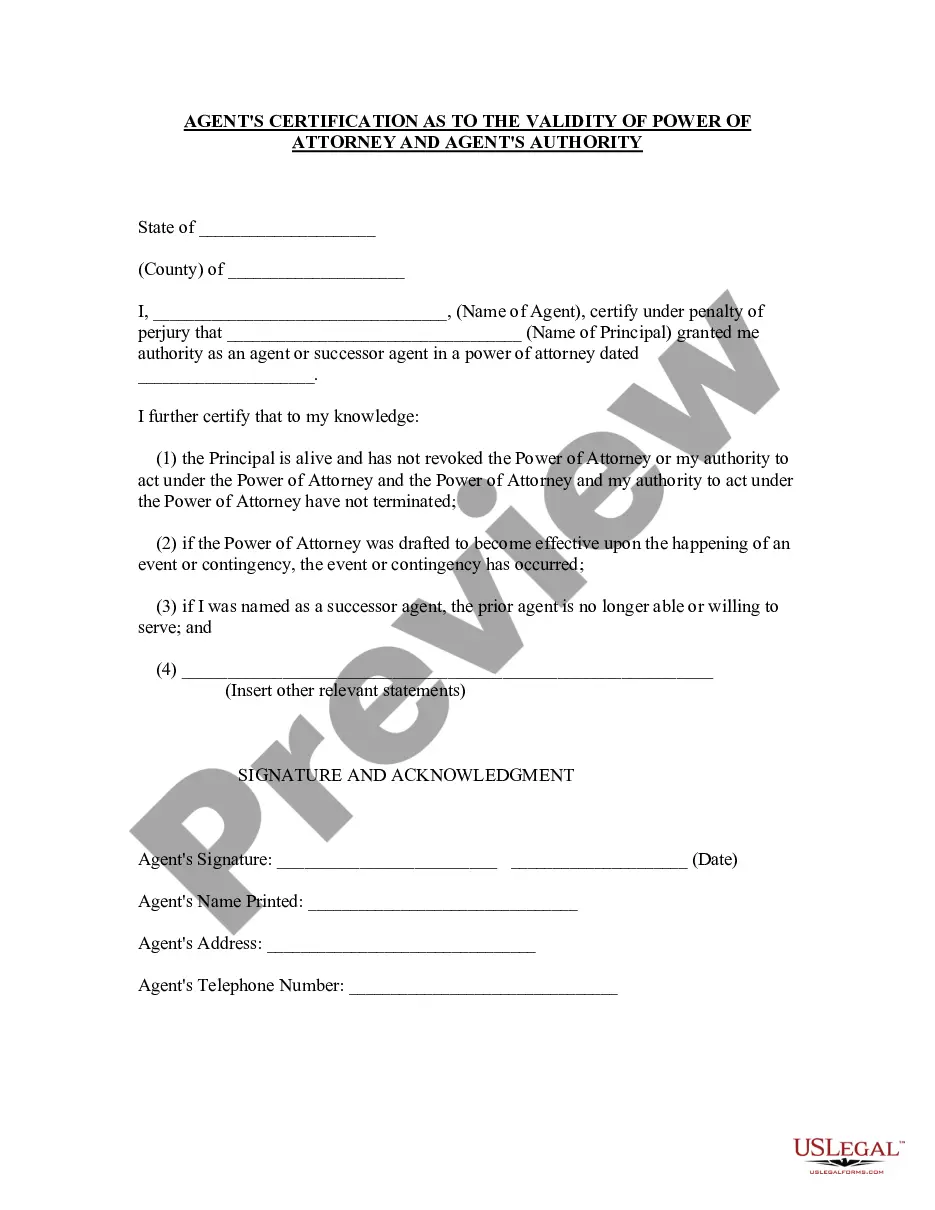

- Click the Preview button to examine the content of the form.

Form popularity

FAQ

The contract must include consideration. Common forms of consideration include money, property in exchange, or a promise to perform. Without consideration, a contract is not legally enforceable.

A legal nonconforming use. The following statement regarding earnest money is FALSE: Earnest money is not required for a contract to be valid. Earnest money must be at least 10% of the contract price.

In an escrow agreement, one partyusually a depositordeposits funds or an asset with the escrow agent until the time that the contract is fulfilled. Once the contractual conditions are met, the escrow agent will deliver the funds or other assets to the beneficiary.

For a contract to be enforceable, both parties must have the capacity to understand the terms of the contract. What makes a contract unenforceable is when one party doesn't understand the terms or how they will be bound by it.

Earnest money protects the seller if the buyer backs out. It's typically around 1 3% of the sale price and is held in an escrow account until the deal is complete.

Contracts need to involve an exchange of something valuable, referred to in legal terms as consideration. In the case of a real estate contract, that consideration would be the title (from the seller) and an earnest money deposit (from the buyer). Without that consideration, the contract is unenforceable.

Settlement Sheet The earnest money deposit will be listed as a credit to the buyer, while any other funds owed will be listed as debits. The closing agent will add up all of the debits and credits for the buyer to get a final amount of funds required at closing.

Earnest money is always returned to the buyer if the seller terminates the deal. While the buyer and seller can negotiate the earnest money deposit, it often ranges between 1% and 2% of the home's purchase price, depending on the market.

Typically, you pay earnest money to an escrow account or trust under a third-party like a legal firm, real estate broker or title company. Acceptable payment methods include personal check, certified check and wire transfer.

A situation beyond the parties' control that makes the transaction impossible or exceedingly difficult or expensive to close may be unenforceable. An example of impossibility is the sale of a home that was destroyed by a tornado while the buyer and seller were under contract.