Alaska Sample Letter to Include Article Relating to Tax Sales

Description

How to fill out Sample Letter To Include Article Relating To Tax Sales?

You are able to commit hours online searching for the legitimate document web template which fits the federal and state requirements you want. US Legal Forms supplies a large number of legitimate forms that happen to be evaluated by specialists. You can easily download or print the Alaska Sample Letter to Include Article Relating to Tax Sales from your support.

If you already have a US Legal Forms account, you can log in and then click the Download key. Afterward, you can comprehensive, revise, print, or sign the Alaska Sample Letter to Include Article Relating to Tax Sales. Each and every legitimate document web template you buy is yours for a long time. To acquire yet another backup associated with a acquired develop, go to the My Forms tab and then click the corresponding key.

Should you use the US Legal Forms website initially, follow the basic recommendations listed below:

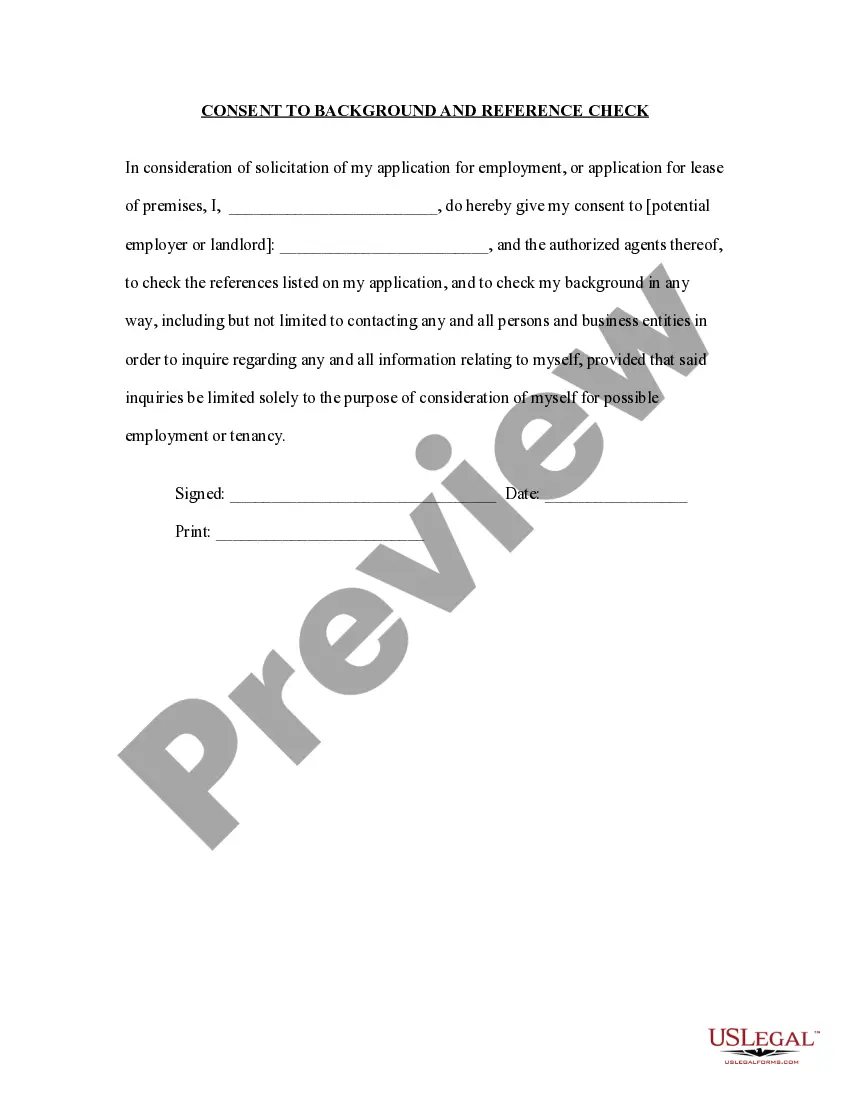

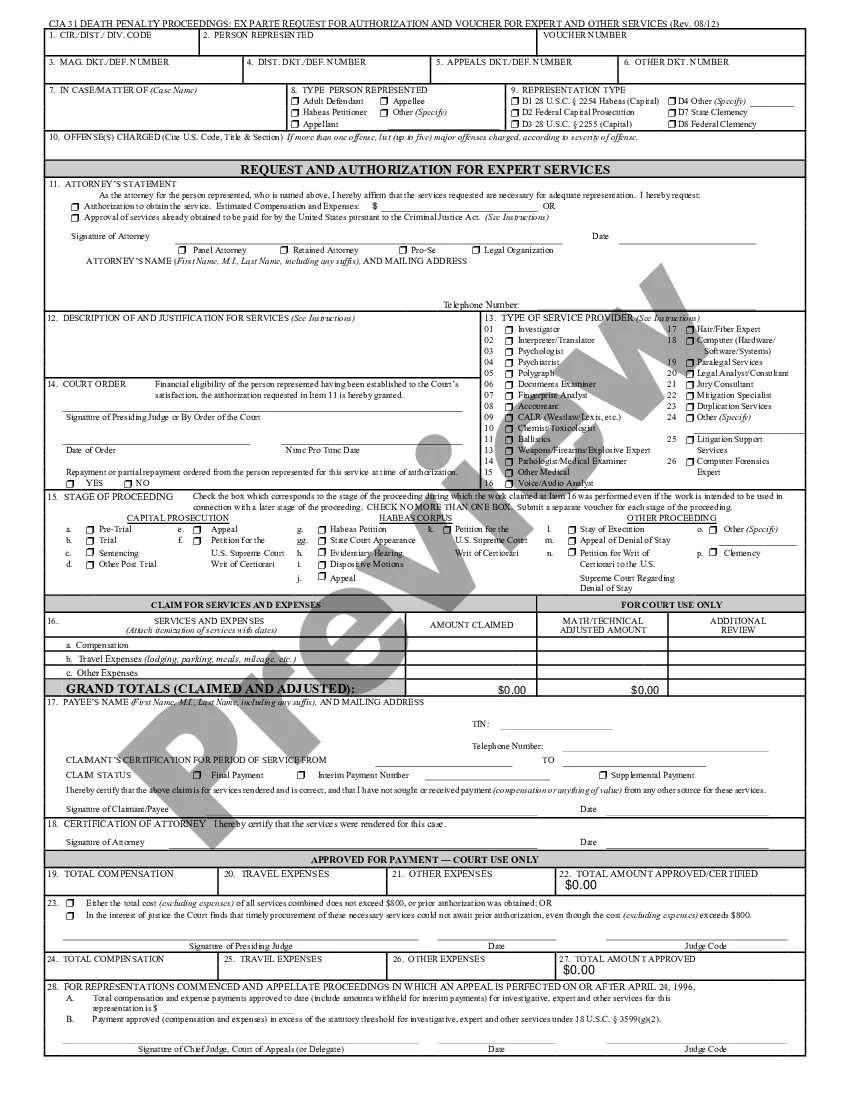

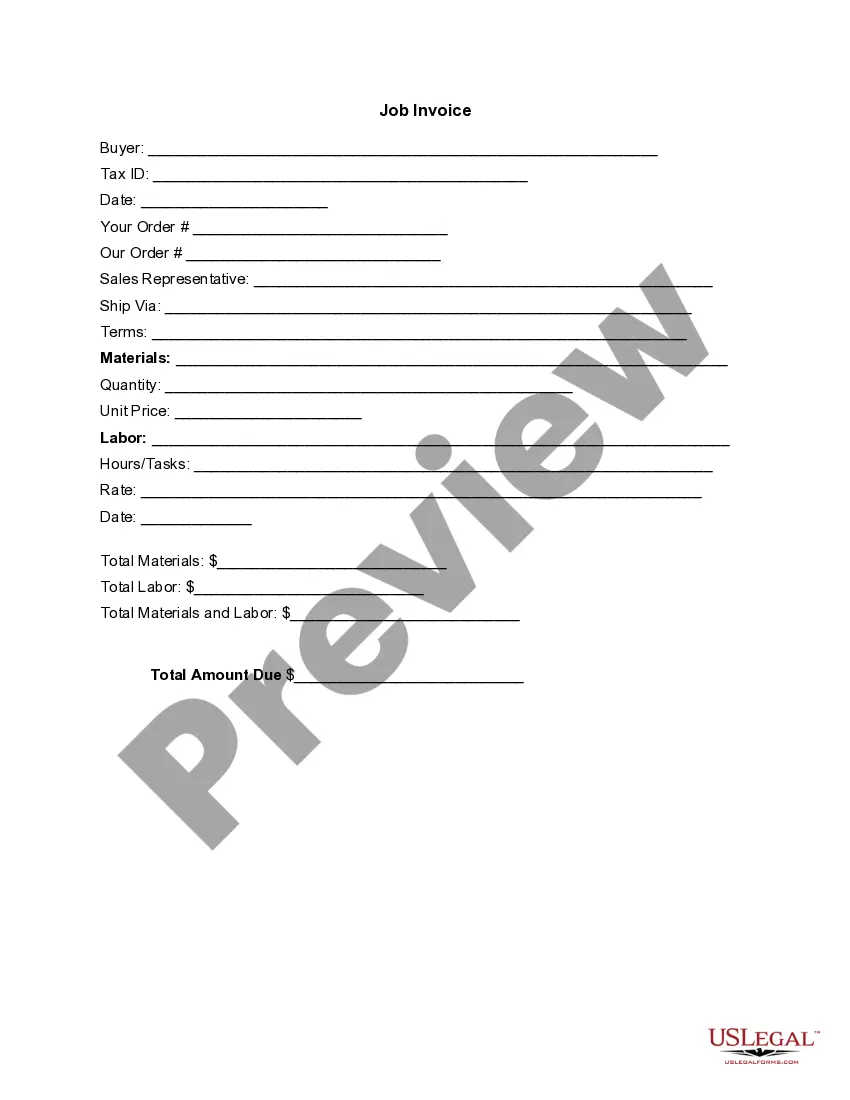

- Initial, ensure that you have selected the best document web template to the region/city of your choice. Look at the develop outline to ensure you have chosen the appropriate develop. If available, make use of the Preview key to appear throughout the document web template at the same time.

- If you wish to find yet another variation of the develop, make use of the Research industry to discover the web template that suits you and requirements.

- After you have located the web template you desire, click on Acquire now to continue.

- Select the rates strategy you desire, enter your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the deal. You can utilize your charge card or PayPal account to fund the legitimate develop.

- Select the file format of the document and download it to the system.

- Make adjustments to the document if necessary. You are able to comprehensive, revise and sign and print Alaska Sample Letter to Include Article Relating to Tax Sales.

Download and print a large number of document web templates using the US Legal Forms site, which provides the most important variety of legitimate forms. Use specialist and state-certain web templates to deal with your business or personal requirements.

Form popularity

FAQ

Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount. The threshold in Alaska is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first.

Alaska Personal Income Tax History ? Established in 1949, 10% of taxpayer's federal income tax liability. from this change was not dramatic. Personal income tax repealed in 1980 after the oil boom.

Which Are the Tax-Free States? As of 2023, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.

Alaska has had an income tax before. In fact, to date it is the only state to have repealed an individual income tax, doing so when the state's oil fields started generating enough tax revenue to obviate the need for one.

Property taxes per person are much higher too. It's got to be taxes on oil. Alaska and Wyoming raise big money from severance taxes. Draw your state's boundaries around the oil fields, tax it as it comes out of the ground, and you won't need income taxes.

The State of Alaska does not have a tax exemption certificate, as it is not necessary to have one. The Alaska Constitution provides that the State of Alaska is exempt from all taxes emanating from within Alaska.

Alaska's tax system underwent major changes in the 1970s when oil was found at Prudhoe Bay. Lawmakers repealed the state's personal income tax (making Alaska the only state ever to do so) and began balancing the state's budget primarily with oil tax and royalty revenue instead.

The two largest cities, Anchorage and Fairbanks, do not charge a local sales tax. The state capital, Juneau, has a 5 percent sales tax rate.