Alaska Sample Letter for Tax Deeds

Description

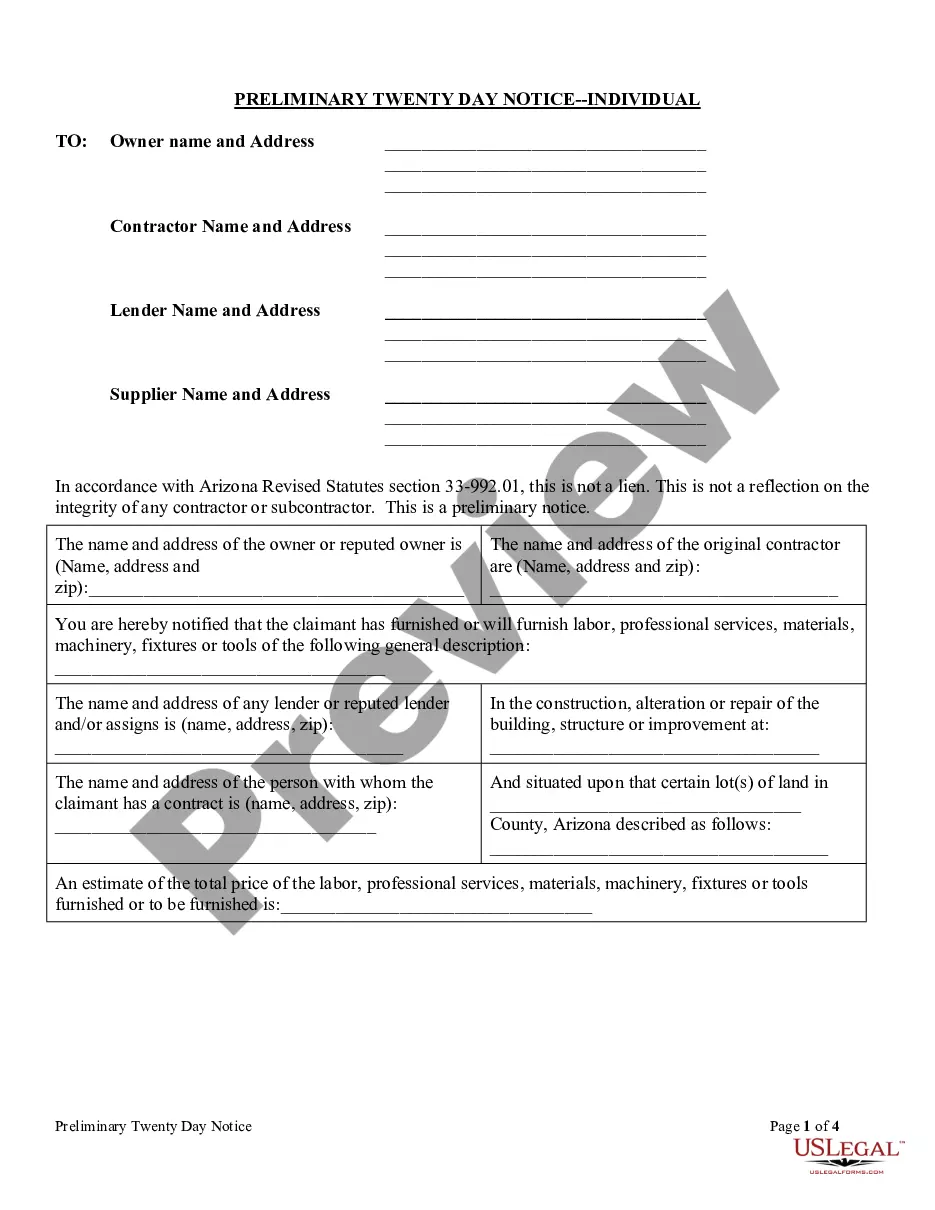

How to fill out Sample Letter For Tax Deeds?

If you need to compile, download, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Employ the site’s straightforward and user-friendly search to locate the documents you require. A range of templates for business and personal purposes are categorized by types and states, or keywords. Utilize US Legal Forms to find the Alaska Sample Letter for Tax Deeds in just a few clicks.

If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Alaska Sample Letter for Tax Deeds. You can also access forms you have previously acquired in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps outlined below: Step 1. Ensure you have selected the form for the correct state/region. Step 2. Use the Preview option to review the form’s details. Remember to check the description. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template. Step 4. Once you have located the form you desire, click on the Get now button. Choose the pricing plan you prefer and enter your information to register for an account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Alaska Sample Letter for Tax Deeds.

- Every legal document template you acquire is yours permanently.

- You will have access to every form you obtained in your account.

- Visit the My documents section and choose a form to print or download again.

- Complete and download, and print the Alaska Sample Letter for Tax Deeds with US Legal Forms.

- There are numerous professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

The lien includes accrued penalty, interest, and costs resulting from delinquency. The lien attaches on the first day of the tax year in which the taxes are levied.? Delinquent real property tax liens are enforced by annual foreclosure, Alaska Statutes §29.45.

FastFilings makes it quick and simple for Alaska small business owners to obtain their resale certificates. Fill out our secure online application. Provide any necessary documentation. Pay your application fee. We review your application for accuracy and file it electronically with the state of Alaska.

Alaska has a 2.0 to 9.40 percent corporate income tax rate. Alaska does not have a state sales tax, but has a max local sales tax rate of 7.50 percent and an average combined state and local sales tax rate of 1.76 percent. Alaska's tax system ranks 3rd overall on our 2024 State Business Tax Climate Index.

The State of Alaska does not have a tax exemption certificate, as it is not necessary to have one. The Alaska Constitution provides that the State of Alaska is exempt from all taxes emanating from within Alaska.

The value of the tax base is found by adding up the assessed value of all taxable property within the Borough boundaries. HOW IS THE PROPERTY TAX DETERMINED? Real property tax is determined by multiplying the assessed value of the property by the mill rate. In other words, Assessed Value X Mill Rate = Taxes.

Under AS 29.45. 030(e), there is a mandatory exemption up to the first $150,000 of assessed value for the primary residence of a senior citizen, age 65 years and older, or a disabled veteran with a service connected disability of 50% or more.

That amount is divided by the total assessed value and the result is identified as a "mill rate". A "mill" is 1/1000 of a dollar, so the mill rate simply states the amount of tax to be charged per $1,000 of assessed value. For example, a mill rate of 18.5 mills equates to $18.50 of tax per $1,000 of assessed value.

Overview of Alaska Taxes Many cities in Alaska do not levy any property tax. However, the largest cities, including Anchorage, do. Average property taxes in the state are a bit higher than the national average property tax. The average effective property tax rate in Alaska is 1.17%, while the U.S. rate is 0.99%.