This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of Portion Of Expected Interest In Estate In Order To Pay Indebtedness?

Choosing the best legal file design could be a have difficulties. Needless to say, there are a variety of themes accessible on the Internet, but how do you find the legal type you will need? Utilize the US Legal Forms web site. The services provides a huge number of themes, including the Alaska Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness, that you can use for enterprise and private requirements. Every one of the forms are checked by specialists and satisfy state and federal specifications.

Should you be previously signed up, log in to your profile and click the Down load button to obtain the Alaska Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness. Make use of your profile to check with the legal forms you have acquired in the past. Proceed to the My Forms tab of your own profile and have yet another backup in the file you will need.

Should you be a fresh user of US Legal Forms, listed here are straightforward recommendations so that you can adhere to:

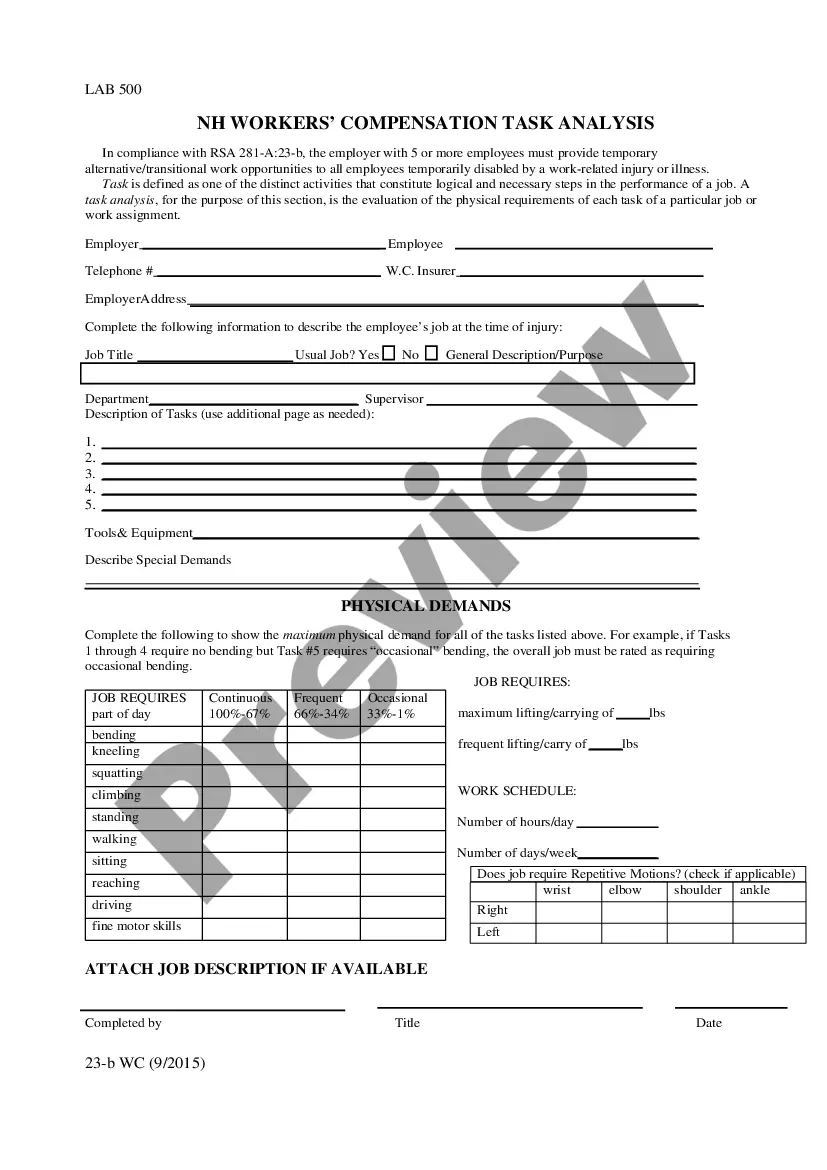

- Initially, make certain you have selected the correct type for your personal metropolis/state. It is possible to look over the form making use of the Review button and look at the form description to make sure it is the best for you.

- In the event the type does not satisfy your expectations, use the Seach discipline to get the appropriate type.

- Once you are sure that the form is proper, go through the Acquire now button to obtain the type.

- Choose the rates strategy you need and type in the required information. Design your profile and pay money for the transaction using your PayPal profile or Visa or Mastercard.

- Pick the file format and acquire the legal file design to your system.

- Complete, edit and printing and sign the received Alaska Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness.

US Legal Forms may be the largest catalogue of legal forms that you can see different file themes. Utilize the service to acquire professionally-manufactured papers that adhere to condition specifications.

Form popularity

FAQ

In fact, many estates can be settled without any court involvement at all. Estates valued at less than $50,000, plus $100,000 worth of motor vehicles, can often avoid the probate process in court, provided the estate contains no real property (land or a home).

If the estate only includes personal property (e.g. bank accounts, household items, insurance payable to the estate, motor vehicles, boats) valued at less than $50,000 (plus $100,000 in motor vehicles), and an heir or devisee is willing to wait 30 days after death, he is authorized to collect the property by presenting ...

Exempt property is personal property of the person who died, worth up to $10,000, that the Personal Representative must give to certain family members.

If you want to avoid probate, you will also need to transfer ownership of all of your property to the revocable trust or name the revocable trust as a beneficiary of your property.

Does Alaska Require Probate? The state government does require all wills in Alaska to go through probate court to prove their validity and ensure that courts follow the deceased's wishes.

A probate is required when a person dies and owns property that does not automatically pass to someone else, or the estate doesn't qualify to use the Affidavit for Collection of Personal Property procedure. A probate allows a Personal Representative to transfer legal title of that property to the proper persons.

Even if the person who died made a will that disinherited the spouse or children, the Personal Representative needs to pay the allowances and exempt property out of the estate.

How Long Do You Have to File Probate After Death in Alaska? There is no limit to when you can file a will with probate court after the deceased passes in Alaska.