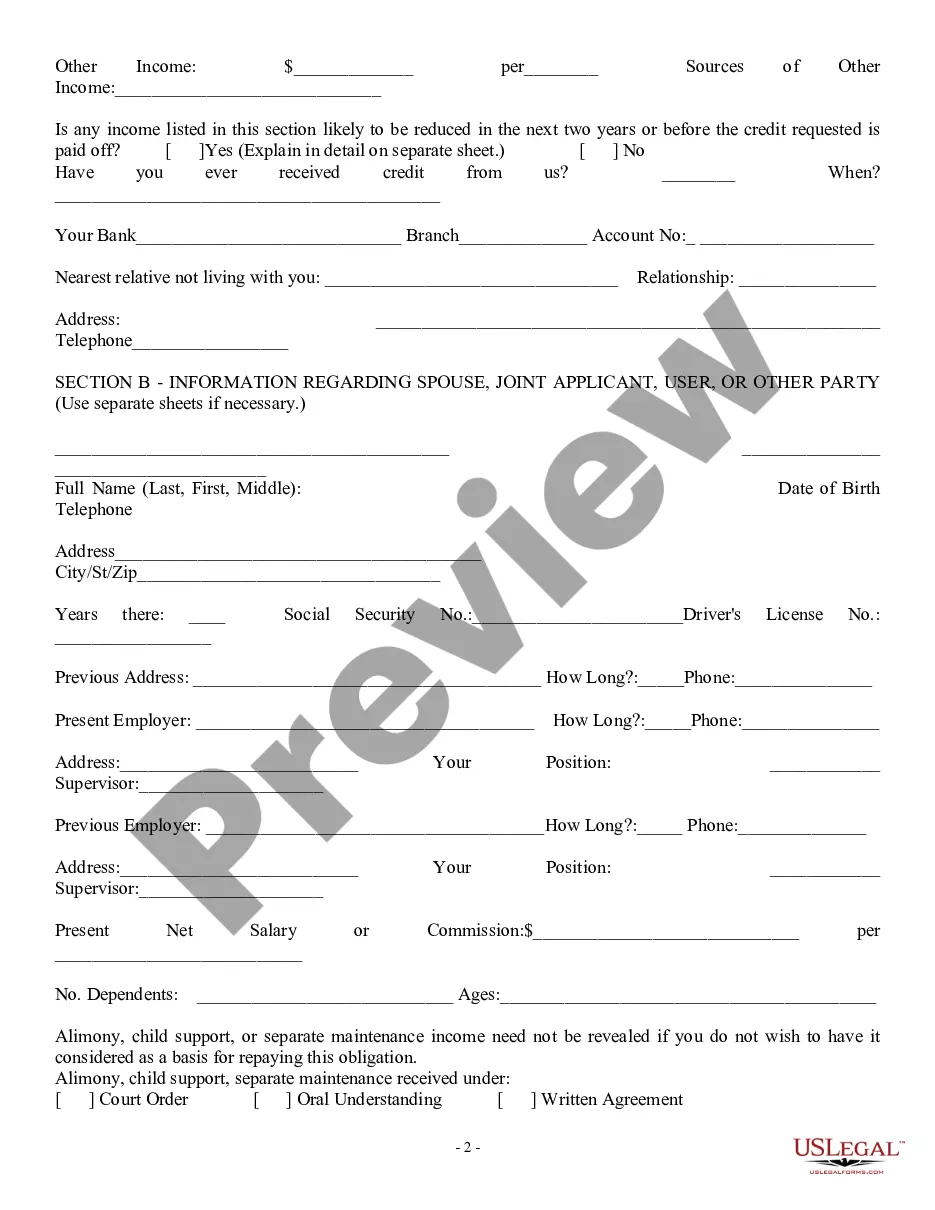

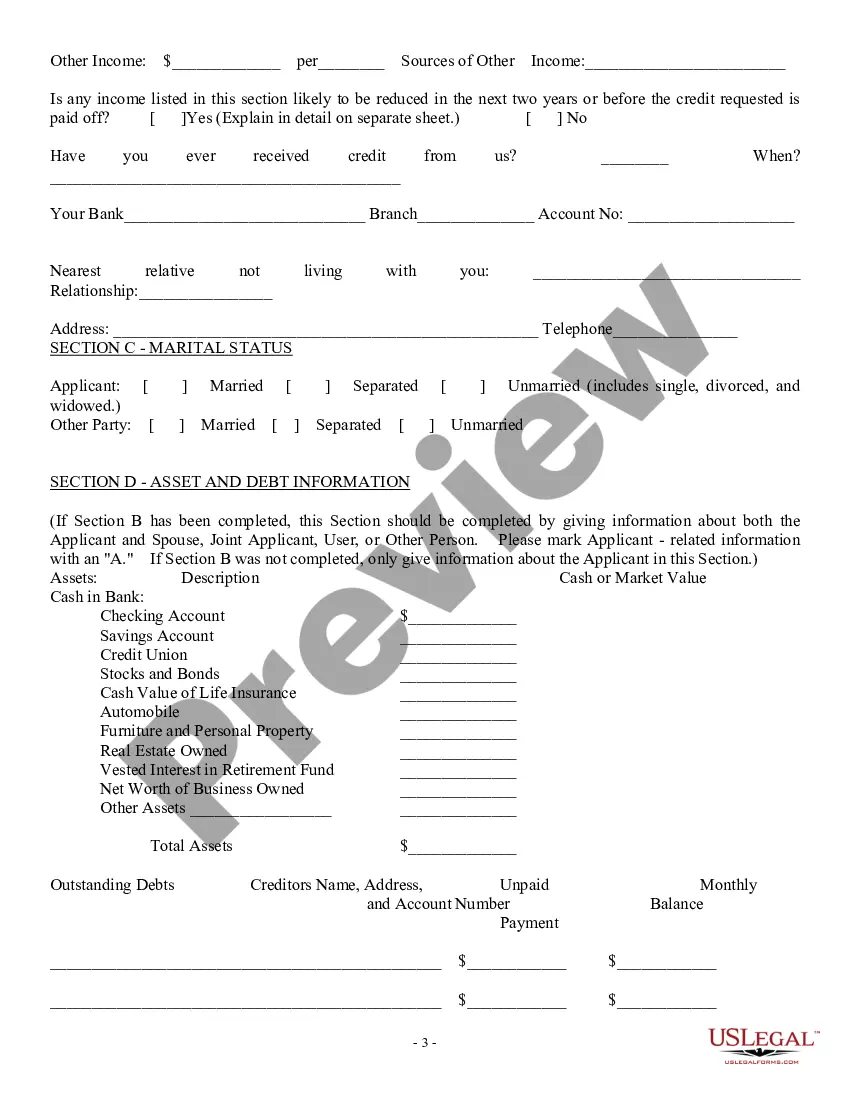

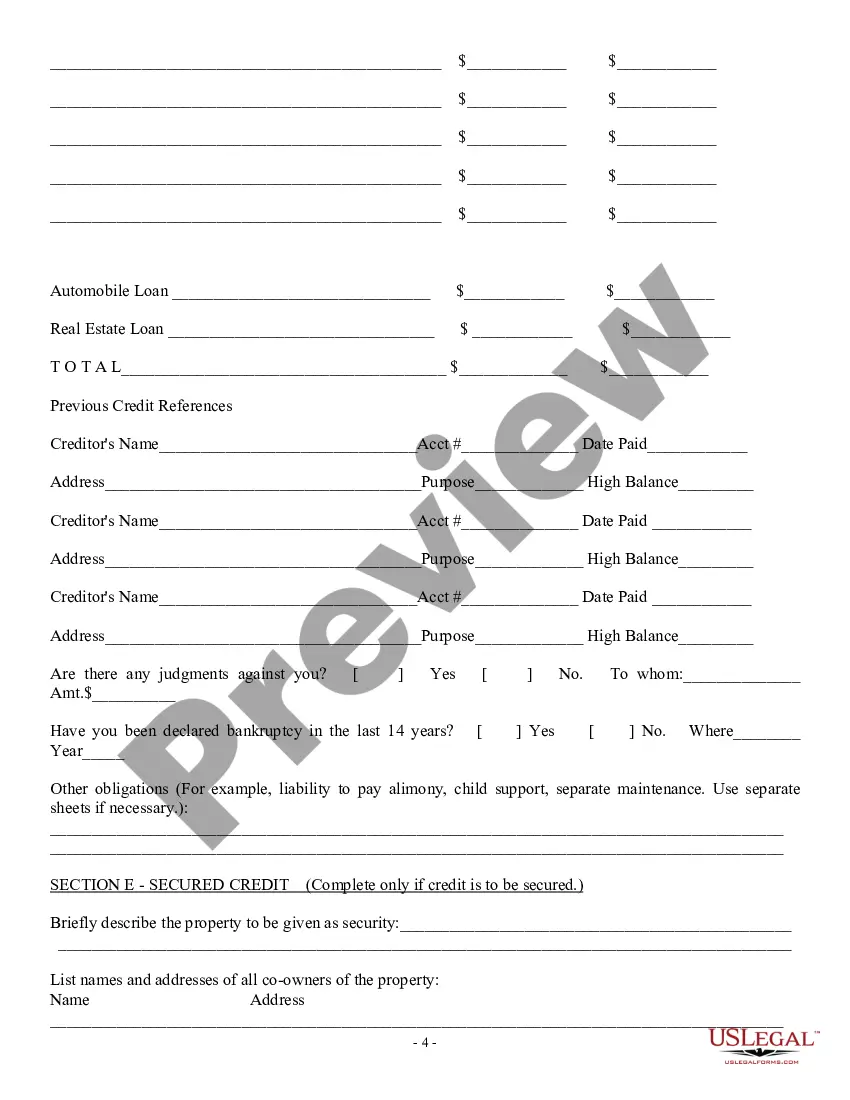

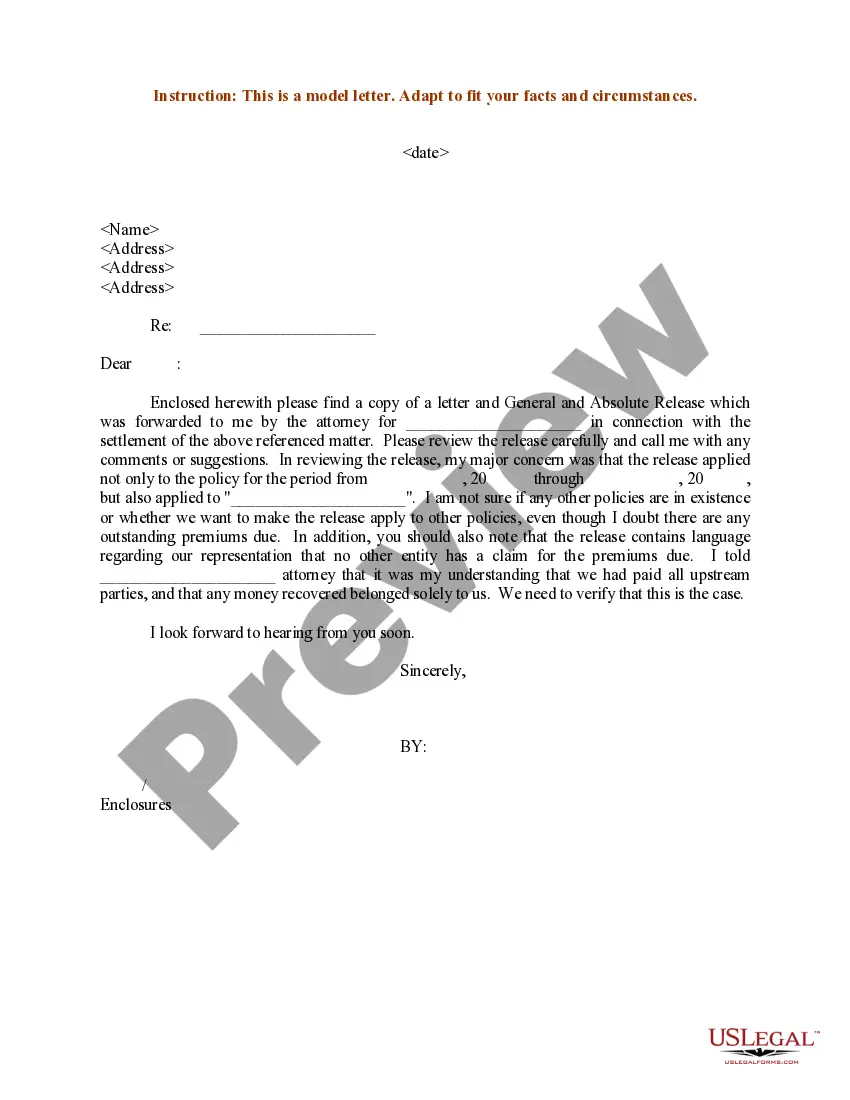

Alaska Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Consumer Loan Application - Personal Loan Agreement?

Finding the appropriate legal document format can be challenging. Naturally, there are numerous templates available online, but how do you acquire the legal form you desire? Use the US Legal Forms website. The service offers a vast array of templates, such as the Alaska Consumer Loan Application - Personal Loan Agreement, which can be utilized for both business and personal purposes. All of the forms are reviewed by experts and comply with state and federal requirements.

If you are already registered, Log In to your account and click the Download button to retrieve the Alaska Consumer Loan Application - Personal Loan Agreement. Use your account to search through the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple guidelines you can follow: First, make sure you have selected the correct form for your region/state. You can preview the document using the Preview option and review the document details to confirm it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the correct form. Once you are certain the form is appropriate, select the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, modify, print, and sign the acquired Alaska Consumer Loan Application - Personal Loan Agreement.

Utilize US Legal Forms for your legal documentation needs and ensure compliance with all necessary regulations.

- US Legal Forms is the largest collection of legal forms where you can find various document templates.

- Use the service to obtain professionally crafted papers that adhere to state regulations.

- The platform provides a user-friendly interface for easy navigation.

- Templates are designed to meet specific legal standards and requirements.

- Access a wide variety of forms for different legal needs.

- The service ensures that all documents are current and valid according to legal standards.

Form popularity

FAQ

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

A consumer credit contract is a formal written agreement to borrow money, or pay something off over time, for personal use. You pay interest and fees for the use of the bank or finance company's money. One or more of your assets might secure the loan. Examples include: vehicle finance to buy a car, van, or boat.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

A loan agreement should accompany any loan of money. For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

They are designed to set expectations for a loan so that both the borrower and the lender understand the terms. A personal loan agreement can be referred to if there are questions about repayment, and it can be used to legally enforce terms if one party doesn't adhere to them.