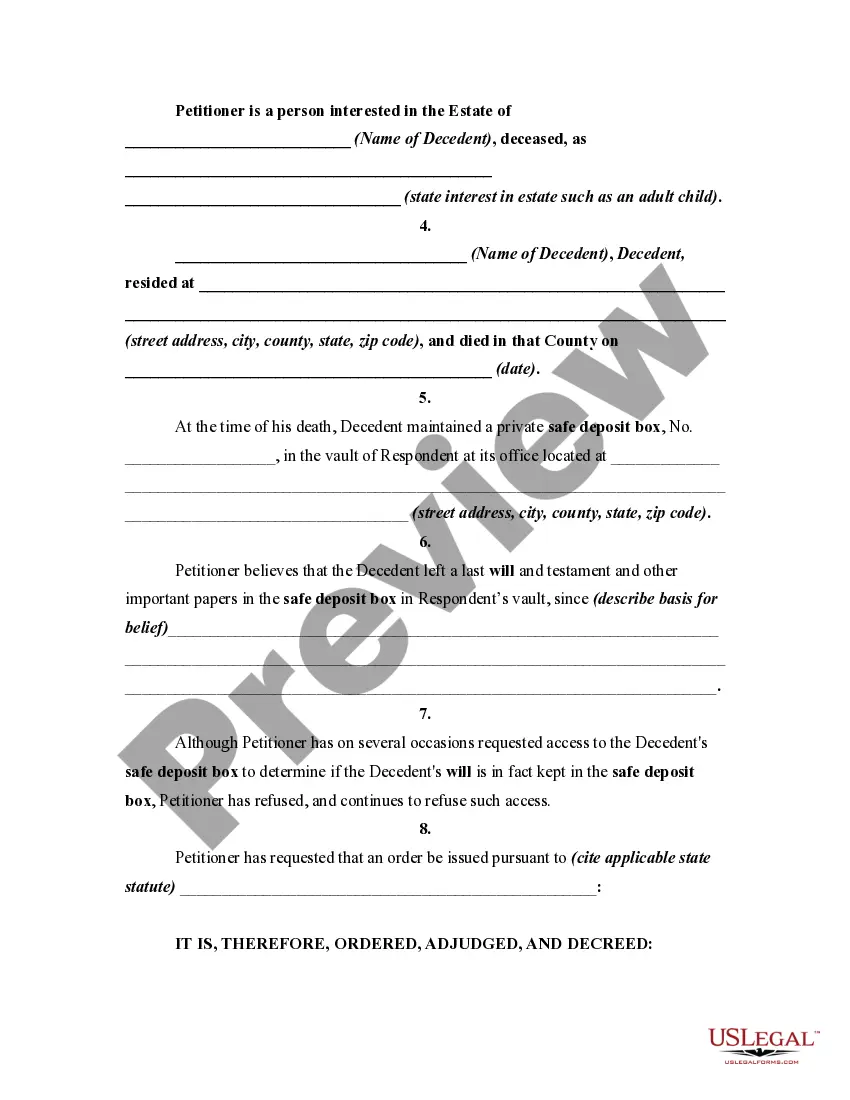

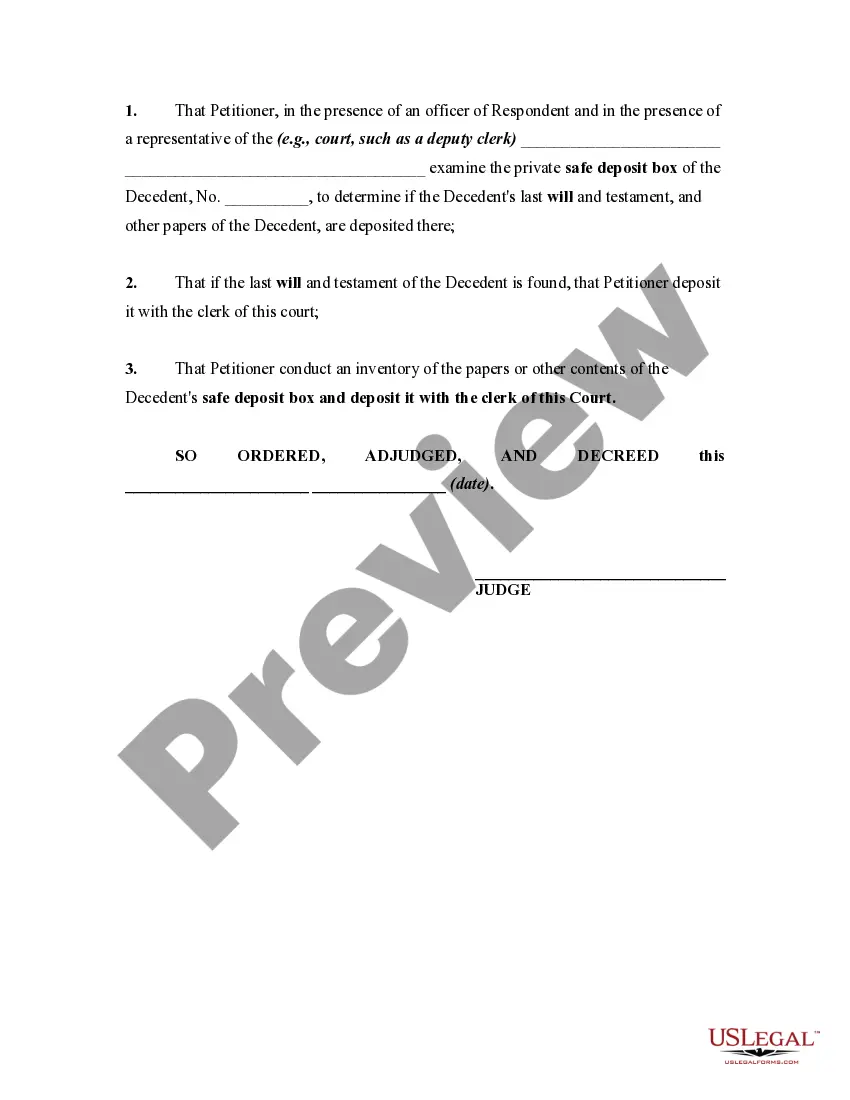

This order goes along with a petition for an order to open a safe deposit box of a decedent. Whether your will should be in a safe deposit box at a bank or elsewhere, such as with your attorney, depends on what your state law says about who has access to your safe deposit box when you die. The recent trend in many states is to make it relatively easy for family members or the executor to remove the will and certain other documents (such as life insurance policies and burial instructions) from a deceased person's safe deposit box. In those states, it might be a good idea to leave your will in the safe deposit box. However, in some states, it may require a court order to remove the will, which can take time and money.

Alaska Order Authorizing Petitioner to Open Safe Deposit Box of Decedent

Description

How to fill out Order Authorizing Petitioner To Open Safe Deposit Box Of Decedent?

Are you presently within a place that you will need papers for sometimes organization or specific purposes nearly every time? There are tons of authorized record web templates available online, but getting types you can trust is not straightforward. US Legal Forms provides a large number of kind web templates, such as the Alaska Order Authorizing Petitioner to Open Safe Deposit Box of Decedent, that happen to be written to meet state and federal demands.

If you are currently knowledgeable about US Legal Forms internet site and also have a free account, basically log in. Next, it is possible to obtain the Alaska Order Authorizing Petitioner to Open Safe Deposit Box of Decedent template.

Should you not provide an account and want to begin using US Legal Forms, abide by these steps:

- Get the kind you require and make sure it is for your appropriate area/county.

- Make use of the Preview switch to examine the shape.

- Browse the explanation to ensure that you have chosen the correct kind.

- When the kind is not what you are looking for, utilize the Research industry to discover the kind that suits you and demands.

- When you obtain the appropriate kind, click on Purchase now.

- Select the prices plan you need, fill in the necessary information and facts to generate your bank account, and purchase the transaction making use of your PayPal or charge card.

- Select a hassle-free paper formatting and obtain your duplicate.

Locate every one of the record web templates you possess bought in the My Forms menu. You can get a further duplicate of Alaska Order Authorizing Petitioner to Open Safe Deposit Box of Decedent any time, if necessary. Just select the essential kind to obtain or printing the record template.

Use US Legal Forms, one of the most extensive assortment of authorized kinds, in order to save efforts and stay away from blunders. The service provides appropriately manufactured authorized record web templates that you can use for a range of purposes. Produce a free account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

Generally, third parties can't access your safe deposit box unless you've given them authorized access (such as by giving them a key and adding their name to the rental agreement).

Items in safe deport boxes are not insured by the bank, so anything you place there should be privately insured if it is valuable. Cash should never be placed in a safe deposit box because it will not be FDIC-protected. You should also make sure that any documents you store there have copies that are kept elsewhere.

If you are trying to find out if a deceased relative had a safety deposit box, your best bet is to search through their financial and legal documents for any clues or references to one. You can also contact the person's bank and ask if they had a safety deposit box.

You'll be left alone in private in the vault when you use your safety deposit box. As such, the bank won't know what you put inside your safety deposit box. Banks also won't vet your items which is another reason why safety deposit boxes aren't insured. The bank doesn't even know what valuables are kept inside.

Items in safe deport boxes are not insured by the bank, so anything you place there should be privately insured if it is valuable. Cash should never be placed in a safe deposit box because it will not be FDIC-protected. You should also make sure that any documents you store there have copies that are kept elsewhere.

During your lifetime, your safe deposit box can be accessed by you, a joint owner, or a Deputy designee. A Deputy is someone who can act on your behalf to access the box in your stead. The Deputy designation can be changed at any time by you with written notice to the bank. A Deputy's authority ceases upon your death.

(3) Qualified person. ? A person possessing a letter of authority or a person named as a deputy, lessee or cotenant of the safe-deposit box to which the decedent had access.

A safe deposit box may be owned as an individual or jointly. You may want to own one with your spouse, children, or a close family member. During your lifetime, your safe deposit box can be accessed by you, a joint owner, or a Deputy designee.