An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

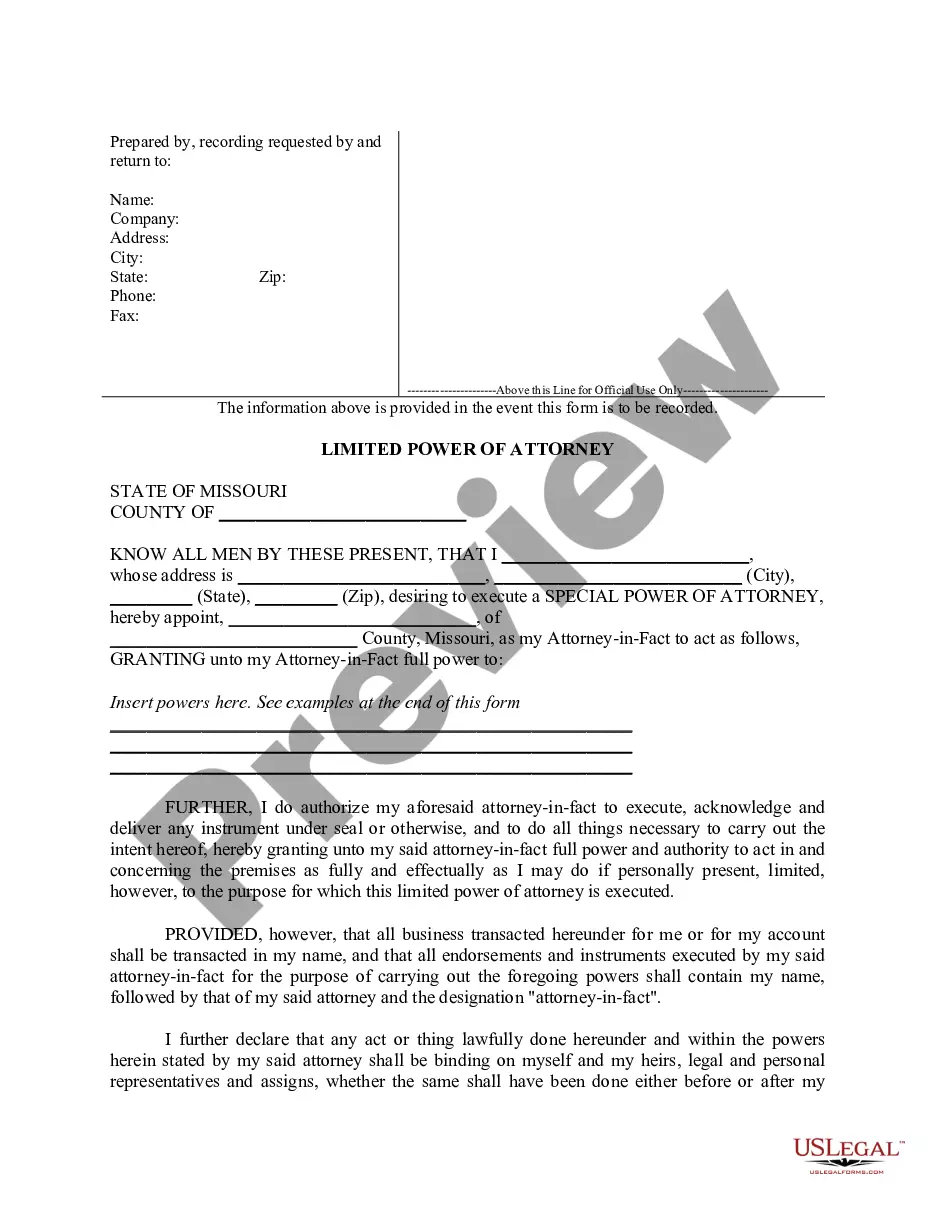

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

If you require thorough, retrieve, or create valid document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site's straightforward and user-friendly search to obtain the documents you need.

A variety of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click on the Acquire now button. Select the pricing plan you prefer and provide your details to register for the account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction. Step 6. Choose the format of the legal document and download it to your device. Step 7. Fill out, review, and print or sign the Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust.

- Use US Legal Forms to obtain the Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to find the Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to browse the content of the form. Don't forget to check the details.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other models in the legal form template.

Form popularity

FAQ

A beneficiary is a person entitled to receive distributions from a trust, while an income beneficiary specifically receives the income generated by the trust assets. This distinction is important for understanding different rights and entitlements. When looking into Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust, it's beneficial to grasp these roles for correct expectations.

Beneficiary income represents the portion of a trust's earnings that is payable to beneficiaries. This income can stem from various sources, including investments and property held by the trust. When exploring Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust, knowing how to identify and quantify beneficiary income helps streamline financial interactions.

Allocating trust income to beneficiaries involves determining how much of the trust's income each beneficiary will receive. This process can depend on the terms of the trust agreement and specific directives from the trustee. In the context of Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust, this allocation is essential for clarity and fairness among beneficiaries.

Generally, trust beneficiary income is subject to taxation. Beneficiaries must report this income on their tax returns, as it represents earnings from the trust. For individuals dealing with Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust, understanding tax implications is fundamental for compliance.

Yes, beneficiaries often receive Form 1099 if they have received taxable income from the trust. This document outlines the amount of income distributed to them throughout the year. For individuals involved in an Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust, this form provides necessary tax information.

Beneficiary income refers to the actual amount a beneficiary earns from the trust assets. It can vary year by year, depending on trust performance and distribution policies. For those interested in Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust, knowing how beneficiary income is calculated is crucial for financial planning.

Beneficiary income includes all the distributions that a beneficiary receives from a trust. This usually consists of interest, dividends, and any share of the trust's profit. In the context of Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust, understanding beneficiary income helps clarify the financial benefits a beneficiary can expect.

Establishing a trust can be a wise decision for asset protection and efficient wealth transfer, especially if it includes an Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust. It ensures that their assets are managed and distributed according to their wishes. Consulting with a legal professional can help determine the best approach for their specific situation.

No, Alaska does not tax trust income, making it an attractive option for individuals considering estate planning. This lack of state taxation allows families to benefit fully from the Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust. It is important to keep this in mind when creating trust structures that aim to preserve wealth.

Putting assets in a trust can limit control over them during your lifetime, depending on how the trust is structured. Additionally, it may involve some upfront costs and complexities in the setup process. However, the benefits of an Alaska Assignment by Beneficiary of a Percentage of the Income of a Trust often outweigh these initial drawbacks by providing lasting financial security.