Alaska Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

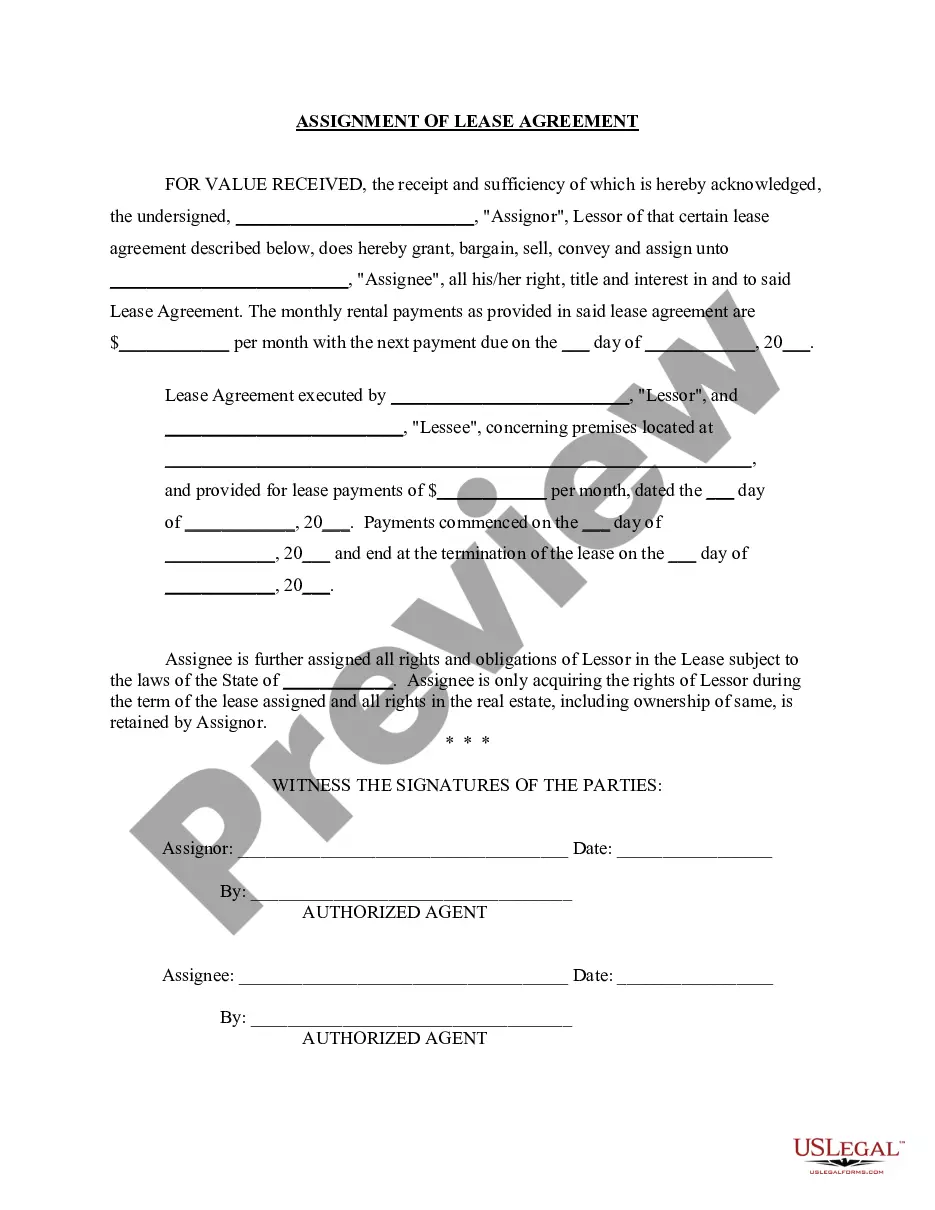

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

Are you situated in a location where you need documents for either professional or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of template forms, including the Alaska Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, which are designed to comply with state and federal regulations.

Once you locate the right form, click Buy now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Alaska Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct area/region.

- Utilize the Preview button to review the document.

- Read the description to confirm you have selected the proper form.

- If the form does not meet your requirements, use the Search feature to find the form that best fits your needs.

Form popularity

FAQ

Statute 23.10.430 in Alaska pertains to employment practices and provides regulations on wage payments and employee rights. This statute emphasizes the obligations of employers regarding employee treatment and wage distribution. If you are entering into an Alaska Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, being informed about labor laws like this can be crucial for ensuring compliance and protecting your consultancy’s interests.

Contract law in Alaska is governed by both state statutes and common law principles. Generally, for a contract to be valid, it must include an offer, acceptance, and consideration. When you create an Alaska Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, understanding these essentials can help you draft enforceable agreements that protect all parties involved.

In Alaska, unlawful contact often refers to actions that violate personal protection laws, including stalking or harassment. These violations can lead to serious consequences. When it comes to an Alaska Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, being aware of the laws surrounding contact can help in establishing boundaries and protecting your interests.

The statute of limitations varies depending on the type of case in Alaska. For most civil claims, including contracts, it is three years. Understanding the duration of the statute of limitations is essential when dealing with an Alaska Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, as timely action can make a significant difference in legal outcomes.

In Alaska, the statute of limitations for breach of contract claims is typically three years. This means that you have three years from the date of the breach to file a lawsuit. When navigating an Alaska Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, you should be aware of this timeframe to protect your rights. Being timely can ensure that your contract is enforced effectively.

To fill out a contract, start by entering the essential information about the parties involved. Clearly outline the services, duration, and payment details, and be sure to highlight any limitation of liability clauses. A structured platform like uslegalforms can assist with this process, ensuring you include all necessary elements for a valid contract.

Writing a simple contract agreement begins with a clear title that reflects the agreement's purpose. Follow this by stating the parties' names, outlining the services agreed upon, and specifying payment terms. By adopting the Alaska Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, you create a straightforward and enforceable document.

When filling a contract, carefully read each section to understand what information is required. Identify the parties involved and mention the services to be provided, along with payment details. Including a limitation of liability clause in your contract can safeguard your interests and using templates from uslegalforms can simplify this task.

To fill an agreement form, start by entering the names of the parties and their addresses. Next, outline the terms and conditions clearly, ensuring that key points such as deliverables and deadlines are well defined. Incorporating the Alaska Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause ensures protection for both parties.

Filling out a contract agreement involves specifying the names and contact details of the parties involved, along with the date of the agreement. Be sure to include the agreed services, payment terms, and any conditions related to the limitation of liability. Utilizing a reliable platform like uslegalforms can streamline this process and provide valuable templates.