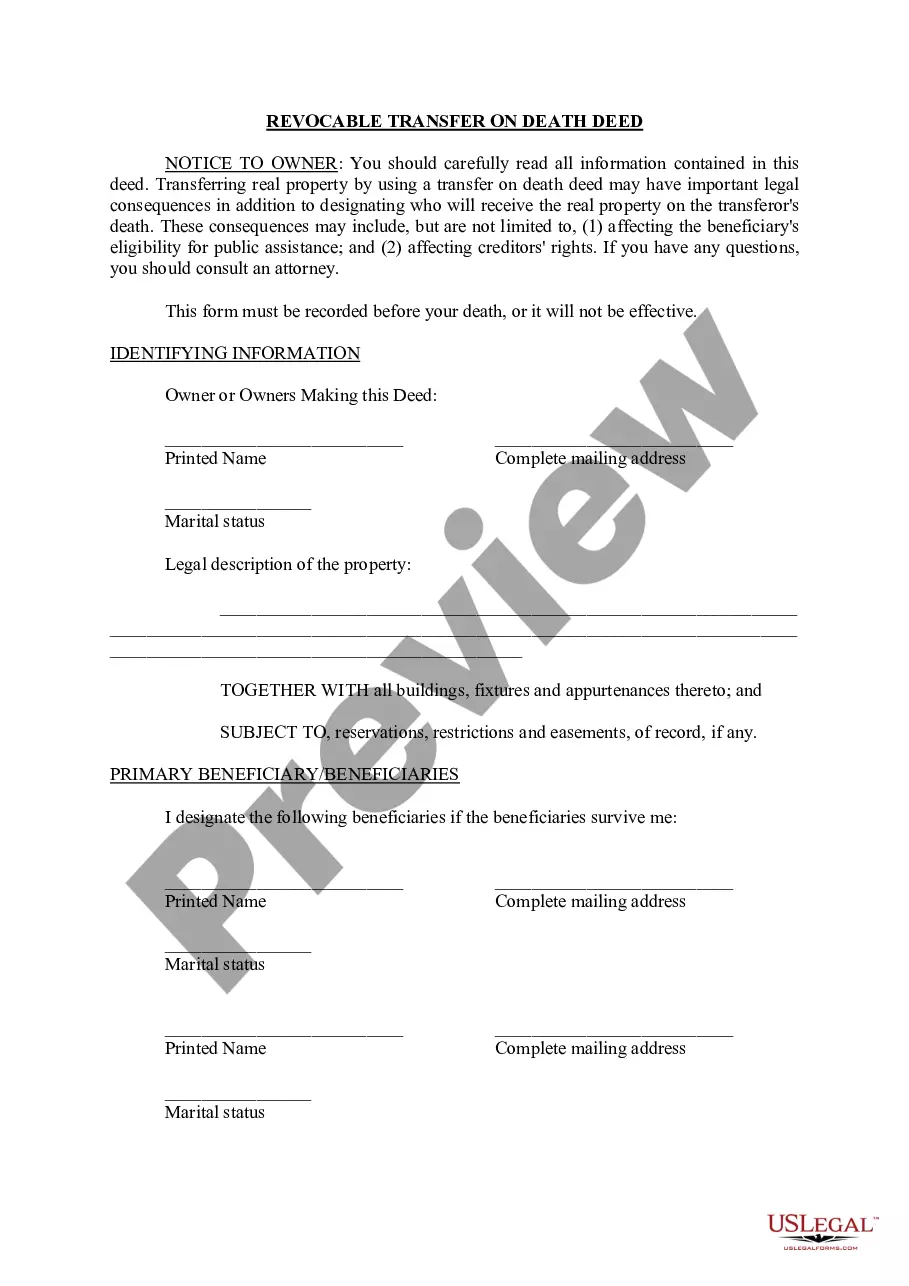

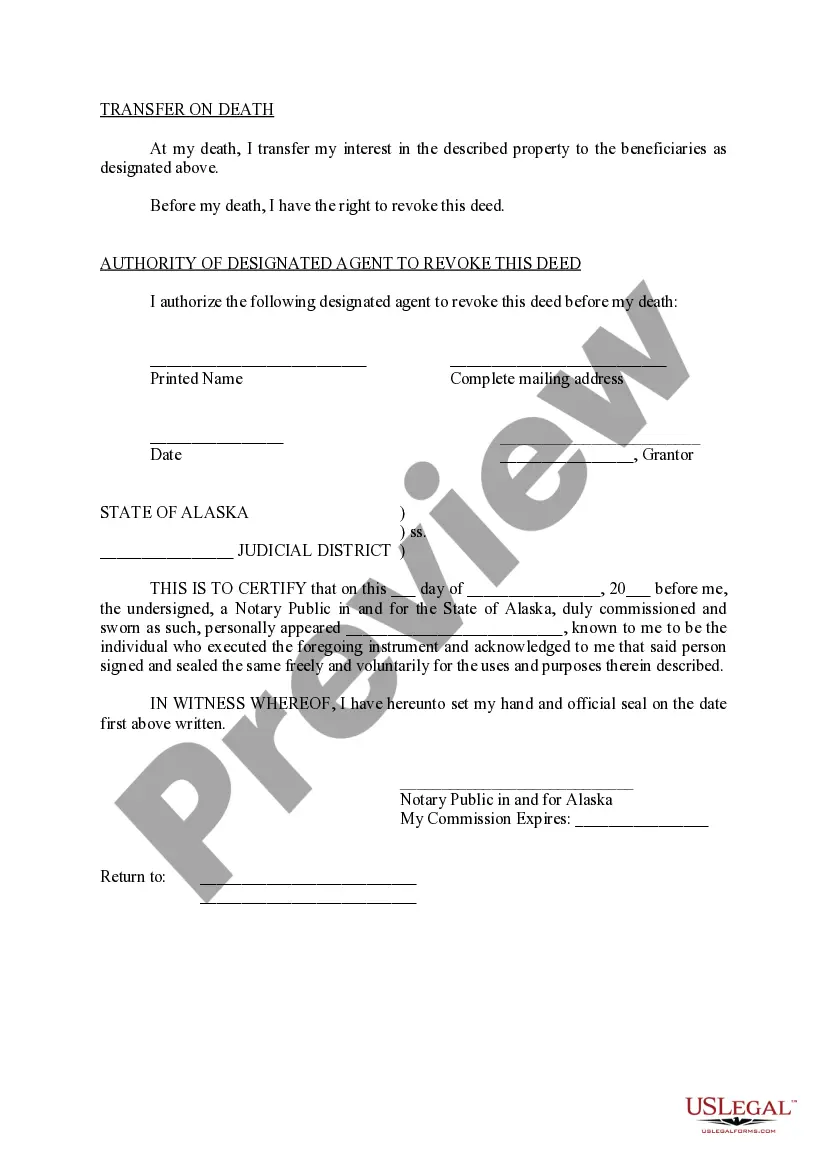

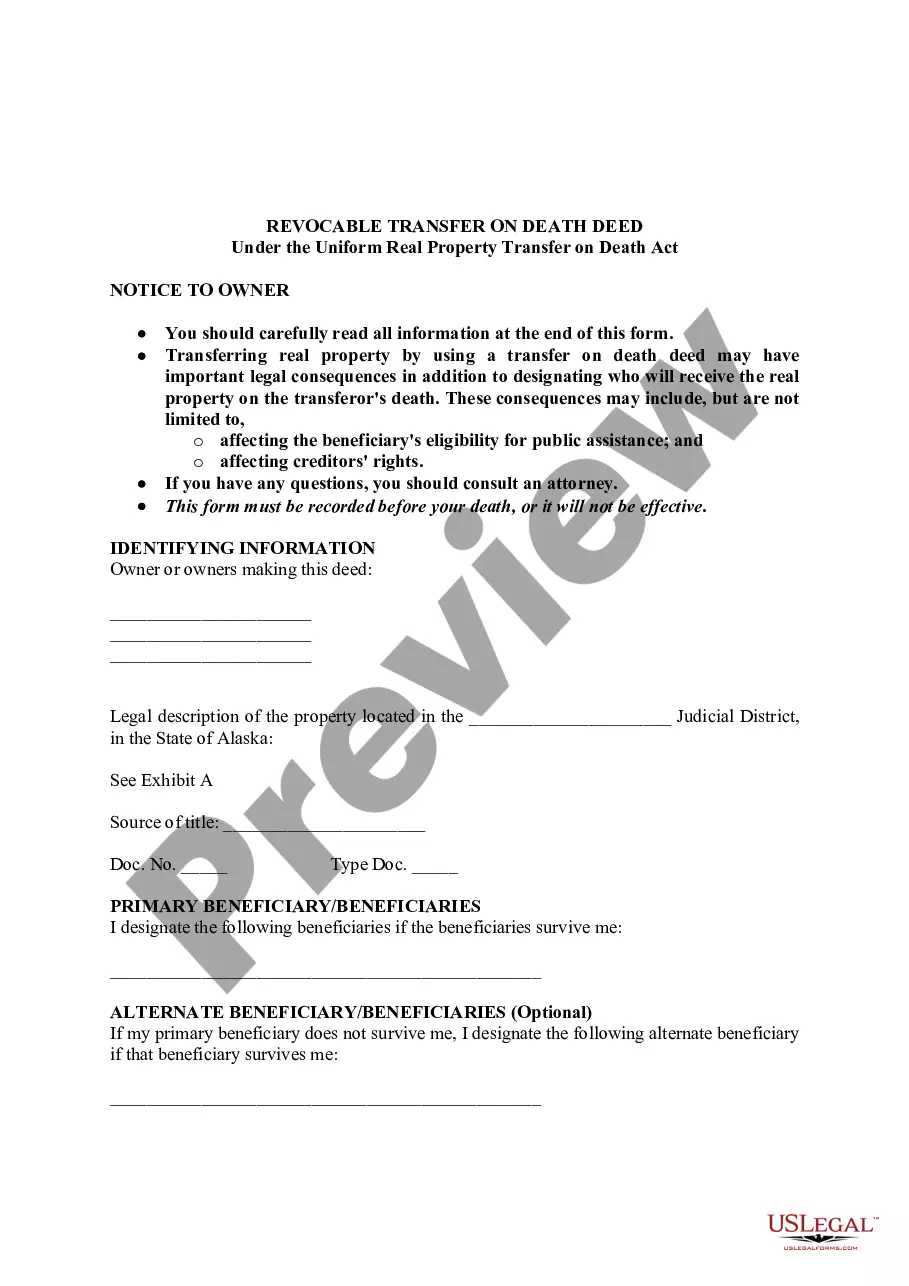

Alaska Revocable Transfer on Death Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

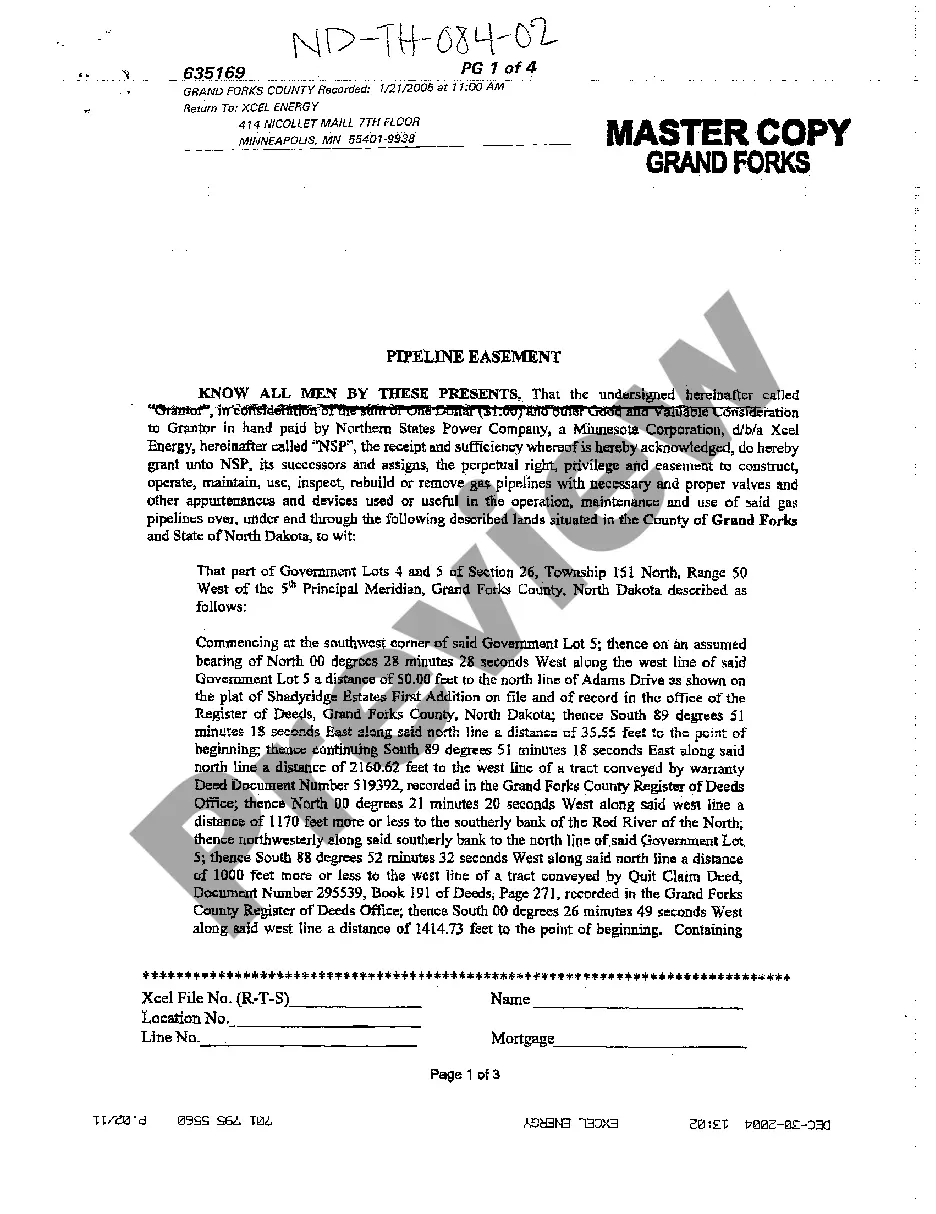

Looking for another form?

How to fill out Alaska Revocable Transfer On Death Deed?

Utilize US Legal Forms to acquire a printable Alaska Revocable Transfer on Death Deed.

Our court-approved forms are crafted and routinely refreshed by experienced attorneys.

Ours is the most comprehensive Forms library online and offers economical and precise samples for individuals and legal experts, as well as small to medium-sized businesses.

Select Buy Now if it’s the template you seek. Create an account and complete payment through PayPal or a credit card. Download the form to your device and feel free to reuse it multiple times. Use the Search field if you need another document template. US Legal Forms provides a vast selection of legal and tax templates and packages for personal and business needs, including the Alaska Revocable Transfer on Death Deed. Over three million users have successfully taken advantage of our service. Choose your subscription plan and get high-quality documents in just a few clicks.

- The templates are organized into state-specific categories and some may be viewed prior to downloading.

- To download templates, users need a subscription and must Log In to their account.

- Click Download next to any form you wish and locate it in My documents.

- For those without a subscription, follow these steps to easily locate and download the Alaska Revocable Transfer on Death Deed.

- Verify to ensure you acquire the accurate form for the required state.

- Examine the form by reading the description and using the Preview function.

Form popularity

FAQ

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.

When someone dies and their property transfers to their beneficiaries, the federal government impose an estate tax on the value of all that property. Since the transfer on death account is not a trust, it does not help you avoid or minimize estate taxes.

A revocable TOD deed does not avoid the owner's creditors. Creditors may seek collection against the designated beneficiaries as to secured and unsecured obligations of the original owner.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

Transferring control Because TOD accounts are still part of the decedent's estate (although not the probate estate that the Last Will establishes), they may be subject to income, estate and/or inheritance tax. TOD accounts are also not out of reach for the decedent's creditors or other relatives.