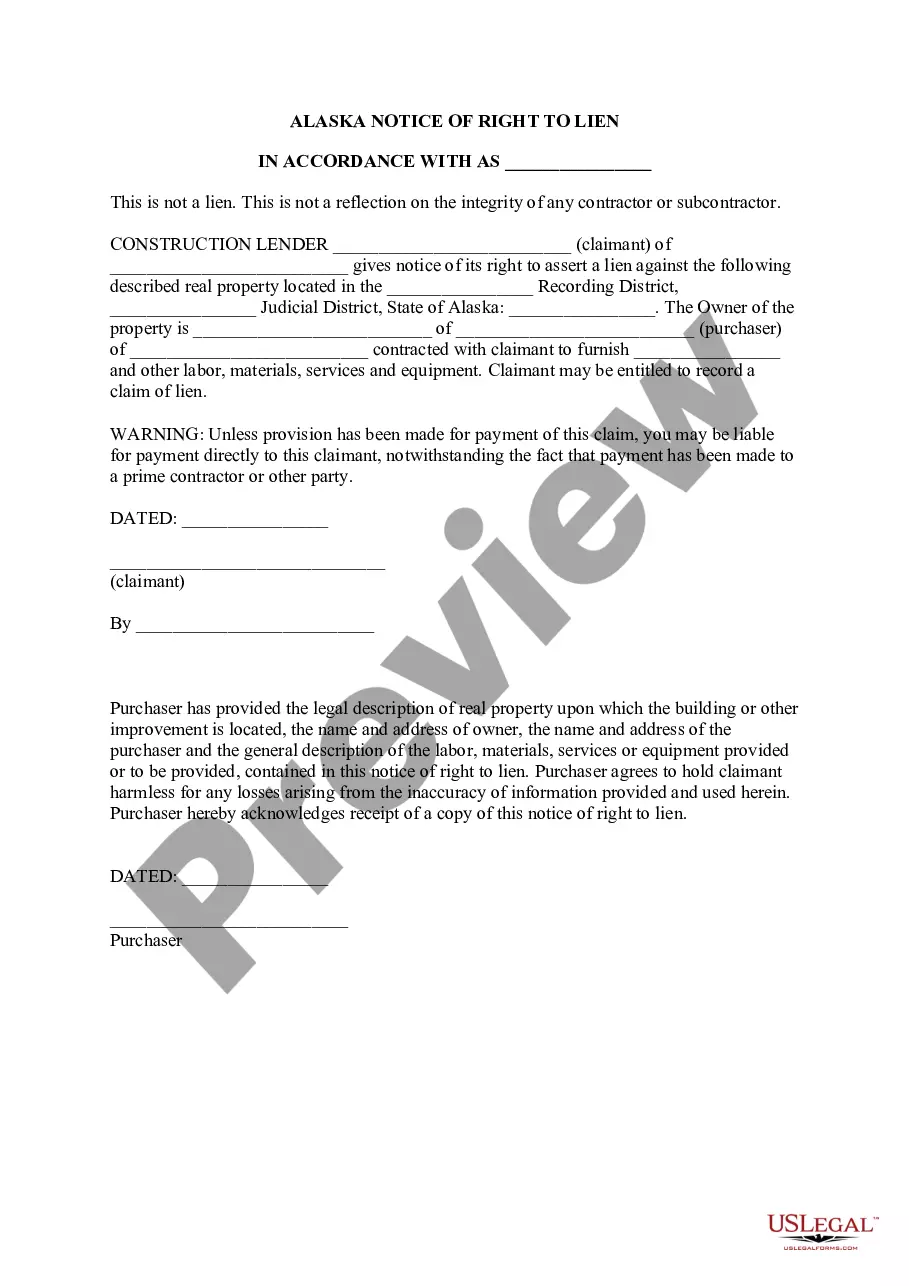

Alaska Notice of Right to Lien

Description

How to fill out Alaska Notice Of Right To Lien?

Utilize US Legal Forms to obtain a printable Alaska Notice of Right to Lien.

Our court-acceptable forms are prepared and consistently revised by qualified attorneys.

Ours is the most extensive Forms catalog available online and offers reasonably priced and precise templates for individuals and legal professionals, as well as small and medium-sized businesses.

US Legal Forms offers thousands of legal and tax templates and packages for both business and personal requirements, including the Alaska Notice of Right to Lien. Over three million users have successfully used our platform. Choose your subscription plan and acquire high-quality forms within a few moments.

- To access samples, users are required to have a subscription and Log In to their account.

- Press Download beside any form you desire and locate it in My documents.

- For users without a subscription, adhere to these steps to swiftly find and download the Alaska Notice of Right to Lien.

- Ensure you select the correct form pertaining to the state in which it’s required.

- Examine the document by browsing through the description and utilizing the Preview feature.

- Click Buy Now if it is the form you require.

- Establish your account and make payment using PayPal or a credit/debit card.

- Download the form to your device and feel free to utilize it multiple times.

- Employ the Search engine if you need to locate another document template.

Form popularity

FAQ

Who you are. The services or materials you provided. The last date you provided the services or materials. How much payment should be. The date on which you will file a lien if you do not receive payment. How the debtor should pay.

How Liens Work. A lien provides a creditor with the legal right to seize and sell the collateral property or asset of a borrower who fails to meet the obligations of a loan or contract. The property that is the subject of a lien cannot be sold by the owner without the consent of the lien holder.

If a creditor puts a lien on your property, you may make an offer to settle the amount for less than you owe. As part of the negotiations, get the creditor to agree to release the lien. If you need help in the negotiations, consider hiring a debt settlement lawyer to help you.

Enforcing your lien claim means actually filing a lawsuit to enforce the action and foreclose on the property itself.Since a mechanics lien gives you a security interest in the property, a foreclosure action is a way to squeeze the funds out of the property.

What Is a Fraudulent Lien?the claimant is owed money on another job by the same general contractor or property owner, but didn't file a lien on that project before time expired; or. the claimant wants to file a lien because of personal reasons generally related to the identity of the property owner.

Formalize a defense for disputing the amount of the lien. Gather supporting documentation for your rebuttal, depending on the type of lien. Contact the agent representing the creditor to dispute the amount of the claim. Negotiate a payment settlement with the creditor if you cannot pay the amount you owe in full.

A Lien Demand Letter or Notice of Intent to Lien is a formal demand for payment.A lien demand letter puts a debtor on notice of your intent to lien the job site property by a specific date deadline. Increase your odds of getting paid with a lien demand letter.

A lien is a legal right or claim against a property by a creditor. Liens are commonly placed against property, such as homes and cars, so creditors, such as banks and credit unions, can collect what is owed to them. Liens can also be removed, giving the owner full and clear title to the property.

Statutory and judgment liens have a negative impact on your credit score and report, and they impact your ability to obtain financing in the future. Consensual liens (that are repaid) do not adversely affect your credit, while statutory and judgment liens have a negative impact on your credit score and report.