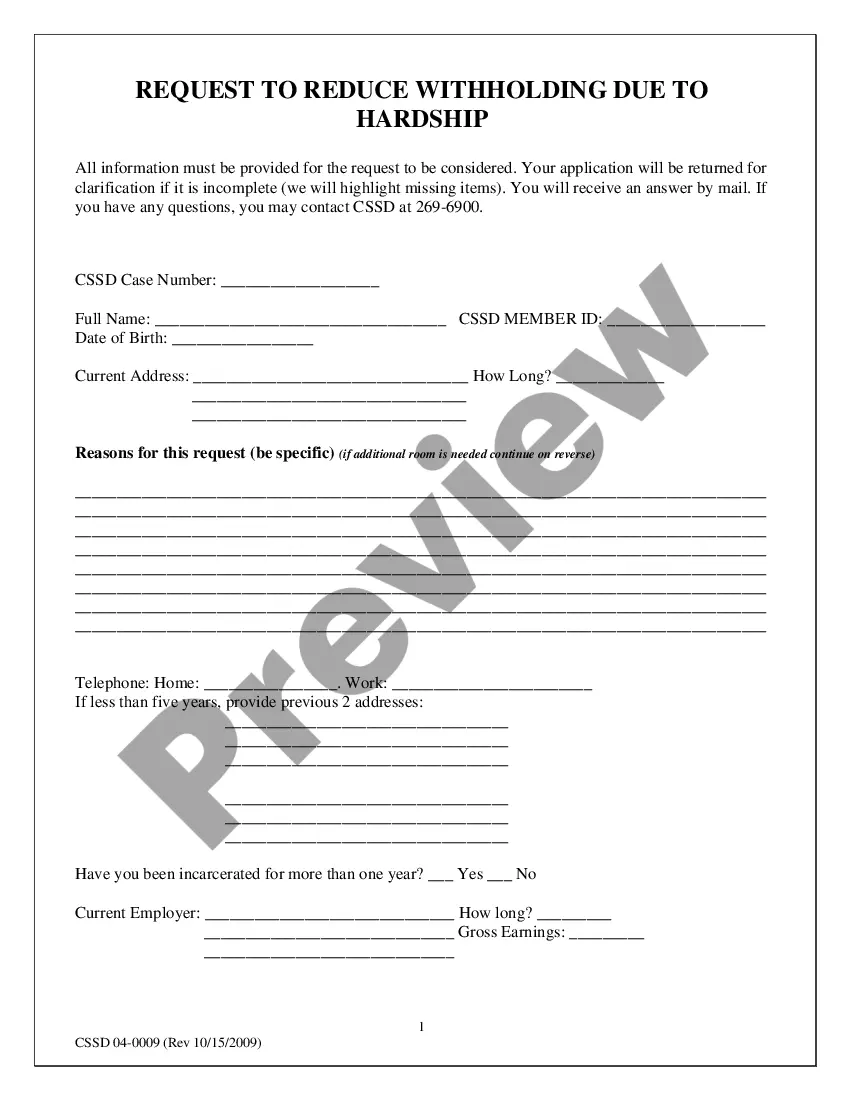

Alaska Hardship Request for Lower Withholding is a form that can be used by Alaska residents who are experiencing financial hardship and would like to reduce their income tax withholding. This form can be used to request a lower withholding rate for individuals or businesses. There are two types of Alaska Hardship Request for Lower Withholding: Temporary Hardship Waiver and Permanent Hardship Waiver. The Temporary Hardship Waiver allows for a temporary reduction in the amount of federal income tax withheld from a taxpayer’s wages while the Permanent Hardship Waiver allows for a permanent reduction in the amount of federal income tax withheld from a taxpayer’s wages. Both waivers require supporting documentation of financial hardship.

Alaska Hardship Request for Lower Withholding

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alaska Hardship Request For Lower Withholding?

Filing official documents can be quite a hassle unless you have fillable templates available. With the US Legal Forms online collection of formal papers, you can rely on the forms you access, as each of them aligns with federal and state laws and has been reviewed by our specialists.

Thus, if you need to complete the Alaska Hardship Request for Lower Withholding, our service is the ideal resource to acquire it.

Here’s a brief overview for you: Document compliance inspection. You should carefully review the contents of the form you require and ensure it meets your needs and complies with your state's legal standards. Viewing your document and going through its general overview will assist you in doing just that.

- Acquiring your Alaska Hardship Request for Lower Withholding from our collection is as straightforward as 1-2-3.

- Previously registered users with an active subscription just need to Log In and click the Download button after locating the correct template.

- Later on, if necessary, users can retrieve the same document from the My documents section of their account.

- However, even if you are new to our platform, registering with a valid subscription will only require a few minutes.